Become a Better Investor Newsletter – 9 December 2023

Noteworthy this week

- Putin and MBS meet

- Maduro turns out to be a socialist imperialist

- The reverse Cramer works again

- Gold hits new all-time high

- Nuclear is green (as most already know)

Putin and MBS meet: Judging by the greeting, they seem pretty tight. Putin visited UAE and Saudi Arabia and was welcomed well. Let’s see what comes out of those meetings.

Russian President Vladimir Putin and Saudi Arabia Crown Prince Mohammed bin Salman | #OOTT 🇸🇦 ⛽️ 🇷🇺 pic.twitter.com/AkZfmdFgPk

— Javier Blas (@JavierBlas) December 6, 2023

Maduro turns out to be a socialist imperialist: I thought socialists were against imperialism. I guess I was wrong. The President of Venezuela, Nicolás Maduro, announced that the majority of the sovereign nation of Guyana is now Venezuelan territory. Guyana got oil.

The President of Venezuela, Nicolás Maduro has announce tonight that the Esequiba Region of Western Guyana is now “Official” a Territory of Venezuela, with a State Map being Released and Oil Expeditions said to be in the Planning Stages. pic.twitter.com/wIKTx5UprU

— OSINTdefender (@sentdefender) December 6, 2023

The reverse Cramer works again: Bitcoin has been a strong performer in 2023. Since the contra indicator, Jim Cramer, told people to sell BTC, it’s up by >80%.

JUST IN: #Bitcoin is up 82% since Jim Cramer told investors to sell 9 months ago.

— Watcher.Guru (@WatcherGuru) December 5, 2023

Gold hits new all-time high: On Monday, gold traded as high as US$2,135/t oz, beating the previous record of US$2,072/t oz in August 2020.

⚠️BREAKING:

*GOLD RISES ABOVE $2,100/OZ TO HIT NEW ALL TIME HIGH AMID MIDDLE EAST TENSIONS$GC_F pic.twitter.com/EgndgGEnhu

— Investing.com (@Investingcom) December 3, 2023

Nuclear is green (as most already know): A small victory for science at COP28, where 22 countries, including US, UK, Canada, France, Ghana, South Korea, Sweden, and UAE, pledged to triple nuclear energy capacity by 2050.

HISTORIC NUCLEAR PLEDGE AT COP28 DUBAI: SIXTEEN COUNTRIES AIM TO TRIPLE GLOBAL NUCLEAR BY 2050

Joined by IAEA, the following are signing, many with heads of state present:

USA, France, UK, Canada, UAE, South Korea, Japan, Belgium (!!), Ukraine, Romania, Slovakia, Sweden,… pic.twitter.com/IbmWxZQ1NU

— Mark Nelson (@energybants) December 2, 2023

Join the world’s toughest valuation training

Become a Valuation Expert. Valuation Master Class Boot Camp graduates can confidently value any company in the world and possess in-demand industry skills.

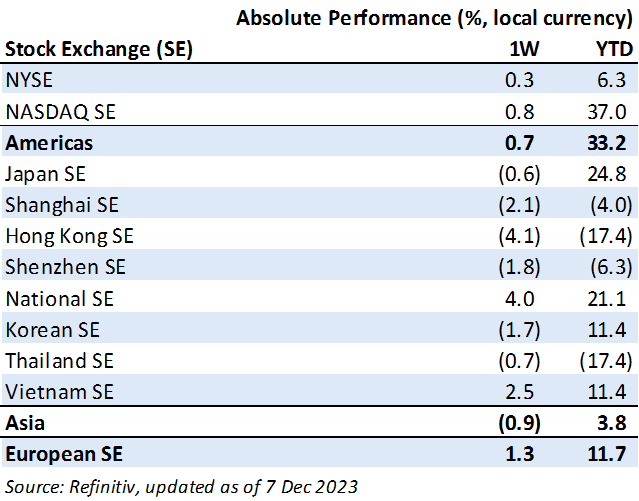

Weekly market performance

Click here to see more markets and periods.

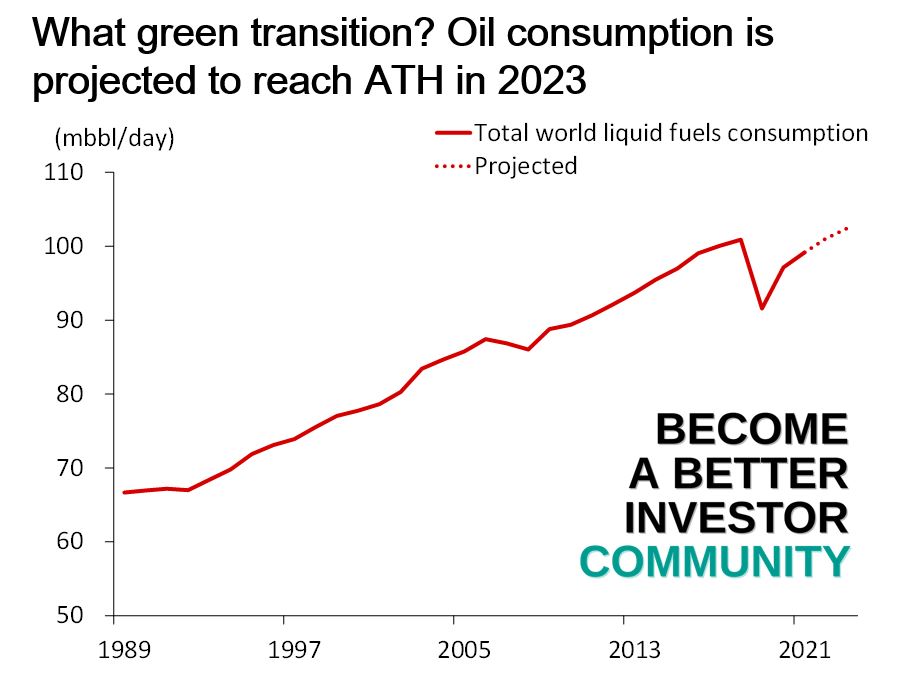

Chart of the week

Discussed in the Become a Better Investor Community this week

“Our ASEAN strategy was the first we launched, and it now celebrates 10 years!”

Try 1 month of the Become a Better Investor Community for FREE today!

You can cancel at any time. Click here to learn more.

Podcasts we listened to this week

RWH035: LEARNING FROM WARREN BUFFETT & CHARLIE MUNGER W/ CHRIS DAVIS

“In this episode, William Green talks with Chris Davis, a renowned investor at Davis Advisors who also serves on Berkshire Hathaway’s board of directors. Here, Chris shares powerful lessons he’s learned from his mentors—Warren Buffett & Charlie Munger—about building financial resilience, learning from our mistakes, avoiding our weaknesses, harnessing trust, & flourishing as we age.”

Readings this week

Frugal vs. Independent

“Frugal, by my definition, means depriving yourself of something you want and could afford. Not wanting something to begin with because you get your pleasure and identity from sources that can’t be purchased is something entirely different. The best word for it is probably independent.”

Book recommendation

We Need to Talk About Inflation: 14 Urgent Lessons from the Last 2,000 Years by Stephen D. King

“From investors and monetary authorities to governments and policy makers, almost everyone had assumed inflation was dead and buried. But now people the world over are confronting a poisonous new economic reality and, with it, the prospect of vast and increasing wealth inequality.”

Get the book on Audible or Kindle.

Audible is great; have you tried it? If not, click here to get 2 books for free.

Memes of the week

🚨🚨🚨 pic.twitter.com/qZOOiGu7L4

— Wall Street Silver (@WallStreetSilv) December 5, 2023

When #Bitcoin pumps 😂 pic.twitter.com/f8Eiv4zFcv

— Bitcoin Magazine (@BitcoinMagazine) December 6, 2023

New My Worst Investment Ever episodes

ISMS 37: Larry Swedroe – Pay Attention to a Fund’s Proper Benchmarks and Taxes

In this episode of Investment Strategy Made Simple (ISMS), Andrew gets into part two of his discussion with Larry Swedroe: Ignorance is Bliss. Today, they discuss two chapters of Larry’s book Investment Mistakes Even Smart Investors Make and How to Avoid Them. In this fourteenth series, they discuss mistake number 26: Do You Fail to Compare Your Funds to Proper Benchmarks? And mistake 27: Do You Focus On Pretax Returns?

LEARNING: Always run a regression analysis against an asset pricing model on portfoliovisualizer.com. Actively managed funds have higher tax expenses than ETFs and mutual funds.

Access the episode’s show notes and resources

Ep755: Jitipol Puksamatanan – Let Time Be Your Friend

BIO: Dr. Jitipol Puksamatanan heads macro and wealth research at CGS-CIMB Securities (Thailand). He develops actionable investment ideas, independent economic analysis, and asset allocation strategies.

STORY: Jitipol learned as much as he could about a stock he was interested in. He was very confident in this stock. So much so that even when the stock price fell, and he made a loss, he doubled his investment, believing the price would go up, but it never did. Jitipol lost all his savings in this investment.

LEARNING: Investing is about knowing yourself and what you’re doing. Investing is not gambling; don’t expect overnight success.

Access the episode’s show notes and resources

Ep754: Anatoliy Labinskiy – Double-Check How Your Product Looks and Works

BIO: Anatoliy Labinskiy is an entrepreneur, eCommerce expert, and a holder of 4-time Two Comma Club awards. He is the founder of GSM Growth, an agency that helps e-commerce entrepreneurs achieve a new level of growth in their businesses.

STORY: When Anatoliy and his partner decided to scale their e-commerce shoe business, they paid a supplier in China $250,000 upfront and let him handle everything. The supplier sent customers low-quality shoes and eventually stopped shipping products despite having large orders. The partners had to refund customers and lost all the money they’d paid the supplier.

LEARNING: Double-check with your supplier how the product looks and works before scaling your sales. Think about how you’ll control your inventory once you scale your sales. Start slow.

Access the episode’s show notes and resources

Published on Become a Better Investor this week

Perfection may be your goal, but unless you create an artificial environment, you’re not going to get it. David Langford and host Andrew Stotz discuss how good managers/teachers let go of perfection and, instead, understand variation, then work on the system to produce better and better outcomes for everyone.

Listen to Are You Expecting Perfection? Role of a Manager in Education (Part 11)

Emperador Incorporated (EMI PM): Profitable Growth rank of 4 was same compared to the prior period’s 4th rank. This is above average performance compared to 570 large Cons. Staples companies worldwide.

Read Emperador – World Class Benchmarking

Siam Wellness Group Public Company Limited (SPA TB): Profitable Growth rank of 3 was up compared to the prior period’s 7th rank. This is above average performance compared to 670 small Industrials companies worldwide.

Read Siam Wellness Group – World Class Benchmarking

In November 2023, we published 13 new episodes of the My Worst Investment Ever podcast. Listen to all of them here.

Listen to My Worst Investment Ever November 2023

In this episode of Investment Strategy Made Simple (ISMS), Andrew gets into part two of his discussion with Larry Swedroe: Ignorance is Bliss. Today, they discuss two chapters of Larry’s book Investment Mistakes Even Smart Investors Make and How to Avoid Them. In this thirteenth series, they discuss mistake number 24: Do You Believe More Heads Are Better Than One? And mistake 25: Do You Believe Active Managers Will Protect You from Bear Markets?

Read ISMS 36: Larry Swedroe – Two Heads Are Not Better Than One When Investing

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.