A. Stotz All Weather Strategies – September 2022

Executive summary

- Inflation continues to race up.

- Destroyed Nord Stream could worsen the European energy crisis.

- Central banks are raising rates into a recession.

- On a positive note, lower stock prices mean buying opportunities.

- Central bankers appear to be raising rates into a recession to stifle inflation; stagflation would be the worst outcome.

- Demand for necessities (food and energy), inflation, and supply-chain disruptions can drive Commodities higher.

- We see opportunities to allocate to specific sectors and markets within equity.

- Bonds and Gold to protect capital.

- Risks: Monetary tightening crash markets, collapsing energy prices, BOT actions.

The All Weather Strategy is available in Thailand through FINNOMENA. If you’re interested in our allocation strategy, you can also join the Become a Better Investor Community. Please note that this post is not investment advice and should not be seen as recommendations. Also, remember that backtested or past performance is not a reliable indicator of future performance.

What happened in world markets in September 2022

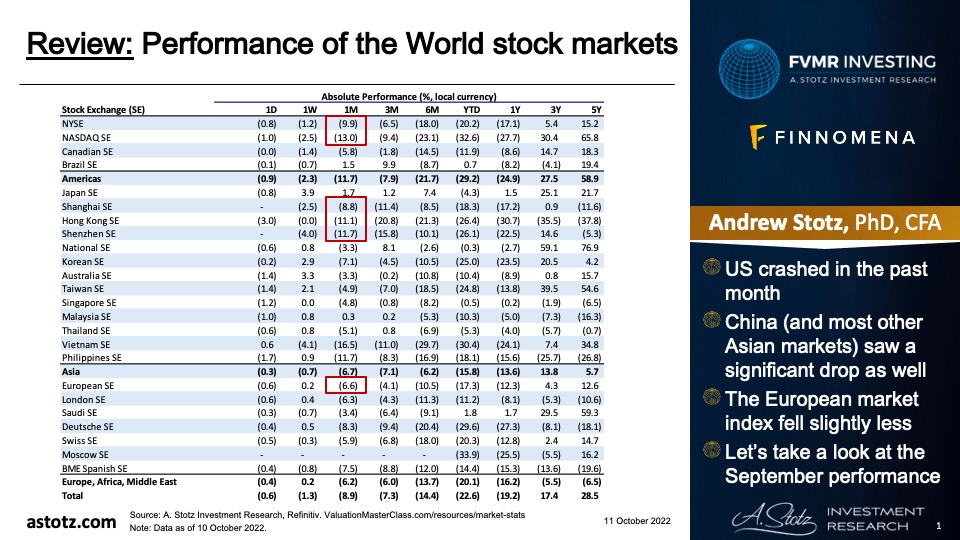

Performance of the World stock markets

- US crashed in the past month.

- China (and most other Asian markets) saw a significant drop as well.

- The European market index fell slightly less.

- Let’s take a look at the September performance.

Find the updated Performance of the World stock markets here.

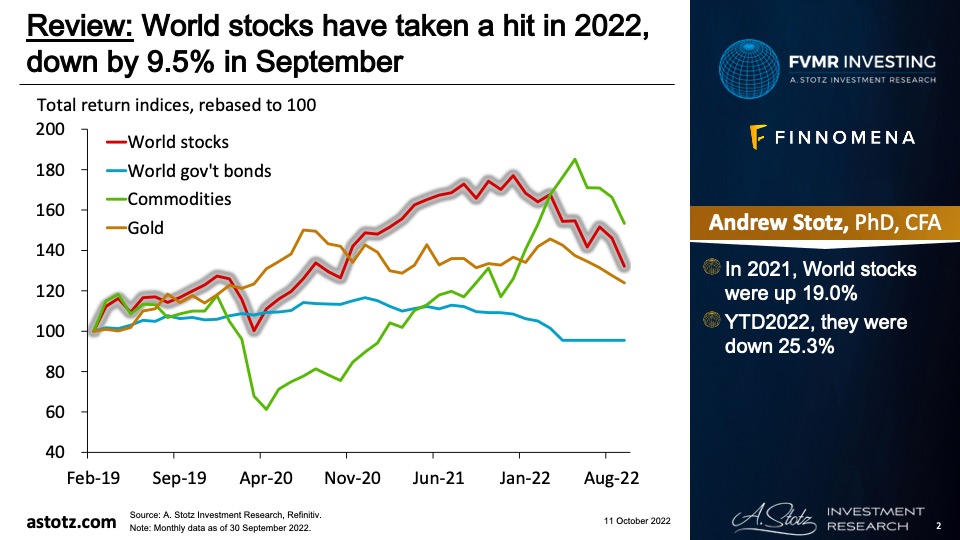

World stocks have taken a hit in 2022, down by 9.5% in September

- In 2021, World stocks were up 19.0%.

- YTD2022, they were down 25.3%.

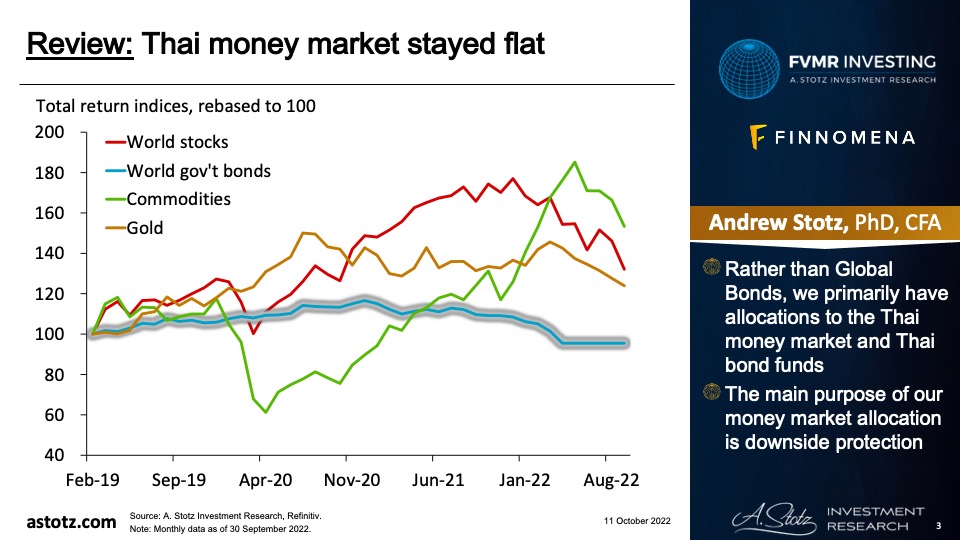

Thai money market stayed flat

- Rather than Global Bonds, we primarily have allocations to the Thai money market and Thai bond funds.

- The main purpose of our money market allocation is downside protection.

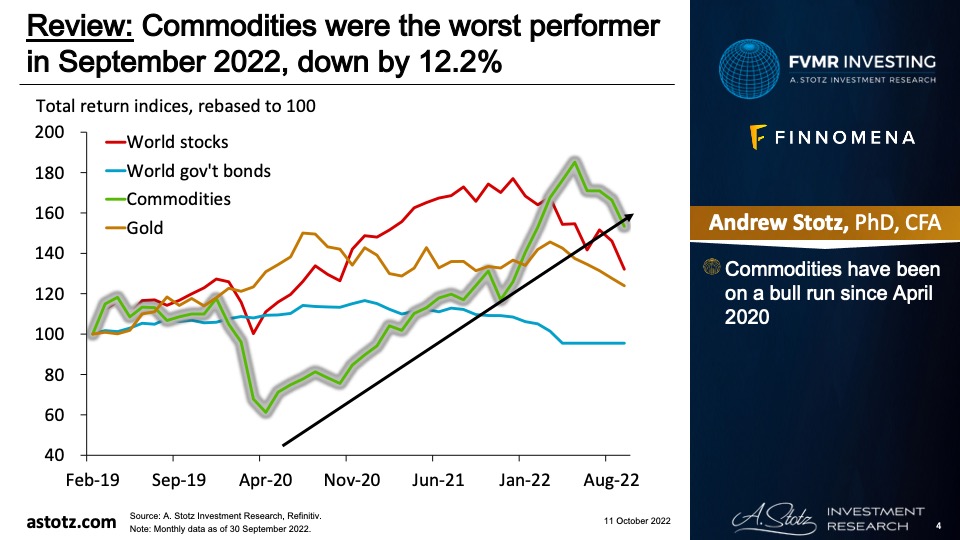

Commodities were the worst performer in September 2022, down by 12.2%

- Commodities have been on a bull run since April 2020.

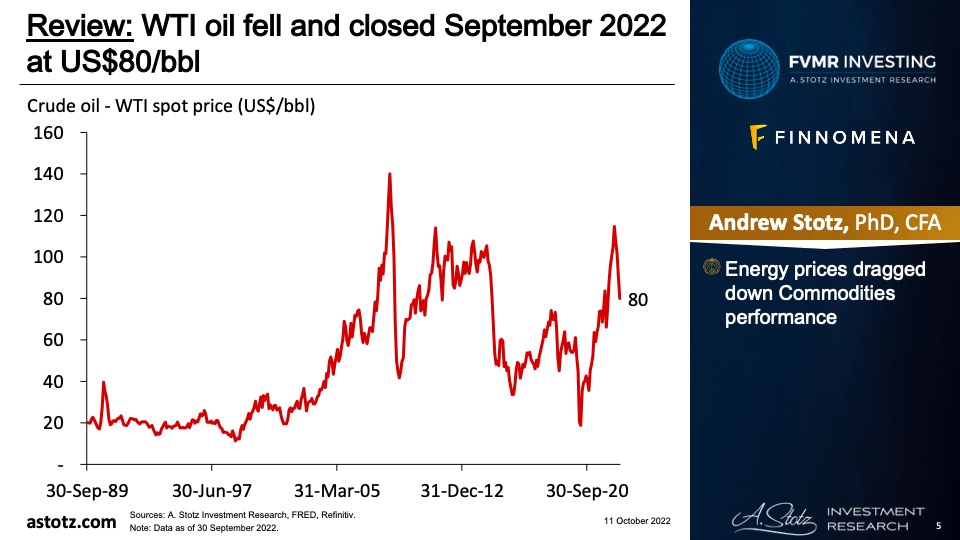

WTI oil fell and closed September 2022 at US$80/bbl

- Energy prices dragged down Commodities performance.

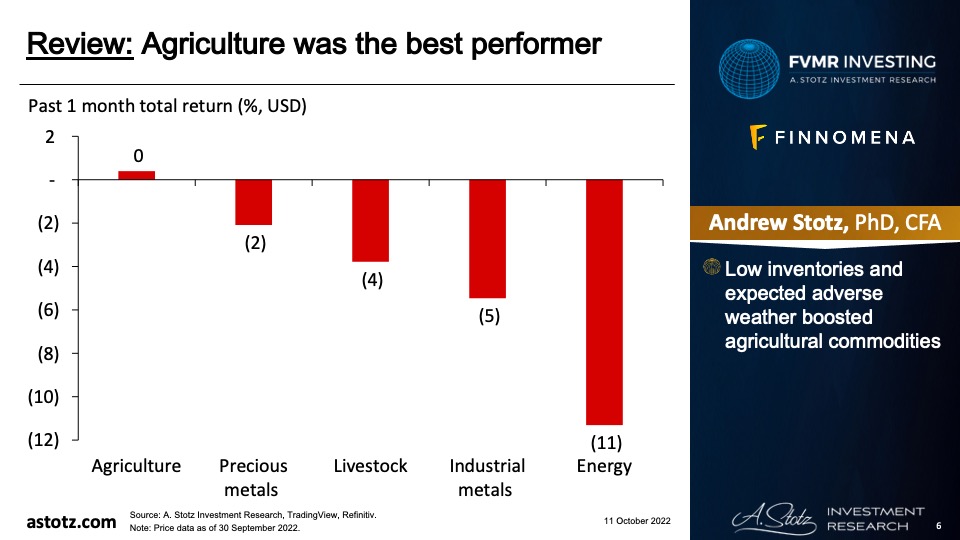

Agriculture was the best performer

- Low inventories and expected adverse weather boosted agricultural commodities.

Agriculture was the best performer

- Low inventories and expected adverse weather boosted agricultural commodities.

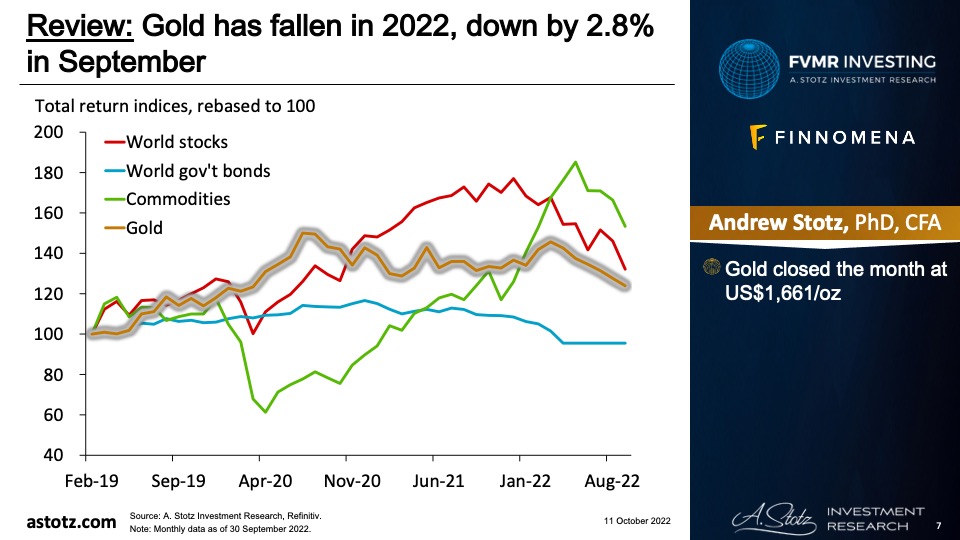

Much of the recent weakness in gold is actually US$ strength

- Think of gold price as a currency pair.

- Typically, a stronger US$ means a lower gold price in US$.

- This also means that gold performance differs in other currencies.

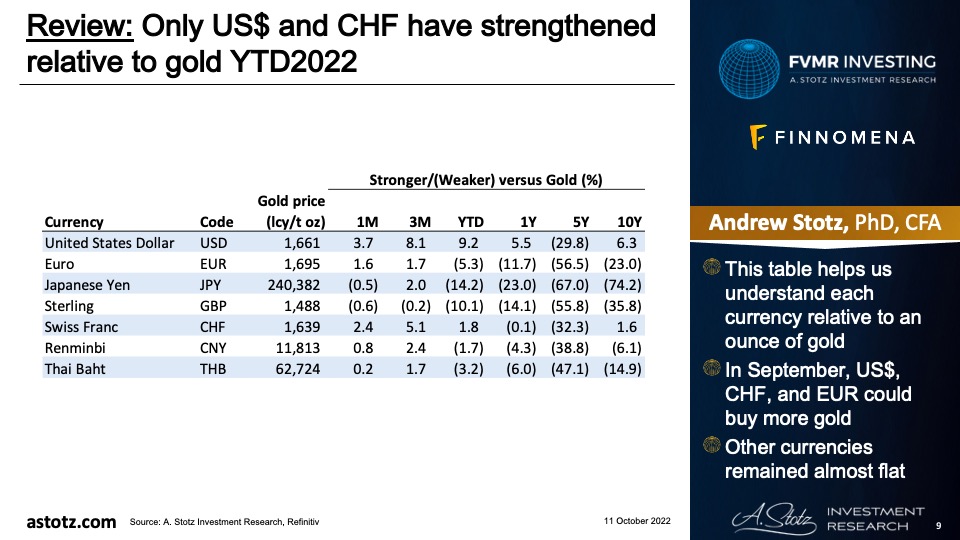

Only US$ and CHF have strengthened relative to gold YTD2022

- This table helps us understand each currency relative to an ounce of gold.

- In September, US$, CHF, and EUR could buy more gold.

- Other currencies remained almost flat.

Inflation continued to rise in Germany

OUCH! German #inflation hits double digits for 1st time since WWII. Sep CPI accelerates to 10% from 7.9% in August. pic.twitter.com/bDmR2PQnNT

— Holger Zschaepitz (@Schuldensuehner) September 29, 2022

- The whole Euro area saw CPI of 10% in September as well.

While ECB tightens, the German government stimulates the economy

Good Morning from Germany where the coalition govt agrees €40bn consumer relief package to mitigate the energy price spike. This is already the 3rd relief package this year. The previous packages had a total volume of ~€30bn. pic.twitter.com/V2TdxhysdY

— Holger Zschaepitz (@Schuldensuehner) September 4, 2022

Energy costs are a large part of inflation

#Germany‘s producer prices rose a whopping 45.8% year-on-year in August, 9 percentage points(!) above expectations.

However, producer prices without #energy rose 14.0%, the slowest pace since March.#inflation is more about energy again. This matters for central banks. pic.twitter.com/k2Ytnu90um

— jeroen blokland (@jsblokland) September 20, 2022

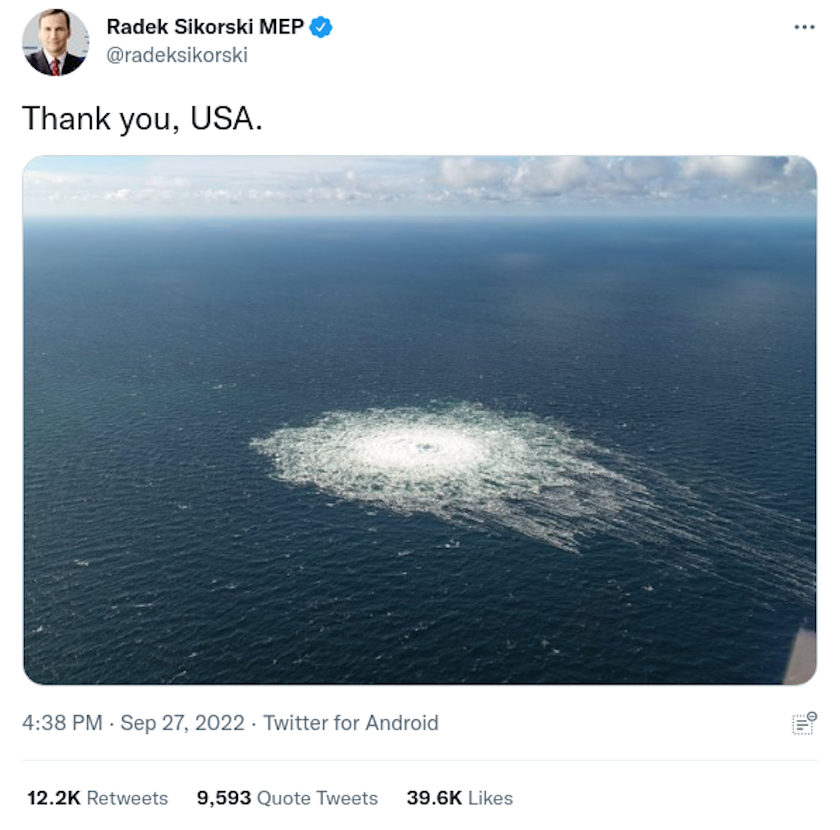

A Polish political veteran and former minister thanked the US on Twitter

- The tweet has since been deleted.

- While media in Developed Europe run stories on why Putin did it, it appears the US could also be behind it.

- The US probably stands more to gain.

German companies and the economy suffer greatly from gas supply disruptions

How much German economic output is dependent on Russian gas?

A very interesting take from Zoltan on the leveraged nature of this relationship.

”In Germany, $2 trillion of value added depends on $27 billion of gas from Russia”

— Alf (@MacroAlf) September 6, 2022

Natural gas prices feed into fertilizer, which feeds into the food supply chain

Fertilizer prices rally as an energy crunch in Europe forces factory closures ⚠️📈

🇺🇸 Common nitrogen fertilizer ammonia in the US rose nearly 24% last week

🇪🇺 Over two-thirds (!!) of European ammonia production is offline due to high natural gas costshttps://t.co/njCivQDlGr pic.twitter.com/QytviBZBna— Stephen Stapczynski (@SStapczynski) September 4, 2022

High fertilizer prices or supply shutdowns hurt the poor the worst

Over 3 BILLION people would starve to death without fertilizer made from natural gas.

Anti-natural gas = Pro-starvation pic.twitter.com/HOTN6F3Mdp

— Brian Gitt (@BrianGitt) September 12, 2022

The Fed hiked 0.75% to battle inflation

— Lyn Alden (@LynAldenContact) January 26, 2022

This is the fastest rate-hike cycle by the Fed since the 1980s

Pace of rate hikes. #FedDay pic.twitter.com/kquHBtygvk

— Kathy Jones (@KathyJones) September 21, 2022

But will the rate hikes be enough to stifle inflation?

What’s the point of hiking rates in Europe to fight inflation, if only 15% of CPI is demand driven? 👇 Chart @PatrickKrizan pic.twitter.com/l4fDd9ww3u

— Michael A. Arouet (@MichaelAArouet) September 1, 2022

- Rate hikes typically reduce demand.

- Though, besides energy, inflation seems to be driven by supply-side issues.

The market thinks Fed’s actions will reduce inflation

Market-based inflation expectations hit an 18-month low today @ 2.19%, down from a peak of 3.02% in April. The global slowdown and tightening monetary policy in nearly every country around the world is breaking the back of inflation. Will soon hear moderation of hawkish rhetoric. pic.twitter.com/ptMd91KQGd

— Charlie Bilello (@charliebilello) September 30, 2022

- Remember to focus on expectations of forward inflation.

Fed hikes have also been reflected in US stock market performance

— Max Crandale (@MaxCrandale) October 1, 2022

Bank of England reversed course when something was about to break

“The BOE decided to intervene to get ahead of a potential crisis

…

The cash call would have happened this afternoon, turning the market one-sided and risking a precipitous collapse as funds were forced into a fire sale.”Pretty violent turnaround for a “potential crisis.” pic.twitter.com/i3G6rZQFO5

— Corey Hoffstein 🏴☠️ (@choffstein) September 28, 2022

- The chart shows UK 30Y government bond yields.

- This shows what we have argued, that central banks are going to stop tightening as soon as something breaks.

US firms appear to expect a recession

An interesting stat: almost half of the S&P 500 constituents cited ”recession” during their Q2 earnings calls.

That’s the highest in 10 years.

Financials and Real Estate companies (roughly 80%) lead the pack in mentioning recession risks. pic.twitter.com/cuSaDCuELj

— Alf (@MacroAlf) September 10, 2022

On a positive note, if you’re young, lower stock prices mean buying opportunities

If you’re a boomer you should probably be mad at the Fed for trying to move the stock market lower

If you’re a young person you should be thanking the Fed for providing you a lower entry point

— Ben Carlson (@awealthofcs) September 22, 2022

At a 20% decline, you’re expected to make a 40% return in 3 years

After stocks drop 20% or more, they average a cumulative rate of return of over 41% over the next 3 years and over 71% over 5 years. Stay disciplined. pic.twitter.com/1WacO3SVhz

— Peter Mallouk (@PeterMallouk) September 30, 2022

Key takeaways

- Inflation continues to race up.

- Destroyed Nord Stream could worsen the European energy crisis.

- Central banks are raising rates into a recession.

- On a positive note, lower stock prices mean buying opportunities.

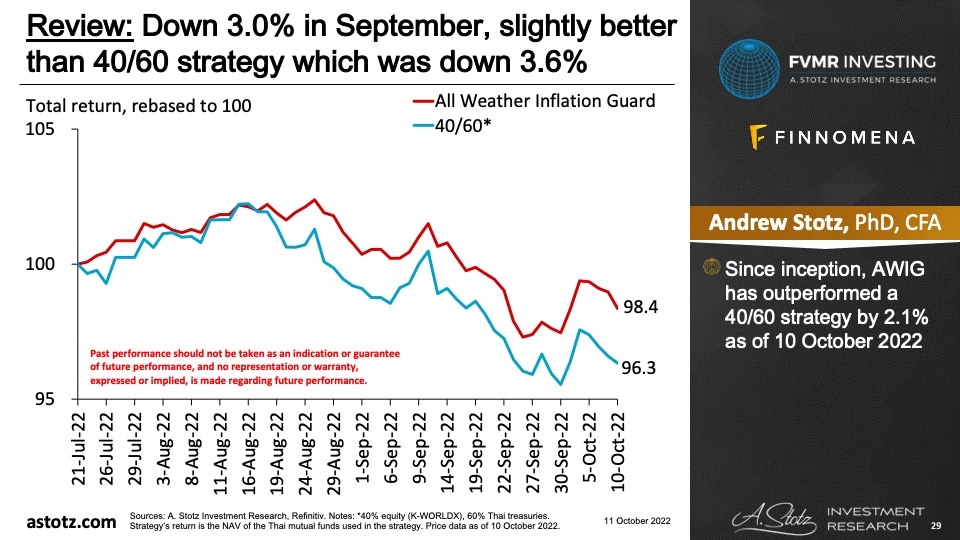

Performance review: All Weather Inflation Guard

All Weather Inflation Guard was down 3.0%

- Since inception, AWIG has outperformed a 40/60 strategy by 2.1% as of 10 October 2022.

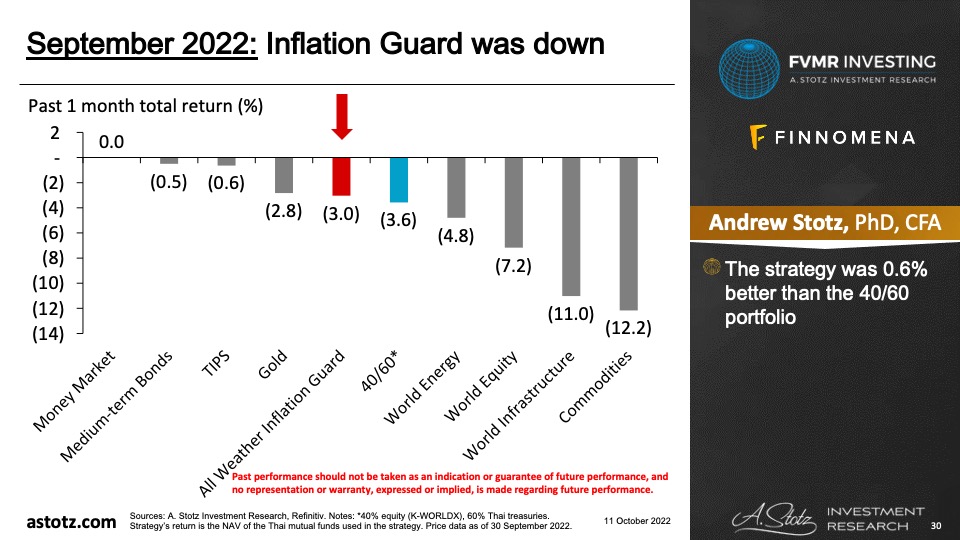

Inflation Guard was down

- The strategy was 0.6% better than the 40/60 portfolio.

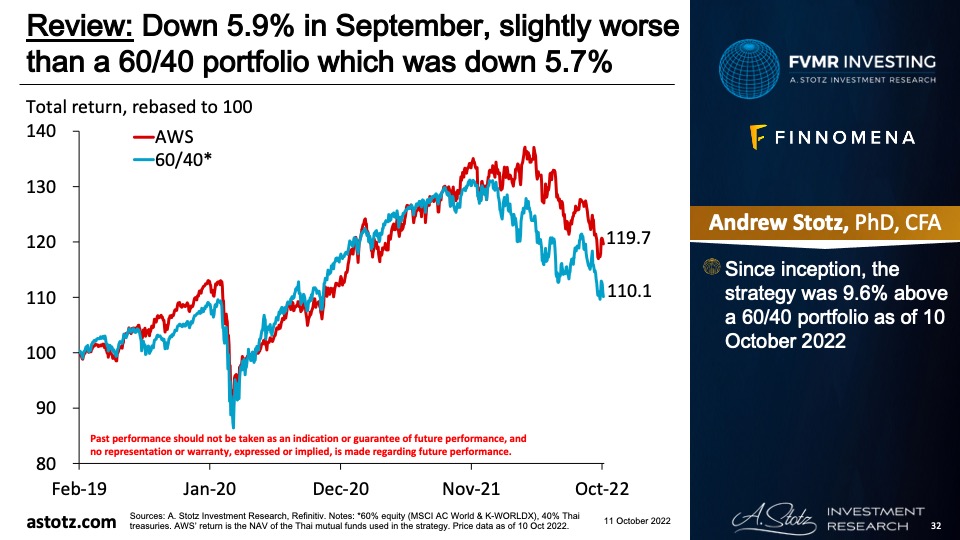

Performance review: All Weather Strategy

All Weather Strategy was down 5.9%

- Since inception, the strategy was 9.6% above a 60/40 portfolio as of 10 October 2022.

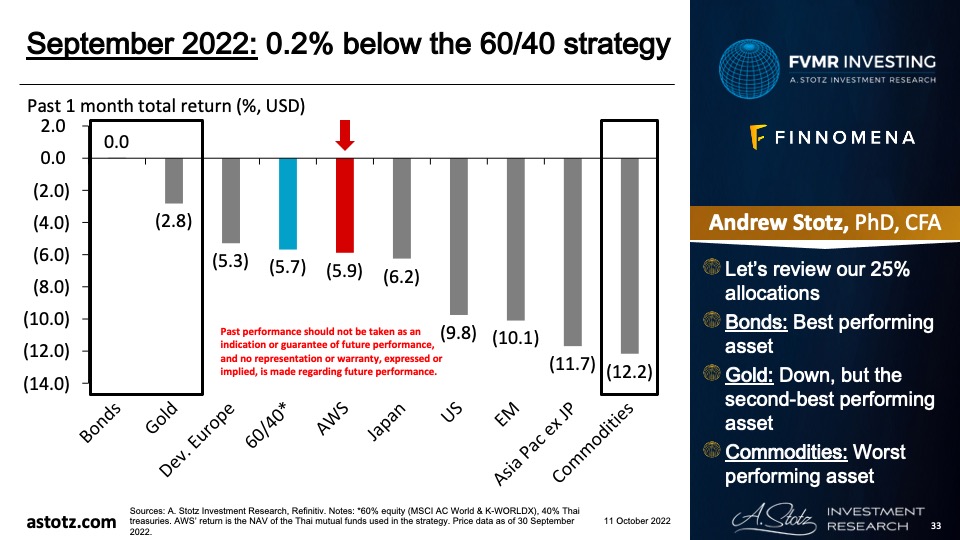

0.2% below the 60/40 strategy

- Bonds: Best performing asset.

- Gold: Down, but the second-best performing asset.

- Commodities: Worst performing asset.

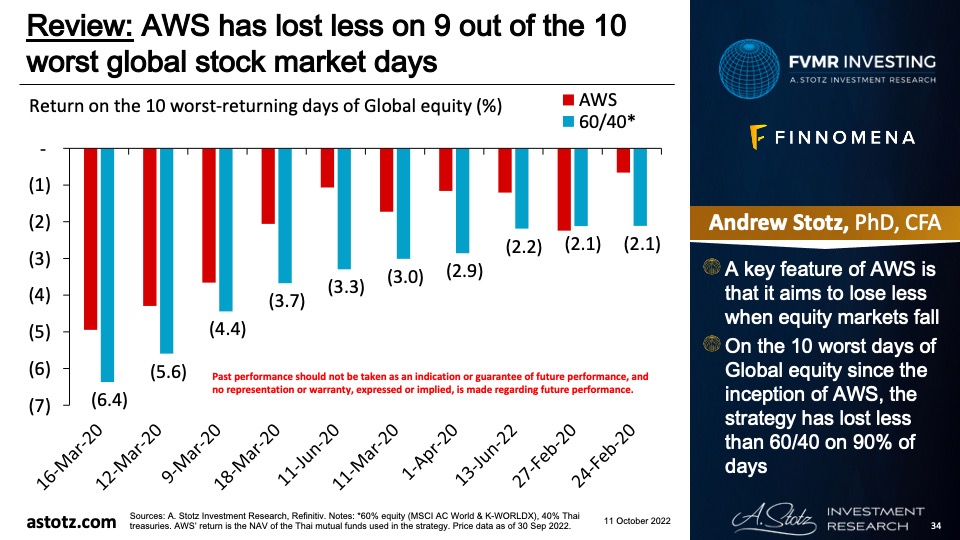

AWS has lost less on 9 out of the 10 worst global stock market days

- A key feature of AWS is that it aims to lose less when equity markets fall.

- On the 10 worst days of Global equity since the inception of AWS, the strategy has lost less than 60/40 on 90% of days.

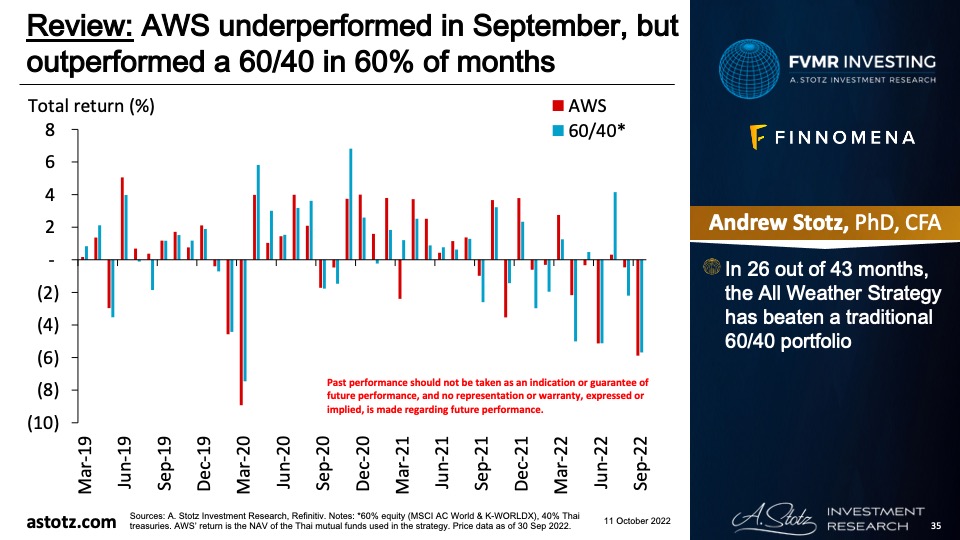

AWS underperformed in September, but outperformed a 60/40 in 60% of months

- In 26 out of 43 months, the All Weather Strategy has beaten a traditional 60/40 portfolio.

Performance review: All Weather Alpha Focus

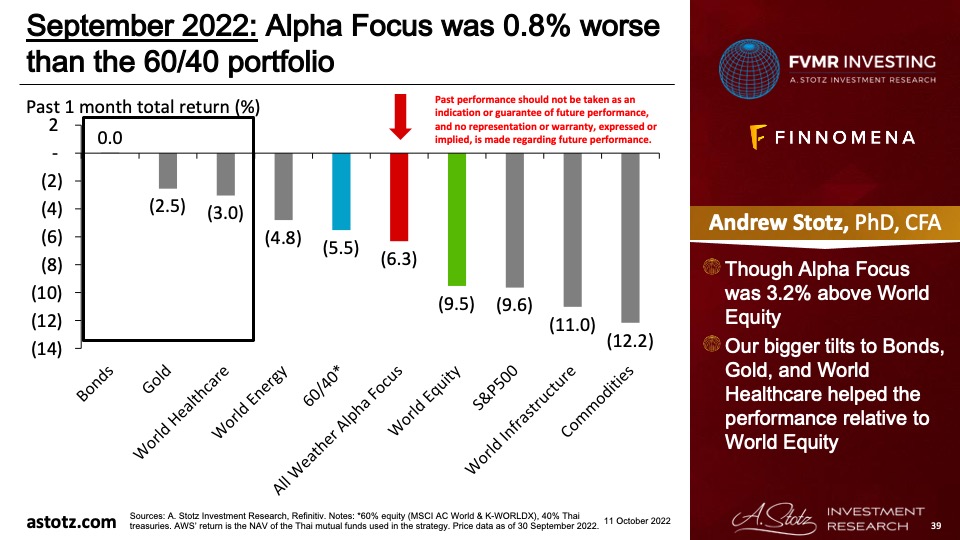

All Weather Alpha Focus was down 6.3%

- Since inception, Alpha Focus was 1.1% above the 60/40 portfolio as of 10 October 2022.

Alpha Focus was down 6.3% in Sept, better than World Equity which was down 9.5%

- Since inception, Alpha Focus was 10.7% above World Equity as of 10 October 2022.

Alpha Focus was down 6.3% in Sept, better than World Equity which was down 9.5%

- Since inception, Alpha Focus was 10.7% above World Equity as of 10 October 2022.

Global outlook that guides our asset allocation

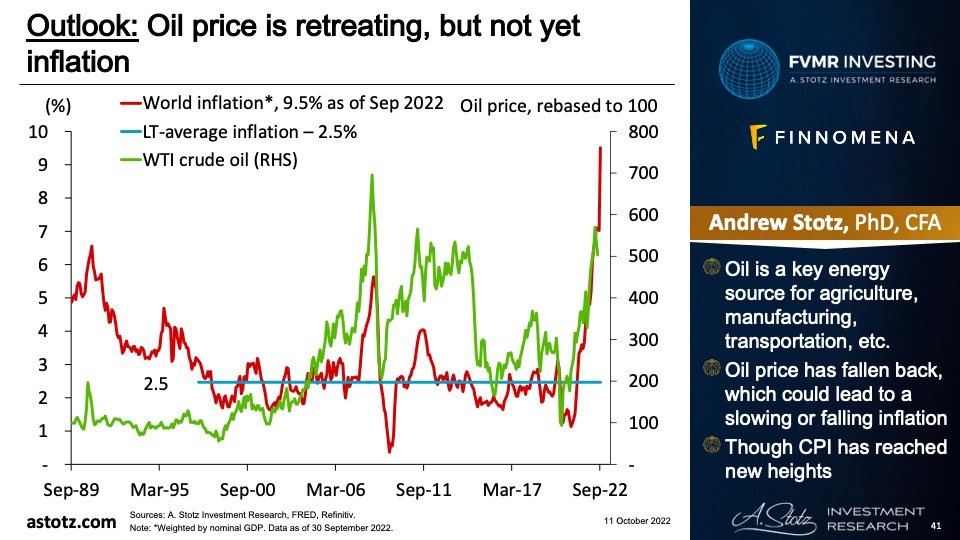

Oil price is retreating, but not yet inflation

- Oil is a key energy source for agriculture, manufacturing, transportation, etc.

- Oil price has fallen back, which could lead to a slowing or falling inflation.

- Though CPI has reached new heights.

Inflation through the roof

- Higher prices, at some point, reduce demand.

- A higher base is also likely to reduce the inflation rate.

- Hence, inflation could be close to a peak, even without central bank intervention.

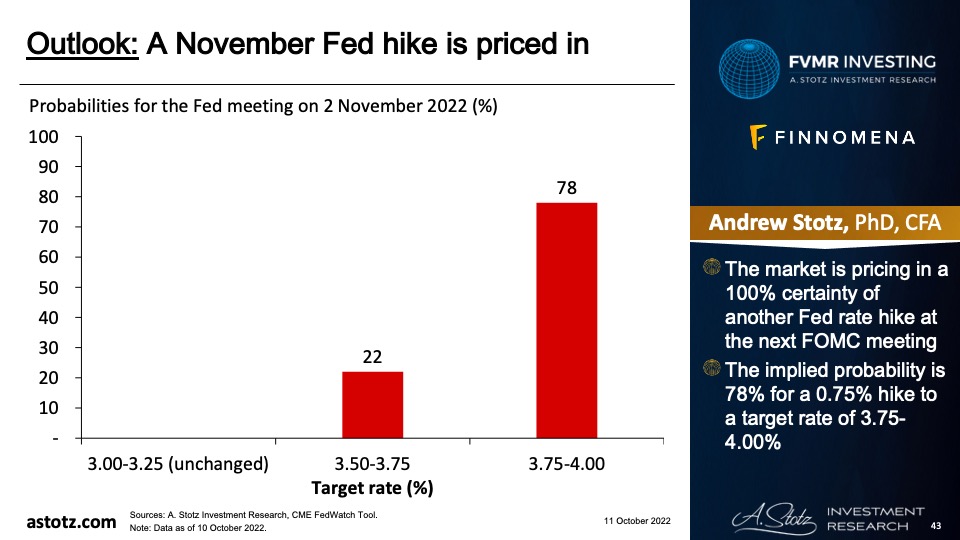

A November Fed hike is priced in

- The market is pricing in a 100% certainty of another Fed rate hike at the next FOMC meeting.

- The implied probability is 78% for a 0.75% hike to a target rate of 3.75-4.00%.

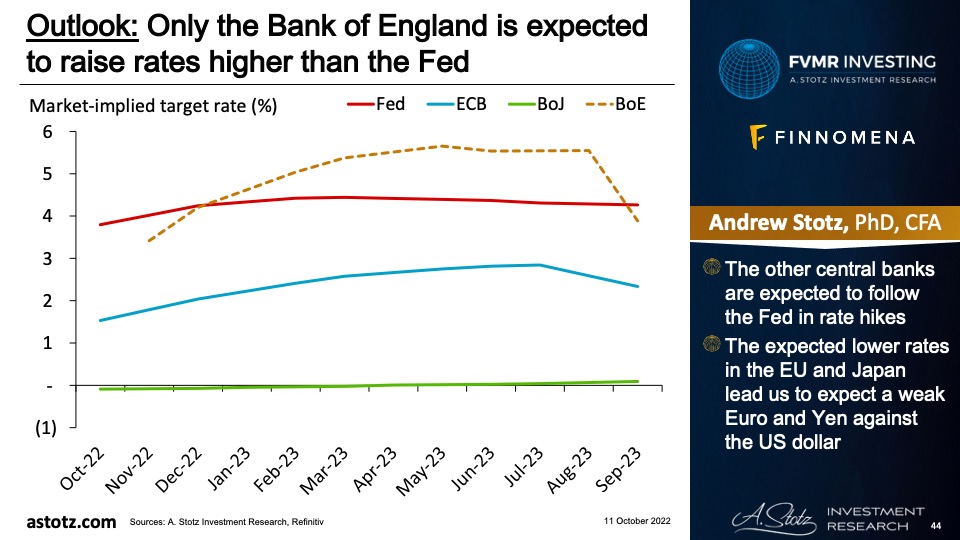

Only the Bank of England is expected to raise rates higher than the Fed

- The other central banks are expected to follow the Fed in rate hikes.

- The expected lower rates in the EU and Japan lead us to expect a weak Euro and Yen against the US dollar.

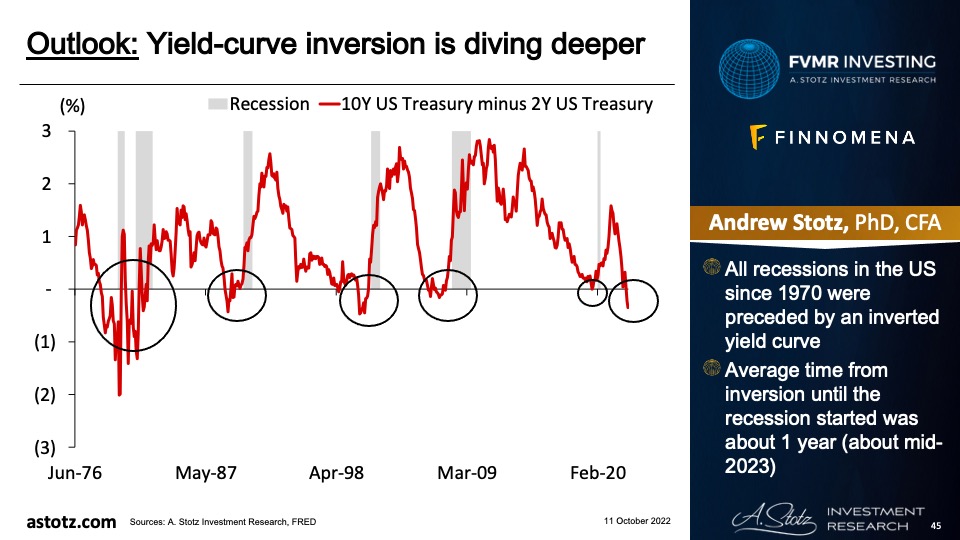

Yield-curve inversion is diving deeper

- All recessions in the US since 1970 were preceded by an inverted yield curve.

- Average time from inversion until the recession started was about 1 year (about mid-2023).

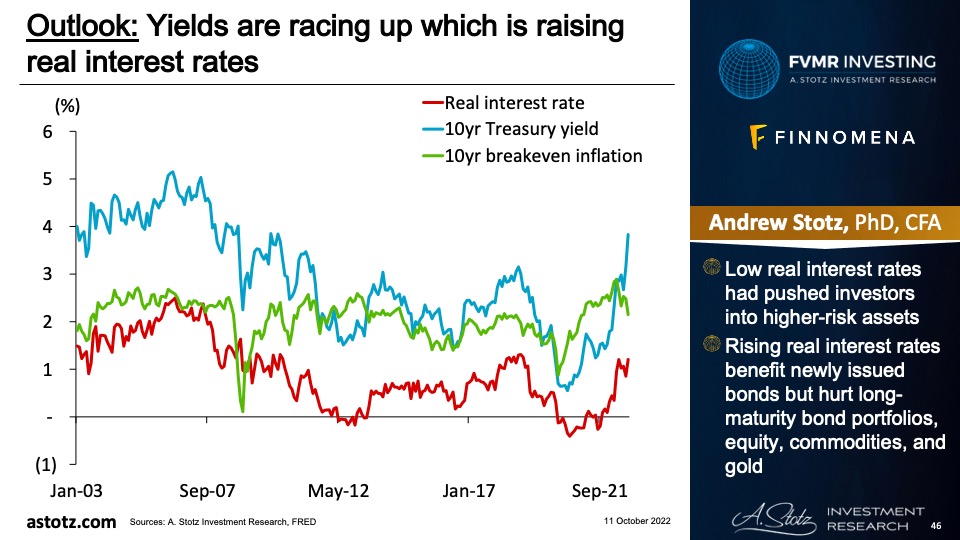

Yields are racing up which is raising real interest rates

- Low real interest rates had pushed investors into higher-risk assets.

- Rising real interest rates benefit newly issued bonds but hurt long-maturity bond portfolios, equity, commodities, and gold.

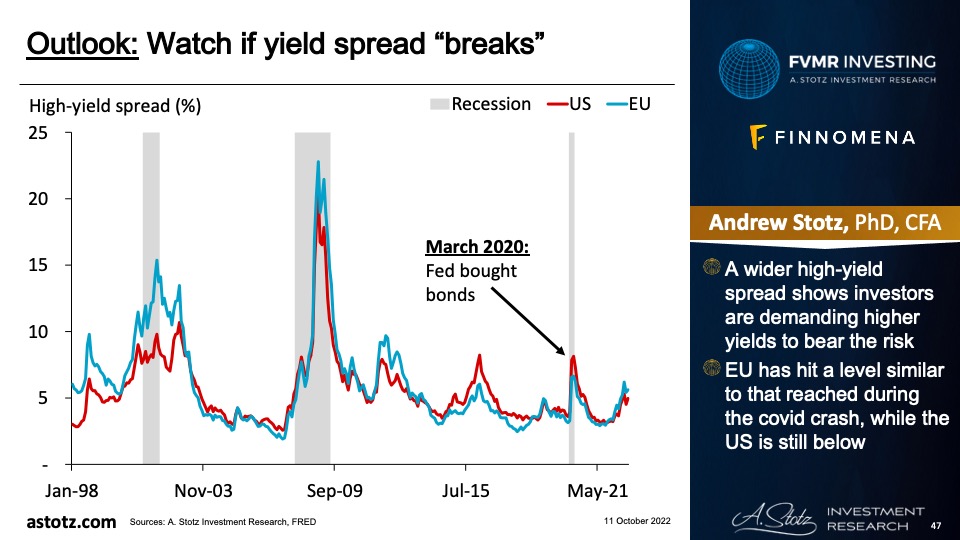

Watch if yield spread “breaks”

- A wider high-yield spread shows investors are demanding higher yields to bear the risk.

- EU has hit a level similar to that reached during the covid crash, while the US is still below.

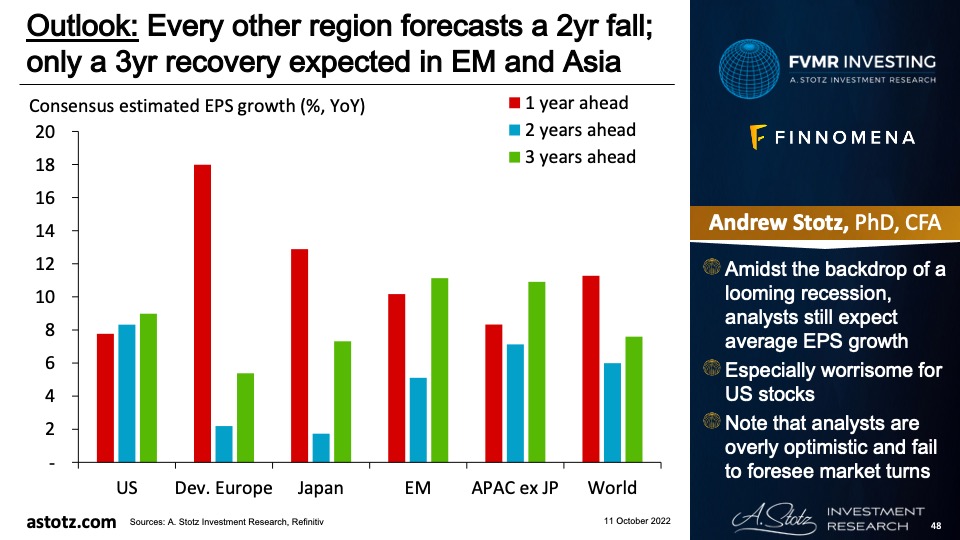

Every other region forecasts a 2yr fall; only a 3yr recovery expected in EM and Asia

- Amidst the backdrop of a looming recession, analysts still expect average EPS growth

- Especially worrisome for US stocks.

- Note that analysts are overly optimistic and fail to foresee market turns.

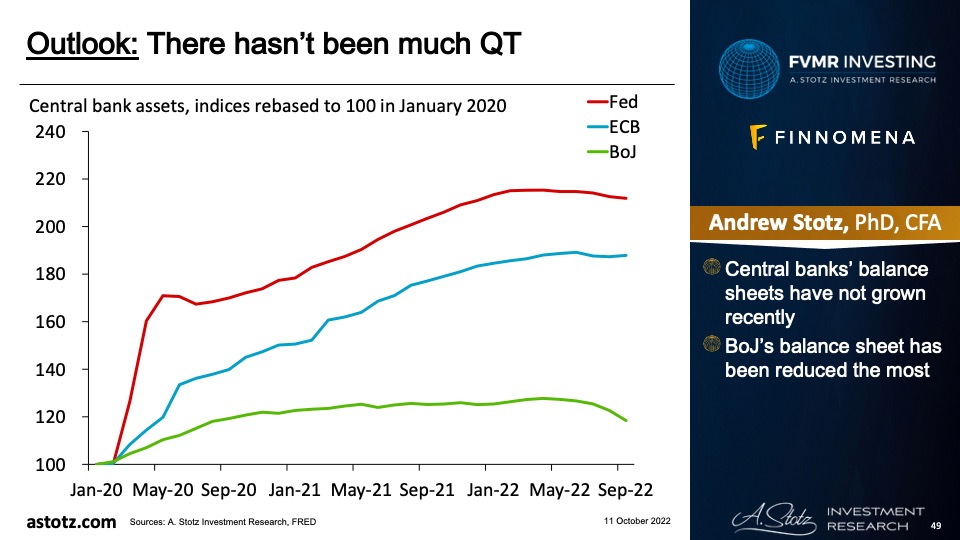

There hasn’t been much QT

- Central banks’ balance sheets have not grown recently.

- BoJ’s balance sheet has been reduced the most.

We think the course will eventually be reversed

- Many central banks are communicating that they’re going to get inflation down, and investors seem to buy the rhetoric.

- We still think central bankers and politicians will change course and return to accommodative policies as soon as something “breaks”.

Bank of England (BOE) reversed course as soon as things were about to break

- UK government bond yields raced up, and the British Pound crashed as the UK government proposed budget deficits.

- Rocketing yields led to margin calls on certain pension schemes.

- BOE stepped in as a buyer of last resort and has committed to continue to intervene.

- This shows that central banks are going back to QE when things are about to break.

Stagflation is the worst possible outcome

- If central banks manage to kill growth but not inflation, we’ll get stagflation.

- Stagflation is typically bad for both stocks and bonds.

- Commodities have typically done well during inflationary times, and gold has historically fared well during stagflation.

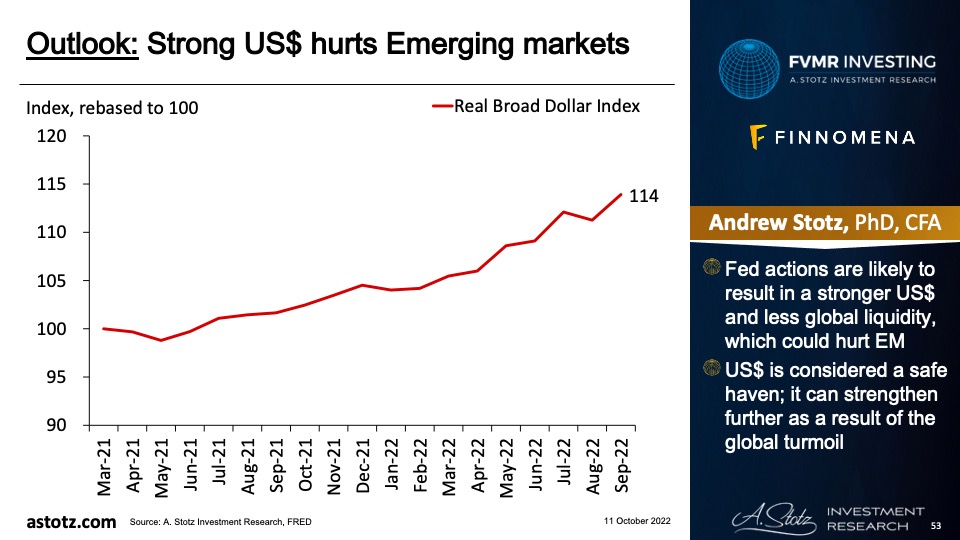

Strong US$ hurts Emerging markets

- Fed actions are likely to result in a stronger US$ and less global liquidity, which could hurt EM.

- US$ is considered a safe haven; it can strengthen further as a result of the global turmoil.

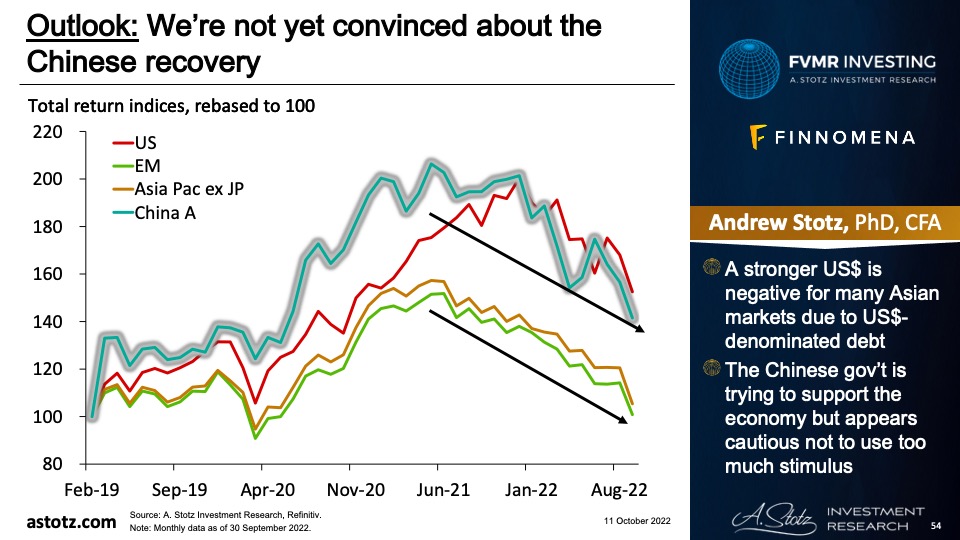

We’re not yet convinced about the Chinese recovery

- A stronger US$ is negative for many Asian markets due to US$-denominated debt.

- The Chinese gov’t is trying to support the economy but appears cautious not to use too much stimulus.

Bonds are typically a safe place to be

- In recessions, safer assets like government bonds are typically performing well.

- Though with high inflation, low yields could still lead to negative real returns.

- We typically don’t allocate to Bonds to speculate on the upside but rather use it as a way to protect capital over time.

Strong US$ and China are concerns

- A stronger US$ is negative for many Asian markets due to US$ denominated debt getting harder to pay back.

- We’re not yet convinced about the Chinese recovery.

- The Chinese gov’t is trying to support the economy but appears cautious to not use too much stimulus.

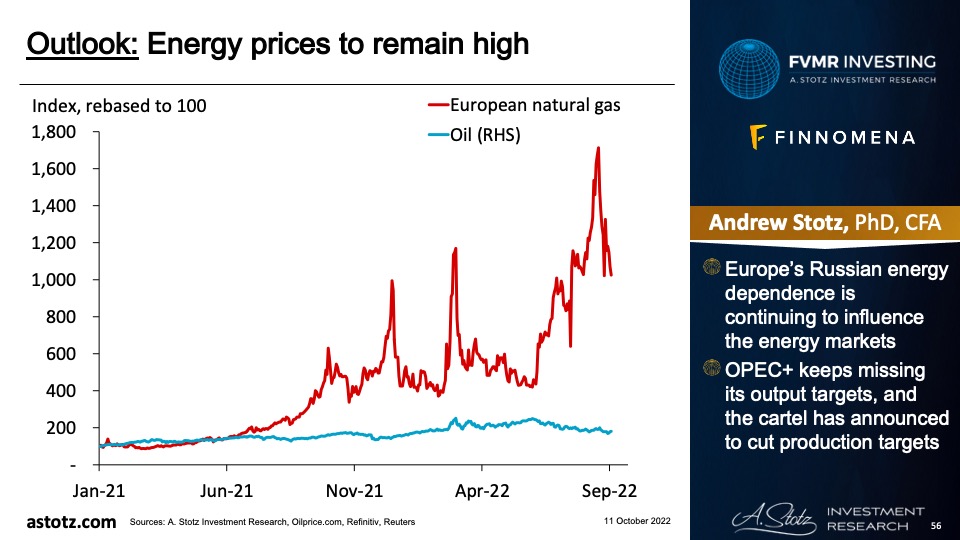

Energy prices to remain high

- Europe’s Russian energy dependence is continuing to influence the energy markets.

- OPEC+ keeps missing its output targets, and the cartel has announced to cut production targets.

Supply for agricultural commodities could tighten further

- Besides energy, Russia is an exporter of many industrial metals, and Russia and Ukraine are both important exporters of soft commodities.

- La Niña* could reduce the supply of important commodities like corn, soybean, and wheat (*La Niña disrupts normal weather patterns and can lead to intense storms and droughts, the impact differs across continents).

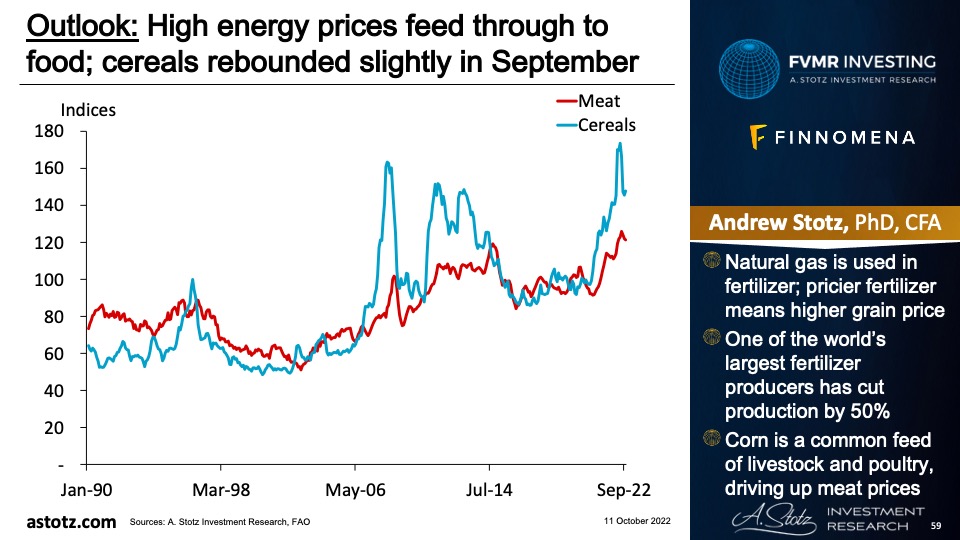

High energy prices feed through to food; cereals rebounded slightly in September

- Natural gas is used in fertilizer; pricier fertilizer means higher grain price.

- One of the world’s largest fertilizer producers has cut production by 50%.

- Corn is a common feed of livestock and poultry, driving up meat prices.

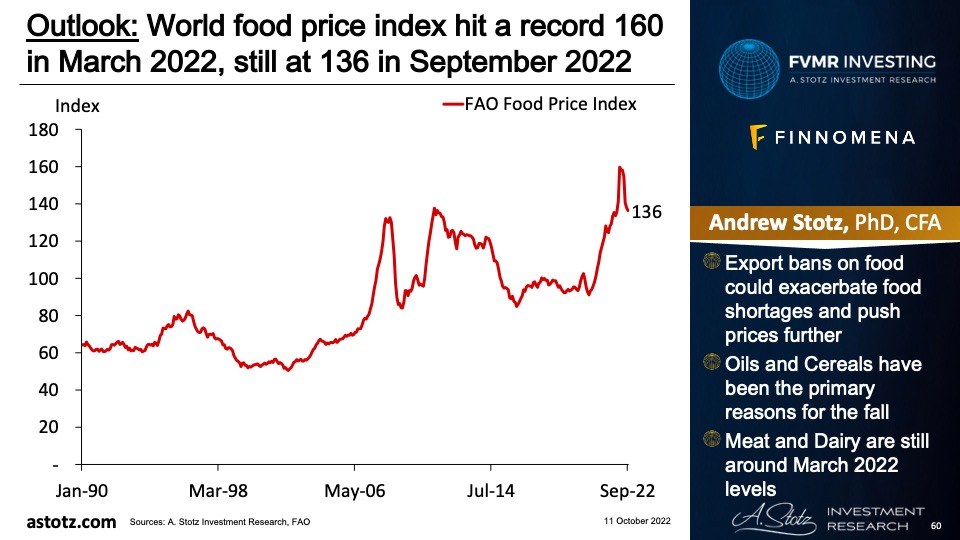

World food price index hit a record 160 in March 2022, still at 136 in September 2022

- Export bans on food could exacerbate food shortages and push prices further.

- Oils and Cereals have been the primary reasons for the fall.

- Meat and Dairy are still around March 2022 levels.

Commodities set to go higher

- Demand for necessities (food and energy), inflation, and supply-chain disruptions related and unrelated to the war in Ukraine are going to drive the asset class higher.

- A re-opening of China could lead to increased demand for Commodities.

- Also, if we were to go into a stagflationary period, Commodities could show resilient.

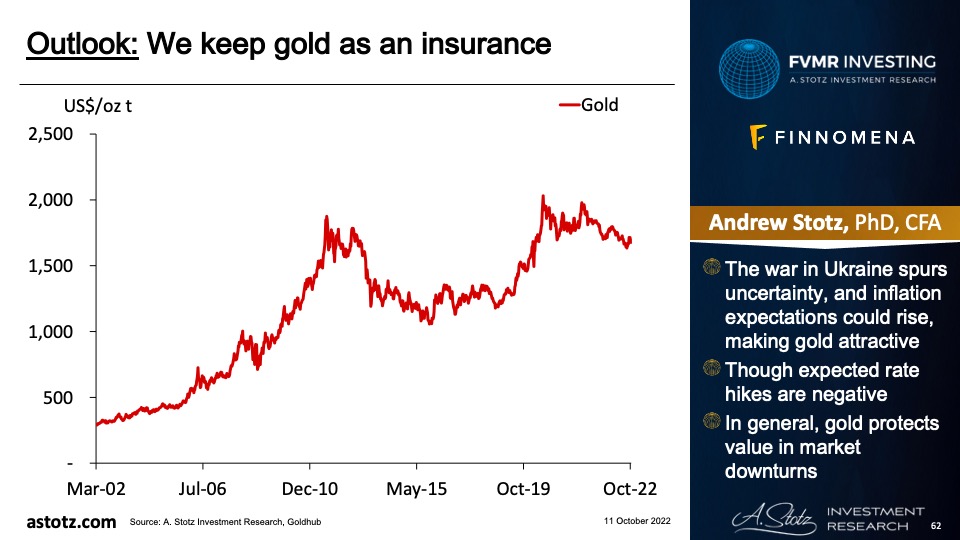

We keep gold as an insurance

- The war in Ukraine spurs uncertainty, and inflation expectations could rise, making gold attractive.

- Though expected rate hikes are negative.

- In general, gold protects value in market downturns.

Global recession pushing down stocks

- If major central banks would surprise and be too aggressive with rate hikes and QT, it could crash the stock markets.

- Collapsing energy prices would be damaging since we have exposure through our allocations to World Energy and Commodities.

- We are mainly exposed to Thai bonds; hence, BOT’s actions impact the most.

Key takeaways

- Central bankers appear to be raising rates into a recession to stifle inflation; stagflation would be the worst outcome.

- Demand for necessities (food and energy), inflation, and supply-chain disruptions can drive Commodities higher.

- We see opportunities to allocate to specific sectors and markets within equity

- Bonds and Gold to protect capital.

- Risks: Monetary tightening crash markets, collapsing energy prices, BOT actions.

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.