A. Stotz All Weather Strategies – November 2023

The All Weather Strategy is available in Thailand through FINNOMENA. If you’re interested in our allocation strategy, you can also join the Become a Better Investor Community. Please note that this post is not investment advice and should not be seen as recommendations. Also, remember that backtested or past performance is not a reliable indicator of future performance.

What happened in world markets in November 2023

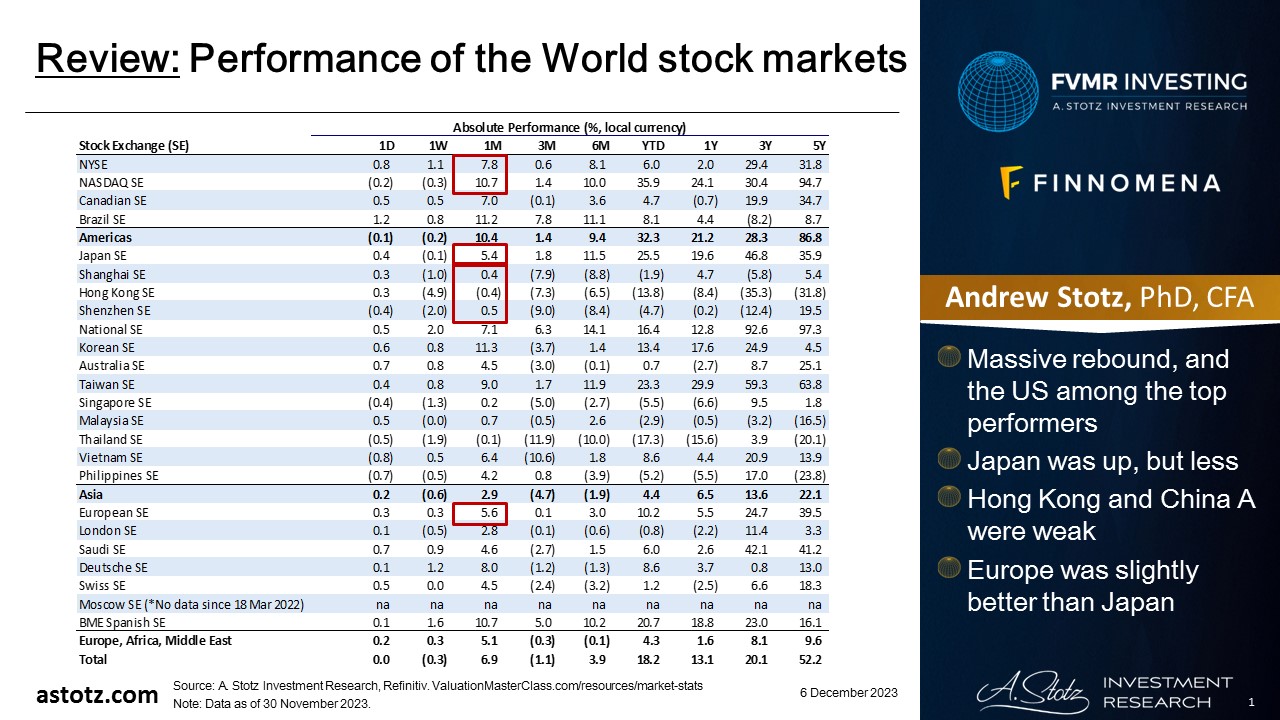

Performance of the World stock markets

- Massive rebound, and the US among the top performers

- Japan was up, but less

- Hong Kong and China A were weak

- Europe was slightly better than Japan

Find the updated Performance of the World stock markets here.

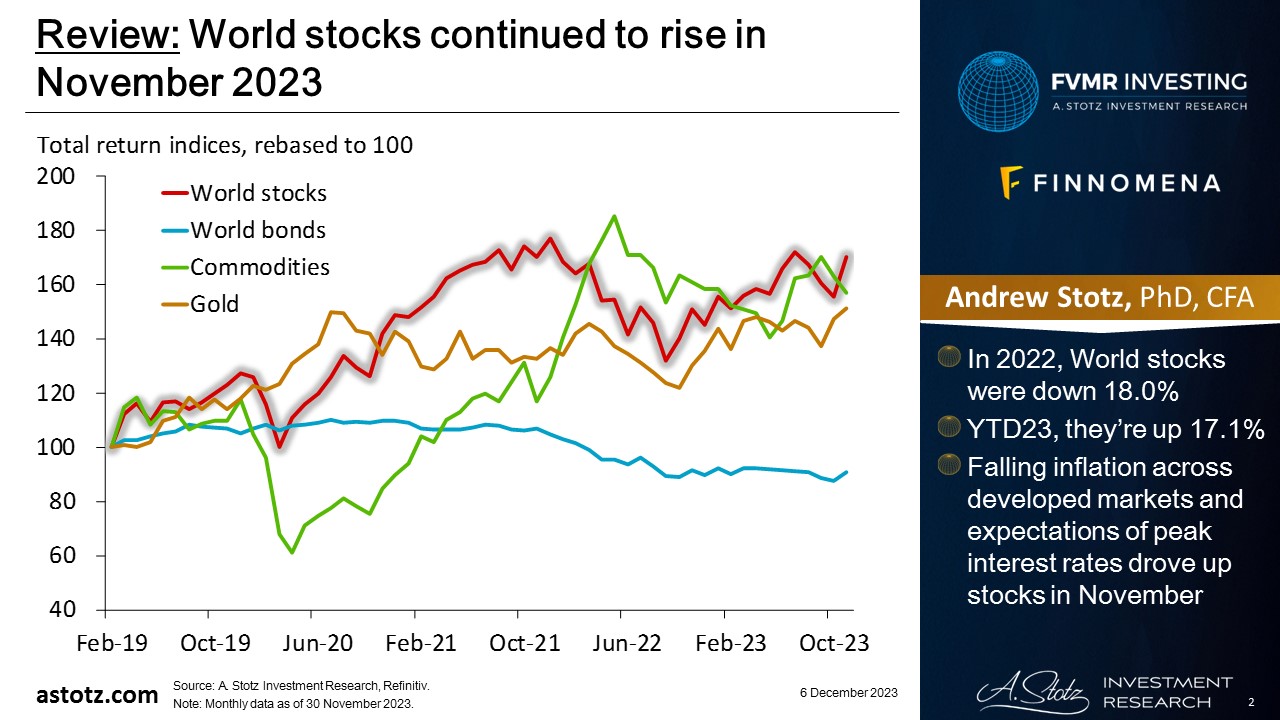

World stocks continued to rise in November 2023

- In 2022, World stocks were down 18.0%

- YTD23, they’re up 17.1%

- Falling inflation across developed markets and expectations of peak interest rates drove up stocks in November

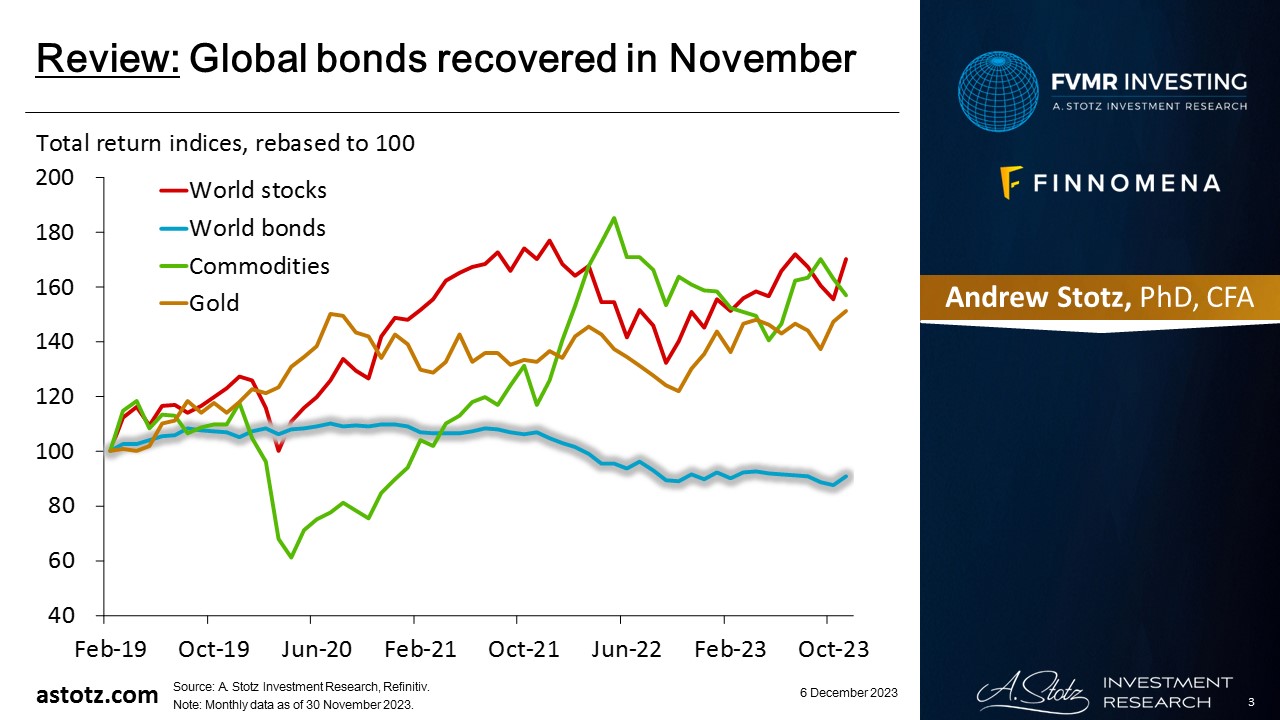

Global bonds recovered in November

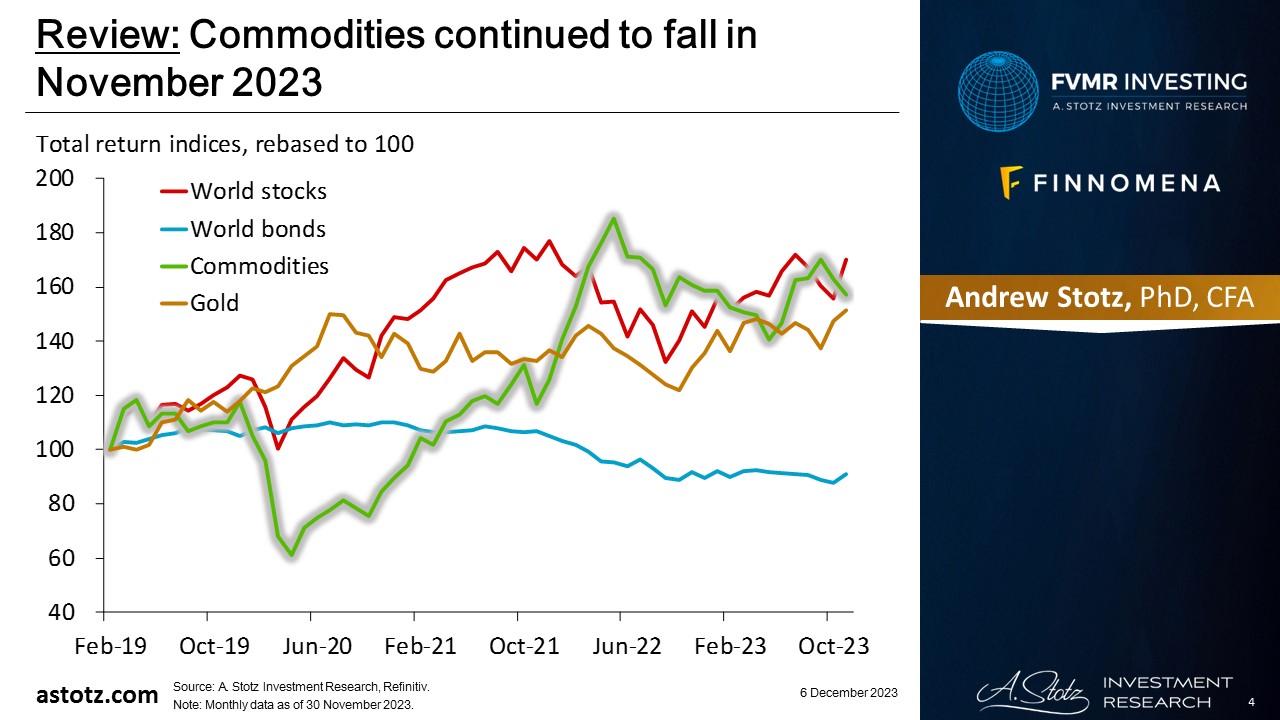

Commodities continued to fall in November 2023

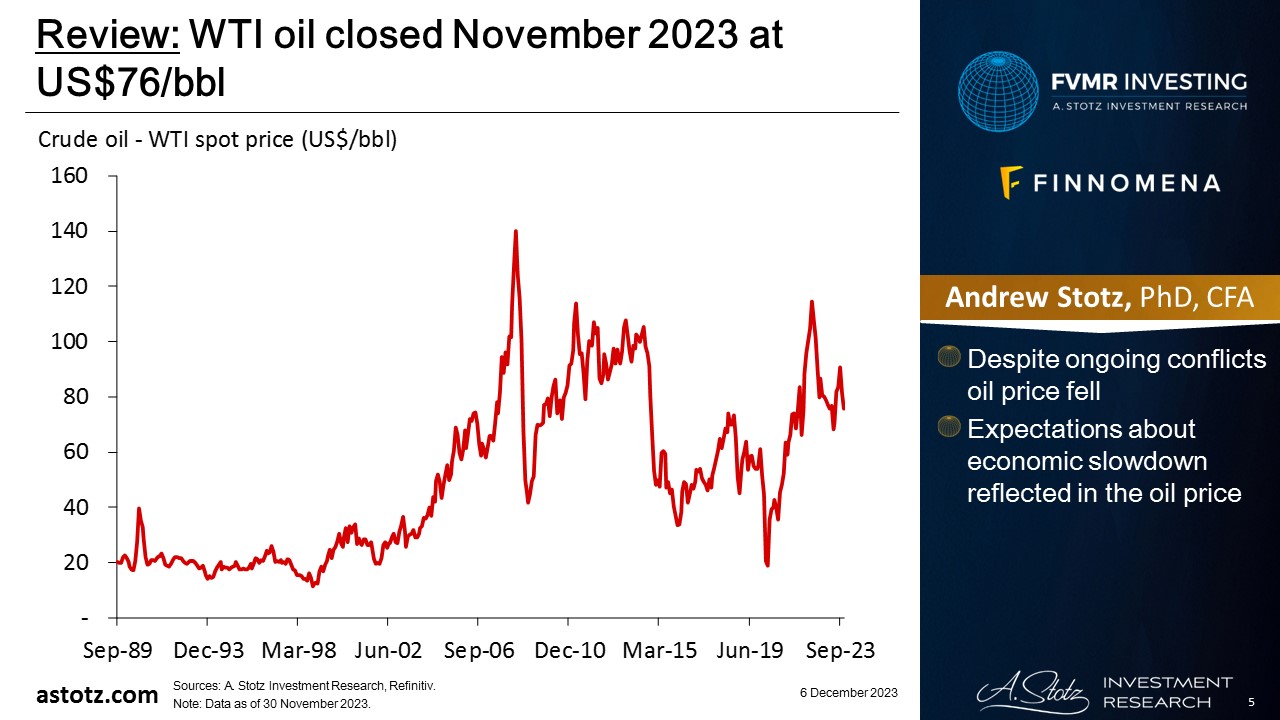

WTI oil closed November 2023 at US$76/bbl

- Despite ongoing conflicts oil price fell

- Expectations about economic slowdown reflected in the oil price

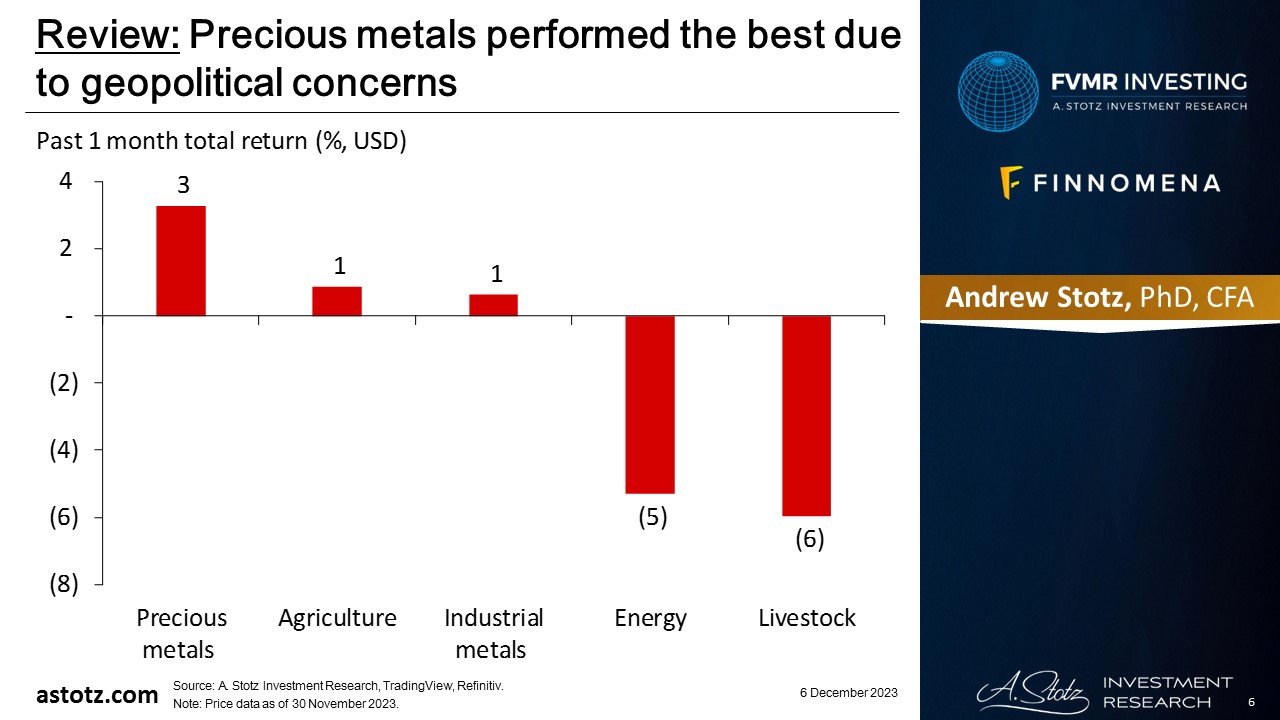

Precious metals performed the best due to geopolitical concerns

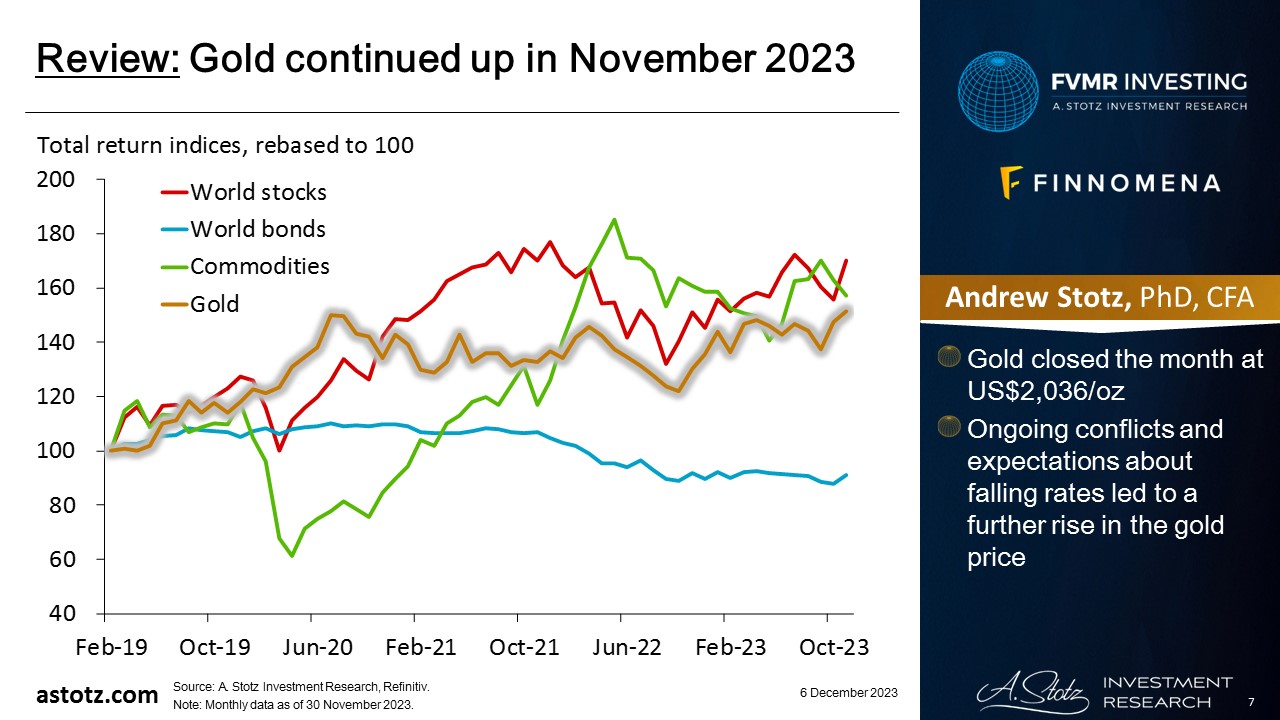

Gold continued up in November 2023

- Gold closed the month at US$2,036/oz

- Ongoing conflicts and expectations about falling rates led to a further rise in the gold price

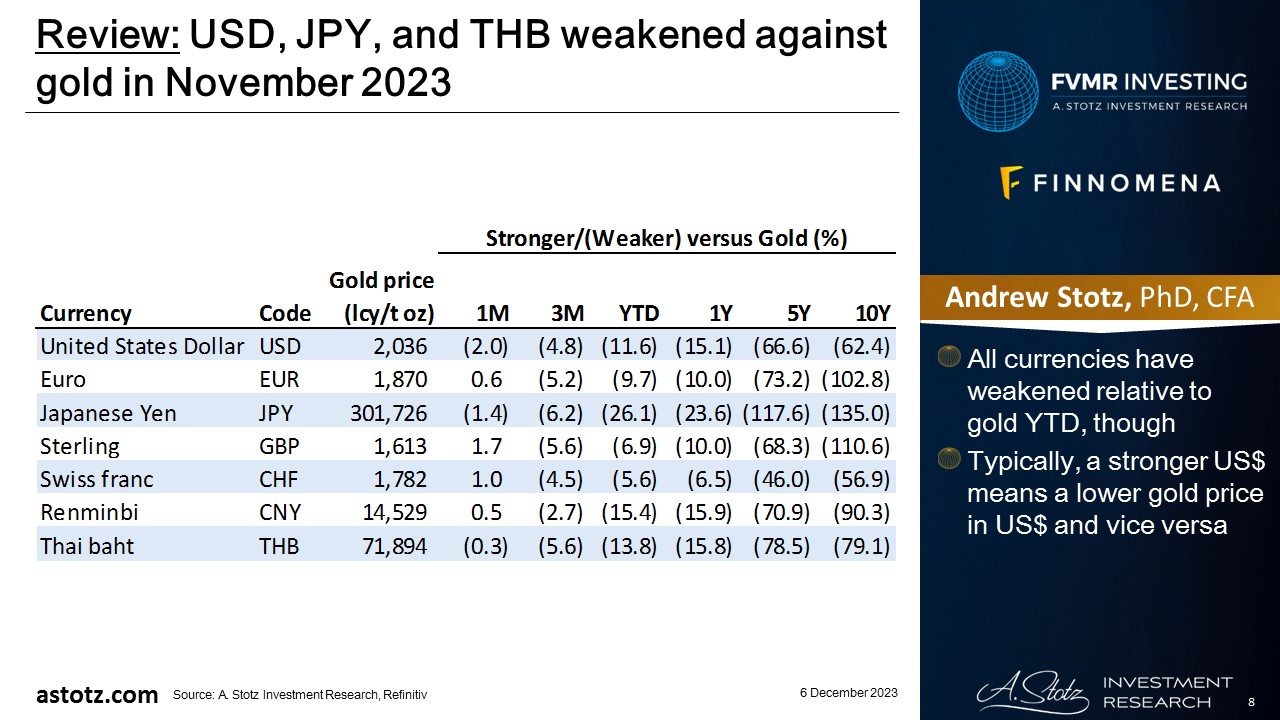

USD, JPY, and THB weakened against gold in November 2023

- All currencies have weakened relative to gold YTD, though

- Typically, a stronger US$ means a lower gold price in US$ and vice versa

One of the greats has left us

Charlie Munger (1924-2023)

What a wise man.

RIP 🙏 pic.twitter.com/SK66JLVONU

— Ramnath (@rmnth) November 29, 2023

- Charlie Munger passed away just a month shy of 100 years old

- His wisdom will live a lot longer

Rates are predicted to be lowered slowly when inflation is under control

When central banks need to cut rates, they need to cut quickly and a lot. What are the odds that this time it will be an orderly and granular process? pic.twitter.com/maeZLnMDED

— Michael A. Arouet (@MichaelAArouet) November 4, 2023

- However, central banks tend to break things and then start cutting fast and furious to undo their own making

Drawdowns can be long, really long

It took two decades for the stock market to durably surpass its early 1970s highs after adjusting for CPI.

And it took about a decade and a half for the stock market to surpass its 2000 high after adjusting for CPI.

Accumulated dividends help to shorten the time a bit. pic.twitter.com/61ikDRt69s

— Lyn Alden (@LynAldenContact) November 12, 2023

- While we typically consider nominal returns, what matters are real returns (nominal returns minus inflation)

- It took close to 15 years to surpass the highs of the dot-com bubble

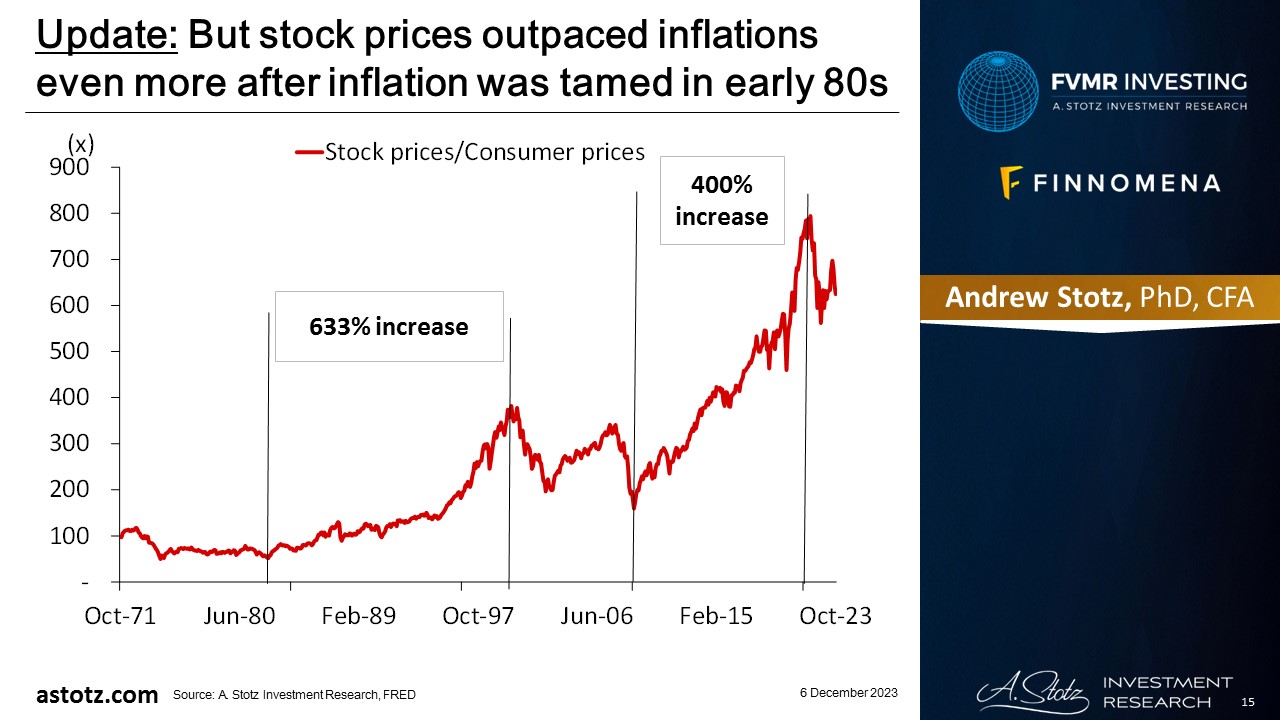

But stock prices outpaced inflations even more after inflation was tamed in early 80s

US Treasuries offer a better yield than Emerging markets bonds

‘An unlikely aberration has taken place in global bond markets for the first time on record: yields on emerging-market bonds in local currencies have fallen below US Treasuries.’ https://t.co/FtsBCqqsQK pic.twitter.com/QHBsHsSpLC

— Jesse Felder (@jessefelder) November 13, 2023

- Emerging markets are generally considered riskier than the US, and you would, therefore, expect/demand higher returns from EM bonds than US Treasuries

- No more cheap money in the US

The US decoupling from China shows in US imports; Mexico has just overtaken China

US is now importing more from Mexico than China

This development has occurred for the first time since 2003 pic.twitter.com/DUwULkeG2j

— Game of Trades (@GameofTrades_) November 13, 2023

China does more trade with Saudi than both the US & EU combined

China does more trade with Saudi than both the US & EU combined, so it’s a bit more than an increase “from zero to 1 in terms of percentage”… 👇 https://t.co/MRrmQAhWGZ pic.twitter.com/LYq9rkctHv

— Luke Gromen (@LukeGromen) November 28, 2023

Korea bans short-selling

KOREAN TECH STOCK INDEX IS NOW UP ALMOST 12% TODAY AFTER SOUTH KOREA BANNED SHORT SELLING

ITS LIKE THE NASDAQ GOING UP 12% IN A DAY AFTER THS US BANS SHORT SELLING https://t.co/q6D5sBxOk6 pic.twitter.com/CpuJuyY1pA

— GURGAVIN (@gurgavin) November 6, 2023

- The ban on short-selling stocks is said to last at least until June 2024

Key takeaways

- Markets predict rates to be lowered slowly when inflation is under control

- US Treasuries offer a better yield than Emerging markets bonds

- The US decoupling from China shows in US imports; Mexico has just overtaken China

- China does more trade with Saudi than both the US & EU combined

- Korea bans short-selling

Performance review: All Weather Inflation Guard

All Weather Inflation Guard gained 4.2%

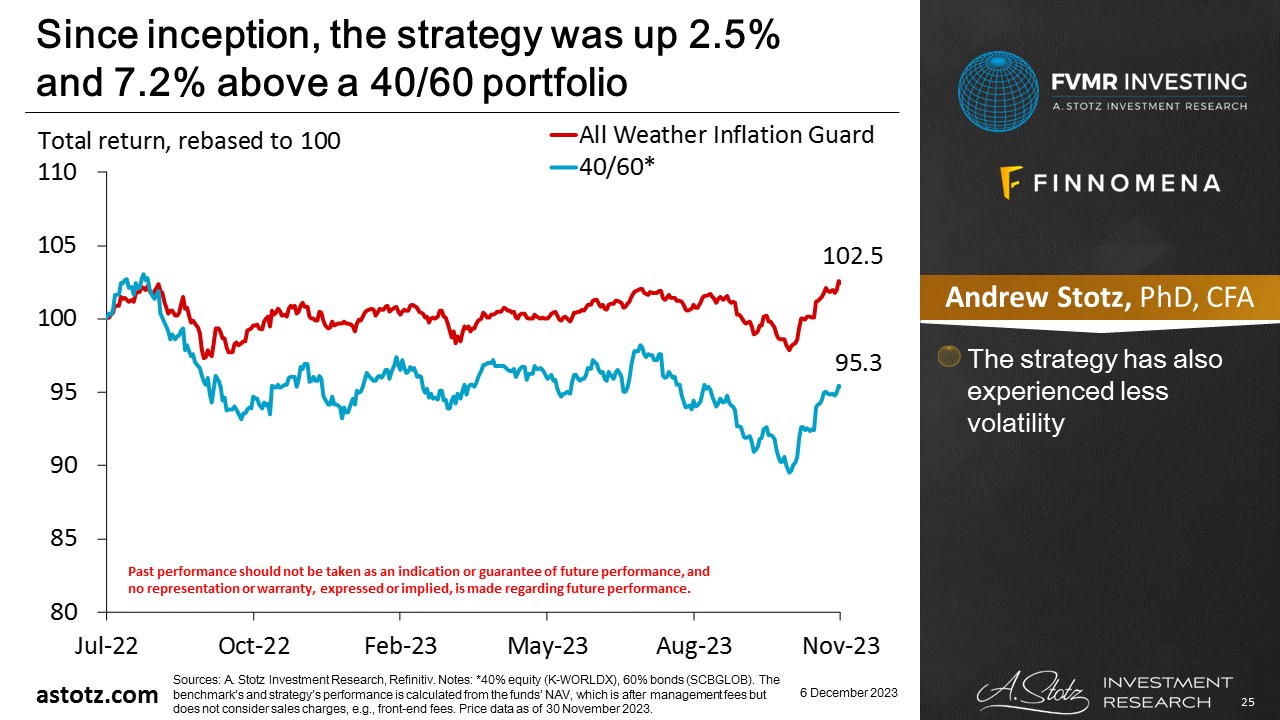

Since inception, the strategy was up 2.5% and 7.2% above a 40/60 portfolio

- The strategy has experienced less volatility though

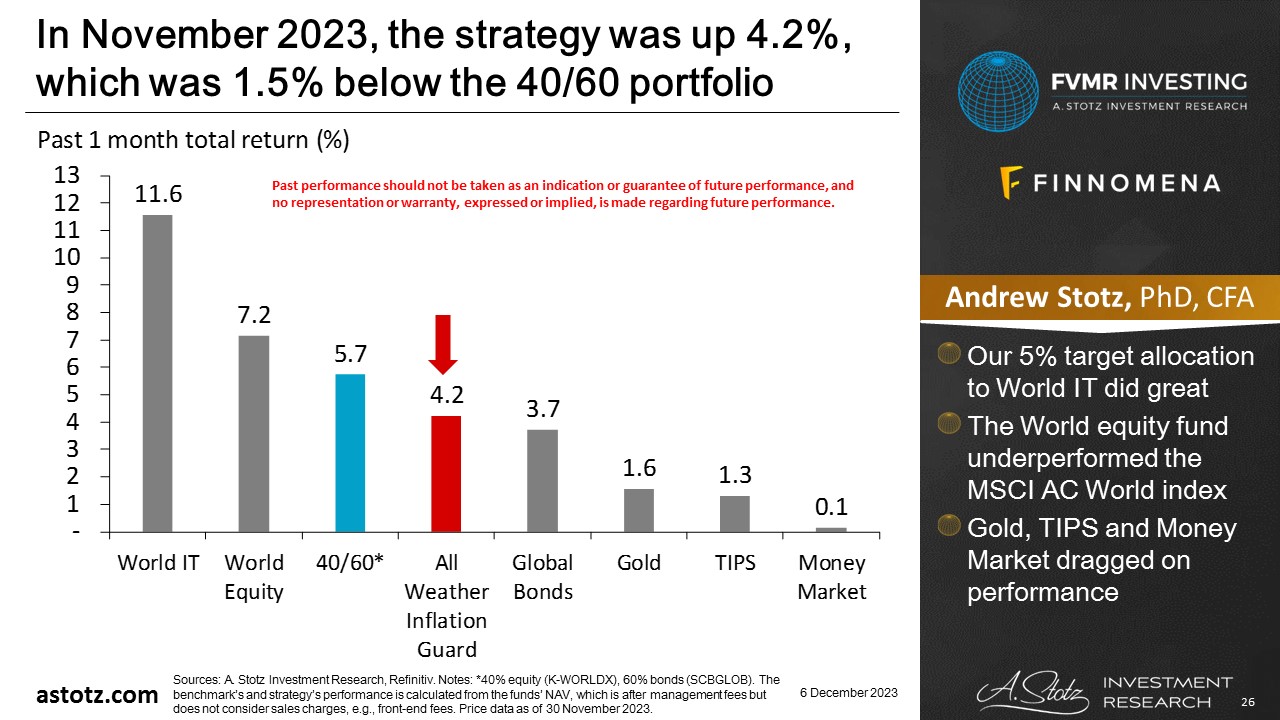

In November 2023, the strategy was up 4.2%, which was 1.5% below the 40/60 portfolio

- Our 5% target allocation to World IT did great

- The World equity fund underperformed the MSCI AC World index

- Gold, TIPS and Money Market dragged on performance

Performance review: All Weather Strategy

All Weather Strategy gained 6.2%

Since inception, the strategy was up 28.9% and 11.4% above a 60/40 portfolio

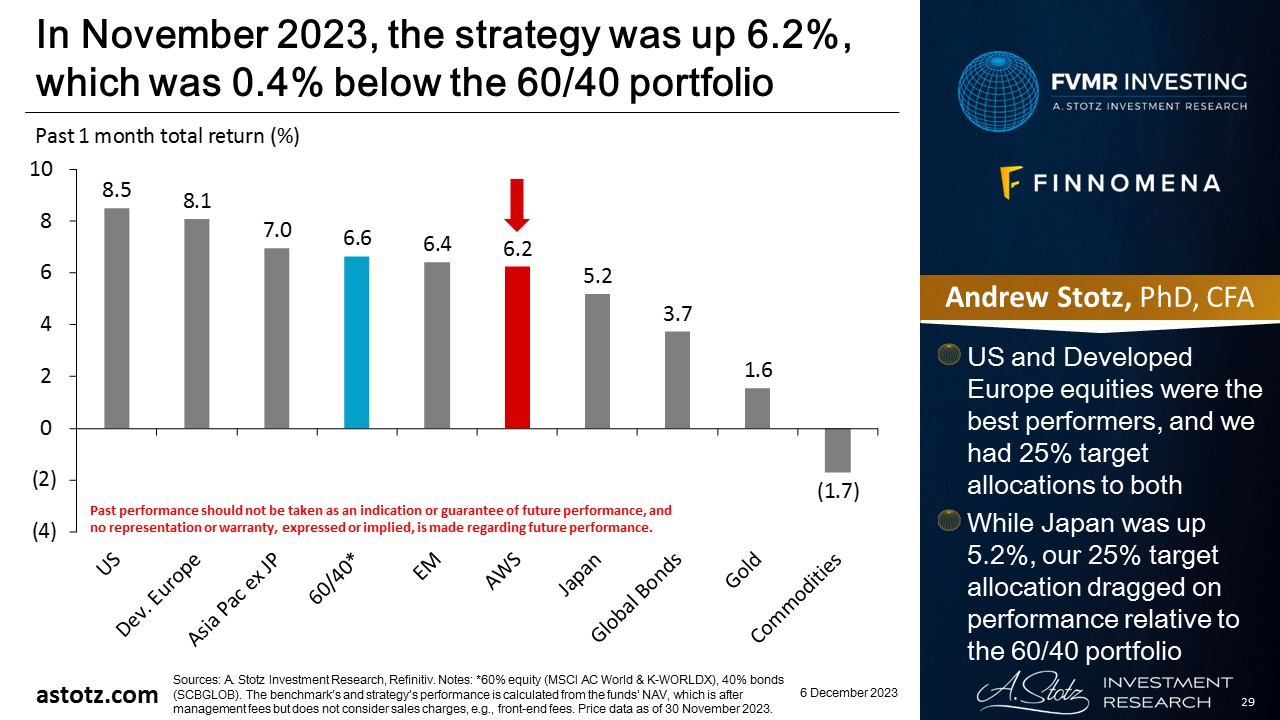

In November 2023, the strategy was up 6.2%, which was 0.4% below the 60/40 portfolio

- US and Developed Europe equities were the best performers, and we had 25% target allocations to both

- While Japan was up 5.2%, our 25% target allocation dragged on performance relative to the 60/40 portfolio

Performance review: All Weather Alpha Focus

All Weather Alpha Focus gained 6.4%

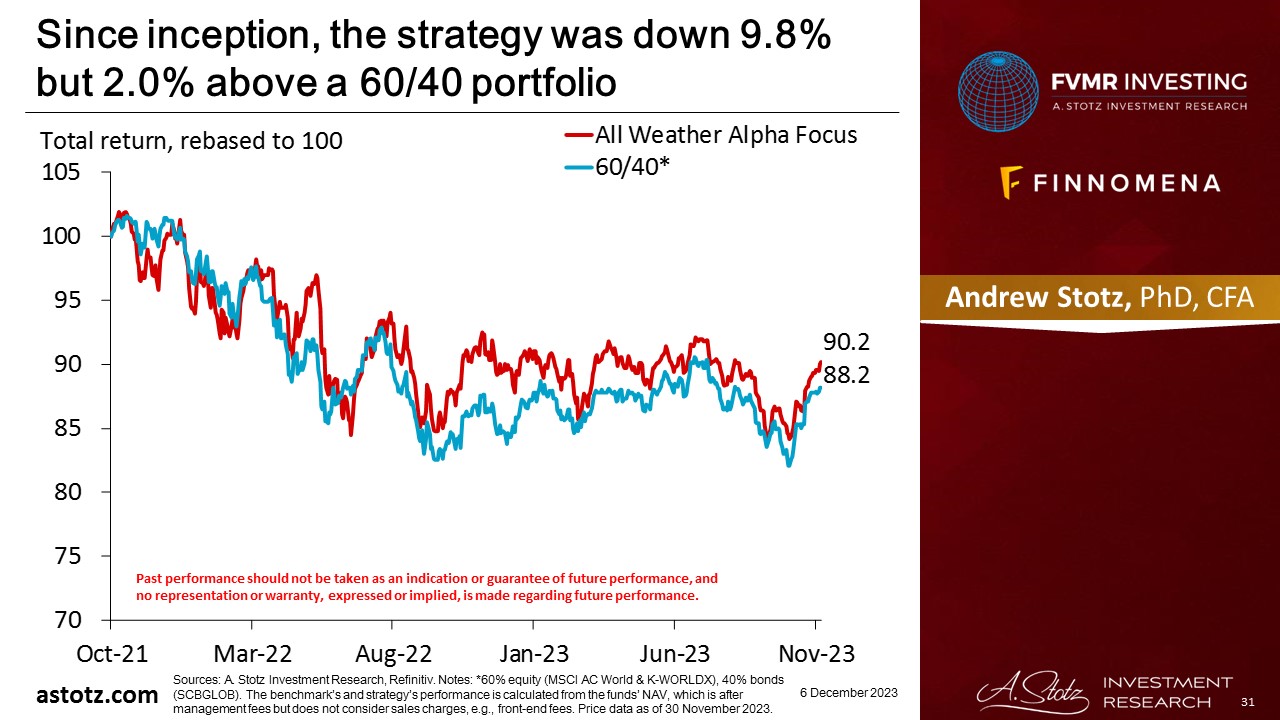

Since inception, the strategy was down 9.8% but 2.0% above a 60/40 portfolio

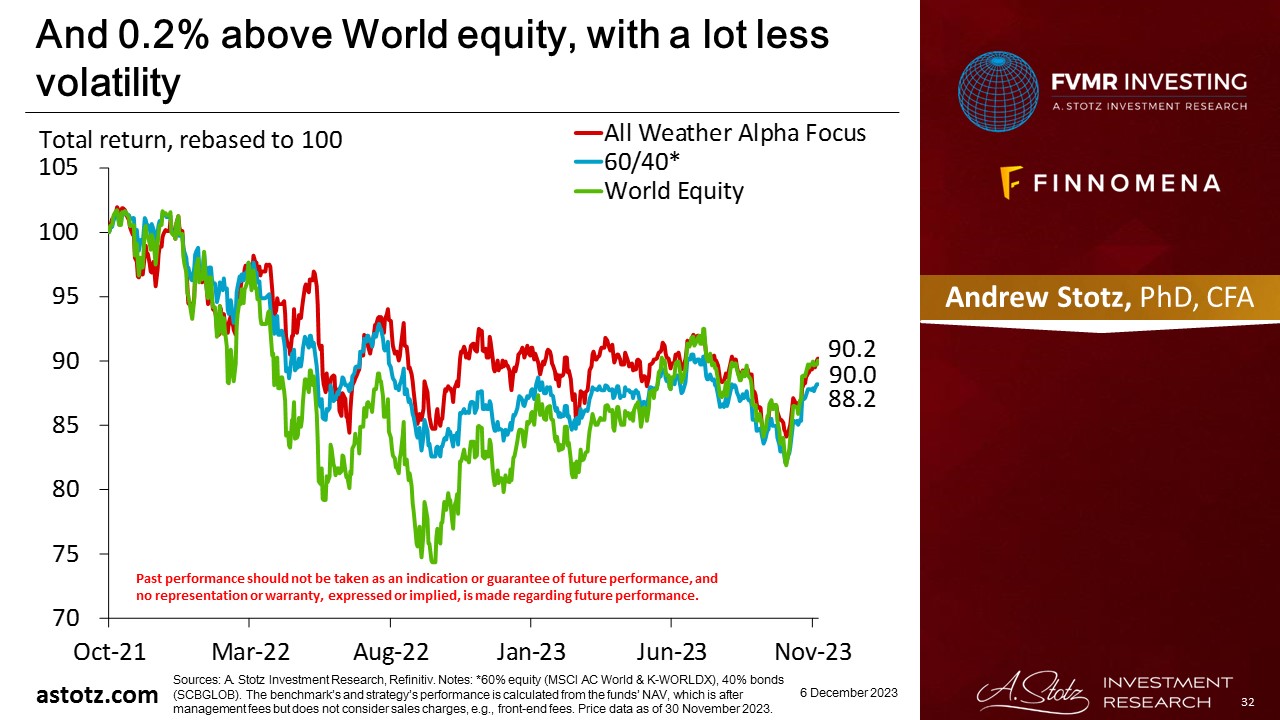

And 0.2% above World equity, with a lot less volatility

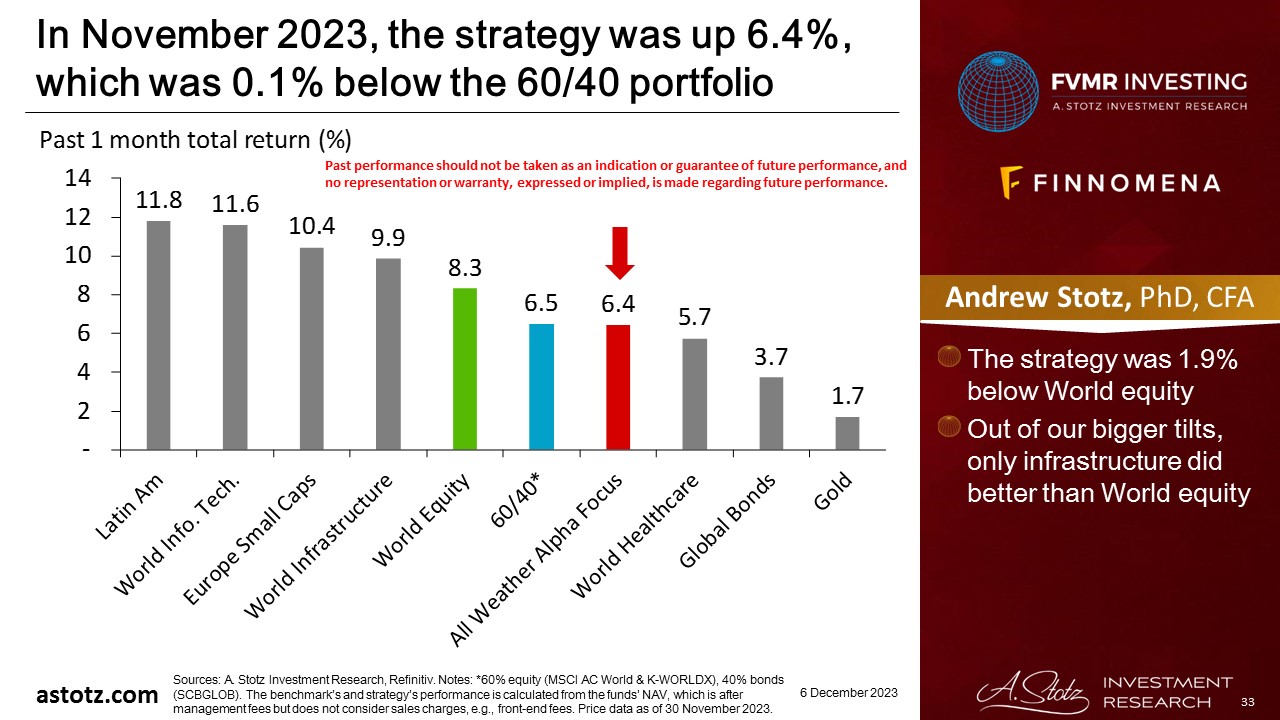

In November 2023, the strategy was up 6.4%, which was 0.1% below the 60/40 portfolio

- The strategy was 1.9% below World Equity

- Out of our bigger tilts, only infrastructure did better than World equity

Global outlook that guides our asset allocation

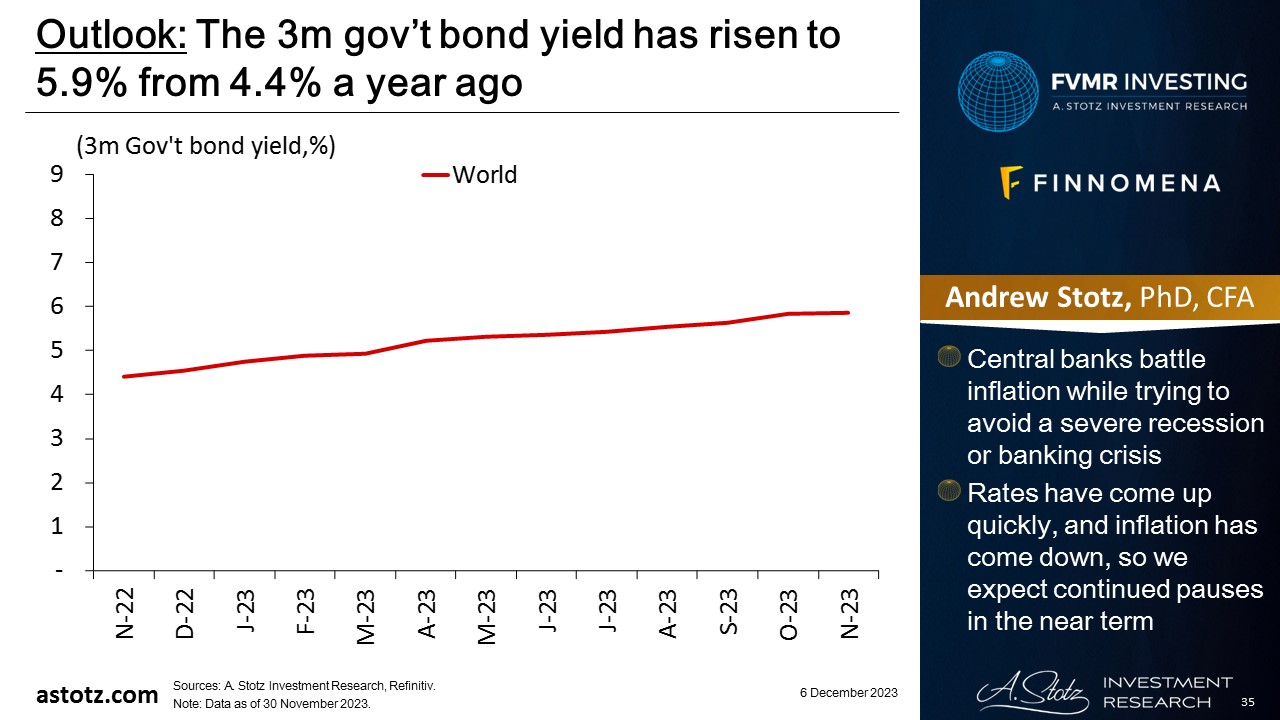

The 3m gov’t bond yield has risen to 5.9% from 4.4% a year ago

- Central banks battle inflation while trying to avoid a severe recession or banking crisis

- Rates have come up quickly, and inflation has come down, so we expect continued pauses in the near term

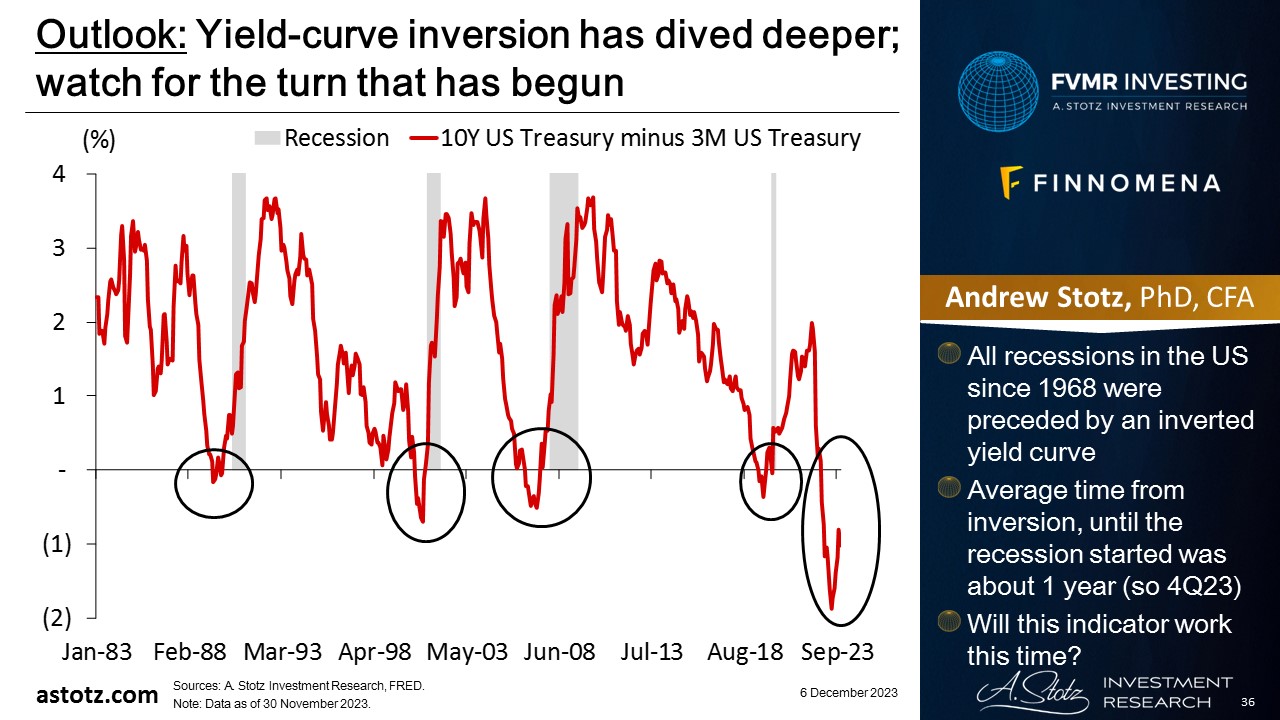

Yield-curve inversion has dived deeper; watch for the turn that has begun

- All recessions in the US since 1968 were preceded by an inverted yield curve

- Average time from inversion, until the recession started was about 1 year (so 4Q23)

- Will this indicator work this time?

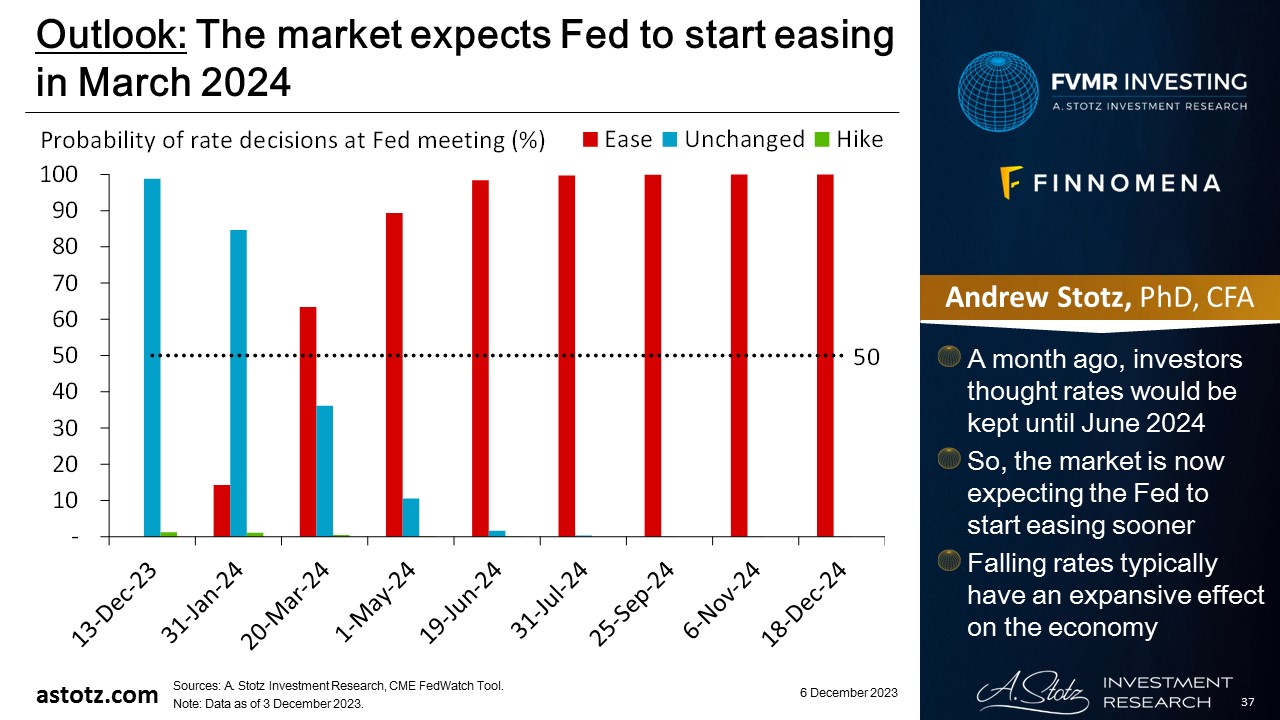

The market expects Fed to start easing in March 2024

- A month ago, investors thought rates would be kept until June 2024

- So, the market is now expecting the Fed to start easing sooner

- Falling rates typically have an expansive effect on the economy

For the past year, we’ve said that we think the course will eventually be reversed

- We still expect central banks will reverse course and return to accommodative policies as soon as something “breaks”

- The massive rise in rates will eventually break something

- When the news turns negative and markets and economies start weakening, we expect the Fed will reverse course and bring rates back to near zero

- This reversal could support equity

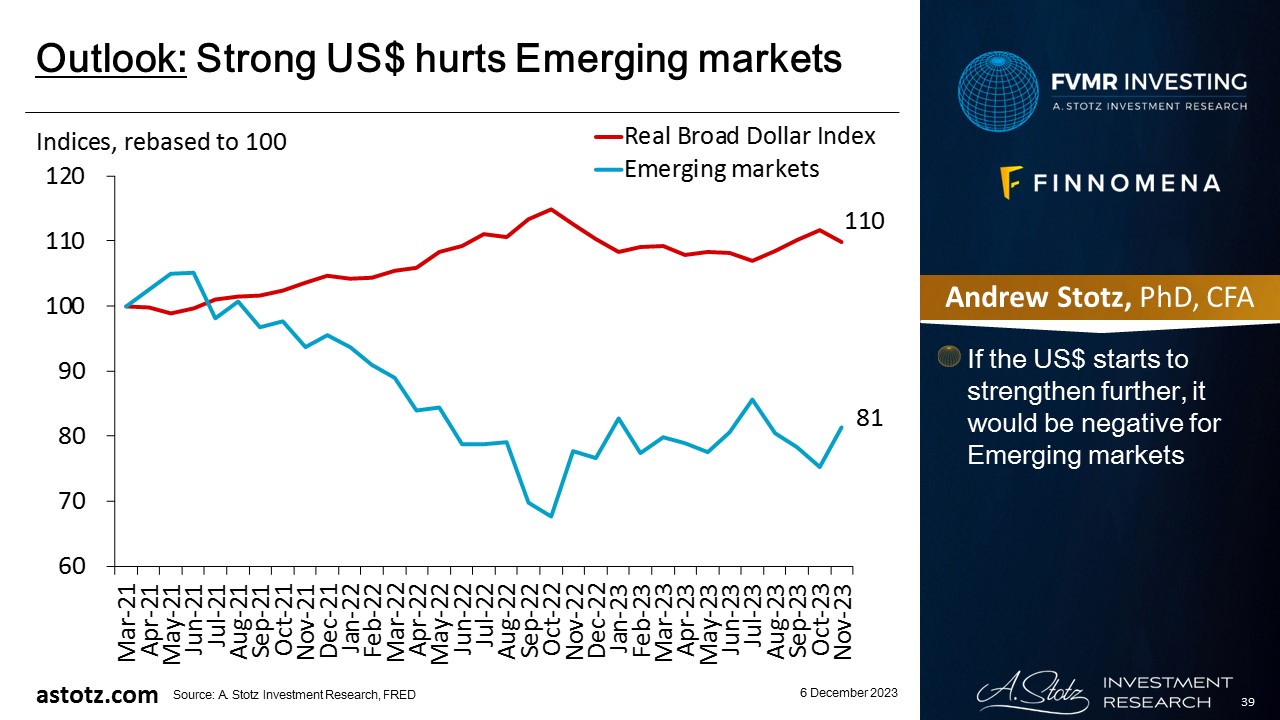

Strong US$ hurts Emerging markets

- If the US$ starts to strengthen further, it would be negative for Emerging markets

Some reasons why a strong dollar is bad for Emerging markets (EM)

- EMs borrow some in US$, which makes it more expensive to service and repay

- The cost of imports of capital goods and commodities can rise, depressing margins and pushing up the price of exports

- Investors move to US$ when risks are rising, bringing dollar strength and EM outflows

- A strong US$ may cause local central banks to defend their currency by raising interest rates, which can slow their economy

Bonds are typically a safe place to be

- In recessions, safer assets like government bonds typically have performed well

- Though with high inflation, low yields could still lead to negative real returns

- We generally don’t allocate to bonds to speculate on the upside but rather use it to protect capital over time

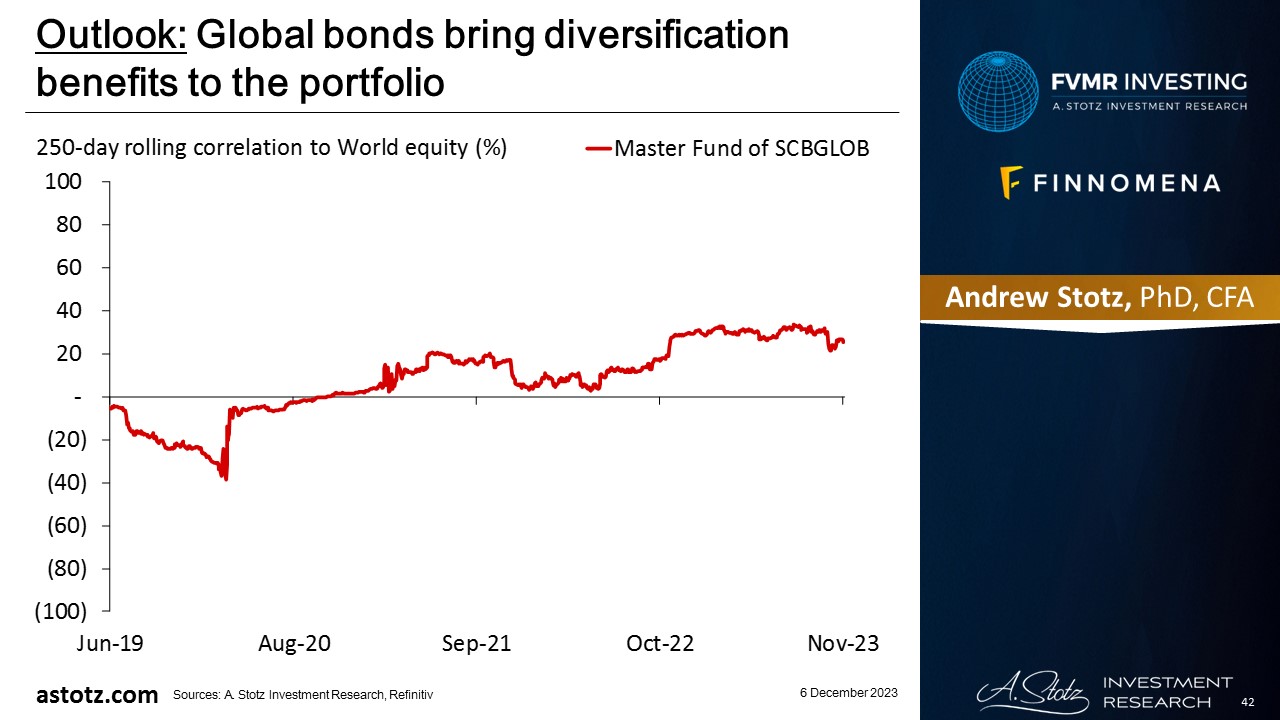

Global bonds bring diversification benefits to the portfolio

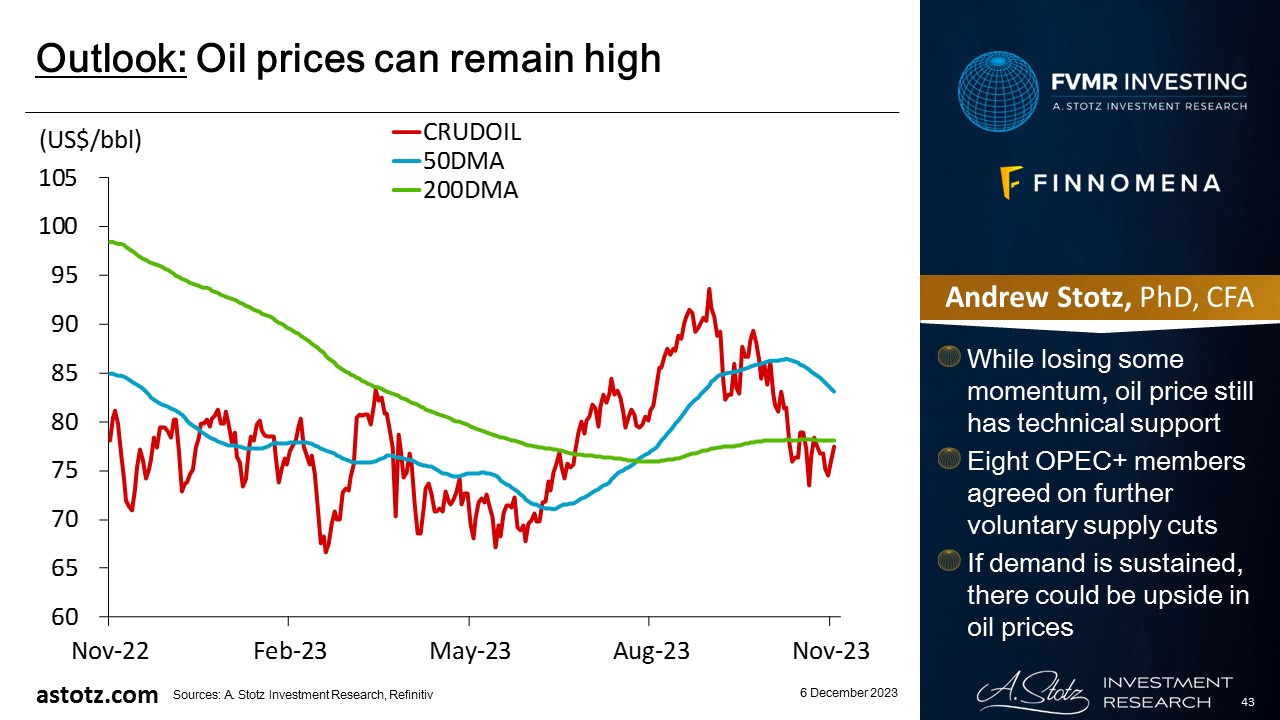

Oil prices can remain high

- While losing some momentum, oil price still has technical support

- Eight OPEC+ members agreed on further voluntary supply cuts

- If demand is sustained, there could be upside in oil prices

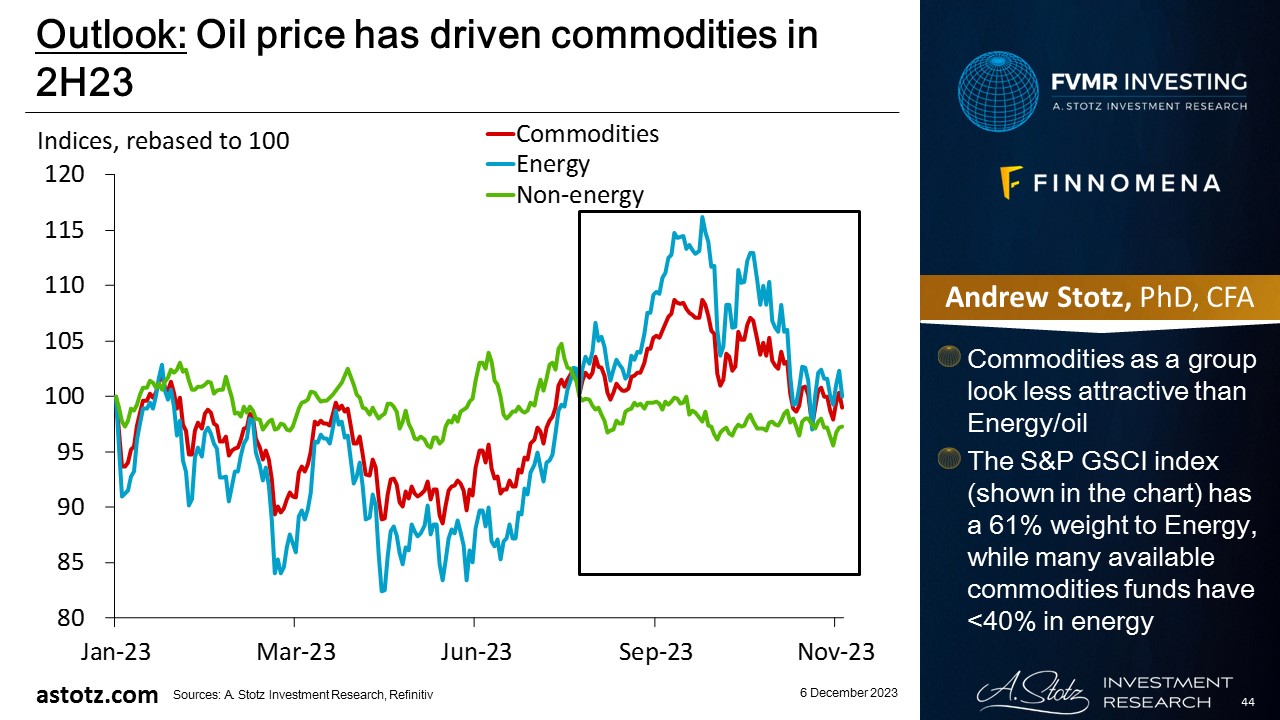

Oil price has driven commodities in 2H23

- Commodities as a group look less attractive than Energy/oil

- The S&P GSCI index (shown in the chart) has a 61% weight to Energy, while many available commodities funds have <40% in energy

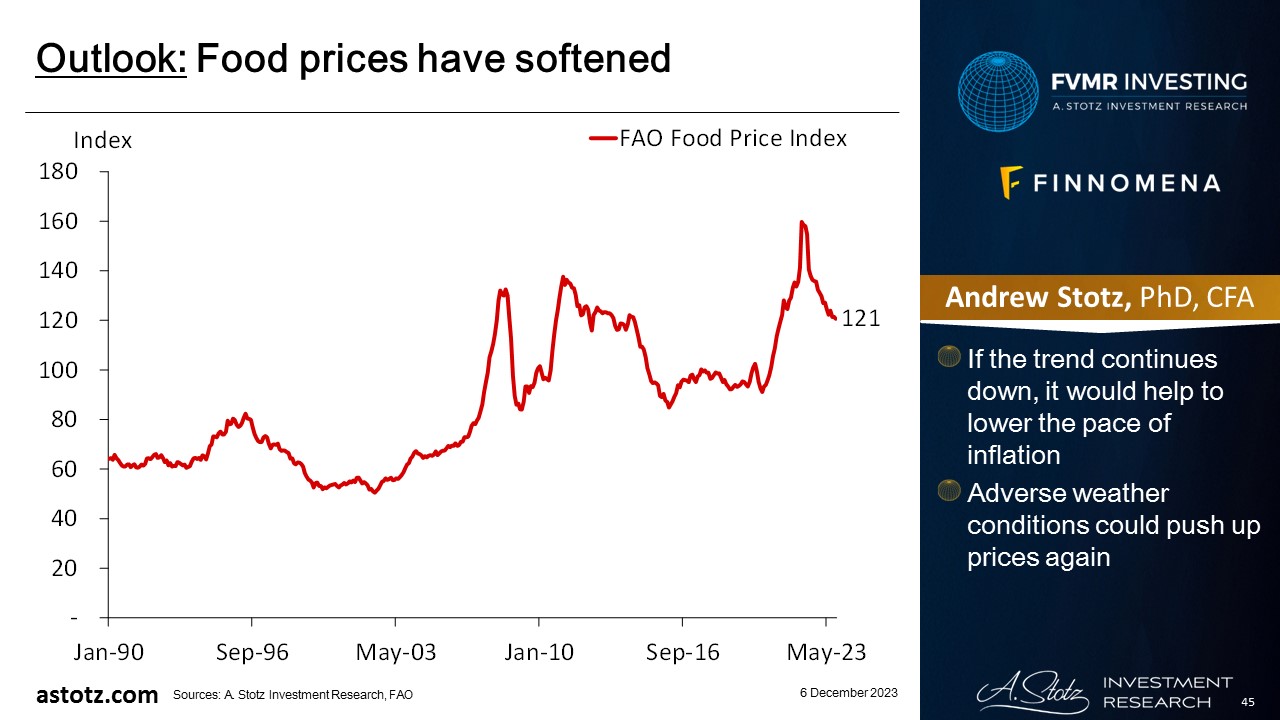

Food prices have softened

- If the trend continues down, it would help to lower the pace of inflation

- Adverse weather conditions could push up prices again

Commodities have rebounded due to oil, but too early to call the turn for the group

- The global economic growth outlook remains uncertain

- The main upside in commodities would come from a supply shock, adverse weather conditions, or significantly higher demand due to an improved growth outlook

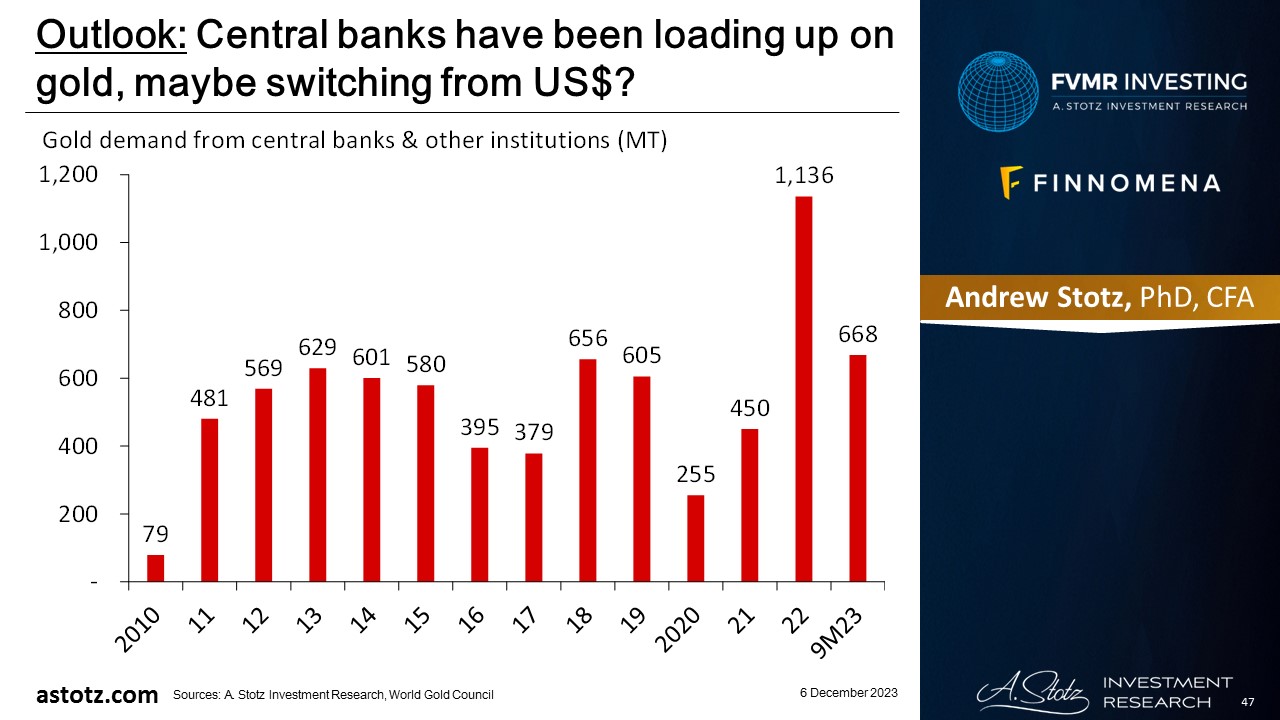

Central banks have been loading up on gold, maybe switching from US$?

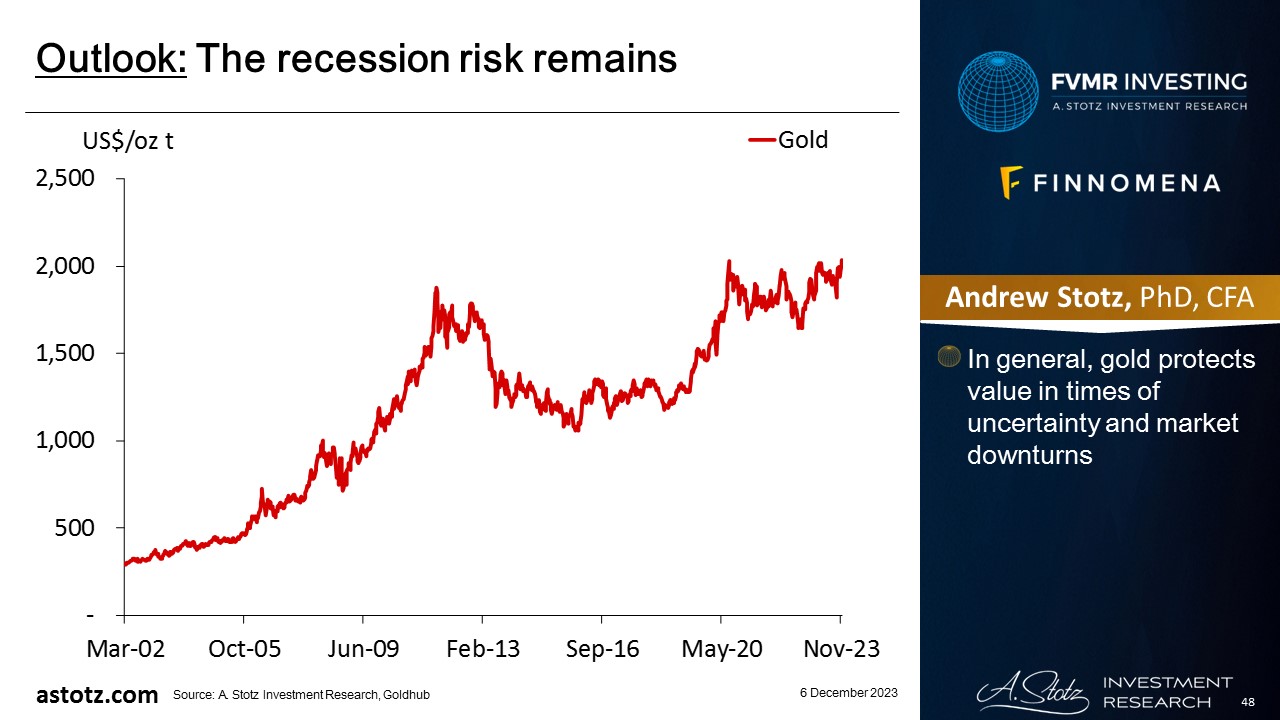

The recession risk remains

- In general, gold protects value in times of uncertainty and market downturns

Risk: Inflation reaccelerates

- Central banks’ aggressive rate hikes and QT crash the stock markets

- Continued rate hikes globally could lower bond yields (as higher rates mean lower bond prices)

- If inflation reaccelerates, we could miss out on rising commodities prices

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.