Become a Better Investor Newsletter – 27 January 2024

Noteworthy this week

- 2 x $3trn

- Tech at dot-com levels

- In the long run, stocks win

- Few fund managers expect a hard landing

- Fuel shipping costs shoot up

2 x $3trn: Both Apple and Microsoft hit a $3trn valuation. Compared to 2023 GDP figures, Apple and Microsoft would rank 8 and 9 after France. Let that sink in.

2 companies 6 trillion in combined market cap.

Top 10 companies: $14.6T.

Just 5.5 years ago in 2018 $AAPL reached $1 trillion market cap for the first time.

It has tripled in valuation since then and $MSFT more so.

We’re witness to the largest market cap expansion in history. pic.twitter.com/LhszlbNDL6— Sven Henrich (@NorthmanTrader) January 24, 2024

Tech at dot-com levels: Looking at the total return of the S&P 500 technology sector relative to the overall index, the Tech sector’s monthly return is at >2.5x, which hasn’t been seen since the dot-com bubble.

The S&P 500 technology sector’s relative strength versus the broad market is at its highest level since March 2000. pic.twitter.com/OGvn6AKYAg

— Charlie Bilello (@charliebilello) January 24, 2024

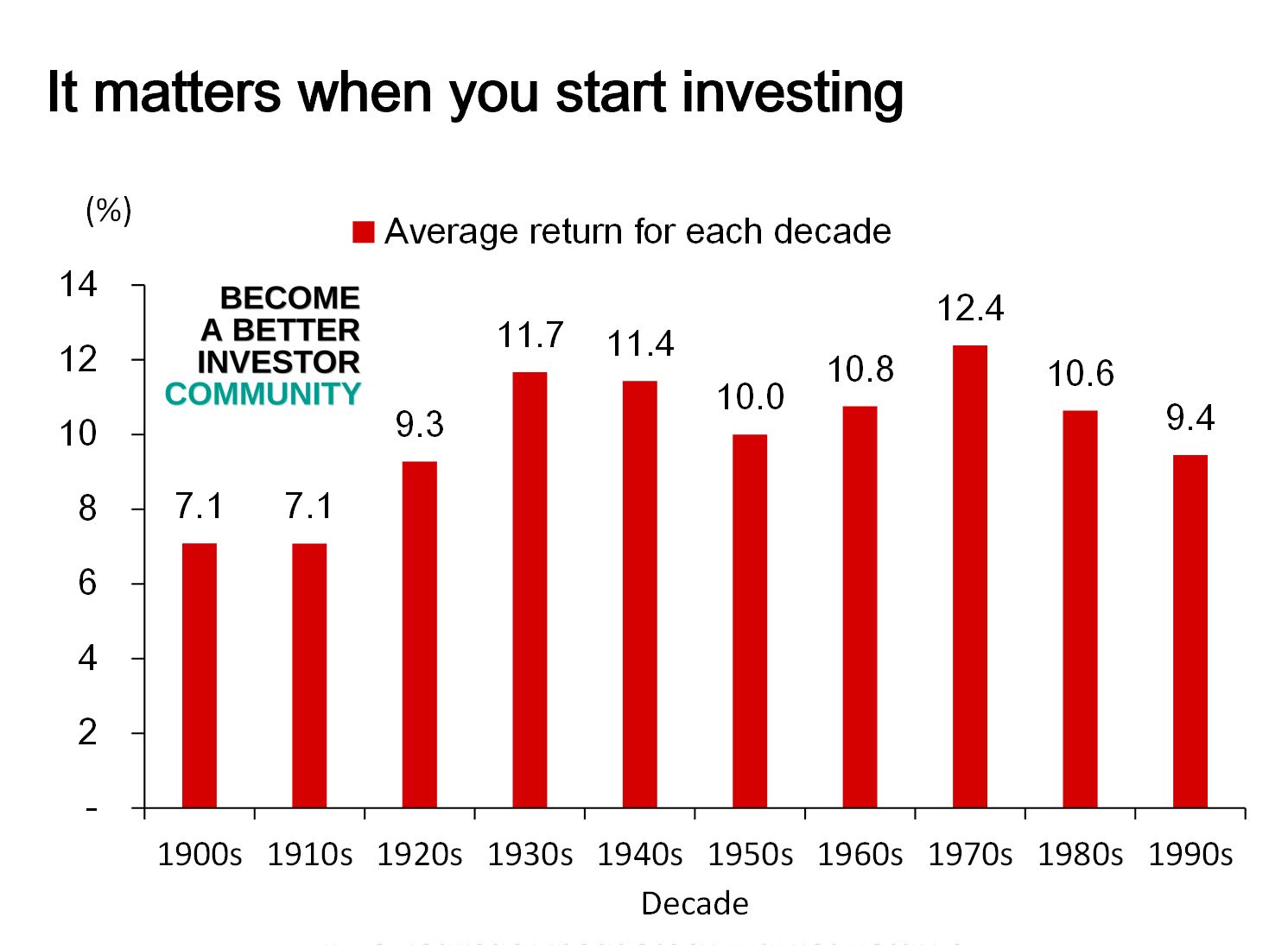

In the long run, stocks win: We shared this same chart a while ago, but it’s worth reviewing again and keeping in mind when making asset allocation decisions.

7 visuals every investor should memorize:

1: In the long run, stocks win: pic.twitter.com/TuKcC4pUGq

— Brian Feroldi (@BrianFeroldi) January 24, 2024

Few fund managers expect a hard landing: 79% of fund managers expect a soft or no landing in 2024. Did the Fed manage to avoid a recession?

Almost 80% of fund managers currently expect a soft or no landing in 2024.

This is up from 72% in December 2023 and 64% in October 2023.

Dovish sentiment and soft landing calls are now at their highest levels since the Fed started raising rates.

It seems like markets are… pic.twitter.com/jwBussCBWu

— The Kobeissi Letter (@KobeissiLetter) January 24, 2024

Fuel shipping costs shoot up: The attacks in the Red Sea, seen as a US–Iran proxy war, have led to shipping costs for fuel from the Middle East shooting up.

Cost to Ship Fuel From Middle East Soars Amid Red Sea Chaos

Day rate for ships carrying 600,000 barrels of fuel pic.twitter.com/FWKujewB8Q

— Tracy (𝒞𝒽𝒾 ) (@chigrl) January 24, 2024

Join the world’s toughest valuation training

Become a Valuation Expert. Valuation Master Class Boot Camp graduates can confidently value any company in the world and possess in-demand industry skills.

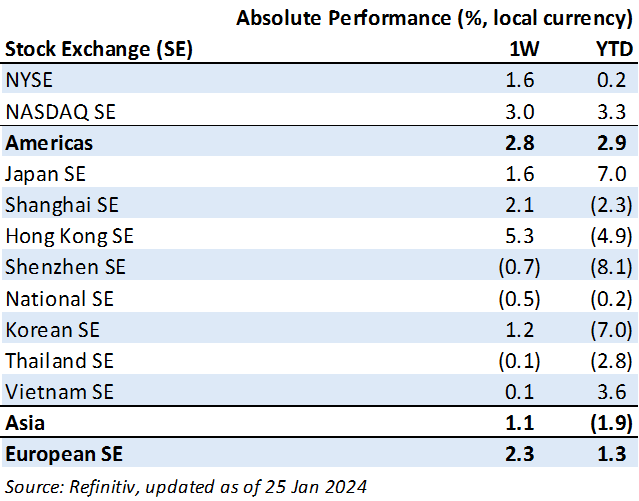

Weekly market performance

Click here to see more markets and periods.

Chart of the week

Discussed in the Become a Better Investor Community this week

“You can now access your weekly updated Market Cheat Sheet.”

Try 1 month of the Become a Better Investor Community for FREE today!

You can cancel at any time. Click here to learn more.

Podcasts we listened to this week

RWH040: GO GLOBAL W/ LAURA GERITZ

“In this episode, William Green chats with Laura Geritz, founder of Rondure Global Advisors, which scours the globe in search of high-quality companies trading at attractive prices in places like India, China, Japan, Thailand, Taiwan, Turkey, Brazil, & Mexico. Here, Laura makes the case for allocating more money to undervalued stocks outside the US. She also discusses her unusual lifestyle, which is built around relentless travel, voracious reading, & abundant time to think.”

Readings this week

Here are the themes found in financial planning research. What’s missing?

“The literature on financial planning is varied and widely distributed across different outlets, both academic and practitioner. In this academic article, the authors pull together an analysis of the types of thematic structures found most often in financial planning studies as well as the theories most often referenced.”

Book recommendation

Mastering Uncertainty: How to Thrive in an Unpredictable World by Matt Watkinson & Csaba Konkoly

“What separates the world’s most successful entrepreneurs and business tycoons from the rest? It’s not their superhuman intelligence. It’s something more fundamental: they understand how to turn uncertainty to their advantage.”

Get the book on Audible or Kindle.

Audible is great; have you tried it? If not, click here to get 2 books for free.

Memes of the week

Warren Buffett is one of the greatest investors ever.

Which is surprising considering he doesn’t:

• Do cold plunges/take cold showers

• Use a sauna 3-4x a week

• Eat super clean

• Sleep on an Eight Sleep Mattress

• Wake up at 4AM to workoutWhat’s his edge … Luck?

— Brandon Beylo (@marketplunger1) January 24, 2024

And he did pic.twitter.com/AZVkmSFiqj

— Elon Musk (@elonmusk) January 25, 2024

New My Worst Investment Ever episodes

Ep768: Bryan Kramer – Be Human and Build Relationships

BIO: Bryan Kramer is a renowned business strategist, global keynote speaker, executive trainer and coach, investor, two-time bestselling author, and Forbes contributor.

STORY: Bryan decided to expand his business, but the growth snowballed out of control to the point where he traveled 200 days a year and missed out on family time. Being on the road too much also saw him develop type two diabetes. Only after his 11-year-old son pointed out the horrible life he was living did Bryan decide to quit it all.

LEARNING: Relationships carry us through the highs, the mid-levels, and the lows. First, look at what you need today and then how you can serve others.

Access the episode’s show notes and resources

Published on Become a Better Investor this week

Should we strive to better understand what happens “downstream” to our defect-free work? No matter the setting, if our work meets requirements and we pass it on, are we responsible for how well it integrates into a bigger system? In this episode, Bill Bellows and Andrew Stotz expand on the interaction between variation and systems and why Dr. Deming regarded Genichi Taguchi’s Quality Loss Function as “a better description of the world.”

Listen to Integration and the Taguchi Loss Function: Awaken Your Inner Deming (Part 13)

Isn’t Capitalism Great!? Here are eight key benefits of increasing the profits of your business. And I challenge you to set the goal for 2024 to increase the profits of your business.

Read 8 Benefits of Increasing the Profits of Your Business

Acer Incorporated (2353 TT): Profitable Growth rank of 9 was down compared to the prior period’s 8th rank. This is poor performance compared to 660 large Info Tech companies worldwide.

Read Acer Inc – World Class Benchmarking

AVIC Jonhon Optronic Technology Company Limited (002179 SZ): Profitable Growth rank of 2 was up compared to the prior period’s 3rd rank. This is World Class performance compared to 660 large Info Tech companies worldwide.

Read AVIC Jonhon Optronic Technology – World Class Benchmarking

Oil and Natural Gas Corporation Limited (ONGC IN): Profitable Growth rank of 6 was down compared to the prior period’s 3rd rank. This is below average performance compared to 350 large Energy companies worldwide.

Read Oil and Natural Gas Corporation – World Class Benchmarking

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.