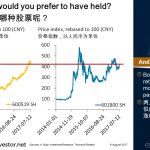

Chart of the Day: Two stocks returned the same, more than 300% in 3.5 years. The stocks had very different paths, but they both ended up yielding the same price return. Which stock would you prefer to have held?

Read MoreMK Restaurant Group Public Company Limited is a Thailand-based restaurant chain company. It franchises MK Suki (Japanese-style hot pot) restaurants in Japan, Vietnam, Indonesia and Singapore. MK outlets account for 80% of revenues and Yayoi restaurants account for 18% of revenues.

Read MoreIn our Top 5 this week, we look at how to avoid overpriced winners, discover the confidence trick the fund industry is playing, and explore Fundamental Investing. All this and more…

Read MoreDelta Electronics Public Company Limited is a Thai-based manufacturer and exporter of electronic components and power supplies. Profitable Growth has been in the green since 2013 but fell slightly to #2 from #1 in 2016.

Read MoreAgripure Holdings Public Company Limited is a Thai producer of sweet corn and other processed, vacuum-packed, canned and fresh vegetables. All of its vegetables are grown and processed locally at its owned or contracted farms, but most of its output is sold and marketed overseas under the brands, Tastee and River Kwai.

Read MoreAAPICO Hitech Public Company Limited was established in 1996 to design, produce and install assembly jigs, especially for automotive manufacturing. Founder & CEO Yeap Swee Chuan has presided over the company since 1996.

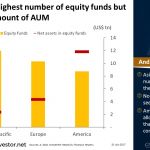

Read MoreChart of the Day: Asia has the highest number of equity funds but the lowest amount of assets under management. The number of funds and total assets seem to be inversely correlated.

Read MoreIn our Top 5 this week, we review lessons following the Great Financial Crisis, examine easy money decisions, and look at assessing fund manager performance. All this and more…

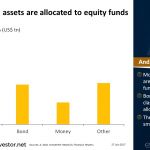

Read MoreChart of the Day: Most assets in the world are allocated to equity funds. Bonds and other asset classes together have a similar allocation at around US$9tn. The money market has the smallest asset allocation.

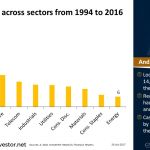

Read MoreChart of the Day: Looked at on average 14,000 companies around the world. Real Estate and Info Tech had the highest cash-to-sales, Energy and Consumer Staples the lowest.

Read More