Become a Better Investor Newsletter – 14 September 2024

Noteworthy this week

- German production is down

- German GDP has fallen behind

- US bankruptcies are rising

- Big drop in US small businesses earnings

- Pets are more important than kids

German production is down: German industrial production has fallen about 16% since peaking in 2017 and is 26% below its pre-pandemic trend.

German industrial production has fallen about 16% since peaking in 2017 and is 26% below its pre-pandemic trend. This is the third longest rout (2009, 2020) in the 21. century. Production dropped 2.4% in July, ending a weak first half of this year. Leading indicators don’t… pic.twitter.com/wtLJhmWnQI

— Boris Kovacevic (@MacroKova) September 6, 2024

German GDP has fallen behind: GDP growth of the US left Germany far behind. 30 years ago, each major US company had a German equivalent. That’s not the case today.

Eye-opening chart, GDP growth of the US left Germany far behind.

30 years ago each major US company had a German equivalent. Today equivalents of US tech giants are in China, and Germany becomes a museum with industry from last century and poor infrastructure. What happened? pic.twitter.com/XHUAcDZsGL

— Michael A. Arouet (@MichaelAArouet) September 12, 2024

US bankruptcies are rising: The number of bankruptcy filings hit 452 year-to-date, the 2nd highest reading in 13 years.

🚨US BANKRUPTCIES ARE SKYROCKETING🚨

The number of bankruptcy filings hit 452 year-to-date, the 2nd largest in 13 YEARS.

In August alone, 63 companies went under, the 4th LARGEST since the COVID CRISIS.

Most bankruptcies have been seen in the consumer discretionary sector. pic.twitter.com/d5xaX30nJf

— Global Markets Investor (@GlobalMktObserv) September 10, 2024

Big drop in US small businesses earnings: 37% of US small businesses have seen their earnings drop over the last 3 months, the highest share in 14 years.

BREAKING: 37% of US small businesses have seen their earnings drop over the last 3 months, the highest share in 14 years.

This is even weaker than the 35% seen during the 2020 pandemic.

Over the last 3 years, small business earnings have declined in a near straight-line lower.… pic.twitter.com/IIAxH3c73w

— The Kobeissi Letter (@KobeissiLetter) September 11, 2024

Pets are more important than kids: American spend on pets reached US$186bn in 2023, more than was spent on childcare. The industry is estimated to reach US$260bn by 2030.

American spend on pets reached $186B in 2023, more than was spent on childcare.

The industry is growing at 11% a year — nearly 2x pace of overall consumer spend — and is estimated to reach $260B by 2030 (with greater millenial/Gen-Z pet ownership). pic.twitter.com/UDU3N1TQ1W

— Trung Phan (@TrungTPhan) September 12, 2024

Join the world’s toughest valuation training

Become a Valuation Expert. Valuation Master Class Boot Camp graduates can confidently value any company in the world and possess in-demand industry skills.

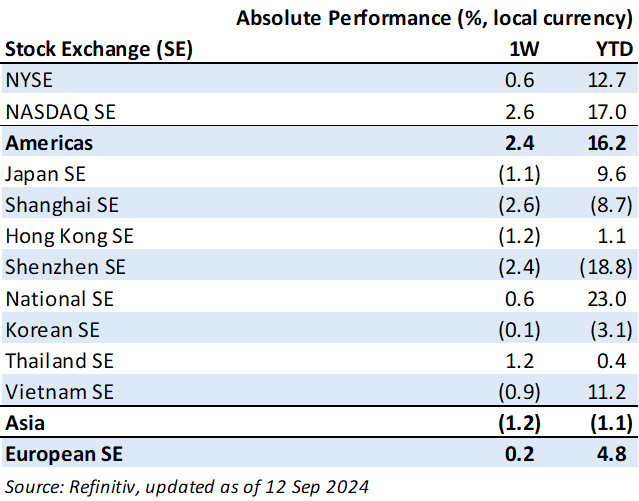

Weekly market performance

Click here to see more markets and periods.

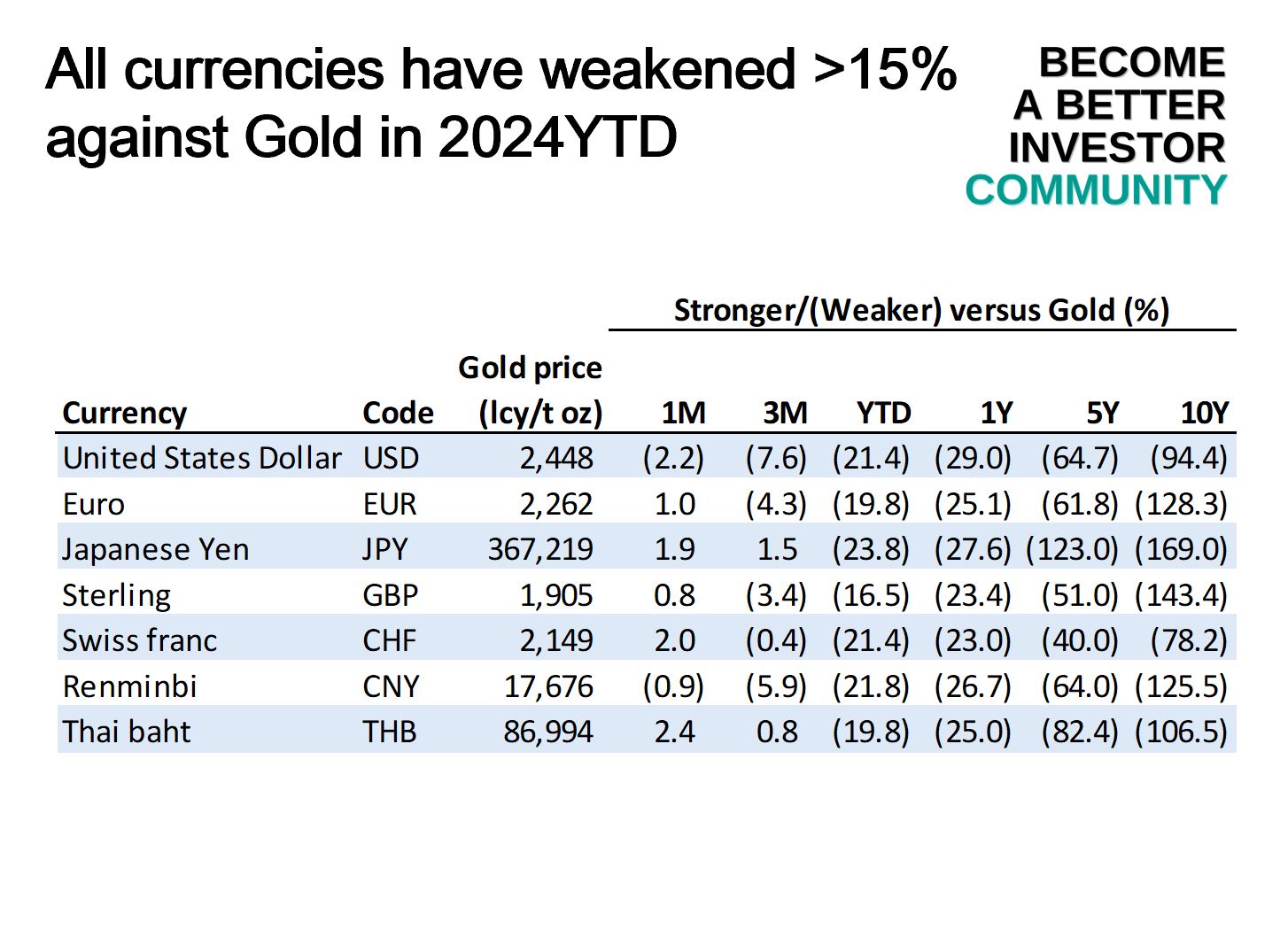

Chart of the week

Discussed in the Become a Better Investor Community this week

“We just published our global asset allocation new weights and performance review.”

Try 1 month of the Become a Better Investor Community for FREE today!

You can cancel at any time. Click here to learn more.

Podcasts we listened to this week

RWH049: CRUSHING THE MARKET OVER 50 YEARS W/ JAY BOWEN

“In this episode, William Green chats with Harold J. (“Jay”) Bowen III, President & CIO of Bowen, Hanes & Company. Jay & his late father generated dazzling returns for their biggest client, the Tampa Firefighters’ & Police Officers’ Pension Fund. The fund’s stock portfolio has achieved an annualized return of 14.4% over 50 years & a cumulative return of more than 81,000%.”

Readings this week

Founder Mode

“At a YC event last week Brian Chesky gave a talk that everyone who was there will remember. Most founders I talked to afterward said it was the best they’d ever heard. Ron Conway, for the first time in his life, forgot to take notes. I’m not going to try to reproduce it here. Instead I want to talk about a question it raised.”

Book recommendation

The Neurobiology of “We”: How Relationships, the Mind, and the Brain Interact to Shape Who We Are by Daniel Siegel

“If you think your brain and mind are one, think again. According to the interpersonal neurobioligy pioneer Daniel J. Siegel, the mind actually emerges out of the interaction between your brain and relationships.”

Get the book on Audible.

Audible is great; have you tried it? If not, click here to get 2 books for free.

Memes of the week

Founder: “I have concepts of a plan”

Masayoshi Son: pic.twitter.com/62CYIfc5lc

— Ana Mostarac (@anammostarac) September 11, 2024

#debate pic.twitter.com/s3O8YLum6U

— Dan Stringer, SEC Pimp (@Danstringer74) September 11, 2024

New My Worst Investment Ever episodes

Ep791: Pritesh Ruparel – Put Yourself in a Position to Get Lucky

BIO: Pritesh Ruparel is the CEO of ALT21, a leading tech company in hedging and currency solutions.

STORY: Pritesh found a good trade and invested 100% in it. His manager later advised him to liquidate that position because it was too concentrated. A day after Pritesh liquidated, a natural disaster occurred, and the spread went from $10 to $250 in an hour.

LEARNING: Put yourself in a position to get lucky. Never decide against your gut. Stay grounded between the highs and the lows.

Access the episode’s show notes and resources

Enrich Your Future 13: Past Performance Is Not a Predictor of Future Performance

In this episode of Enrich Your Future, Andrew and Larry Swedroe discuss Larry’s new book, Enrich Your Future: The Keys to Successful Investing. In this series, they discuss Chapter 13: Between a Rock and a Hard Place.

LEARNING: Past performance is not a strong predictor of future performance.

Access the episode’s show notes and resources

Published on Become a Better Investor this week

In this episode of Enrich Your Future, Andrew and Larry Swedroe discuss Larry’s new book, Enrich Your Future: The Keys to Successful Investing. In this series, they discuss Chapter 12: Outfoxing the Box.

Listen to Enrich Your Future 12: When Confronted With a Loser’s Game Do Not Play

Is reaching A+ quality always the right answer? What happens when you consider factors that are part of the system, and not just the product in isolation? In this episode, Bill Bellows and Andrew Stotz discuss acceptability versus desirability in the quality realm.

Listen to Acceptability VS Desirability: Misunderstanding Quality (Part 3)

Maruha Nichiro Corporation (1333 JP): Profitable Growth rank of 9 was down compared to the prior period’s 7th rank. This is poor performance compared to 560 large Cons. Staples companies worldwide.

Read Maruha Nichiro Corp – World Class Benchmarking

The concept of Key Performance Indicators (KPIs) emerged in the late 20th century as businesses sought better ways to measure and manage performance in increasingly complex environments.

Read The Evolution of Key Performance Indicators (KPIs): From Concept to Cornerstone

Gold and Bonds shined. Performance review of our strategies in August 2024 – All Weather Inflation Guard gained 0.6%, All Weather Strategy was flat, All Weather Alpha Focus gained 1.9%.

Read A. Stotz All Weather Strategies – August 2024

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.