Become a Better Investor Newsletter – 7 October 2023

Noteworthy this week

- US$ on a rally

- China might not be getting out of US$

- Corporates took advantage of QE

- We’ve heard about soft landings before

- Truckers yell, “Recession!”

US$ on a rally: “Just like everyone predicted.” That’s, of course, irony. In fact, every single currency has depreciated against the US Dollar over the last 10 years.

Over the last 3 years, the US Money Supply (M2) has increased by 14%, US inflation (CPI) has increased by 18%, and National Debt has grown by 24%.

And over that time the US Dollar Index ETF has gained 19% while the Gold ETF has lost 5%.

Just like everyone predicted. pic.twitter.com/iVOTHPCTCk

— Charlie Bilello (@charliebilello) October 5, 2023

China might not be getting out of US$: While China has reduced US Treasuries in its dollar reserves, they’ve increased the use of offshore custodians and likely still holds about 50% of its reserves in dollar bonds.

Hold the presses. The odds are that China isn’t actually selling dollar bonds. Or even moving its reserves out of the dollar.

A new blog on how to interpret the US TIC datahttps://t.co/4v4yvLLuW2

— Brad Setser (@Brad_Setser) October 4, 2023

Corporates took advantage of QE: Net corporate interest expense has gone down this year. Corporates took advantage of QE to term out borrowing at record-low rates and are now earning 5%+ interest on their cash.

“Net corporate interest expense has gone down this year. It is effectively as if the Fed cut rates. Why? Because corporates took advantage of QE to term out borrowing at record-low rates and are now earning 5%+ interest on their cash:” DB’s George Saravelos pic.twitter.com/3YrDBOioFG

— Lisa Abramowicz (@lisaabramowicz1) October 2, 2023

We’ve heard about soft landings before: News about soft landings has peaked before previous recessions. It may not be a leading indicator but rather a reflection of the hope of a better outcome when recession is on the horizon.

Soft landing narrative is not new, it preceded two last hard landings pic.twitter.com/RynAAWlu8L

— Michael A. Arouet (@MichaelAArouet) October 2, 2023

Truckers yell, “Recession!”: Fall in trucking employment has historically preceded recessions. Will this time be different?

Recession is closing in

Buckle up. pic.twitter.com/6AiEqozrhH

— Game of Trades (@GameofTrades_) October 1, 2023

Join the world’s toughest valuation training

Become a Valuation Expert. Valuation Master Class Boot Camp graduates can confidently value any company in the world and possess in-demand industry skills.

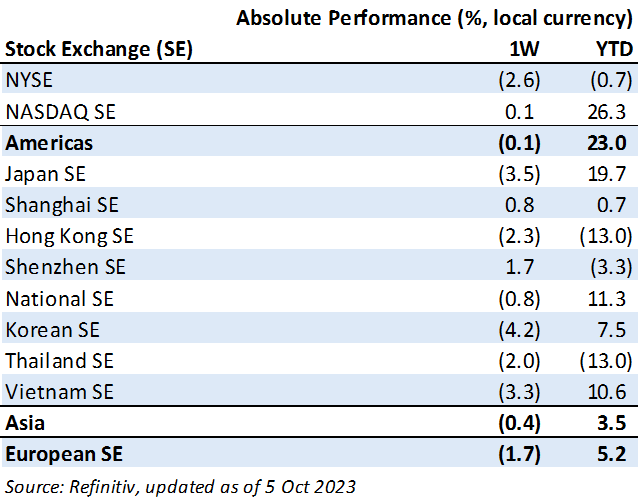

Weekly market performance

Click here to see more markets and periods.

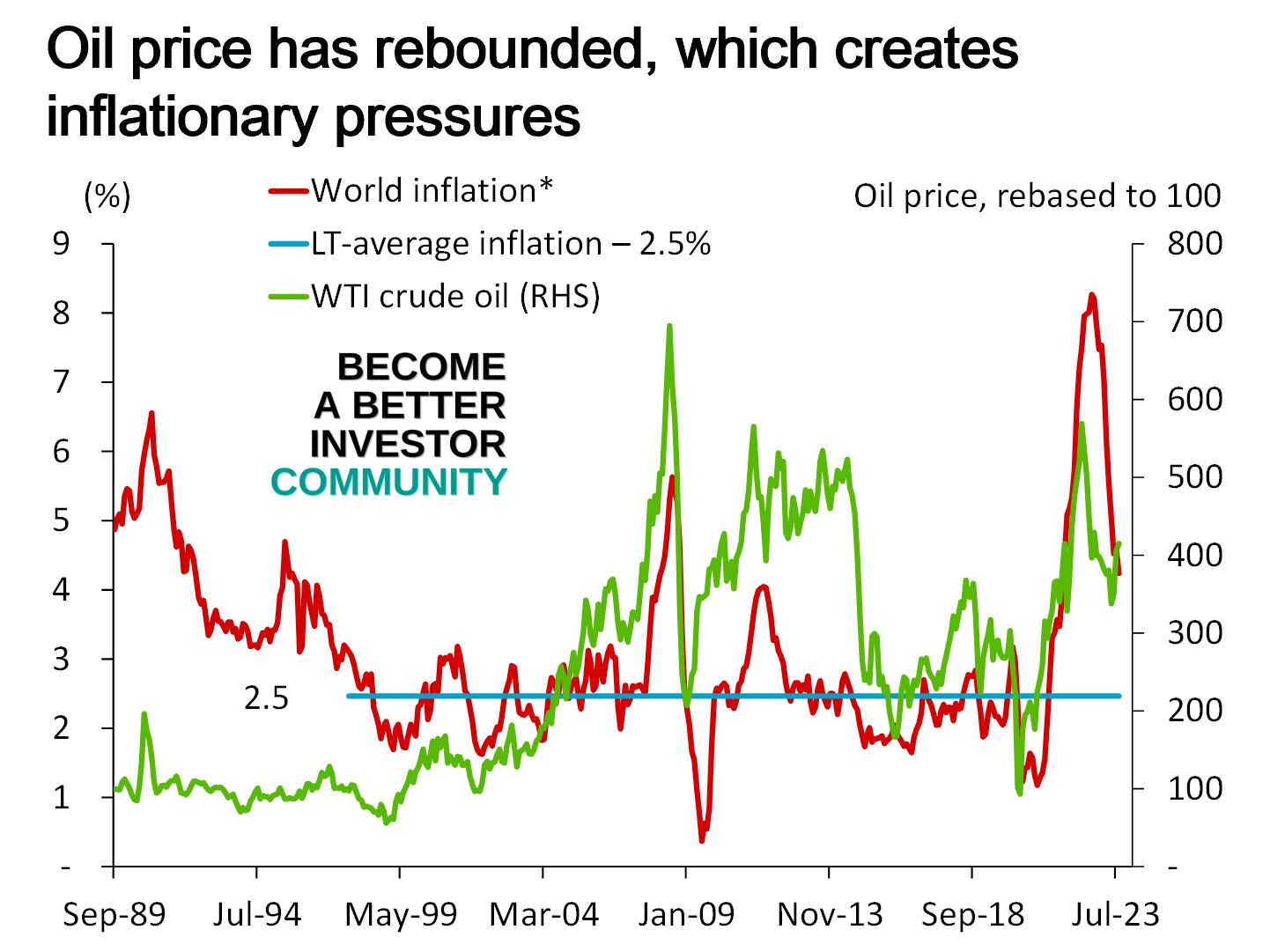

Chart of the week

Discussed in the Become a Better Investor Community this week

“We just uploaded the performance review of our Global Asset Allocation Strategy.”

Try 1 month of the Become a Better Investor Community for FREE today!

You can cancel at any time. Click here to learn more.

Podcasts we listened to this week

The Tim Ferriss Show – Nassim Nicholas Taleb & Scott Patterson — How Traders Make Billions in The New Age of Crisis, Defending Against Silent Risks, Personal Independence, Skepticism Where It (Really) Counts, The Bishop and The Economist, and Much More (#691)

Readings this week

China Isn’t Shifting Away From the Dollar or Dollar Bonds

“China’s reserves has shifted its dollar reserves from Treasuries to Agencies, and made increased use of offshore custodians. The available evidence suggests that it still holds about 50 percent of its reserves in dollar bonds.”

Book recommendation

Myths of Light: Eastern Metaphors of the Eternal by Joseph Campbell

“In Myths of Light, Campbell explores the core philosophies and mythologies of the East, comparing them through vivid examples and stories to each other and to those of the West. A worthy companion to Thou Art That and to Campbell’s Asian Journals, this volume conveys complex insights through warm, accessible storytelling, revealing the intricacies and secrets of his subject with his typical enthusiasm.”

Get the book on Audible or Kindle.

Audible is great; have you tried it? If not, click here to get 2 books for free.

Memes of the week

— Not Jerome Powell (@alifarhat79) October 4, 2023

These CAPTCHAs are getting tough! pic.twitter.com/QTd1qujIcP

— Ramp Capital (@RampCapitalLLC) October 4, 2023

New My Worst Investment Ever episodes

ISMS 31: Global CPI saw 2nd MoM uptick in August

Will the global CPI slowdown continue? Or will it rebound?

Access the episode’s show notes and resources

Ep735: Swen Lorenz – Carefully Consider Liquidity in Your Portfolio

BIO: Swen Lorenz is a passionate public equity investor and the face of Undervalued-Shares.com. With over 30 years of experience in investing, Swen has a knack for finding exciting investment opportunities in very unexpected places, which he discovers while traveling the globe.

STORY: Swen had a 12.5% stake in a German fund manager performing well. A competitor wanted to buy up companies in that space and approached Swen to ask other shareholders if they would sell. The company didn’t like this, asked the regulator to look into Swen’s affairs, and accused him of all sorts of things. It ended with Swen narrowly losing a contentious proxy battle.

LEARNING: Carefully consider the liquidity of the investments you’re holding. Going above the disclosure threshold as an investor is dangerous.

Access the episode’s show notes and resources

Ep734: Paul Merriman – What You Do When You Are Young, Is Golden

BIO: Paul Merriman is a nationally recognized authority on mutual funds, index investing, and asset allocation. After retiring in 2012 from Merriman Wealth Management, which he founded in 1983, Paul created The Merriman Financial Education Foundation, dedicated to providing investors of all ages with free information and tools to make better investment decisions.

STORY: Paul has had a series of bad investments, and they were all driven by emotions. It wasn’t until Paul got the emotion out of that process that his money started to grow.

LEARNING: The first five years of the money you put away can, theoretically, represent 40% of the value of your portfolio over the long term. Start investing early so that you can benefit from the compounding effect.

Access the episode’s show notes and resources

Ep733: Vikram Mansharamani – Liquidity Will Not Always Be There

BIO: Dr. Vikram Mansharamani is a global trend-watcher who shows people how to anticipate the future, manage risk, and spot opportunities.

STORY: Vikram invested in a small commercial condo that he hoped to rent to Ph.D. students, but they weren’t interested. He had to sell it after a few years of no income. He took a 50% loss.

LEARNING: Liquidity is not a constant. If the timing of your thesis is off, then you’re wrong. The market can stay irrational longer than you can remain liquid.

Access the episode’s show notes and resources

Published on Become a Better Investor this week

In this episode, Bill and Andrew discuss the shades of variation: meeting requirements, accuracy, precision, and precision around variety. Is reducing variation to zero a good thing? Plus, Bill and Andrew share stories that offer practical ways to think about these concepts.

Listen to Understanding Shades of Variation: Awaken Your Inner Deming (Part 8)

Asian markets were down in 9M23 except for Taiwan, India, Korea, Vietnam, and Indonesia. Taiwan was the strongest performer in USD and local terms.

Read Taiwan Was the Best Performer in Asia in 9M23

Daiichikosho Company Limited (7458 JP): Profitable Growth rank of 2 was up compared to the prior period’s 9th rank. This is World Class performance compared to 250 large Comm. Serv. companies worldwide.

Read Daiichikosho – World Class Benchmarking

Tangshan Port Group Company Limited (601000 SH): Profitable Growth rank of 3 was same compared to the prior period’s 3rd rank. This is above average performance compared to 1,460 large Industrials companies worldwide.

Read Tangshan Port Group – World Class Benchmarking

In September 2023, we published 9 new episodes of the My Worst Investment Ever podcast. Listen to all of them here.

Listen to My Worst Investment Ever September 2023

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.