Become a Better Investor Newsletter – 22 October 2022

Noteworthy this week

- UK political crisis continues

- US ramps up the Tech war with China

- The East loads up on gold

- US mortgage rate hits 7%

- Private investments are at risk of blowing up

- Where are we in the cycle?

UK political crisis continues: Liz Truss resigned, making her the shortest-serving PM in UK history. Will Boris return?

Uber has no cars.

Airbnb has no real estate.

The UK has no government.This is the new economy.

— Genevieve Roch-Decter, CFA (@GRDecter) October 20, 2022

US ramps up the Tech war with China: Semiconductors have become a part of national security. The US Bureau of Industry and Security restricted the “ability of US persons to support the development or production” of chips at certain Chinese manufacturers. The US-China conflict escalates.

What happened in China yesterday is massive. I haven’t seen anything as big in my lifetime. Basically Biden said to American engineers working in China in the semiconductor to either resign or be ready to lose their American citizenship. Everyone resigned. Industry collapsed 🤯

— abhishek (@abhishek_tri) October 15, 2022

The East loads up on gold: In the past six months, Asian countries have been loading up on the yellow metal, while the US has been a big seller.

No sense of history, these Chinese and Indians. pic.twitter.com/jPI7A8Qxdh

— Rudy Havenstein, probably a threat to democracy. (@RudyHavenstein) October 20, 2022

US mortgage rate hits 7%: The 30-year rate has risen to 7% from below 3% in 2020. This is going to impact US housing prices for sure. The question is if it will be a crash or the Fed-intended soft landing.

Average 30-Year Mortgage Rate in the US…

1970s: 8.9%

1980s: 12.7%

1990s: 8.1%

2000s: 6.3%

2010s: 4.1%

2020s: 3.6%

—

Today’s Rate: 6.9% pic.twitter.com/Y1viLvNxBn— Charlie Bilello (@charliebilello) October 21, 2022

Private investments are at risk of blowing up: Private investments are not priced on an exchange but periodically on the holder’s books. This gives investments an attractive return profile and high returns at low volatility, making it popular for pension funds. We could see massive losses when these private investments finally get priced in the market.

1)Every cycle has a place where fraud congregates. I am convinced that the mark-to-fantasy world of PE/VC is where the fraud is this cycle. Many of these funds are levered, hence taking massive losses, yet showing their LPs big gains b/c they can make up the marks. Look below👇 pic.twitter.com/iZOsi3x7yU

— Kuppy (@hkuppy) October 20, 2022

Where are we in the cycle?

Where are we on this chart? pic.twitter.com/YCqLITgX7e

— Wasteland Capital (@ecommerceshares) October 14, 2022

Poll of the week

The US Fed funds rate is currently 3.25%; where do you think it will peak?

— Andrew “The Worst” Stotz (

@andrew

) October 21, 2022

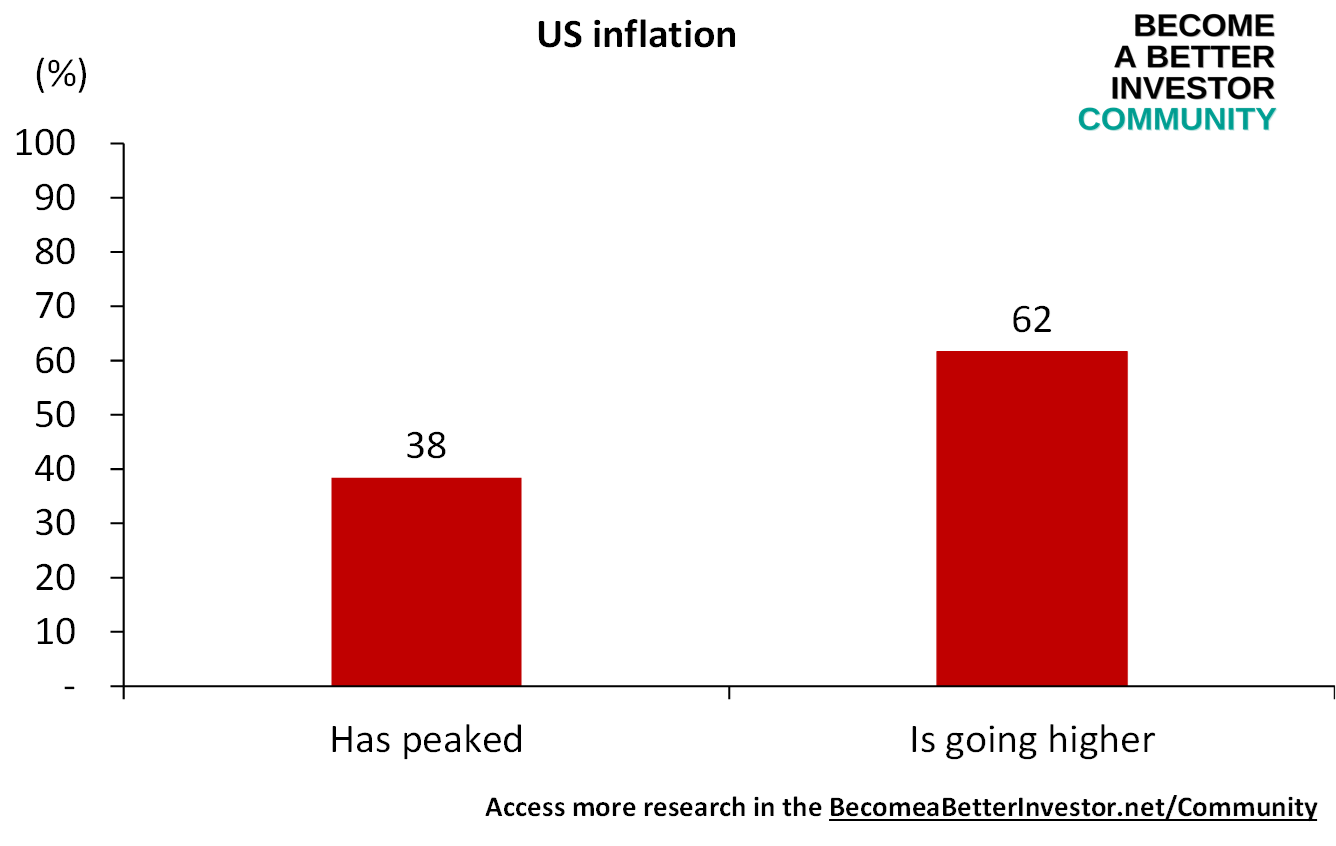

Results from last week’s poll

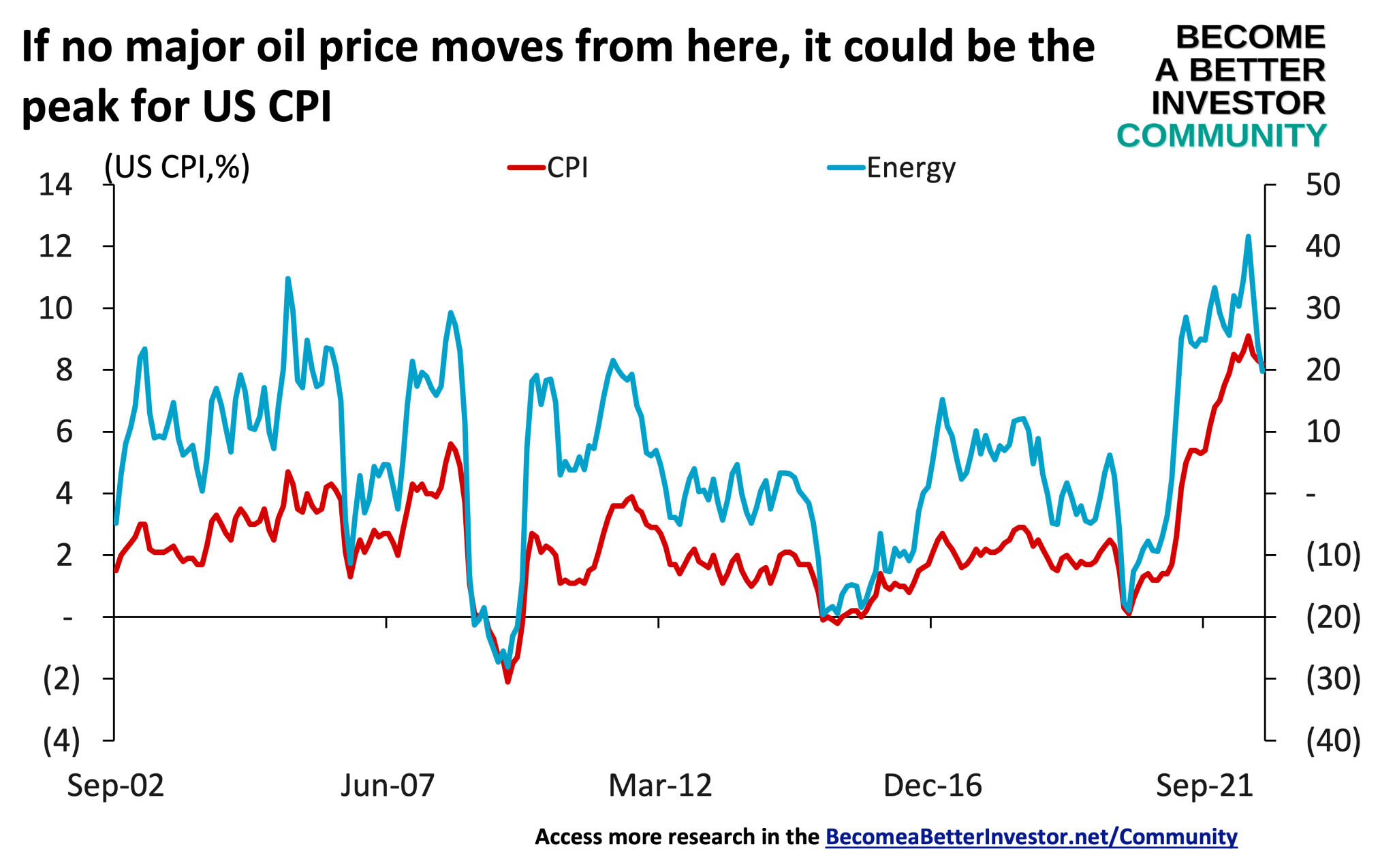

The majority of respondents to our most recent poll believe that US inflation is going higher. In my recent Your Wealth Engine video I show that, if the oil price stays low, we are likely to see oil prices work through the economy, preventing inflation from falling.

Join the world’s toughest valuation training

The Valuation Master Class Boot Camp is a 6-week intensive company valuation boot camp for a successful career in finance.

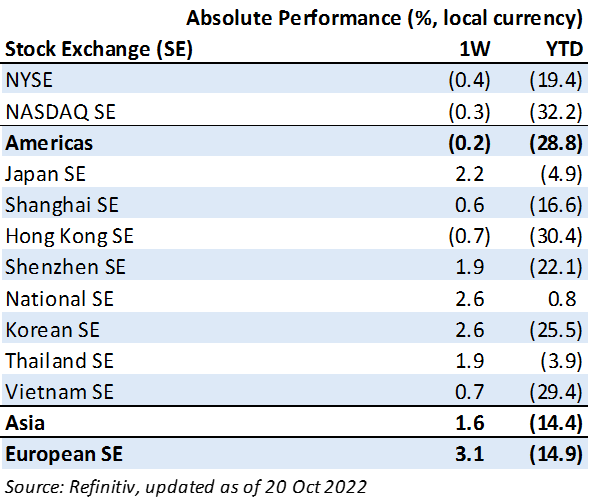

Weekly market performance

Click here to see more markets and periods.

Chart of the week

Discussed in the Become a Better Investor Community this week

“Andrew: @XXXX said to “go deep on the content on the YouTube show, don’t go quickly through many topics,”…so I am doing that this time… I am deep underwater, scuba diving working on inflation which I will feature on Monday’s 7 am show, and will share the ppt with you all when done”

Join the Become a Better Investor Community today! You can cancel any time, and as a newsletter reader you get a massive discount when you use this coupon code: READER

Podcasts we listened to this week

While Dr. Marc Faber often is a bit of “gloom and doom porn,” he’s an independent thinker and entertaining. Check out his two-part interview with Wealthion.

Marc Faber: A Massive Systemic Shock Is Coming & The Fed Is Actively Courting It

Marc Faber: ‘A Lot Of People Will Lose All Their Money’ – Huge Market Losses Lie Ahead

Readings this week

“What’s the endgame of this process, then?

We saw the endgame before, and that was the stagflation of the 1970s, when we had high inflation in combination with high unemployment.”

Read the full interview with Russell Napier.

“Behavioral scientists were consistently no better than, and often worse than, simple heuristics and models.

Behavioral mutual funds were tantamount to value investing and not much more.”

Read The Failure of Behavioral Science by Larry Swedroe.

Memes of the week

These two bullets collided in the battle of Gallipoli in 1915. The chances of this happening are 1 in 70 billion.

This is still more likely to happen than the Fed fixing inflation pic.twitter.com/pLCwCxOZIQ

— Not Jerome Powell (@alifarhat79) October 19, 2022

— Orwell & Goode (@OrwellNGoode) October 19, 2022

New My Worst Investment Ever episodes

Ep608: Craig Handley – Revenue Is Your Shield From Your Mistakes

BIO: Craig Handley is an author of a best-selling book: Hired to Quit, Inspired to Stay: How Focusing on Employee Dreams Built an Exceptional Culture and an Unbreakable Company. He is a musician writing music for artists all over the world.

STORY: Craig’s company invested over a million dollars in software that was never used.

LEARNING: Find a niche and concentrate on that. Review your financial statements monthly.

Ep607: Amit Kumar – Invest Long-term but Don’t Forget About It

BIO: Amit Kumar is a nuclear scientist turned serial entrepreneur who never thought of being an entrepreneur and now coaching and mentoring thousands of small business entrepreneurs through the MSMEx platform.

STORY: Amit got so engrossed in his first entrepreneurial venture that he forgot about some investments he had made. When he remembered them, he learned that the companies he’d invested in had long been delisted.

LEARNING: Define your long-term. Always track your investments. Take care of your own money.

Ep606: Mark Longo – Don’t Be Afraid to Look That Gift Horse in the Mouth

BIO: Mark Longo is the Founder & CEO of the Options Insider Media Group. A former Chicago Board Options Exchange (CBOE) member, Mark created the first options podcast over 15 years ago.

STORY: Mark was working as an equity puts trader on the floor of the CBOE when, one day, every broker on the floor started calling out orders for puts. Mark, however, was hesitant to join in the funfair. This caused him a few dollars but saved him a lot more because the S&P futures started tumbling, traders lost millions of dollars, and many lost their jobs after that.

LEARNING: Listen to your intuition. Don’t be afraid to walk away from an option that looks too good to be true. There will always be other options to trade.

Published on Become a Better Investor this week

AEM Holdings Limited (AEM SP): Profitable Growth rank of 1 was same compared to the prior period’s 1st rank. This is World Class performance compared to 840 medium Info Tech companies worldwide.

Read AEM Holdings – World Class Benchmarking

Malaysia Airports Holdings Berhad (MAHB MK): Profitable Growth rank of 9 was up compared to the prior period’s 10th rank. This is poor performance compared to 1,240 medium Industrials companies worldwide.

Read Malaysia Airports Holdings – World Class Benchmarking

Inflation continues to race up. Destroyed Nord Stream could worsen the European energy crisis. Central banks are raising rates into a recession.

Read A. Stotz All Weather Strategies – September 2022

The show that helps you create, grow, and protect your wealth through the power of free-market Capitalism.

Read Your Wealth Engine – 17 October 2022

Gas Malaysia Berhad (GMB MK): Profitable Growth rank of 1 was same compared to the prior period’s 1st rank. This is World Class performance compared to 300 large Utilities companies worldwide.

Read Gas Malaysia – World Class Benchmarking

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.