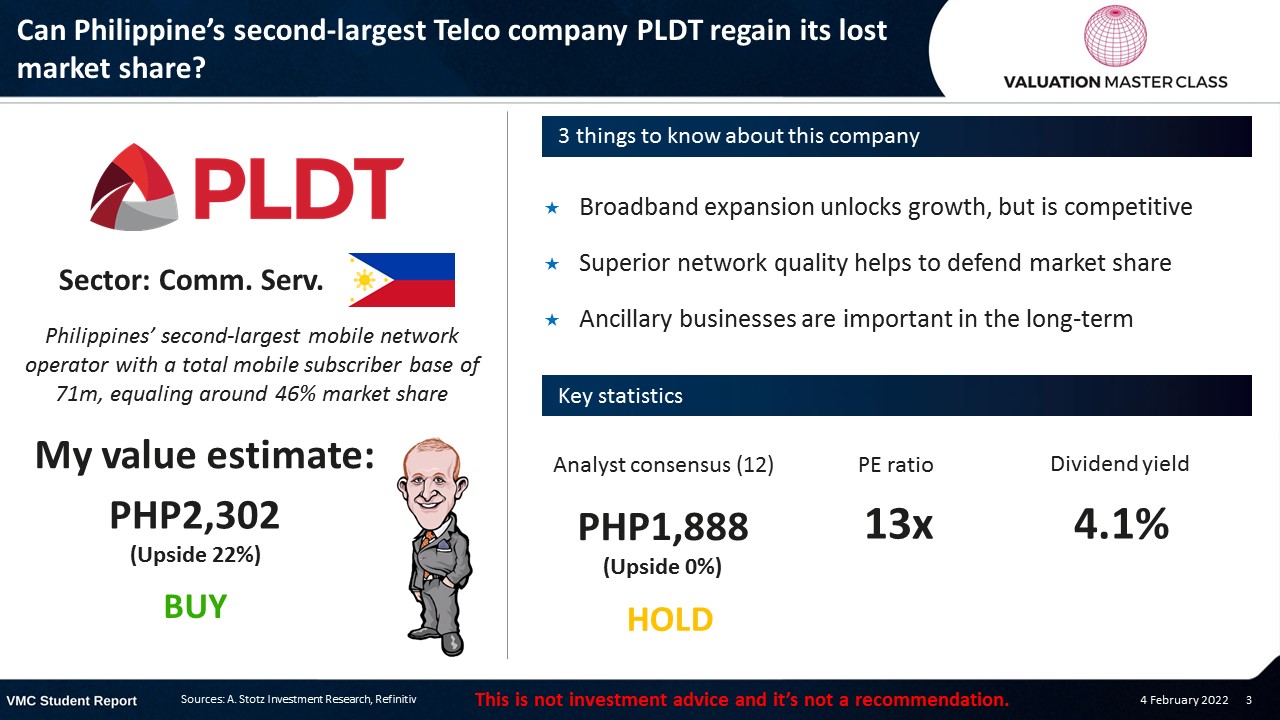

Can Philippine’s Second-Largest Telco Company PLDT Regain Its Lost Market Share?

The post was originally published here.

Highlights:

- Broadband expansion unlocks growth, but is competitive

- Superior network quality helps to defend market share

- Ancillary businesses are important in the long-term

Download the full report as a PDF

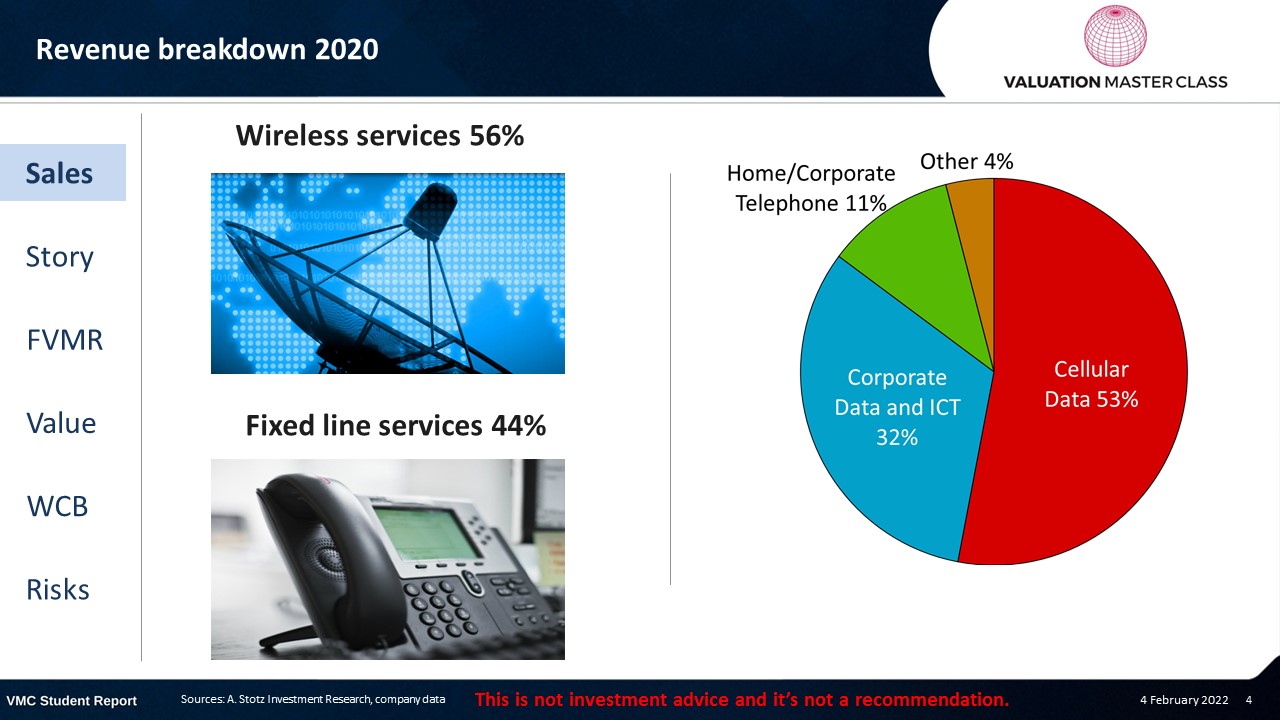

PLDT’s revenue breakdown 2020

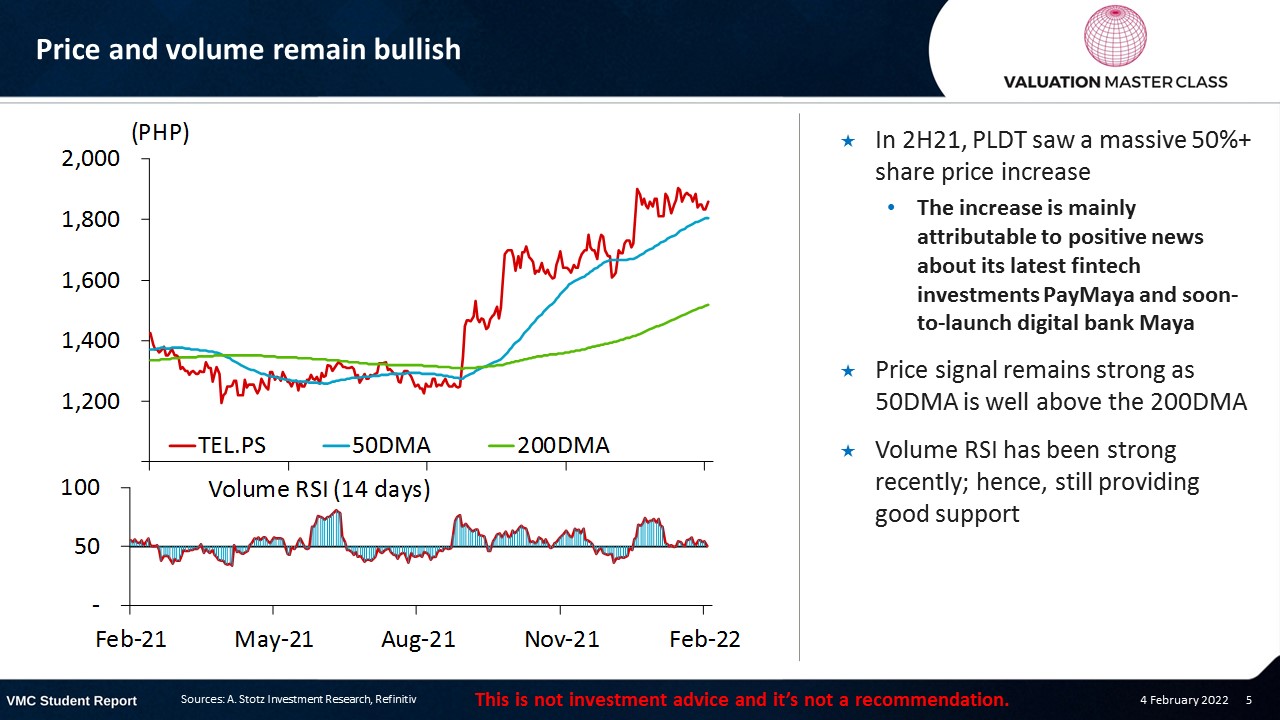

Price and volume remain bullish

- In 2H21, PLDT saw a massive 50%+ share price increase

- The increase is mainly attributable to positive news about its latest fintech investments PayMaya and soon-to-launch digital bank Maya

- Price signal remains strong as 50DMA is well above the 200DMA

- Volume RSI has been strong recently; hence, still providing good support

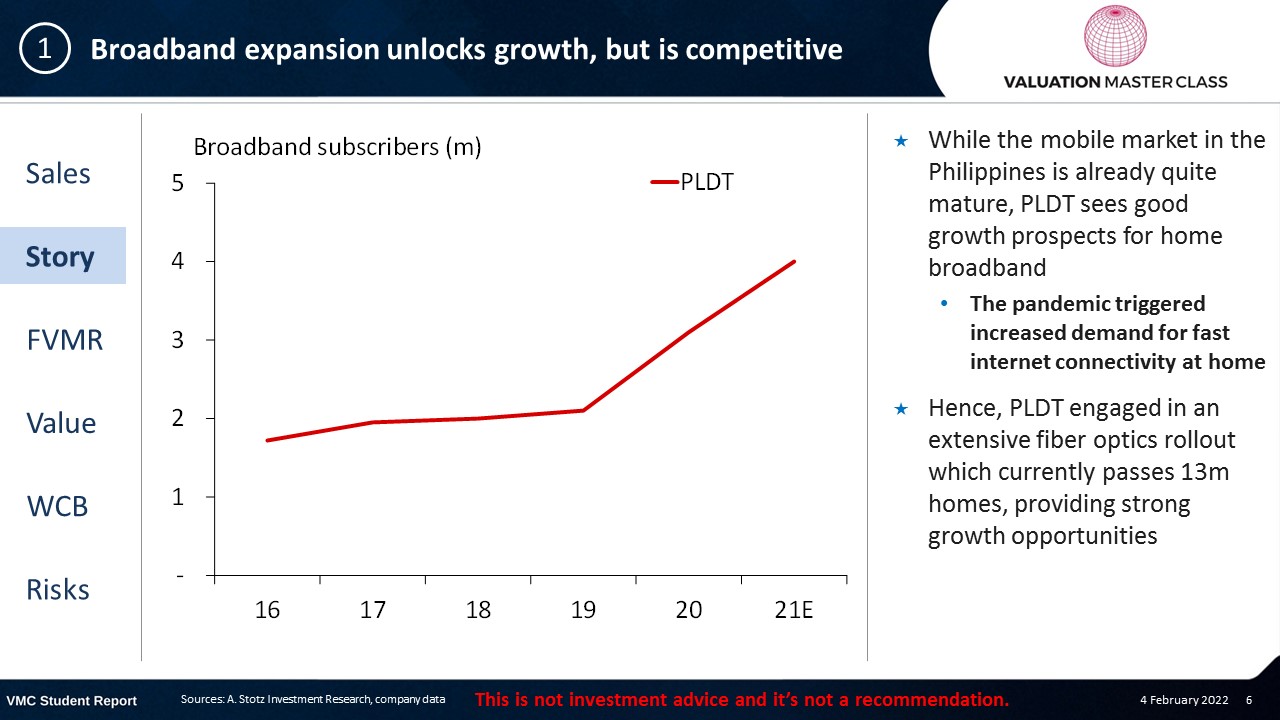

Broadband expansion unlocks growth, but is competitive

- While the mobile market in the Philippines is already quite mature, PLDT sees good growth prospects for home broadband

- The pandemic triggered increased demand for fast internet connectivity at home

- Hence, PLDT engaged in an extensive fiber optics rollout which currently passes 13m homes, providing strong growth opportunities

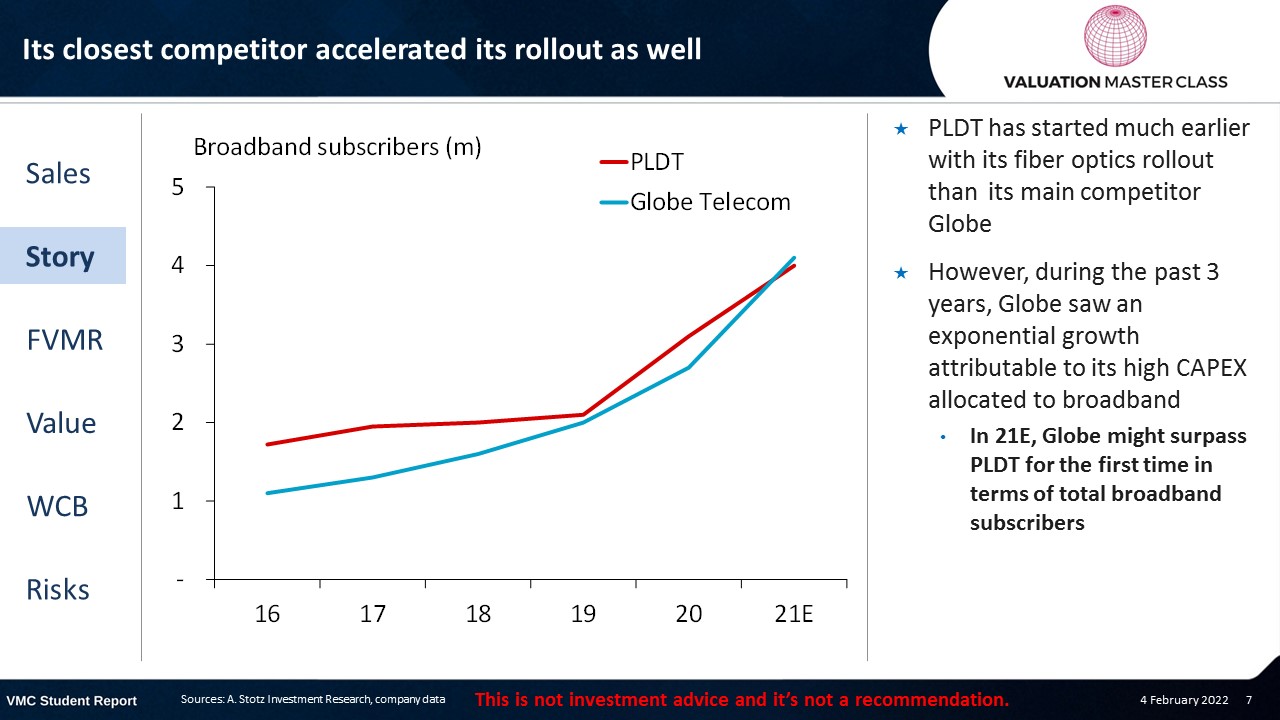

Its closest competitor accelerated its rollout as well

- PLDT has started much earlier with its fiber optics rollout than its main competitor Globe

- However, during the past 3 years, Globe saw an exponential growth attributable to its high CAPEX allocated to broadband

- In 21E, Globe might surpass PLDT for the first time in terms of total broadband subscribers

Superior network quality helps to defend market share

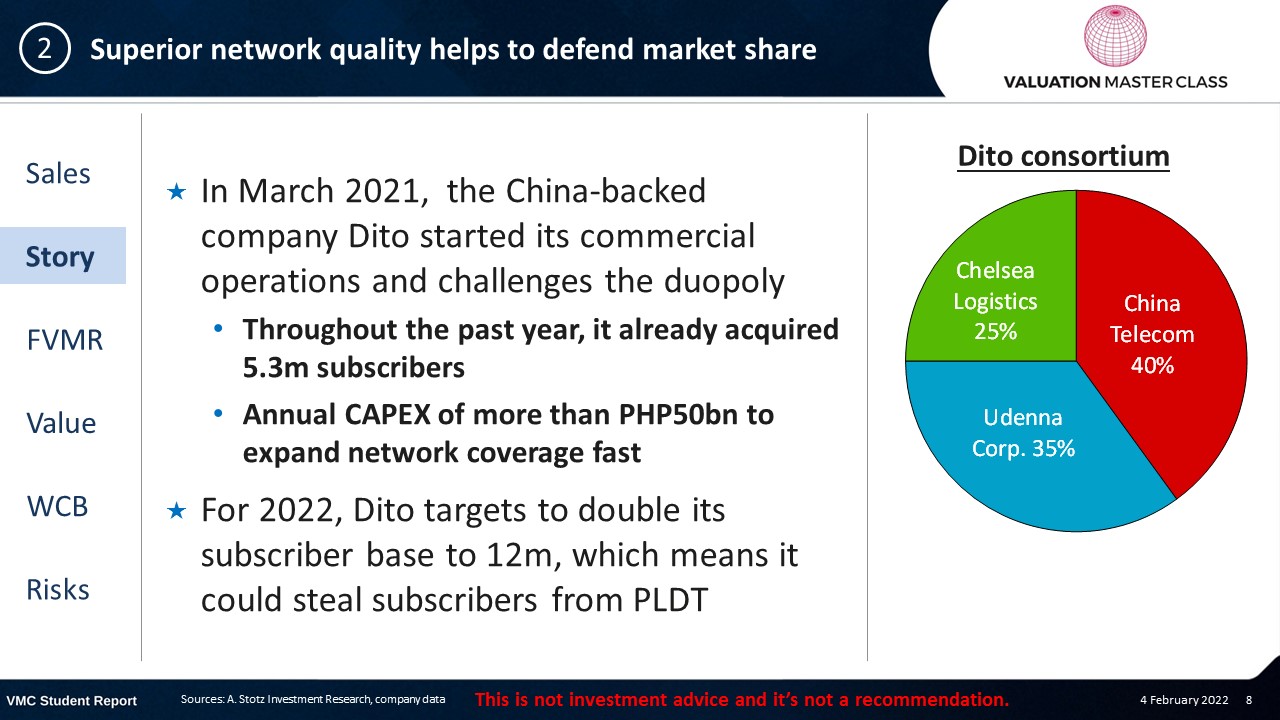

- In March 2021, the China-backed company Dito started its commercial operations and challenges the duopoly

- Throughout the past year, it already acquired 5.3m subscribers

- Annual CAPEX of more than PHP50bn to expand network coverage fast

- For 2022, Dito targets to double its subscriber base to 12m, which means it could steal subscribers from PLDT

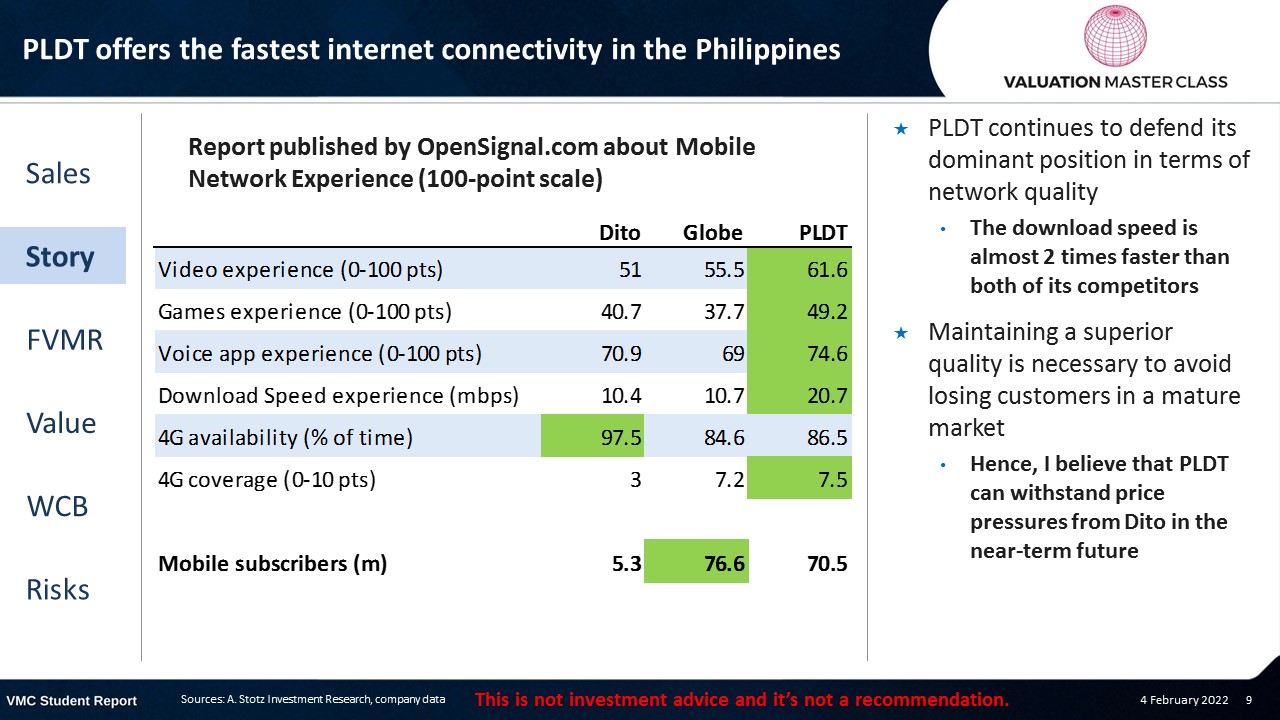

PLDT offers the fastest internet connectivity in the Philippines

- PLDT continues to defend its dominant position in terms of network quality

- The download speed is almost 2 times faster than both of its competitors

- Maintaining a superior quality is necessary to avoid losing customers in a mature market

- Hence, I believe that PLDT can withstand price pressures from Dito in the near-term future

Ancillary businesses are important in the long-term

- Through its investment in Voyager, PLDT offers the mobile payment solution and e-wallet “PayMaya”

- With 41m registrations, it is the second-largest e-wallet in the Philippines (Globe’s GCash has 51m users)

- The e-wallet business still produces annual losses of PHP2bn+, providing a drag on profits in the short run

- However, the investment could pay off big in the future

Driving growth by bundling services

- PLDT also tries to grow its data segment by investing in value-added content services such as Pay TV

- The most prominent one is Cignal TV, part of PLDT’s investment in MediaQuest

- Cignal TV has 3.7m subscribers as of 3Q21

- It allows PLDT to create attractive bundle offers of mobile, fixed-line and TV packages

- I believe that complimentary services like this are going to be important to realize growth in a mature market

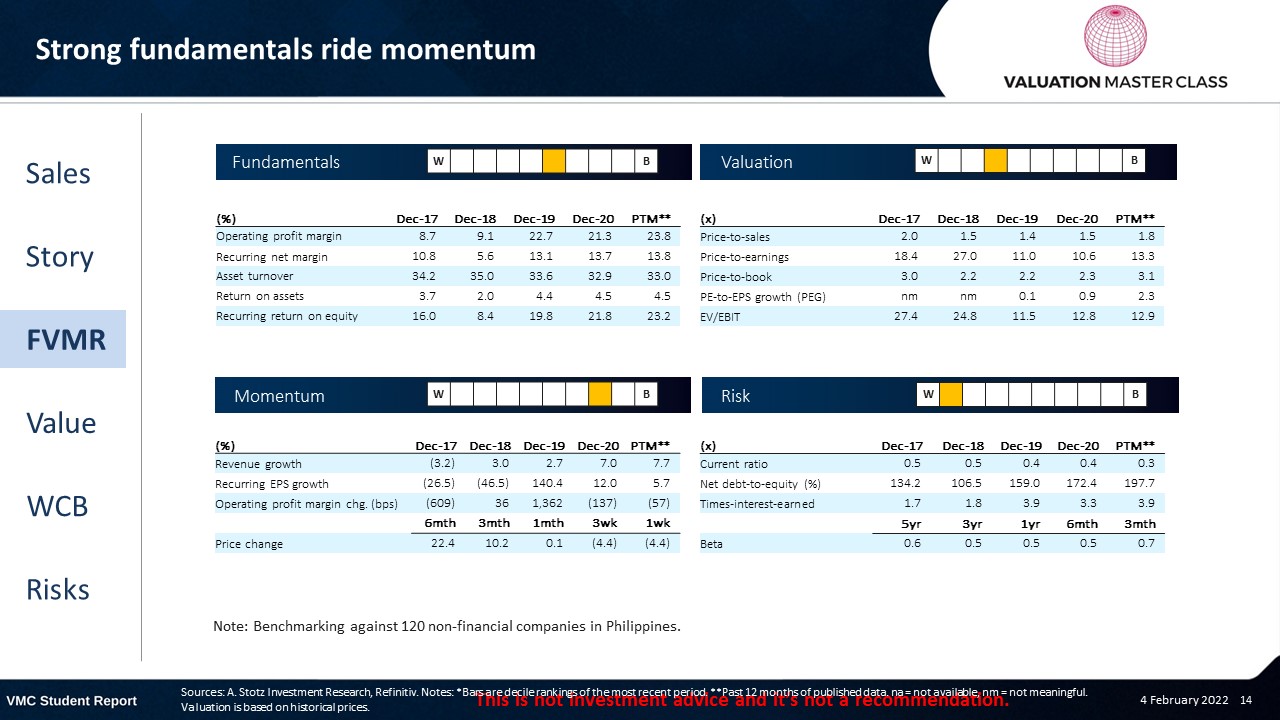

FVMR Scorecard – PLDT

- A stock’s attractiveness relative to stocks in that country or region

- Attractiveness is based on four elements

- Fundamentals, Valuation, Momentum, and Risk (FVMR)

- Scale from 1 (Best) to 10 (Worst)

Consensus don’t see further upside

- The majority analysts has a BUY recommendation, but upside is already captured by recent price rally

- Consensus expects solid single-digit revenue growth for the future

- Also, margins are expected to stay stable

Get financial statements and assumptions in the full report

P&L – PLDT

- Its investment in the e-wallet PayMaya is still not profitable yet but could start deliver profits in 22E

- Over time, it could evolve to a serious profit contributor

Balance sheet – PLDT

- Heavy CAPEX required to expand broadband and 5G coverage to defend market share

- Issuance of long-term debt necessary to fund expansion

- Operating cash flows are not sufficient to fund growth internally yet

Ratios – PLDT

- Dividend payout is high which means it could continue to deliver a solid dividend yield of 4%+

- Leverage slightly increased over time

- However, I don’t expect it to grow much further

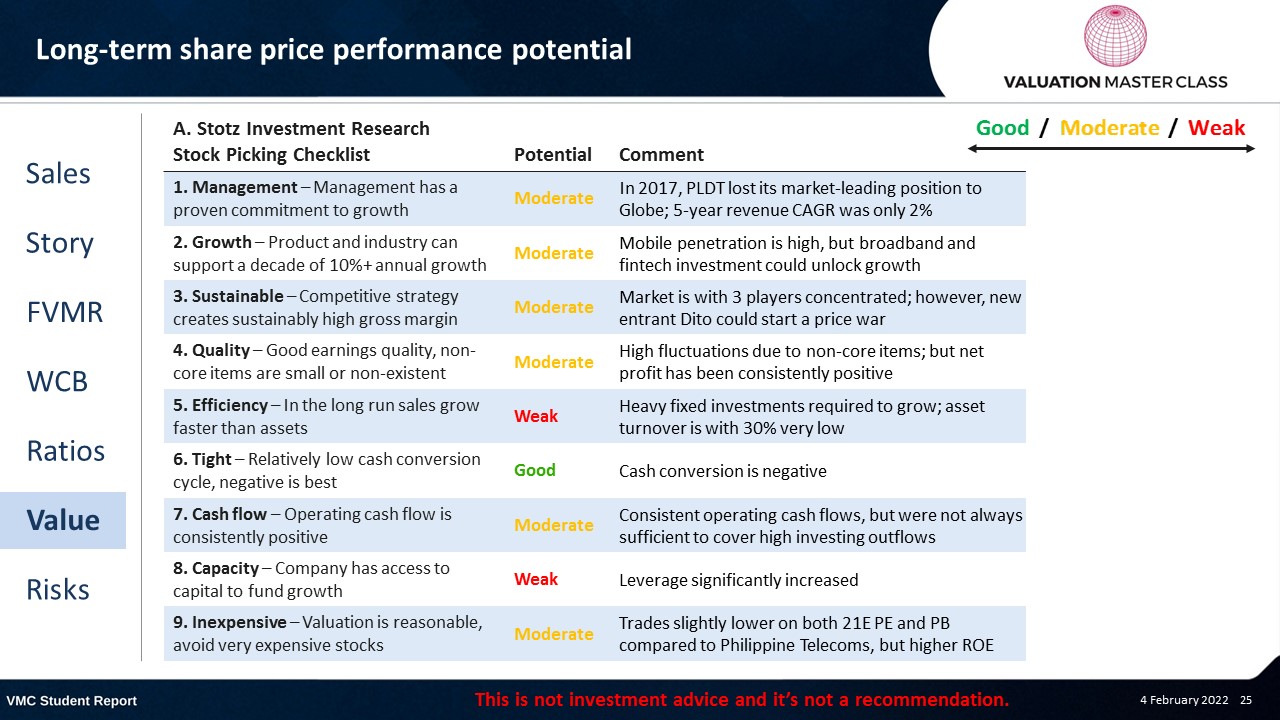

Long-term share price performance potential

Free cash flow – PLDT

- Negative FCFF in 2019 likely to be an exemption

- I expect stable and growing FCFF from 21E onward

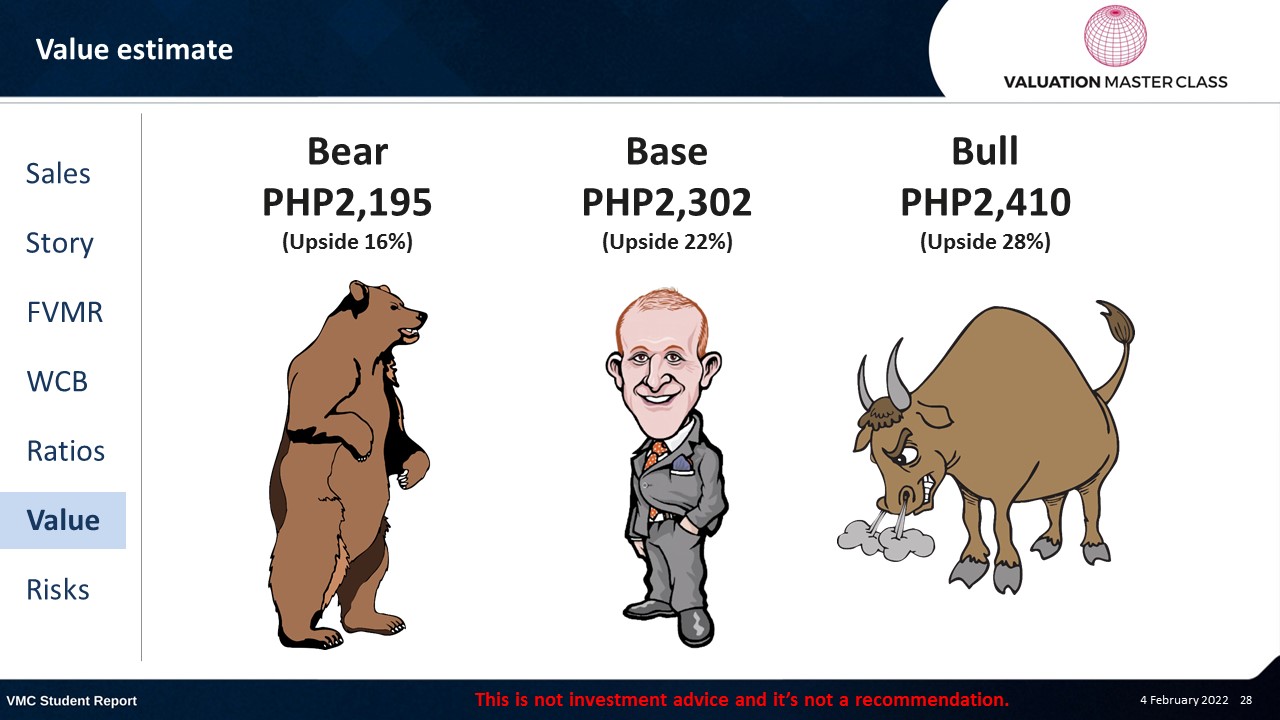

Value estimate – PLDT

- Similar to consensus, I expect stable revenue growth over the next few years

- I am a bit more optimistic on margins as I expect the third competitor Dito will not be able to scale fast enough and achieve similar network quality

- Over the long run, I assume PLDT to grow in line with population growth, which is around 2%

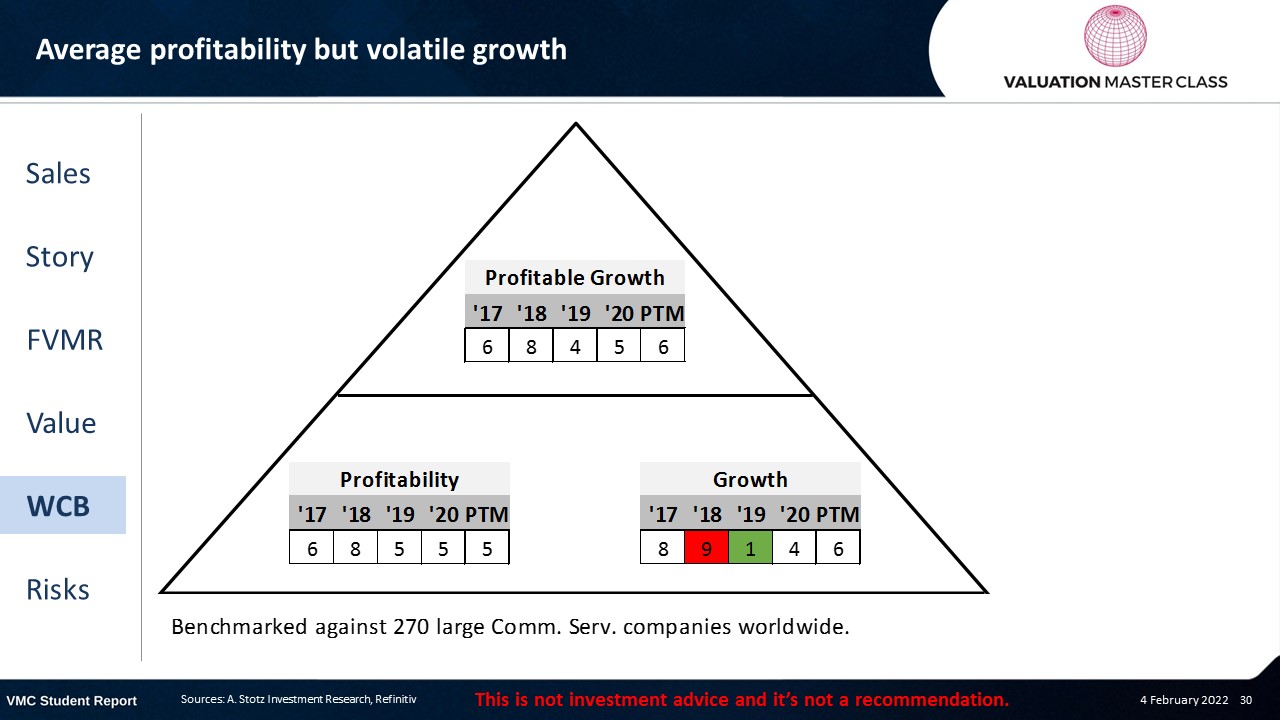

World Class Benchmarking Scorecard – PLDT

- Identifies a company’s competitive position relative to global peers

- Combined, composite rank of profitability and growth, called “Profitable Growth”

- Scale from 1 (Best) to 10 (Worst)

Key risk is intensified price competition

- Less-than-expected return on CAPEX in a capital-intensive industry

- Overestimation of profit contribution from Fintech investments

- Failure to keep up with technological changes

Conclusions

- Maintaining a superior network quality is critical success factor

- FinTech investments and value-added services could drive stable growth in a rather mature market

- High ROE and dividend yield make it an attractive play

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.