Become a Better Investor Newsletter – 11 March 2023

Noteworthy this week

- Are economists making weather forecasters look good again?

- Suffering is necessary to kill inflation

- The US bond market is in a record drawdown

- You need to be contrarian to make money in the markets

- Solar and wind resources aren’t plugged in

Are economists making weather forecasters look good again?: “The economy depends about as much on economists as the weather does on weather forecasters.” – Jean-Paul Kauffmann

Economists’ expectations for future inflation is irrelevant.

They always expect inflation to go back to 2% anyway.

Like literally always. pic.twitter.com/6n4QxK7Phj

— Alf (@MacroAlf) March 6, 2023

Suffering is necessary to kill inflation: Governments’ continuous fiscal support to deal with higher living costs increases the inflationary pressure.

When you cost-of-living-adjust benefits and tax brackets, you automatically entrench inflation

Fiscal suffering is needed to win the battle against inflation. Not sure monetary policy can stand alone.. pic.twitter.com/SzFFiJHqAM

— AndreasStenoLarsen (@AndreasSteno) March 8, 2023

The US bond market is in a record drawdown: The drawdown in US bonds has lasted for almost three years and is the longest on record.

The US Bond Market now has been in a drawdown for 31 months, by far the longest drawdown in history. pic.twitter.com/eulI5Qfy6u

— Charlie Bilello (@charliebilello) March 2, 2023

You need to be contrarian to make money in the markets: That yield-curve inversion precedes a recession is a consensus view. Bob says his non-consensus view is that this cycle is going to be “slower, longer, higher and eventually deeper than consensus.”

Deepening YC inversion driving increasingly aggressive bonds buy calls b/c recession is coming.

That is *consensus*. Because its believed, it’s in the price. To make money in markets, you have to have a non-consensus view. YC inversion precedes recession isn’t one. pic.twitter.com/KXw2oLk9PS

— Bob Elliott (@BobEUnlimited) March 6, 2023

Solar and wind resources aren’t plugged in: Apparently, more than 1,500 gigawatts of renewal power sources are not plugged into the West grid. Makes sense?

This isn’t just a Vietnam problem (even though those 3.5 gigawatts would go a long way for the developing nation)

🔌 Over 1,500 gigawatts (!!) of solar and wind is also waiting to be plugged into the grid in the US and Europe pic.twitter.com/r2Il49Cr52

— Stephen Stapczynski (@SStapczynski) March 9, 2023

Join the world’s toughest valuation training

Become a Valuation Expert. Valuation Master Class Boot Camp graduates can confidently value any company in the world and possess in-demand industry skills.

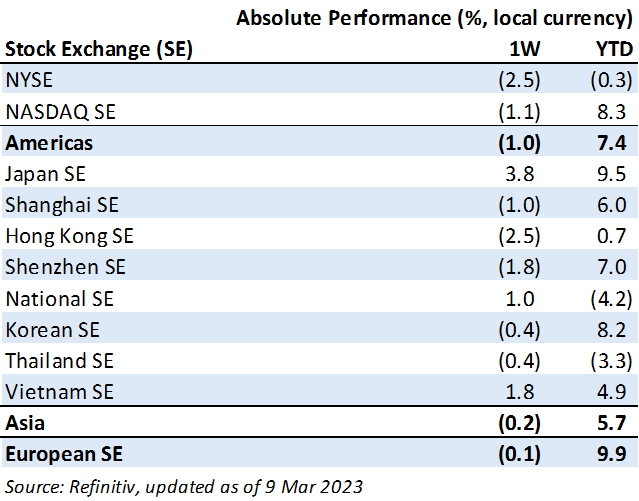

Weekly market performance

Click here to see more markets and periods.

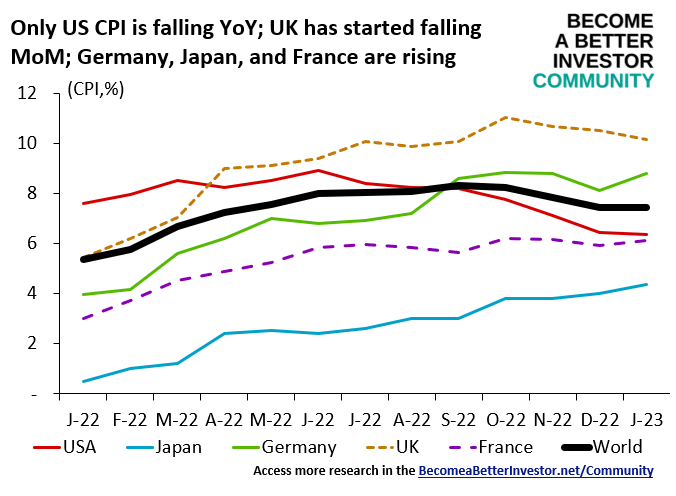

Chart of the week

Discussed in the Become a Better Investor Community this week

“European stocks have been out of favor leading to relatively low valuations, and a severe energy crisis was avoided due to mild weather. As confidence improves in Europe and China reopens, we think it’s time for European outperformance. Like European, Japanese stocks are relatively cheap. We see improvements in the Japanese service sector, and Japan should also benefit from the Chinese reopening.”

Join the Become a Better Investor Community today! You can cancel any time, and as a newsletter reader you get a massive discount when you use this coupon code: READER

Podcasts we listened to this week

The Memo by Howard Marks – The Rewind – Calling the Market

“Howard looks back on several memos he’s written near major turning points in the market over the last few decades, from the bursting of the dot-com bubble to the pandemic-driven crisis in early 2020. He considers what an investor should – and shouldn’t – focus on when making a market call.”

Readings this week

ICYMI: You Must Make the World a Better Place Because the Woke ESG Movement Won’t

“Your investments are about your values, and you are responsible for your decisions. Don’t consider ESG standards an easy way to be granted an indulgence.”

Book recommendation

They Thought They Were Free: The Germans, 1933 by Milton Sanford Mayer

“First published in 1955, They Thought They Were Free is an eloquent and provocative examination of the development of fascism in Germany. Milton Mayer’s book is a study of 10 Germans and their lives from 1933-45, based on interviews he conducted after the war when he lived in Germany..”

Get the book on Audible or Kindle.

Audible is great; have you tried it? If not, click here to get 2 books for free.

Memes of the week

My favorite Warren Buffett quote 🙏 pic.twitter.com/pw2VxrkonD

— Wall Street Memes (@wallstmemes) March 8, 2023

— Chairman (@WSBChairman) March 9, 2023

New My Worst Investment Ever episodes

ISMS 8: Larry Swedroe – Are You Overconfident in Your Skills?

In this episode of Investment Strategy Made Simple (ISMS), Andrew and Larry discuss a chapter of Larry’s book Investment Mistakes Even Smart Investors Make and How to Avoid Them. In this first series of many, they talk about mistake number one: Are you overconfident in your skills?

LEARNING: Don’t be overconfident. Look for value-added information when researching an investment.

Access the episode’s show notes and resources

Ep657: Brian Feroldi – Be Careful When Trading Options

BIO: Brian Feroldi is a financial educator, YouTuber, and author. His career mission statement is “to demystify finance.”

STORY: Brian invested in an oil pipeline company with take-or-pay contracts. This meant that the company would get paid either way if the price of oil or natural gas went up or down. Prices went down and despite the contract, the pipeline’s stock went down because its customers couldn’t afford to pay. Brian lost 70% of his entire portfolio.

LEARNING: Don’t use options as an investment strategy. Never let one company become your largest position. Be careful about trying to leverage beyond your capability.

Access the episode’s show notes and resources

Ep656: Matt LeBris – Prepare for the Downs During the Uptime

BIO: Matt LeBris is a born and raised NY’er who inevitably caught the hustler’s spirit that fills his hometown streets.

STORY: Matt got an opportunity to be part of a successful business venture in his early 20s. He was making good money and living a good life. Unfortunately, the business went down, and he took an unpaid internship with Daymond John of Shark Tank. Matt’s biggest mistake was to continue living large even though he no longer had money coming up. He blew over $80,000 of his savings by living way above his means.

LEARNING: Understand how you’re subconsciously programmed about money. Live below your means.

Access the episode’s show notes and resources

Ep655: Pim van Vliet – Just Because It’s Cheap Doesn’t Mean You Have to Buy It

BIO: Pim van Vliet is Head of Conservative Equities and Chief Quant Strategist at Robeco. He is responsible for a wide range of global, regional, and sustainable low-volatility strategies.

STORY: Pim wanted to make more money investing, so he decided to go all in on a cheap stock. He believed the price would eventually go up as it had done a few years back. Unfortunately, the company went bankrupt, and Pim lost 75% of his investment.

LEARNING: Don’t be overconfident and over-optimistic when investing. Just because it’s cheap doesn’t mean you have to buy it.

Access the episode’s show notes and resources

Published on Become a Better Investor this week

How do you tap into intrinsic motivation when the assignments (or jobs) are boring or feel irrelevant? Andrew and David talk about the role of challenge in intrinsic motivation, including why being challenged is key to innovation and improvement.

Listen to The Role of Challenge: Cultivating Intrinsic Motivation Series with David P. Langford (Part 4)

What do you think: Which of the global sectors is most attractive?

Download the PDF with all charts and graphs

Read ISMS 7: Financials, Cons. Disc., and Utilities Sectors Look Most Interesting

Bangkok Aviation Fuel Services Public Company Limited (BAFS TB): Profitable Growth rank of 7 was up compared to the prior period’s 8th rank. This is below average performance compared to 690 small Industrials companies worldwide.

Read Bangkok Aviation Fuel Services – World Class Benchmarking

Türk Hava Yollari Anonim Ortakligi (THYAO TI): Profitable Growth rank of 2 was up compared to the prior period’s 5th rank. This is World Class performance compared to 1,590 large Industrials companies worldwide.

Read Türk Hava Yollari – World Class Benchmarking

Plan B Media Public Company Limited (PLANB TB): Profitable Growth rank of 1 was up compared to the prior period’s 8th rank. This is World Class performance compared to 260 medium Comm. Serv. companies worldwide.

Read Plan B Media – World Class Benchmarking

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.