Become a Better Investor Newsletter – 8 July 2023

Noteworthy this week

- US core inflation lower than expected

- The service sector holds up the economy

- Bankruptcies peak at the end of a recession

- Extremely low earnings yield for S&P 500

- The top 1% is recovering

US core inflation lower than expected: Fed’s preferred inflation measure, the personal consumption expenditures price index (PCE), was 3.8% in May 2023. Though, core CPE, which excludes the volatile food and energy components, didn’t slow as much.

BREAKING: PCE inflation, the Fed’s preferred inflation metric, FALLS to 3.8%, below expectations of 4.6%.

Core PCE inflation is now at 4.6%, also below expectations of 4.7%.

This is the largest monthly drop this year.

The Fed may finally be winning the fight against inflation.

— The Kobeissi Letter (@KobeissiLetter) June 30, 2023

The service sector holds up the economy: The service sector has been outperforming manufacturing recently (not only in the US). However, the excess savings are running out.

With manufacturing in recession, solid services due to excess savings have been holding up the US economy. What will hold it up in 2024 when excess savings run out? (WF) pic.twitter.com/rAT5VlXMIx

— Michael A. Arouet (@MichaelAArouet) July 2, 2023

Bankruptcies peak at the end of a recession: Bankruptcy filings lag the business cycle; hence, the peak in filings is expected at the end of a recession. Though bankruptcy filings lead loan write-offs.

GFC Starting Point Matters

Bankruptcies lag business cycle, w/peak seen at end of recession. Ch 11 filings heavily lagged in 2001 recession, not peaking until 2003/04. Bankruptcy filings also lead bank loan charge-off rates. Moreover, filings lead loan delinquencies@SimonHWhite pic.twitter.com/sGJYlDhs0t

— Danielle DiMartino Booth (@DiMartinoBooth) July 4, 2023

Extremely low earnings yield for S&P 500: Earnings yield is only at 2.8%, which marked 1929 and 1966 market tops. Hence, this is likely not a great entry point into US stocks.

Long-term investors should not touch the market even with a ten-foot pole

Earnings yield is only at 2.8%

Current valuations have marked iconic tops, like 1929 and 1966 pic.twitter.com/mLlFDgrqHN

— Game of Trades (@GameofTrades_) July 1, 2023

The top 1% is recovering: The 1% lost significant income share in the early 1900s. However, the income share has risen in many countries since the late 1900s and the 2000s.

The graph below shows how well the richest Top 1% have done across different countries over the past 200 years.

Some interesting patterns explored in 🧵.#dataviz pic.twitter.com/zomM2F6fWe

— Ruben Mathisen (@rubenbmathisen) July 1, 2023

Join the world’s toughest valuation training

Become a Valuation Expert. Valuation Master Class Boot Camp graduates can confidently value any company in the world and possess in-demand industry skills.

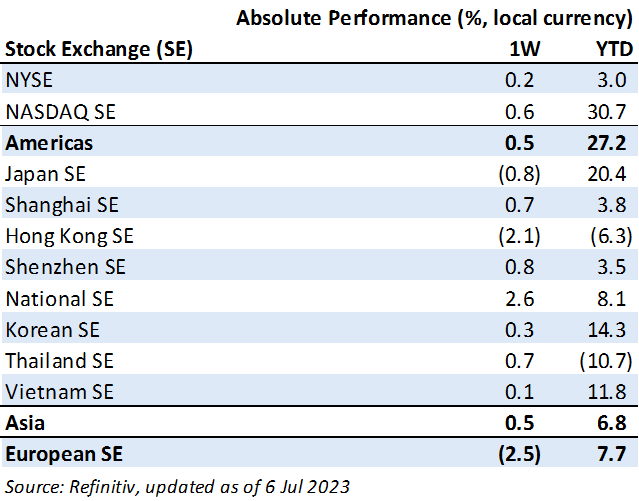

Weekly market performance

Click here to see more markets and periods.

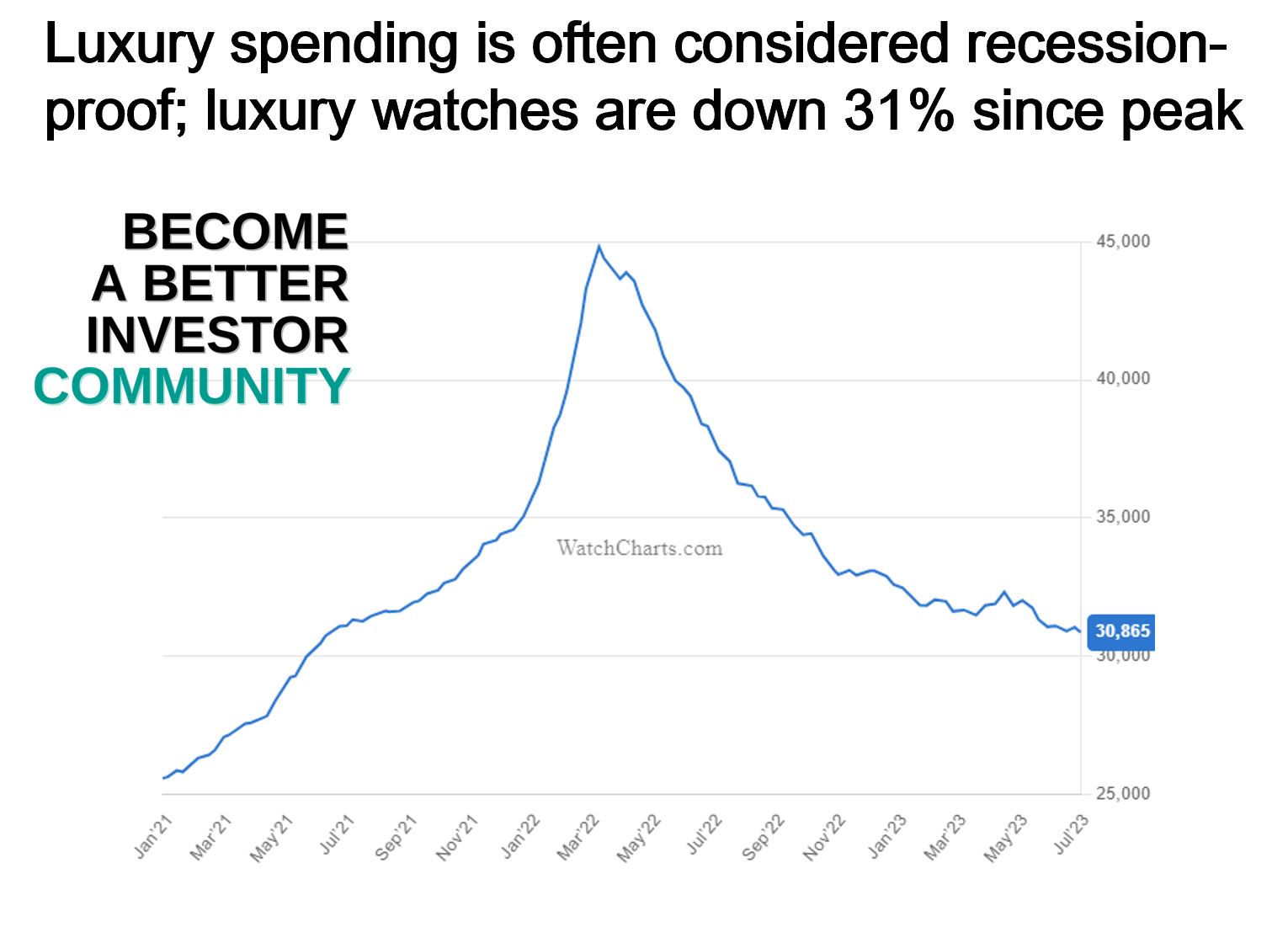

Chart of the week

Discussed in the Become a Better Investor Community this week

“In tonight’s live session, @andrew will present 13 warning signs of a recession (suitable number, isn’t it?). These are 13 indicators we have been looking at in our research, and we’d like to discuss them with you. Do you have any recession indicators you look at? Share them in tonight’s live session.”

Try 1 month of the Become a Better Investor Community for FREE today!

You can cancel at any time. Click here to learn more.

Podcasts we listened to this week

Joe Rogan Experience #1807 – Douglas Murray

“Douglas Murray is a political commentator, journalist, and author of numerous books, the most recent of which is ‘The War on the West: How to Prevail in the Age of Unreason.’”

Listen to/watch the episode on Spotify

Readings this week

Failure Found to Be an “Essential Prerequisite” for Success

“Scientists use big data to understand what separates winners from losers.”

Book recommendation

Against the Gods: The Remarkable Story of Risk by Peter L. Bernstein

“In this unique exploration of the role of risk in our society, Peter Bernstein argues that the notion of bringing risk under control is one of the central ideas that distinguishes modern times from the distant past. Against the Gods chronicles the remarkable intellectual adventure that liberated humanity from oracles and soothsayers by means of the powerful tools of risk management that are available to us today.”

Get the book on Audible or Kindle.

Audible is great; have you tried it? If not, click here to get 2 books for free.

Memes of the week

— Not Jerome Powell (@alifarhat79) July 4, 2023

you’re not alone pic.twitter.com/Bee0S8lQjG

— Wall Street Memes (@wallstmemes) July 5, 2023

New My Worst Investment Ever episodes

Ep708: Phil Bak – Be Slow to Jump Onto Bandwagons

BIO: Phil Bak is the CEO of Armada ETFs, a REIT-specialty asset manager that delivers customized solutions to REIT investors through ETFs, SMAs, and proprietary AI and machine learning REIT valuation models.

STORY: Phil got into baseball cards when he was 14. Rookie Greg Jeffries became the hype one year and was poised to be the next big thing. Phil bought the hype, sold all his cards, and invested in Jeffries’ cards. He believed cards would be worth $40 to $50 a piece in just a few years. It never happened because Jeffries’ career didn’t pan out, and the entire baseball card bubble collapsed.

LEARNING: Be slow to jump onto bandwagons. Expect the unexpected, be prepared, and have a backup plan. Be diversified in as many different ways as possible.

Access the episode’s show notes and resources

Ep707: Jack Schwager – Never Stay in a Position That Violates What You Believe In

BIO: Jack D. Schwager is a recognized industry expert on futures and hedge funds and the author of the iconic Market Wizards series, in which he interviewed about 70 trading legends of our time.

STORY: Jack stayed too long in a position where his short was the strongest and his long the weakest, even though he knew this wasn’t the way to invest.

LEARNING: Never stay in a position that violates something that you believe in. In every position, know where you’ll get out before you get in.

Access the episode’s show notes and resources

Ep706: Sampark Sachdeva – Don’t Be Afraid to Take the Plunge

BIO: Sampark Sachdeva has 12 years of corporate experience across Asian Paints and other businesses.

STORY: Sampark let the security of his corporate job distract him from building a business out of his love for training. It wasn’t until COVID struck and he found himself without a job that he decided to work on the plan. The business turned out to be a huge success.

LEARNING: Nothing good comes easy. Don’t let job security restrict you from pursuing your entrepreneurial dreams.

Access the episode’s show notes and resources

Published on Become a Better Investor this week

What’s the difference between “perfect” and “that will work?” We use them interchangeably all the time. In this episode, Bill and Andrew discuss what “perfect” means and why it’s standing in the way of innovation and improvement at work and at home.

Listen to The End of Perfection: Awaken Your Inner Deming (Part 4)

In this episode of Investment Strategy Made Simple (ISMS), Andrew and Larry discuss two chapters of Larry’s book Investment Mistakes Even Smart Investors Make and How to Avoid Them. In this seventh episode, they talk about mistake number 11: Do you let the price paid affect your decision to continue to hold an asset? And mistake number 12: Are you subject to the fallacy of the hot streak?

Read ISMS 26: Larry Swedroe – Are You Subject to the Endowment Effect or the Hot Streak Fallacy?

Triveni Turbine Limited (TRIV IN): Profitable Growth rank of 2 was same compared to the prior period’s 2nd rank. This is World Class performance compared to 770 small Industrials companies worldwide.

Read Triveni Turbine – World Class Benchmarking

Asian markets were down in 1H23 except for Taiwan, Korea, Vietnam, Indonesia, and India. Taiwan was the strongest performer in USD and local terms.

Read Taiwan Was the Best Performer in Asia in 1H23

In June 2023, we published 16 new episodes of the My Worst Investment Ever podcast and one blog post. Listen to all of them here.

Listen to My Worst Investment Ever June 2023

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.