Become a Better Investor Newsletter – 16 December 2023

Noteworthy this week

- US core inflation down to 4%

- Fed continues to pause

- US stock valuations at crazy (?) levels

- Milei starts shock treatment

- Oil is forecasted to be in oversupply

US core inflation down to 4%: US CPI fell to 3.1% YoY in November, while the core CPI moved down to 4.0% YoY. Worth noting is that JPow likes to look at core services ex housing inflation, which increased by 0.4% MoM.

Overall US CPI moved down to 3.1% YoY in November from 3.2% in October. Lowest since June.

US Core CPI (ex-Food/Energy) moved down to 4.0% YoY, the lowest core inflation reading since September 2021. pic.twitter.com/nHEjKPAp02

— Charlie Bilello (@charliebilello) December 12, 2023

Fed continues to pause: Fed leaves rates unchanged for 3rd straight meeting. Most Fed officials see interest rate cuts in 2024.

SUMMARY OF FED DECISION (12/13/23):

1. Fed leaves rates unchanged for third straight meeting

2. Fed says growth of economy “has slowed” since Q3 2023

3. Most Fed officials see interest rate cuts in 2024

4. Median projection shows 3 rate cuts in 2024

5. Fed sees 4.1%…

— The Kobeissi Letter (@KobeissiLetter) December 13, 2023

US stock valuations at crazy (?) levels: US stocks remain extremely valued relative to global stocks. There are certainly arguments for why the US market should trade at a premium, but current levels might be a bit rich.

A good chart to reflect on a day like today.

US stocks have an exorbitant valuation compared to global equities.

Primarily propelled by technology firms, the current environment stands out as one of the most speculative periods for American stocks in history.

The next decade… pic.twitter.com/l9uosPJgAy

— Otavio (Tavi) Costa (@TaviCosta) December 11, 2023

Milei starts shock treatment: Argentina’s new president initiated his shock treatment of the economy by devaluing the Peso by 54%. Let’s hope he can get the hyperinflation under control.

⚠️BREAKING:

*ARGENTINA DEVALUES THE PESO BY 54%, LETTING IT FALL TO 800 PESOS/DOLLAR, AS PART OF PRESIDENT JAVIER MILEI’S SHOCK PROGRAM TO REVIVE THE ECONOMY

🇦🇷🇦🇷 pic.twitter.com/1Xq5i5tOVS

— Investing.com (@Investingcom) December 12, 2023

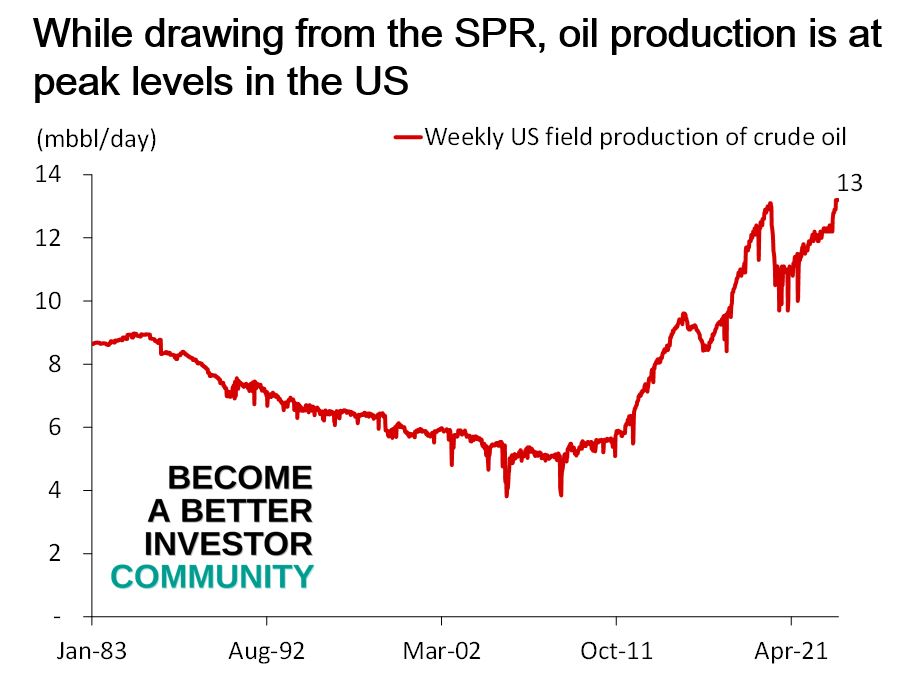

Oil is forecasted to be in oversupply: Previous forecasts have been undersupply in early 2024, but this has now changed to expectations of oversupply throughout 2024.

Oil forecasts have flipped.

Forecasts now show a significantly oversupplied market for 2024. pic.twitter.com/OvZ0kEzoje

— Ayesha Tariq, CFA (@AyeshaTariq) December 11, 2023

Careers in Finance – Live Streaming

Pichet Sithi-Amnuai – December 18, 17:00 (GMT+7/ICT)

Pichet Sithi-Amnuai is the President of Bualuang Securities, the capital markets arm of Bangkok Bank. He is also the Chairman of the Association of Thai Securities Companies (ASCO) and the Vice chairman of The Stock Exchange of Thailand (SET).

Click attend on the LinkedIn event

Join the world’s toughest valuation training

Become a Valuation Expert. Valuation Master Class Boot Camp graduates can confidently value any company in the world and possess in-demand industry skills.

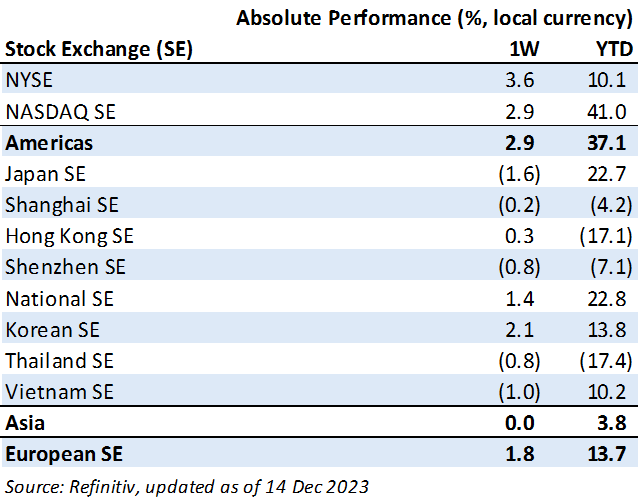

Weekly market performance

Click here to see more markets and periods.

Chart of the week

Discussed in the Become a Better Investor Community this week

“We just updated the Global Interest Rate Chartbook and will update it regularly exclusively for our Become a Better Investor community.”

Try 1 month of the Become a Better Investor Community for FREE today!

You can cancel at any time. Click here to learn more.

Podcasts we listened to this week

RWH036: THE POWER OF SIMPLICITY W/ ANTHONY KINGSLEY

“In this episode, William Green chats with Anthony Kingsley, who oversees more than $10 billion at an investment firm named Findlay Park. Anthony is the portfolio manager of the Findlay Park American Fund, which has crushed its benchmark index by 1,200 percentage points over 25 years. Here, he discusses his firm’s surprisingly simple path to exceptional returns.”

Readings this week

After-Tax Performance of Actively Managed Funds

“After taxes, the median active fund trailed the S&P 500 over every time horizon (1, 3, 5, 10, and 20 years) by up to 3.5% annually. Over the 20-year horizon, while 92% of all domestic funds underperformed their benchmarks on a pretax basis, 97% failed on an after-tax basis.”

Book recommendation

Complete Family Wealth: Wealth as Well-Being by James E. Hughes et al.

“A primer for families of high net worth on how to manage their qualitative and financial wealth for generations.”

Get the book on Audible or Kindle.

Audible is great; have you tried it? If not, click here to get 2 books for free.

Memes of the week

America with 5% interest rates vs. 4.5% rates pic.twitter.com/DHZb9YUfjW

— John W. Rich (Wealthy) (@Cokedupoptions) December 13, 2023

— Elon Musk (@elonmusk) December 12, 2023

New My Worst Investment Ever episodes

Ep757: Kimberly Flynn – Don’t Put All Your Savings Into a Single Idea

BIO: Kimberly Flynn, CFA, is a founder and Managing Director of XA Investments, responsible for all product and business development activities.

STORY: Kimberly put all her $2,000 savings into a single telecom-dedicated mutual fund at the peak of telecom valuations and saw it go down to 30 cents on the dollar.

LEARNING: Don’t put all your savings into a single idea. Be diversified, especially when dealing with active manager selection. Know yourself and your risk tolerance.

Access the episode’s show notes and resources

Ep756: Peter Goldstein – Check Your Emotions at the Door

BIO: Peter Goldstein is a seasoned entrepreneur, capital markets expert, and investor with over 35 years of diverse international business experience.

STORY: He and four others put a significant amount of money into opening up this facility in Long Beach, California, where cannabis was in great demand just when it was being legalized for recreational purposes. At the time, there were no clear regulations, making compliance with the ever-changing rules costly to the point where the business was not making any profits.

LEARNING: Check your emotions at the door. Be cautious before you jump on a trend. Analyze and understand your risk. Get expert help if you don’t understand your investment.

Access the episode’s show notes and resources

Published on Become a Better Investor this week

What causes fear in an organization? How is fear hurting employee morale, productivity, and overall performance? What great things can happen when you remove fear? In this episode, John Dues and host Andrew Stotz talk about fear, and how managers can get rid of it.

Listen to Drive Out Fear: Deming in Schools Case Study (Part 14)

Toyota Motor Corporation (7203 JP): Profitable Growth rank of 6 was up compared to the prior period’s 7th rank. This is below average performance compared to 940 large Cons. Disc. companies worldwide.

Read Toyota Motor – World Class Benchmarking

Big rebound in equity; everything up except commodities. Performance review of our strategies in November 2023 – All Weather Inflation Guard gained 4.2%, All Weather Strategy gained 6.2%, All Weather Alpha Focus gained 6.4%. Global outlook that guides our asset allocation.

Read A. Stotz All Weather Strategies – November 2023

Genting Berhad (GENT MK): Profitable Growth rank of 9 was down compared to the prior period’s 8th rank. This is poor performance compared to 960 large Cons. Disc. companies worldwide.

Read Genting – World Class Benchmarking

Ningbo Sanxing Medical Electric Company Limited (601567 SH): Profitable Growth rank of 2 was up compared to the prior period’s 3rd rank. This is World Class performance compared to 1,450 large Industrials companies worldwide.

Read Ningbo Sanxing Medical Electric – World Class Benchmarking

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.