Become a Better Investor Newsletter – 3 February 2024

Noteworthy this week

- What if Japan re-rated to 1x PB?

- Non-US equity isn’t expensive

- We’re due for war

- Deficit spending avoids recession

- Market wizard Nancy Pelosi does it again

What if Japan re-rated to 1x PB?: 44% of all Japanese companies trade below book value. However, if all these companies were to re-rate to 1x PB at once, it would have a limited impact on the large Japan ETFs. This is because almost all of these companies are microcaps.

The Tokyo Stock Exchange has all public companies trading at less than 1x P/B to publish a plan to raise their valuations. 44% of all Japanese cos trade at < book. But if all companies were instantly to trade to 1, it would have limited impact on the largest Japanese ETFs. pic.twitter.com/zSJLDMaMyr

— Dan Rasmussen (@verdadcap) January 29, 2024

Non-US equity isn’t expensive: Besides the US, only Japan trades significantly above its 20-year forward PE. In the case of Japan, valuations have been depressed for decades. Will the US live up to these expectations?

US valuations look cute in historical context, but never forget, this time it’s different pic.twitter.com/WXzRMBPPzp

— Michael A. Arouet (@MichaelAArouet) January 30, 2024

We’re due for war: An interesting and scary pattern shows that we have big wars about every 40 years and major economic wars about every 80 years.

The reason why we have big wars about every 40 years, and major economic wars about every 80, is that all of the people who remember how bad the last one was have died, and so the new “best and brightest” don’t have anyone telling them they ought to avoid such things. The U.S.… https://t.co/hr17nI70W8 pic.twitter.com/mfeUJ0P4oH

— Tom McClellan (@McClellanOsc) January 30, 2024

Deficit spending avoids recession: Don’t want a recession? Borrow money from the future. It’s that simple, it appears.

Q4 GDP:

3.3% vs 2.0% exp.

The best GDP report a half a trillion dollar deficit in one quarter can buy! pic.twitter.com/l30jwzJitD

— Geiger Capital (@Geiger_Capital) January 25, 2024

Market wizard Nancy Pelosi does it again: NVIDIA is up close to 30% since she bought back in November. She probably knew nothing about the decisions that were about to be made.

Breaking 🚨: Pelosi’s NVDA just hit another All Time High$NVDA is up 28%+ since she bought back in Nov.

Since her buy Nvidia,

– received government approval to sell chips to China

– announced a new AI partnership with the governmentAnd this is why we follow the Politicians pic.twitter.com/J96fy4JVyb

— Nancy Pelosi Stock Tracker ♟ (@PelosiTracker_) January 29, 2024

Join the world’s toughest valuation training

Become a Valuation Expert. Valuation Master Class Boot Camp graduates can confidently value any company in the world and possess in-demand industry skills.

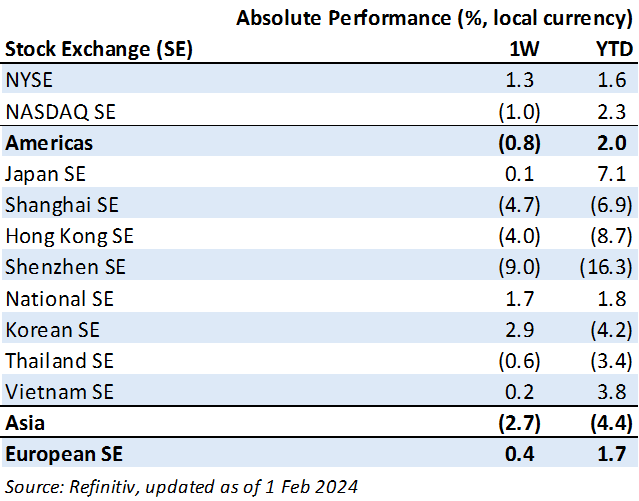

Weekly market performance

Click here to see more markets and periods.

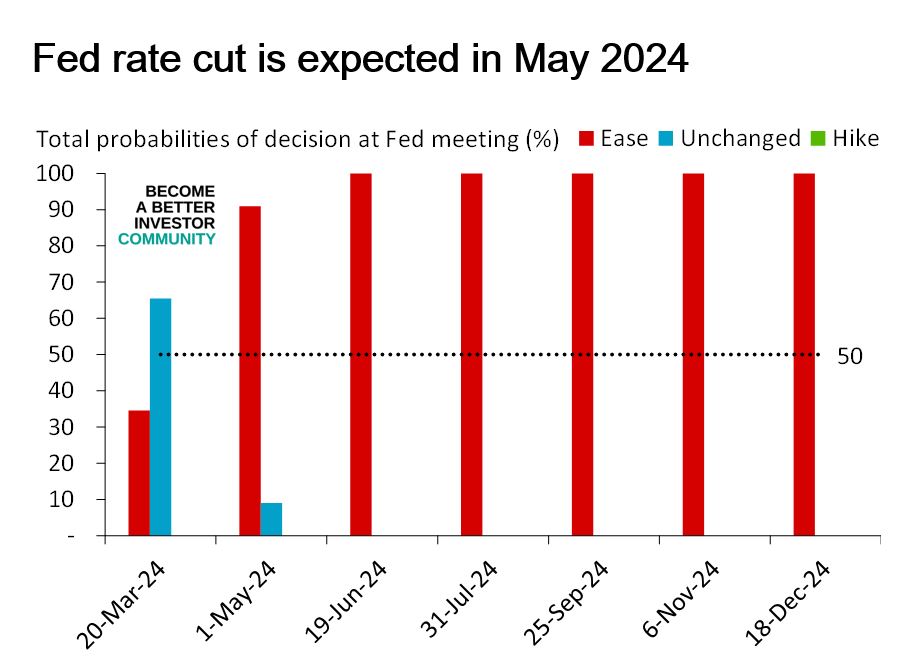

Chart of the week

Discussed in the Become a Better Investor Community this week

“We go live today at 6 PM GMT+7. See you!”

Try 1 month of the Become a Better Investor Community for FREE today!

You can cancel at any time. Click here to learn more.

Podcasts we listened to this week

The Direk Khanijou Show – #33 Best Books I Read in 2023!

“Best books I read in 2023: Never Finished by David Goggins, Showboat: The Life of Kobe Bryant by Roland Lazenby, Born of This Land by Chung Ju-yung.”

Readings this week

Increasing Returns: Identifying Forms of Increasing Returns and What Drives Them

“We review five areas of micro- and macroeconomics where the concept of increasing returns applies and attempt to show why they are relevant to investors today.

Most forms of increasing returns are deeply intertwined with the rise of intangible assets, which can scale faster than tangible ones but are also harder to protect.”

The Blowoff

“If I’m destined to underperform for a period, then I’ll underperform. I’m not going to do something foolish, just to have a few months with better numbers. A lot of portfolio managers do not have that luxury. They’re stampeding in, fully expecting that they can get out in time. They’ll all get trapped.

But at least they’ll track their benchmarks…”

Book recommendation

The One Thing: The Surprisingly Simple Truth Behind Extraordinary Results by Gary Keller

“The ONE Thing will bring your life and your work into focus. Authors Gary Keller and Jay Papasan teach you the tricks to cut through the clutter, achieve better results in less time, dial down stress, and master what matters to you.”

Get the book on Audible or Kindle.

Audible is great; have you tried it? If not, click here to get 2 books for free.

Memes of the week

Airlines Offering $100 Upgrade Where You’re Guaranteed An Old Male Pilot Named Steve https://t.co/ID7T48962h pic.twitter.com/2ydpzdAxYU

— The Babylon Bee (@TheBabylonBee) January 25, 2024

One of my favorites. pic.twitter.com/e5wKjDEVcs

— Dave the MemeSmith (@ForgingLiberty) January 29, 2024

New My Worst Investment Ever episodes

Ep769: Dan McClure – Understand Who You Are and What You’re About

BIO: Dan McClure is an innovation choreographer. That’s someone whose job is to run into burning buildings, looking for opportunities to reinvent how the world works.

STORY: Dan took up a senior management job because his friends and family insisted he should have a ‘real’ job. However, Dan hated the job and was terrible at it.

LEARNING: Understand who you are and what you’re about. Be committed to following your passion and talents. Otherwise, you’ll be dragged into things that make you miserable.

Access the episode’s show notes and resources

Published on Become a Better Investor this week

Quotas, arbitrary targets, work standards with numerical goals – these don’t seem to apply to schools. But, as John Dues and host Andrew Stotz discuss, quotas show up a lot in classrooms, causing harm and preventing improvement.

Listen to Eliminate Arbitrary Numerical Targets: Deming in Schools Case Study (Part 17)

In January 2024, we published 8 new episodes of the My Worst Investment Ever podcast. Listen to all of them here.

Listen to My Worst Investment Ever January 2024

Ferrari NV (RACE IM): Profitable Growth rank of 1 was up compared to the prior period’s 2nd rank. This is World Class performance compared to 960 large Cons. Disc. companies worldwide.

Read Ferrari NV – World Class Benchmarking

Kweichow Moutai Company Limited (600519 SH): Profitable Growth rank of 1 was same compared to the prior period’s 1st rank. This is World Class performance compared to 570 large Cons. Staples companies worldwide.

Read Kweichow Moutai – World Class Benchmarking

GS Holdings Corporation (078930 KS): Profitable Growth rank of 8 was down compared to the prior period’s 6th rank. This is below average performance compared to 320 large Energy companies worldwide.

Read GS Holdings – World Class Benchmarking

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.