You Must Make the World a Better Place Because the Woke ESG Movement Won’t

Would you include an oil company in your environmentally, socially, and governance (ESG) friendly portfolio? Would you consider a tobacco company? What about a weapons manufacturer? Would you have any concerns about adding Coca-Cola to your ESG portfolio?

Oil, tobacco, and weapons may at least get you thinking whether they are environmentally and socially responsible investments, but Coca-Cola? There’s little doubt that obesity is a massive health issue that is getting worse by the day. I would also claim there’s little doubt that sugary drinks can add to the obesity problem.

It’s complex to evaluate the ESG impact

It’s hard to evaluate how good a company is in terms of ESG, especially the environmental and social impact. Let’s continue with the example of sugary drinks, which play a part in the obesity pandemic, a negative social impact.

If you, for example, invest in a company that uses sugar produced in Thailand, you can also assume that you are investing in something that leads to air pollution. Most sugarcane producers in Thailand still engage in crop burning, leading to increased air pollution levels.

We may take the easy way and pass the responsibility onto others

Don’t get me wrong. I don’t try to bash Coca-Cola or soda companies in general. I’m barely highlighting the complexity of evaluating ESG. It also becomes a question of who should be responsible.

While I believe the consumer is responsible for deciding if they want to drink a Coke, others may think the government should impose excise taxes on sugar. The complexity of evaluating ESG may lead us to pass the responsibility onto others.

“Most people do not really want freedom, because freedom involves responsibility, and most people are frightened of responsibility.”

– Sigmund Freud

The environmental and social impacts are especially hard to assess

Many of the issues concerning the environmental and social impact of a business and the governance of a company aren’t black and white. Is an electric vehicle company that uses batteries with nickel extracted from a coal-powered mine in the world’s largest nickel producer, Indonesia, environmentally friendly?

How about a fossil fuel company that invents a technology that reduces CO2 emissions? What’s the social impact of a smartphone company using batteries with bauxite from a mine in DR Congo which uses child labor? Does a company with high family ownership and family members in the company’s leadership automatically have poor governance?

So, should you include Coca-Cola in your ESG portfolio?

In fact, the answer is really simple. It’s up to you!

Responsible investing is ultimately about values, your values

In addition to the ESG impact being hard to evaluate, your view on specific issues will depend on your values. The ultimate challenge for ESG investing is that we have different values. Instead of embracing the diversity of values (and I thought diversity was high on the ESG agenda), the ESG movement has force-fed us like a French goose destined to become foie gras with woke values.

Or values can differ, and that’s OK

The reason ESG peddlers want you to subscribe to these woke values is also simple. It makes the creation of responsible investment products and strategies much easier. If we all have the same values, it’s easy to define what’s responsible. But we don’t.

You may also feel that it’s easier when someone else defines what’s a “good” investment, and it helps you feel good about yourself. But ultimately, you should feel responsible for the impact your investing has.

The ESG movement suffers from religion envy

ESG proponents are undoubtedly jealous of other values-based investing approaches, like Shariah investing. Shariah investing has the benefit of having a common foundation of values, Islam. Sure, there are different interpretations of religion, but there are shared values that more or less all practitioners have or at least want to be seen as having. It makes it easy to create values-based investing products and strategies. But it’s not only because of this religion envy we’ve been force-fed woke values by the ESG movement.

Woke ESG standards lead to greenwashing

While the woke ESG standards make evaluating an investment’s ESG friendliness easier, they give birth to another problem, so-called greenwashing. By saying there is one right way to be ESG compliant, many companies will do what they can to be “compliant,” even if they don’t actually care, especially when compliance impacts the cost of capital.

But isn’t the important thing that companies act according to ESG standards? Do they have to care too? At first glance, one may be compelled to say it doesn’t matter. Though, would greenwashing exist if companies really cared? Like poorly set KPIs, the focus becomes on delivering on a specific measure, ticking off boxes, rather than having a positive impact.

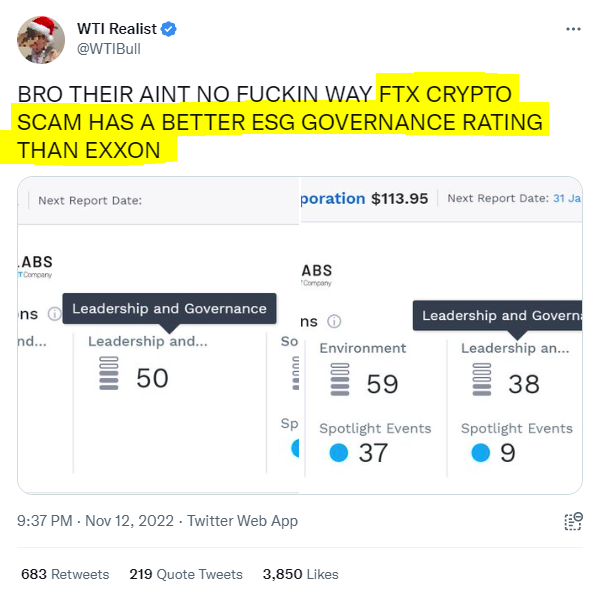

We have seen a recent example with the recent debacle around the crypto exchange FTX. Apparently, this allegedly fraudulent company had a better ESG governance score than Exxon Mobil. Does that make sense?

The woke ESG movement is all about virtue signaling

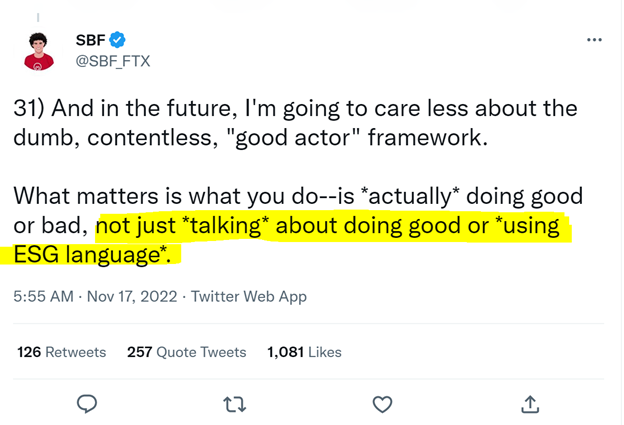

While we’re talking about FTX, when its founder and woke poster child Sam Bankman-Fried aka SBF, tried to make amends in a Twitter thread, he highlighted the importance of actually doing good, “not just *talking* about doing good or *using ESG language*.”

In a conversation with a journalist, he also referred to this as “this dumb game we woke westerners play where we say all the right shiboleths and so everyone likes us.”

It’s sad to see how it’s all about virtue signaling and not about actually making the world a better place, which is the proclaimed goal of ESG.

Democratically elected representatives should set the policies and legal framework

I don’t say all ESG questions have easy answers. Central committees at large institutional investors like BlackRock, pension funds, or radical activists are not the ones to decide for us all what’s right or wrong regarding ESG.

We need democratically elected and competent politicians to set policies, strategies, and legal frameworks that deal with ESG issues. That responsibility should not be pushed on corporations and their leaders, which are not elected officials.

A politician engaged in unsupported activism may be voted out of office. But how are you getting rid of a woke pension fund manager if you’re not allowed to move your money out of the fund?

“Activism is a way for useless people to feel important, even if the consequences of their activism are counterproductive for those they claim to be helping and damaging to the fabric of society as a whole.”

– Thomas Sowell

Take full responsibility for your decisions

Your investments are about your values, and you are responsible for your investment decisions. Don’t consider the current ESG standards an easy way to be granted an indulgence. Make investments that match your values, not some woke ESG agenda (unless that is your values).

This also means you are free to invest only to maximize expected returns. Whatever floats your boat, as long as it is within the law and your moral standards. You’re responsible for evaluating how your investments align with your values, or you can identify a manager whose values align with yours.

“In the long run, we shape our lives, and we shape ourselves. The process never ends until we die. And the choices we make are ultimately our own responsibility.”

– Eleanor Roosevelt

From Urban Dictionary: Woke: Umbrella term for individuals engrossed by social justice and think of themselves as saviors with a moral high ground but remain willfully ignorant to the irrationality of their claims and the problems they create. These individuals give special treatment to certain minorities in hopes of ending racism and perpetuating mental illnesses as the norm.