Become a Better Investor Newsletter – 23 November 2024

Noteworthy this week

- US executives are cashing out

- Malaysian oil from Iran and Venezuela

- 59% of stocks underperform T-Bills

- Admins for healthcare

- In the good old days, there was no income tax

US executives are cashing out: The ratio of insider sellers to buyers of US companies’ stock hit the highest level on record.

⚠️US EXECUTIVES HAVE NEVER BEEN SELLING STOCKS SO RAPIDLY⚠️

The ratio of insider sellers to buyers of US companies’ stock hit the highest level on RECORD.

The ratio has even exceeded the previous high seen in 2021, before the 2022 bear market.

US executives are cashing out. pic.twitter.com/ucHJcp0w7C

— Global Markets Investor (@GlobalMktObserv) November 19, 2024

Malaysian oil from Iran and Venezuela: Oil from the two sanctioned countries is smuggled and re-branded as Malaysian and then sold to China.

Seriously, why do they even bother about rebranding it into Malaysian crude, if the volume is three times higher than the entire Malaysian oil output? pic.twitter.com/Sfiwiu2vXB

— Michael A. Arouet (@MichaelAArouet) November 20, 2024

59% of stocks underperform T-Bills: Most stocks underperform Treasury bills over their lifetime, and more than half end up having a negative cumulative return.

A majority of stocks (59%) underperform Treasury bills over their lifetime and more than half end up having a negative cumulative return.

“Don’t look for the needle in the haystack. Just buy the haystack.” – Jack Bogle

Video: https://t.co/OS2d3Nrjjx pic.twitter.com/iwjpkSvAmT

— Charlie Bilello (@charliebilello) November 20, 2024

Admins for healthcare: In the US, the growth in admins has far surpassed the growth in physicians. It’s possible there were too few admins in 1975, but this difference in growth rates still doesn’t make much sense.

Admin growth has far exceeded physician growth. pic.twitter.com/UXmuLI7aC9

— The Rabbit Hole (@TheRabbitHole84) November 17, 2024

In the good old days, there was no income tax: An interesting thing to consider. For most of US history, the federal government was funded by tariffs, there was no income tax, the budget was (mostly) balanced, and federal spending was less than 10% of GDP. Not a fan of tariffs, but still.

For most of our country’s history

the federal government was funded by tariffs, there was no income tax, the budget was (mostly) balanced, and federal spending was less than 10% of GDP. pic.twitter.com/vyxL9LTT9A

— Thomas Massie (@RepThomasMassie) November 15, 2024

Join the world’s toughest valuation training

Become a Valuation Expert. Valuation Master Class Boot Camp graduates can confidently value any company in the world and possess in-demand industry skills.

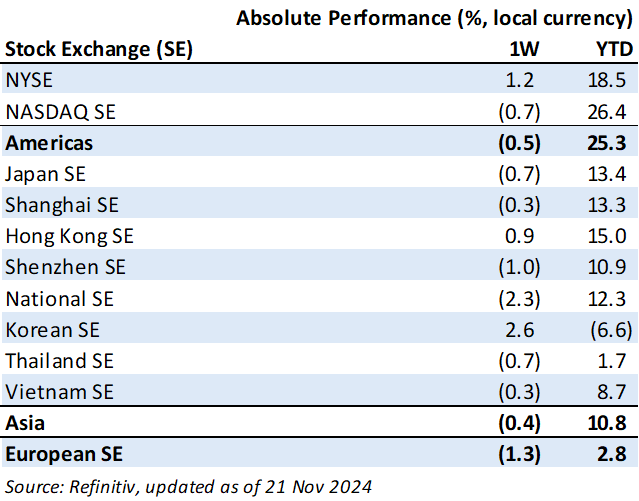

Weekly market performance

Click here to see more markets and periods.

Chart of the week

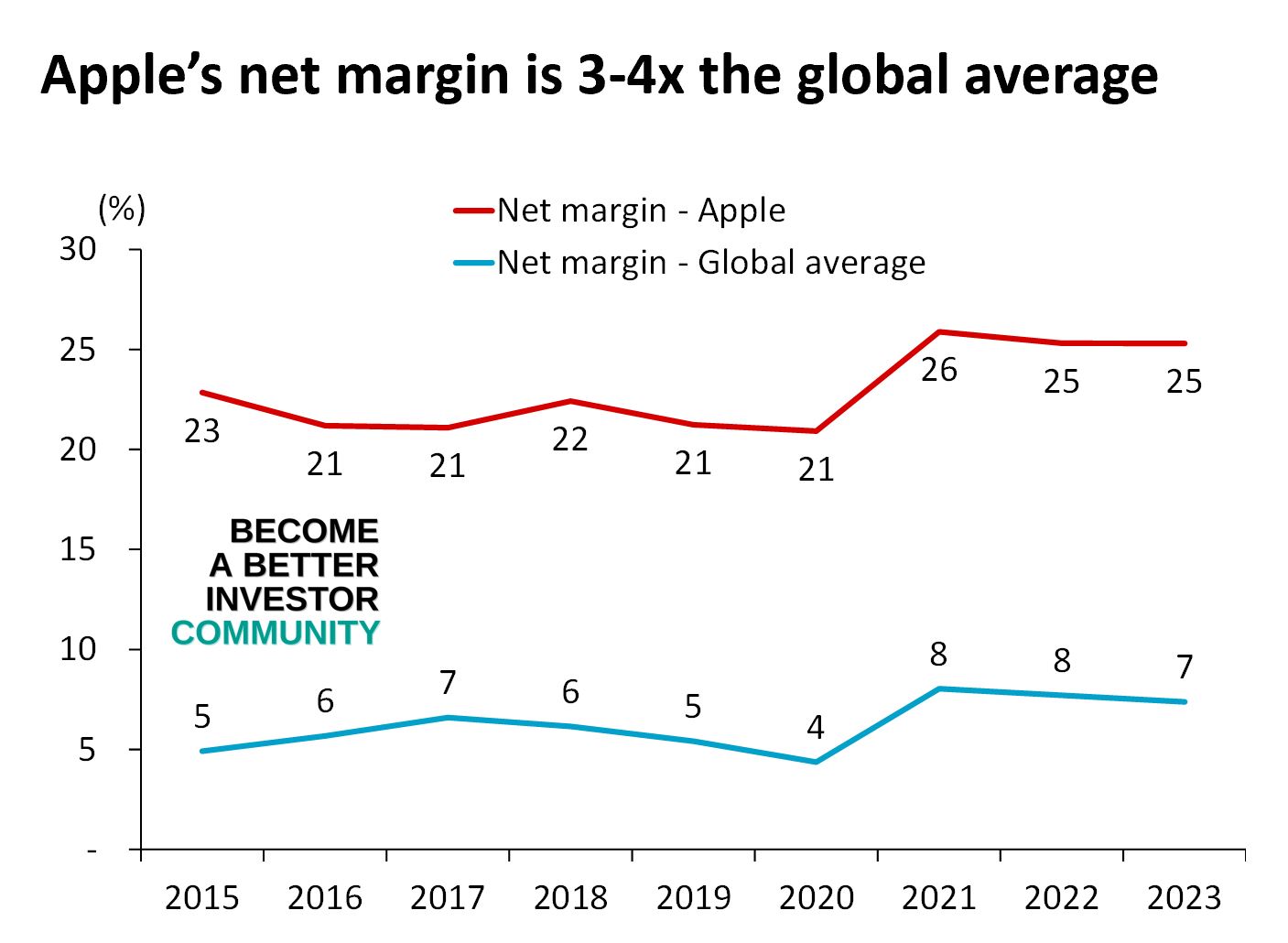

Discussed in the Become a Better Investor Community this week

“Andrew just posted a video on Apple and comments on Buffett selling down his stake.”

Try 1 month of the Become a Better Investor Community for FREE today!

You can cancel at any time. Click here to learn more.

Podcasts we listened to this week

RWH051: MASTER OF CHANGE W/ BRAD STULBERG

“Brad is the best-selling author of Master of Change: How to Excel When Everything is Changing—Including You & The Practice of Groundedness: A Transformative Path to Success that Feeds—Not Crushes—Your Soul. Here, he shares practical tools & strategies based on scientific research, battled-tested wisdom, & his work as a high-performance coach to business leaders & elite athletes.”

Readings this week

Asymmetric effects of favorable and unfavorable information on decision-making under ambiguity

“Most daily decisions involve uncertainty about outcome probabilities arising from incomplete knowledge, i.e. ambiguity. We explore how the addition of partial information affects these types of choices using theoretical and empirical methods.”

Book recommendation

Broken Money: Why Our Financial System is Failing Us and How We Can Make it Better by Lyn Alden

“Broken Money explores the history of money through the lens of technology. Politics can affect things temporarily and locally, but technology is what drives things forward globally and permanently. The book’s goal is for the reader to walk away with a deep understanding of money and monetary history, both in terms of theoretical foundations and in terms of practical implications.”

Get the book on Audible or Kindle.

Audible is great; have you tried it? If not, click here to get 2 books for free.

Memes of the week

“When do you sell a losing position?”

Me: pic.twitter.com/CQ6vqhok3R

— Not Jerome Powell (@alifarhat79) November 20, 2024

Which way, western man? pic.twitter.com/zE1N7S5M7i

— litquidity (@litcapital) November 21, 2024

New My Worst Investment Ever episodes

Enrich Your Future 20: Passive Investing Is the Key to Prudent Wealth Management

In this episode of Enrich Your Future, Andrew and Larry Swedroe discuss Larry’s new book, Enrich Your Future: The Keys to Successful Investing. In this series, they discuss Chapter 20: A Higher Intelligence.

LEARNING: Choose passive investing over active investing.

Access the episode’s show notes and resources

Published on Become a Better Investor this week

In this episode of Enrich Your Future, Andrew and Larry Swedroe discuss Larry’s new book, Enrich Your Future: The Keys to Successful Investing. In this series, they discuss Chapter 19: Is Gold a Safe Haven Asset?

Listen to Enrich Your Future 19: The Gold Illusion: Why Investing in Gold May Not Be Safe

Traditional management uses “carrots,” like bonuses, and “sticks”, like Performance Improvement Plans, to motivate employees. But are humans really built that way? In this episode, Jacob Stoller and Andrew Stotz dive into the myth surrounding that approach and talk about what actually motivates people at work.

Listen to Myth of Sticks and Carrots: Boosting Lean with Deming (Part 5)

Xintec Incorporated (3374 TT): Profitable Growth rank of 1 was same compared to the prior period’s 1st rank. This is World Class performance compared to 700 medium Info Tech companies worldwide.

Read Xintec – World Class Benchmarking

Guangshen Railway Company Limited (601333 SH): Profitable Growth rank of 5 was up compared to the prior period’s 7th rank. This is average performance compared to 1,370 large Industrials companies worldwide.

Read Guangshen Railway – World Class Benchmarking

ANA Holdings Incorporated (9202 JP): Profitable Growth rank of 5 was same compared to the prior period’s 5th rank. This is average performance compared to 1,370 large Industrials companies worldwide.

Read ANA Holdings – World Class Benchmarking

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.