Become a Better Investor Newsletter – 19 August 2023

Noteworthy this week

- US corporate bankruptcies double

- American life expectancy falling

- PBOC cuts rates

- The Yuan has lost ground

- China FDI at a 25-year low

US corporate bankruptcies double: In 7M23, corporate bankruptcies are up by 96% YoY, and we’ve already seen more bankruptcies than in all of 2022. “Can the Fed really avoid a recession?”

In the first 7 months of 2023, the U.S. has seen an alarming 402 corporate bankruptcies.

This is more than the entire 2022 total of 373.

In the first 7 months of 2022, the U.S. saw just 205 bankruptcies.

In other words, bankruptcies this year are up 96% compared to 2022.

Can… pic.twitter.com/rXWi5VAiJU

— The Kobeissi Letter (@KobeissiLetter) August 15, 2023

American life expectancy falling: Comparable countries’ life expectancy has rebounded post-COVID, while US life expectancy has continued to fall. No exceptionalism to be proud of.

Shades of post-1989 USSR in the US since the GFC in 2008.

Comparable countries bounced post-COVID, but US did not.

~1 million Americans have died of OD’s just since 2010; that’s more than the # of Americans that died in all wars America has ever fought in.

Via @DanRDimicco pic.twitter.com/8WRkDXiPDB

— Luke Gromen (@LukeGromen) August 14, 2023

PBOC cuts rates: The China recovery won’t come easy. While the West is raising rates, China is cutting to stimulate the economy.

*PBOC CUTS RATE ON 1-YEAR MLF LOANS TO 2.5% FROM 2.65%

*PBOC INJECTS NET 1B YUAN VIA MLF

*PBOC CUTS 7-DAY REVERSE REPO RATE TO 1.8% FROM 1.9%— 𝕏𝐟𝐟𝐢𝐜𝐢𝐞𝐧𝐭 𝕏𝐚𝐫𝐤𝐞𝐭 𝕏𝐲𝐩𝐞 (@EffMktHype) August 15, 2023

The Yuan has lost ground: CNY has lost all the strength it regained after COVID. This is likely to force PBOC to take action and sell US Treasuries.

The biggest unpriced duration supply risk is that the PBOC will need to intervene to support the CNY.

CNY at 15 year lows means not too much longer before the PBOC mounts a more aggressive defense. Last time they did, it created a huge ripple through global markets. Thread. pic.twitter.com/44pAAtMpg5

— Bob Elliott (@BobEUnlimited) August 14, 2023

China FDI at a 25-year low: Inbound FDI to China is the lowest since at least 1998. The geopolitical situation has an impact, and China faces challenges to get its economy back on its feet.

OUCH! FDI in #China slumped to the lowest level since at least 1998. pic.twitter.com/IESGLHAjpA

— Holger Zschaepitz (@Schuldensuehner) August 13, 2023

Join the world’s toughest valuation training

Become a Valuation Expert. Valuation Master Class Boot Camp graduates can confidently value any company in the world and possess in-demand industry skills.

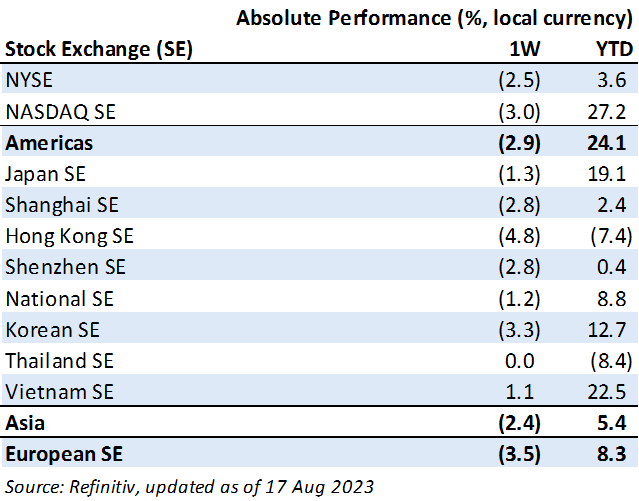

Weekly market performance

Click here to see more markets and periods.

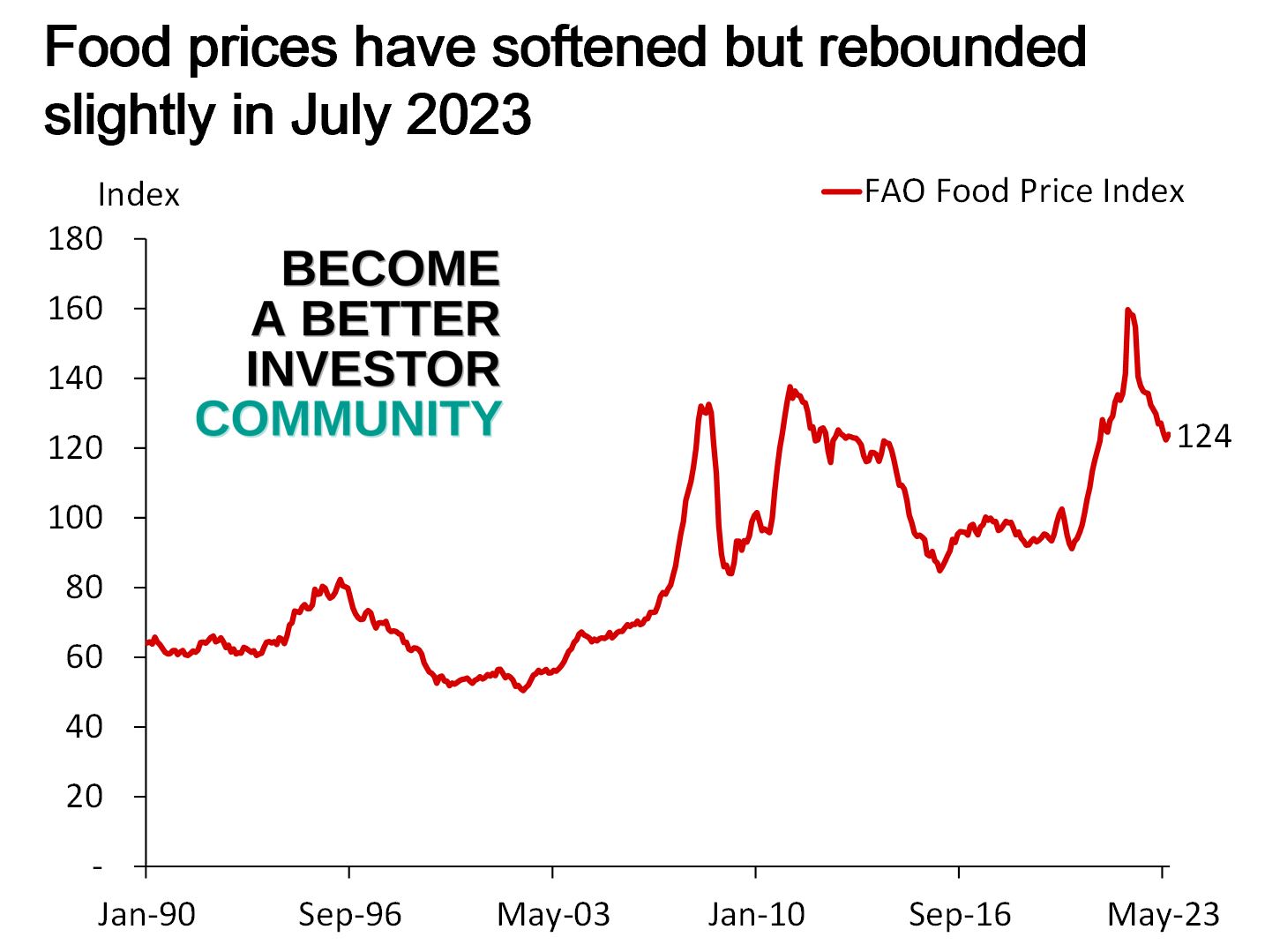

Chart of the week

Discussed in the Become a Better Investor Community this week

“The US and UK are getting desperate. They never expected things to turn out this way. Their global influence is waning. And Putin is all smiles.”

Try 1 month of the Become a Better Investor Community for FREE today!

You can cancel at any time. Click here to learn more.

Podcasts we listened to this week

The Morgan Housel Podcast – Fluke — A Story About How Fragile The World Can Be

“This is a short personal story about a fluke event 16 years ago that changed everything in my life. You probably have a similar story, and there is so much to learn about how everything can change from an event you never saw coming.”

Readings this week

Value and Profitability/Quality: Complementary Factors

“Value and quality are philosophically and economically related because they both aim to purchase future streams of income at a discount today. While quality strategies purchase highly profitable firms at average prices, value strategies purchase average profitability firms at low prices. These two approaches are philosophically similar as they seek to benefit from multiple expansion over time as valuation discounts close in tandem with improved fundamentals.”

Book recommendation

The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel Ruiz & Janet Mills

“In The Four Agreements, don Miguel Ruiz reveals the source of self-limiting beliefs that rob us of joy and create needless suffering. Based on ancient Toltec wisdom, The Four Agreements offer a powerful code of conduct that can rapidly transform our lives to a new experience of freedom, true happiness, and love.”

Get the book on Audible or Kindle

Audible is great; have you tried it? If not, click here to get 2 books for free.

Memes of the week

Can’t wait to see The Big Short 2 pic.twitter.com/ICFycL7PII

— Wall Street Memes (@wallstmemes) August 15, 2023

— Not Jerome Powell (@alifarhat79) August 15, 2023

New My Worst Investment Ever episodes

Ep719: David Kass – Don’t Invest in a Company Unless the CEO Owns a Large Stake

BIO: Dr. David Kass received his Ph.D. in Business Economics from Harvard University and has published articles in corporate finance, industrial organization, and health economics. He currently teaches Advanced Financial Management.

STORY: In his early 20s, David invested $2,000 in a company giving out high dividends. Only after he invested did he realize that none of the senior executives in the company owned its shares. Soon enough, the stock went down to zero due to accounting fraud.

LEARNING: Only invest in a company if senior executives, especially the CEO, own a significant stake. The value of the CEO’s stock in his own company to his annual salary should be at least 3:1.

Access the episode’s show notes and resources

Published on Become a Better Investor this week

Dr. Deming railed against performance appraisals, listing them 3rd in his Seven Deadly Diseases of Management and calling them “Destroyer of People”. In this discussion, John Dues explains our cultural attachment to appraising workers and why it is a myth to assume that appraisals have any impact on performance at all.

Listen to Performance Appraisals: Deming in Schools Case Study with John Dues (Part 8)

In this episode of Investment Strategy Made Simple (ISMS), Andrew gets into part two of his discussion with Larry Swedroe; Ignorance is Bliss. Today they discuss two chapters of Larry’s book Investment Mistakes Even Smart Investors Make and How to Avoid Them. In this ninth series, they discuss mistake number 16: Do You Fail To See The Poison Inside the Shiny Apple? And mistake number 17: Do You Confuse Information With Knowledge?

Read ISMS 29: Larry Swedroe – The Shiny Apple is Poisonous and Information is Not Knowledge

YG Entertainment Incorporated (122870 KS): Profitable Growth rank of 1 was up compared to the prior period’s 3rd rank. This is World Class performance compared to 210 medium Comm. Serv. companies worldwide.

Read YG Entertainment – World Class Benchmarking

Shenzhen INVT Electric Company Limited (002334 SZ): Profitable Growth rank of 2 was up compared to the prior period’s 3rd rank. This is World Class performance compared to 1,210 medium Industrials companies worldwide.

Read Shenzhen INVT Electric – World Class Benchmarking

Srinanaporn Marketing Public Company Limited (SNNP TB): Profitable Growth rank of 2 was same compared to the prior period’s 2nd rank. This is World Class performance compared to 410 medium Cons. Staples companies worldwide.

Read Srinanaporn Marketing – World Class Benchmarking

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.