Become a Better Investor Newsletter – 6 July 2024

Noteworthy this week

- Unemployment to rise in the US

- Small caps perform record bad

- Milei sorts out Argentina

- Young French rejects centrism

- Buffett is no longer buddies with Gates

Unemployment to rise in the US: According to the chart, small businesses’ hiring plans lead unemployment in the US. So, if this relationship holds true, we should soon start seeing a significant increase in US unemployment.

Next few months will be interesting

Chart @Gavekal pic.twitter.com/QHNH1lKnEJ

— Michael A. Arouet (@MichaelAArouet) July 1, 2024

Small caps perform record bad: Small caps post worst first half-year performance in history relative to large caps.

Small Cap Stocks post worst first half in HISTORY relative to Large Caps pic.twitter.com/pcyt0pK3nd

— Barchart (@Barchart) July 2, 2024

Milei sorts out Argentina: Milei’s policies have already reduced consumer prices and increased the value of the Peso. Rock on!

The Milei Effect on inflation and exchange rates in Argentina (via @TheEconomist) pic.twitter.com/mVYXJwkkD7

— Jon Hartley (@Jon_Hartley_) June 30, 2024

Young French rejects centrism: The most recent election results in France show that the 18-24-year-olds prefer the far left and, thereafter, the far right, and definitely not Macron’s center alternative.

An underrated story in this French election is young people’s total rejection of centrism.

Macron’s party wins among people aged 70+, and absolutely bombs with 18-24s. pic.twitter.com/b7JwNHrL7K

— John Burn-Murdoch (@jburnmurdoch) July 2, 2024

Buffett is no longer buddies with Gates: Buffett has already given money to the Gates Foundation, but it seems he has changed his mind about his inheritance. Good decision!

BUFFETT SAYS MOST OF WEALTH WILL GO TO A NEW CHARITABLE TRUST OVERSEEN BY HIS CHILDREN — WSJ

BUFFETT: ‘GATES FOUNDATION HAS NO MONEY COMING AFTER MY DEATH’ — WSJ

— *Walter Bloomberg (@DeItaone) June 28, 2024

Join the world’s toughest valuation training

Become a Valuation Expert. Valuation Master Class Boot Camp graduates can confidently value any company in the world and possess in-demand industry skills.

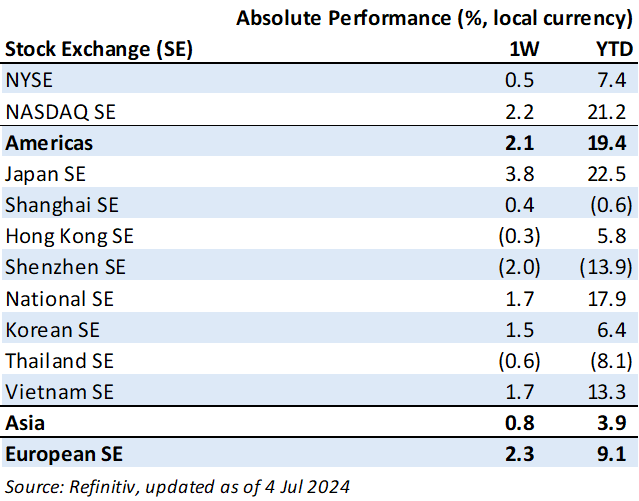

Weekly market performance

Click here to see more markets and periods.

Chart of the week

Discussed in the Become a Better Investor Community this week

“Great thought-out research is provided here. I have some questions.

1. Why or what is the benefit of comparing gold’s price to M2 supply?

2. It seems that if we consider point A as an overvalue for the gold price and come up with the comparable price as point B, what are the links between these two factors, or what is your thesis?”

Try 1 month of the Become a Better Investor Community for FREE today!

You can cancel at any time. Click here to learn more.

Podcasts we listened to this week

RWH046: A NEW GOLDEN AGE W/ BOB ROBOTTI

“In this episode, William Green chats with Bob Robotti, a great investor who’s crushed the S&P 500 over the last 40 years. Bob, the President & Chief Investment Officer of Robotti & Co, explains why he believes we’re in a ‘new golden age’ for active, value-oriented investors (not index funds); why he expects persistently high inflation; why he’s betting heavily on the resurgence of Old Economy businesses; & how he’s positioned to profit from ‘the first truly global energy crisis.’”

Readings this week

Quiet Compounding

“Giant sequoias, advanced organisms, towering mountains – it builds the most jaw-dropping features of the universe. And it does so silently, where growth is almost never visible right now but staggering over long periods of time.”

Book recommendation

Dynasty: The Rise and Fall of the House of Caesar by Tom Holland

“A wonderful, surging narrative… anyone interested in history, politics or human nature – and it has never been better told.”

Get the book on Audible or Kindle.

Audible is great; have you tried it? If not, click here to get 2 books for free.

Memes of the week

Uno reverse card pic.twitter.com/KiycPBRG8o

— Wall Street Memes (@wallstmemes) July 3, 2024

🤣🤣🤣 pic.twitter.com/BxUgx3PmOV

— Not Jerome Powell (@alifarhat79) July 4, 2024

New My Worst Investment Ever episodes

Enrich Your Future 04: Why Is Persistent Outperformance So Hard to Find?

In this episode of Enrich Your Future, Andrew and Larry Swedroe discuss Larry’s new book, Enrich Your Future: The Keys to Successful Investing. In this series, they discuss Chapter 04: Why Is Persistent Outperformance So Hard to Find?

LEARNING: Focus on building a robust asset allocation plan, regularly rebalancing it, and stick with it.

Access the episode’s show notes and resources

Published on Become a Better Investor this week

In this episode of Enrich Your Future, Andrew and Larry Swedroe discuss Larry’s new book, Enrich Your Future: The Keys to Successful Investing. In this series, they discuss Chapter 03: Persistence of Performance: Athletes Versus Investment Managers.

Listen to Enrich Your Future 03: Persistence of Performance: Athletes Versus Investment Managers

CTCI Corporation (9933 TT): Profitable Growth rank of 9 was down compared to the prior period’s 7th rank. This is poor performance compared to 1,390 large Industrials companies worldwide.

Read CTCI Corp – World Class Benchmarking

Prima Marine Public Company Limited (PRM TB): Profitable Growth rank of 3 was up compared to the prior period’s 6th rank. This is above average performance compared to 160 medium Energy companies worldwide.

Read Prima Marine – World Class Benchmarking

In June 2024, we published 4 new episodes of the My Worst Investment Ever podcast. Listen to all of them here.

Listen to My Worst Investment Ever June 2024

Asian markets were up in 1H24 except for Philippines, Hong Kong, Indonesia and Thailand in local currencies. Taiwan was the strongest performer in USD and local terms.

Read Taiwan Was the Best Performer in Asia in 1H24

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.