In our Top 5 this week, we look at what to own over the next decade, wrap our heads around second-level thinking, and reveal how to ride out bear markets. All this and more…

Read MoreUnder concession from the Provincial Waterworks Authority, TTW runs water to businesses in Nakhon Pathom and Samut Sakhon provinces with a capacity of 440,000 m3 per day. Profitable growth has been excellent since 2013, consistently ranked among the best.

Read MoreThe Lanna Resources Public Company Limited is a Thai company engaged in the production and distribution of coal from mines located in Indonesia. Profitability and Growth ranked at no. 2 in the past 12 months after great improvements over the years.

Read MoreChart of the Day: Infographic of the top 5 ASEAN markets showing population, median age, population growth, and the number of investable stocks in each stock market.

Read MoreChart of the Day: 3,016 instruments available, 663 or 22% of which are liquid. Singapore, Philippines, and Indonesia have more concentrated markets. Thailand has the largest number of liquid instruments.

Read MoreLive Event: During the week of March 12, Andrew Stotz will have two events in Bangkok. All events are free to attend and we invite you to join us!

Read MoreIn our Top 5 this week, we look at Michael Porter’s value investing ideas, uncover the best ways to avoid investment disasters, and check out dollar-cost averaging. All this and more…

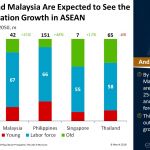

Read MoreChart of the Day: By 2050, Indonesia, Malaysia, and the Philippines are expected to have seen 25-48% population growth and relatively high labor force participation. This gives an optimistic outlook for economic growth in ASEAN.

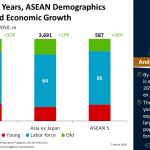

Read MoreChart of the Day: By 2050, the ASEAN population is expected to grow by 26%, much more than Asia ex Japan. The larger share of youngsters in ASEAN is also expected to make it have a larger share of the population in the labor force.

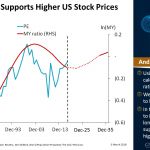

Read MoreThe idea behind the MY ratio is that a large middle-aged population who want to invest should drive up prices of investment securities. The MY ratio has had strong correlation, 86%, to the PE of the US market since 1973.

Read More