Become a Better Investor Newsletter – 21 December 2024

Noteworthy this week

- Fed cuts by 0.25%

- Value stocks get historically hit

- Fartcoin hits US$1bn

- Fund managers move to stocks

- Bitcoin takes over Bloomberg

Fed cuts by 0.25%: In line with market expectations JPow cut by 0.25%. The Fed reduced their outlook to 2 from 3 rate cuts in 2025. HJigher for longer is the current message.

BREAKING: The S&P 500 falls sharply after the Fed cuts rates by 25 basis points, but raises inflation forecast.

The Fed reduced their outlook from 3 to 2 rate cuts in 2025 and raised inflation expectations from 2.1% to 2.5%.

Inflation is back. pic.twitter.com/kKtEHD0IF0

— The Kobeissi Letter (@KobeissiLetter) December 18, 2024

Value stocks get historically hit: S&P 500 Value Stocks have declined for 13 consecutive days, the longest losing streak in history.

S&P 500 Value Stocks have declined for 13 consecutive days, the longest losing streak in history 🚨 pic.twitter.com/lmF95TsveE

— Barchart (@Barchart) December 19, 2024

Fartcoin hits US$1bn: Half a billion wasn’t enough. The market cap has doubled since last week. Makes sense. Not.

Amidst the sea of red ink in markets today there remains one shining store of value in the green:

Fartcoin, who’s market cap just hit $1 billion.

The safe haven asset of the future… pic.twitter.com/T64SHWqO8J

— Charlie Bilello (@charliebilello) December 18, 2024

Fund managers move to stocks: The fund manager survey by BofA shows that institutions are moving into equities from cash. Risk on.

Fund managers’ enthusiasm for stocks has hit extreme levels, with cash allocations dwindling.

Source: @BankofAmerica pic.twitter.com/N2p6UbDKQ7

— (((The Daily Shot))) (@SoberLook) December 17, 2024

Bitcoin takes over Bloomberg: As everyone and their dog learned that BTC surpassed US$100K, Bloomberg jumped on the train.

Bitcoin takeover on the Bloomberg home page.. pic.twitter.com/msVNy6TTDb

— Eric Balchunas (@EricBalchunas) December 16, 2024

Join the world’s toughest valuation training

Become a Valuation Expert. Valuation Master Class Boot Camp graduates can confidently value any company in the world and possess in-demand industry skills.

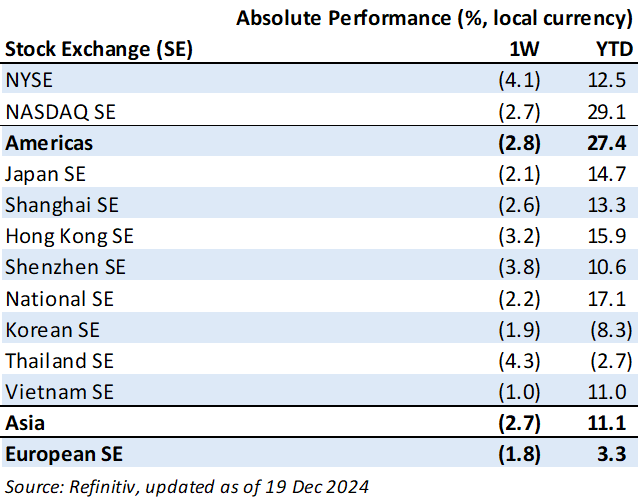

Weekly market performance

Click here to see more markets and periods.

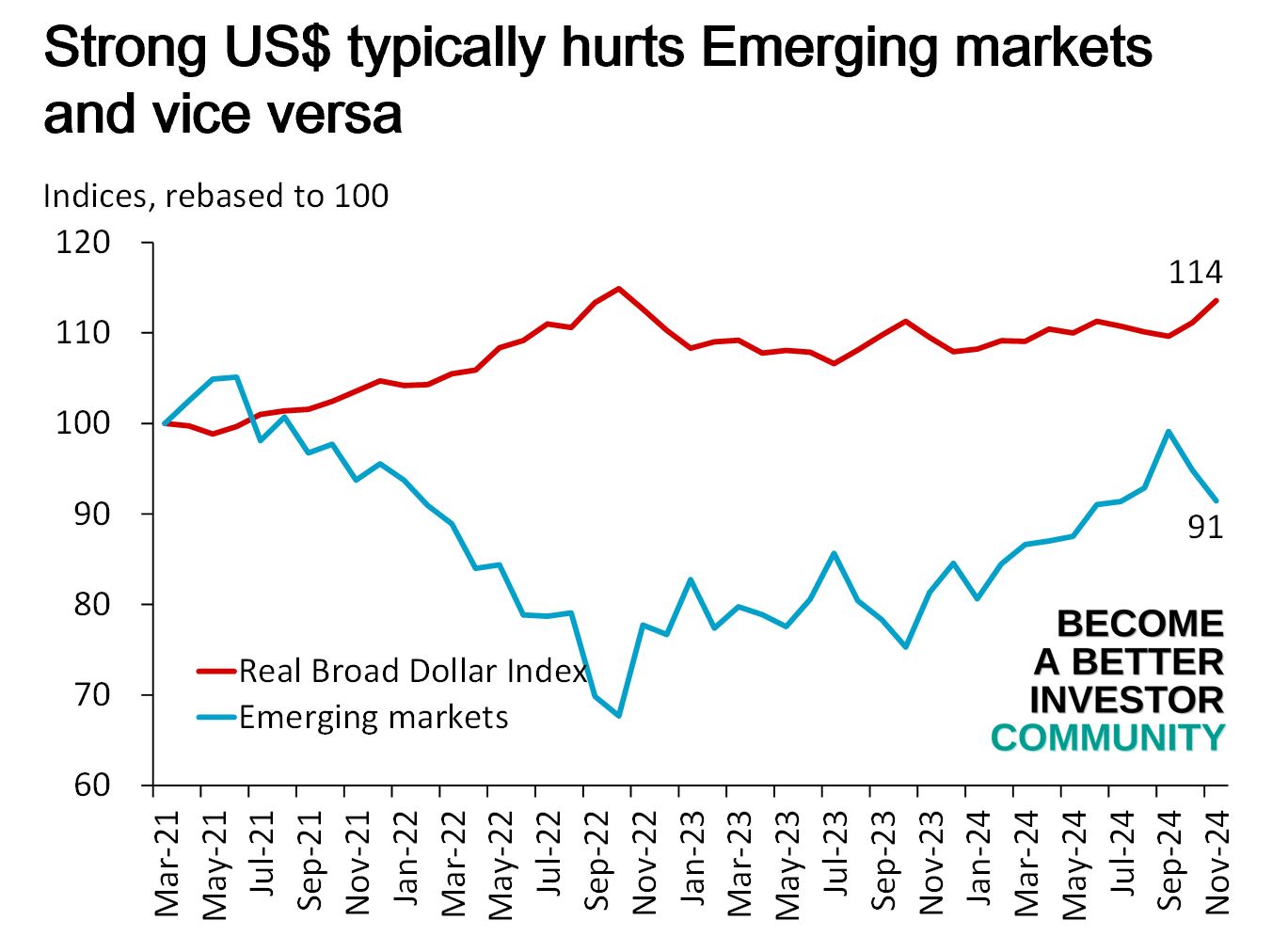

Chart of the week

Discussed in the Become a Better Investor Community this week

“@channel please find the above performance chart of the 5 stock strategies and 1 asset allocation strategy you have access to in the community.”

Try 1 month of the Become a Better Investor Community for FREE today!

You can cancel at any time. Click here to learn more.

Podcasts we listened to this week

#373 Breakfast with Brad Jacobs + How To Make A Few Billion Dollars – Founders

“Brad Jacobs is one of the most talented living entrepreneurs. Brad has started 8 different billion dollar or multi-billion dollar businesses. He has done over 500 acquisitions and has raised over $30 billion.”

Readings this week

Vanguard economic and market outlook for 2025: Beyond the landing

Book recommendation

Discrimination and Disparities by Thomas Sowell

“Economic and other outcomes differ vastly among individuals, groups, and nations. Many explanations have been offered for the differences. Some believe that those with less fortunate outcomes are victims of genetics. Others believe that those who are less fortunate are victims of the more fortunate.”

Get the book on Audible or Kindle.

Audible is great; have you tried it? If not, click here to get 2 books for free.

Memes of the week

This summarizes things in Europe really well pic.twitter.com/vii4fHpvaE

— Michael A. Arouet (@MichaelAArouet) December 13, 2024

🧵 VIRAL MEME THREAD 🧵

Check out some of the most viral Memes the make fun of Socialists. 🔥

Leave us your favorite memes below! 😎

1/12 🧵 pic.twitter.com/NHBfQKd1QR

— Declaration of Memes (@LibertyCappy) December 16, 2024

New My Worst Investment Ever episodes

Ep795: Craig Cecilio – From Trust to Turmoil: Lesson on Friendship and Business

BIO: Craig Cecilio is a visionary disruptor and CEO of DiversyFund, dedicated to democratizing wealth building. He has broken barriers in private markets, raising over $1 billion and offering investment opportunities once reserved for the elite.

STORY: Craig had a potential business partner introduced to him by a friend. The partner had a land deal and convinced Craig to invest $10,000. A couple of other people joined in and deposited about $250,000 into the land development deal in New Mexico. A week went by, and the investors got ghosted by the land deal owner.

LEARNING: Don’t mix friendship with business. Do your due diligence on all the parties involved in the transaction.

Access the episode’s show notes and resources

Published on Become a Better Investor this week

In this episode of Enrich Your Future, Andrew and Larry Swedroe discuss Larry’s new book, Enrich Your Future: The Keys to Successful Investing. In this series, they discuss Chapter 21: You Can’t Handle the Truth.

Listen to Enrich Your Future 21: Think You Can Beat the Market? Think Again

Before you jump into tools and solutions, you need to take a step back. In this episode, John Dues and Andrew Stotz discuss the four questions you need to ask in order to make the system you want to work on visible, and decide on a direction.

Listen to See the System: Path for Improvement (Part 4)

Thai Union Group Public Company Limited (TU TB): Profitable Growth rank of 7 was up compared to the prior period’s 9th rank. This is below average performance compared to 540 large Cons. Staples companies worldwide.

Read Thai Union Group – World Class Benchmarking

MBM Resources Berhad (MBM MK): Profitable Growth rank of 1 was up compared to the prior period’s 3rd rank. This is World Class performance compared to 830 medium Cons. Disc. companies worldwide.

Read MBM Resources – World Class Benchmarking

LT Group Incorporated (LTG PM): Profitable Growth rank of 8 was same compared to the prior period’s 8th rank. This is below average performance compared to 1,370 large Industrials companies worldwide.

Read LT Group – World Class Benchmarking

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.