A. Stotz All Weather Strategy – January 2022

The All Weather Strategy significantly outperformed a traditional 60/40 portfolio by 2.2% in January 2022. Fed/ECB unwillingness to crash markets could drive equities higher. Recovery demand and supply-chain bottlenecks to drive commodities. Risks: Inflation quickly gets under control, new lockdowns, Fed rate hikes crashing the US market.

The A. Stotz All Weather Strategy is Global, Long-term, and Diversified:

- Global – Invests globally, not only Thailand

- Long-term – Gains from long-term equity return, while trying to reduce a portion of losses during equity market downturns

- Diversified – Diversified globally across four asset classes

The All Weather Strategy is available in Thailand through FINNOMENA. Please note that this post is not investment advice and should not be seen as recommendations. Also, remember that backtested or past performance is not a reliable indicator of future performance.

Review

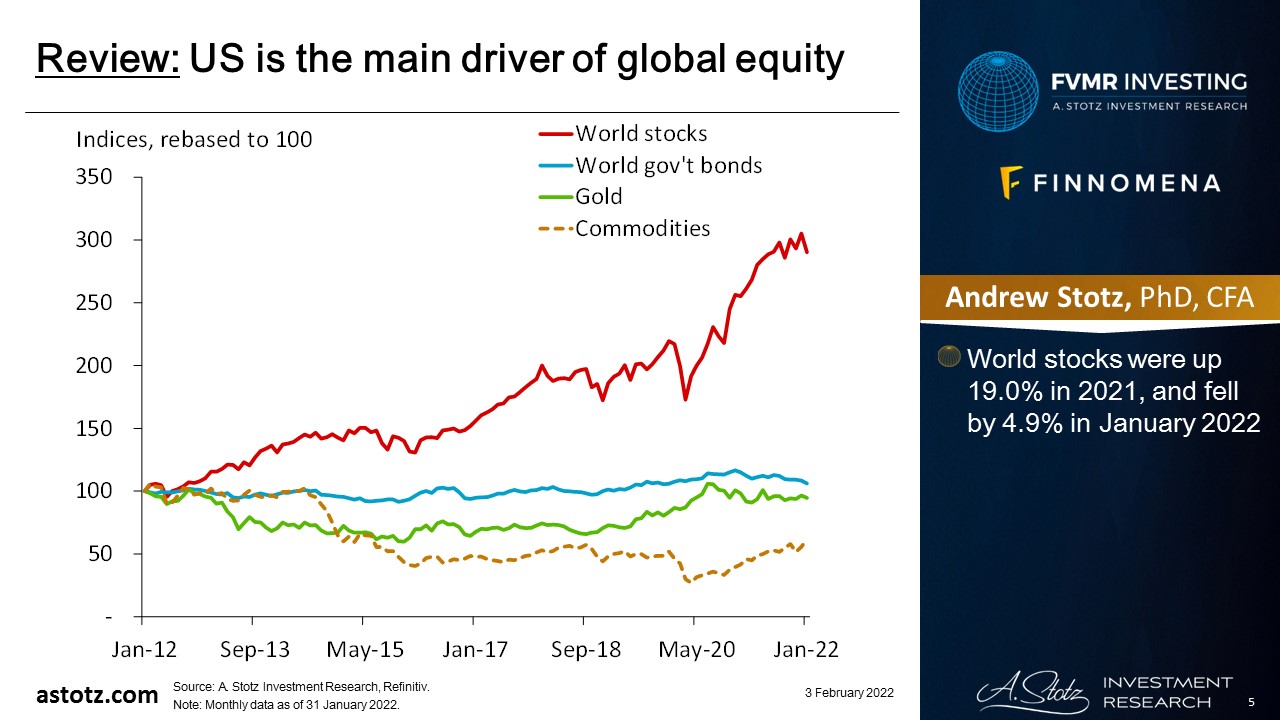

US is the main driver of global equity

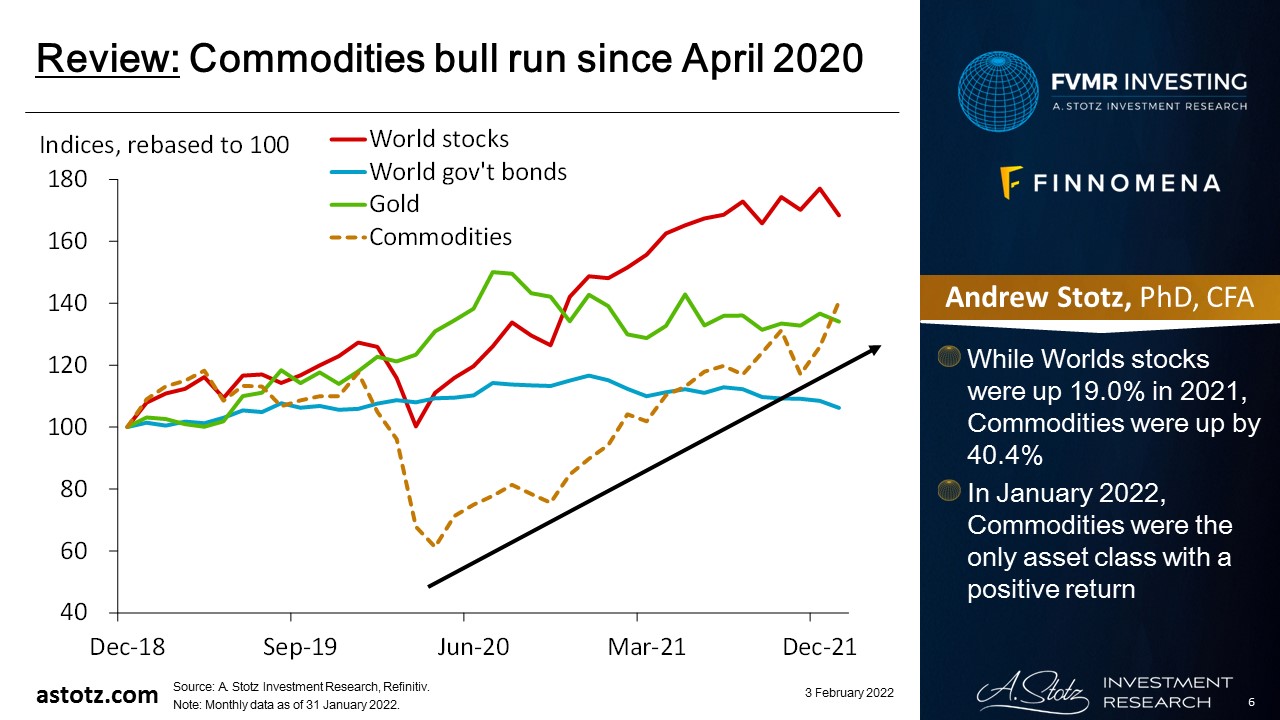

Commodities bull run since April 2020

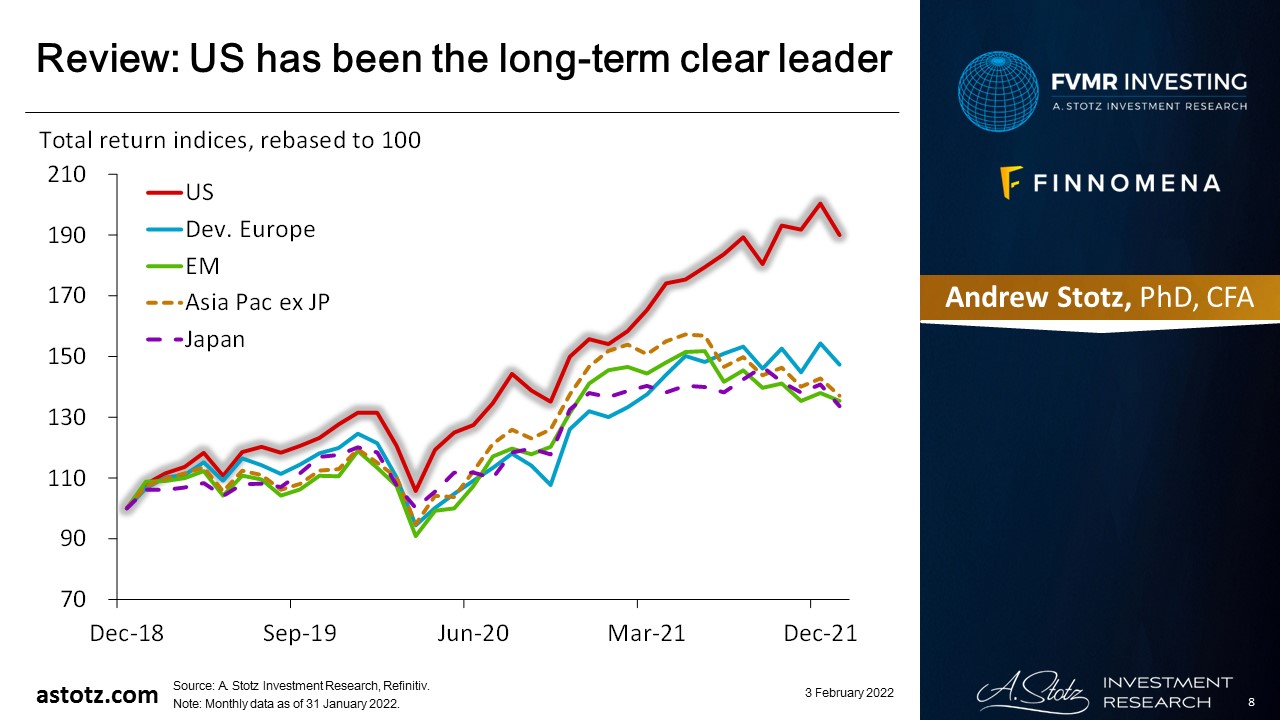

US has been the long-term clear leader

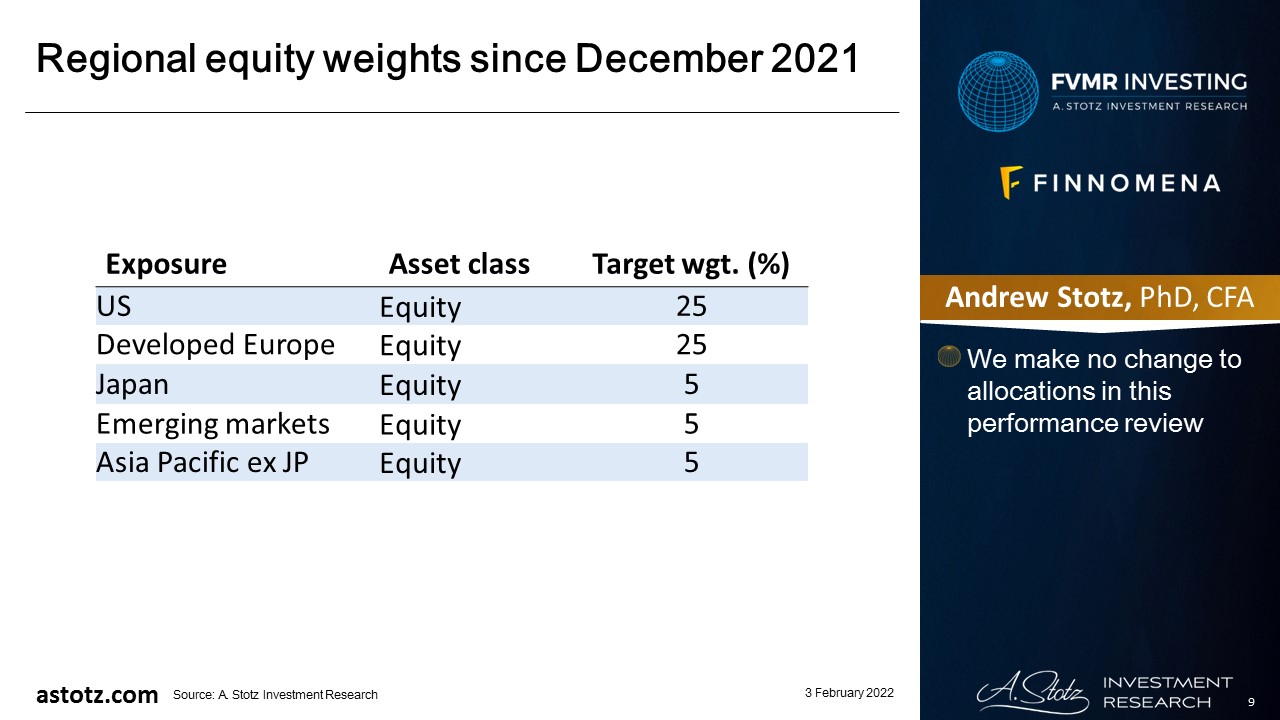

Regional equity weights since December 2021

Heavy in Western Developed markets

- In our June 2021 revision, we switched our 25% equity allocations to the US and Developed Europe from Emerging markets and Asia Pacific ex Japan

- We made no change in the September and December revisions

Fed rate hikes and falling Tech

- In January, US was the worst performer, down by 5.5%

- Fed convinced the market of rate hikes in March 2022, which led to an equity sell-off

- US Tech stocks saw large falls due to high valuations

- US-Russian tensions around Ukraine added uncertainty; Russia fears NATO expansion, the US fears Russian expansion

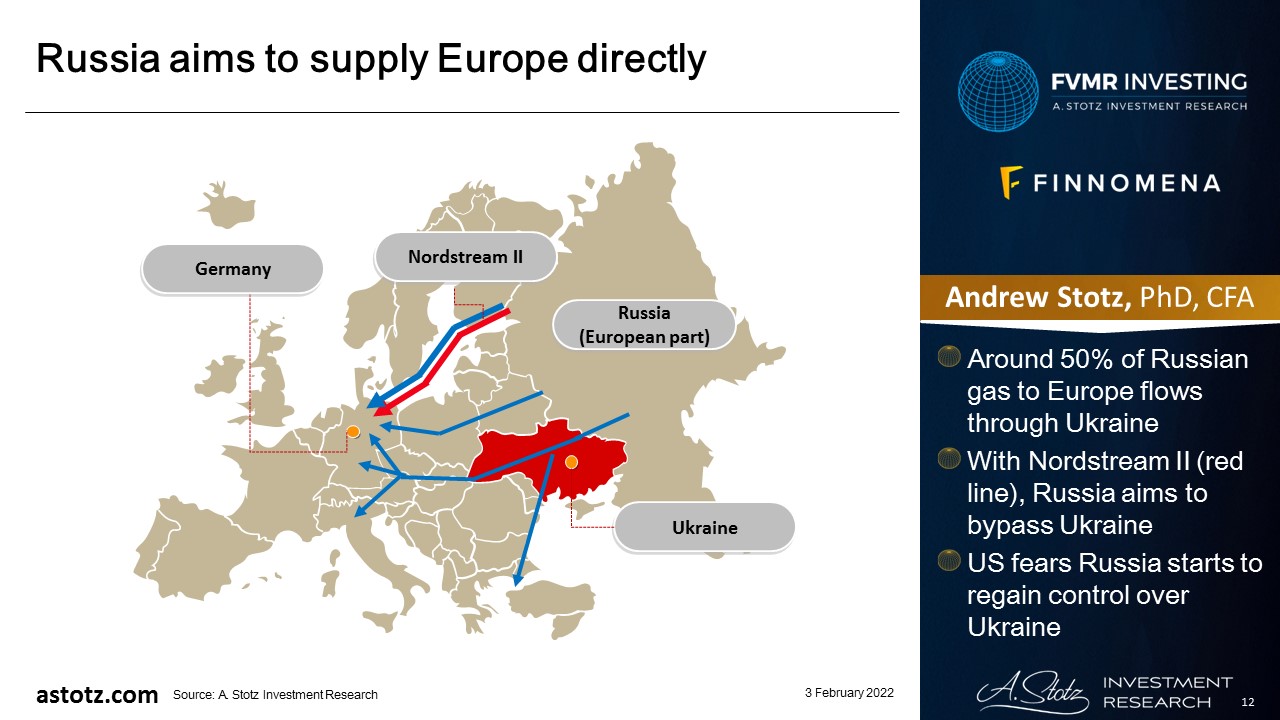

Russia aims to supply Europe directly

- Around 50% of Russian gas to Europe flows through Ukraine

- With Nordstream II (red line), Russia aims to bypass Ukraine

- US fears Russia starts to regain control over Ukraine

Europe got involved in Ukraine too

- European markets also fell on the conflicts around Ukraine, though, EU is unlikely to act due to its energy dependency

- More countries in Europe are loosening or removing COVID restrictions

- Spain and France’s GDP growth numbers came in positive and above consensus

- The region held up better than the US and closed the month down by 2.9%

Emerging markets outperformed

- Emerging markets that suffered in 2021 held up well in January 2022 and closed the month slightly up at 0.2%

- More and more countries are easing COVID restrictions or opening up

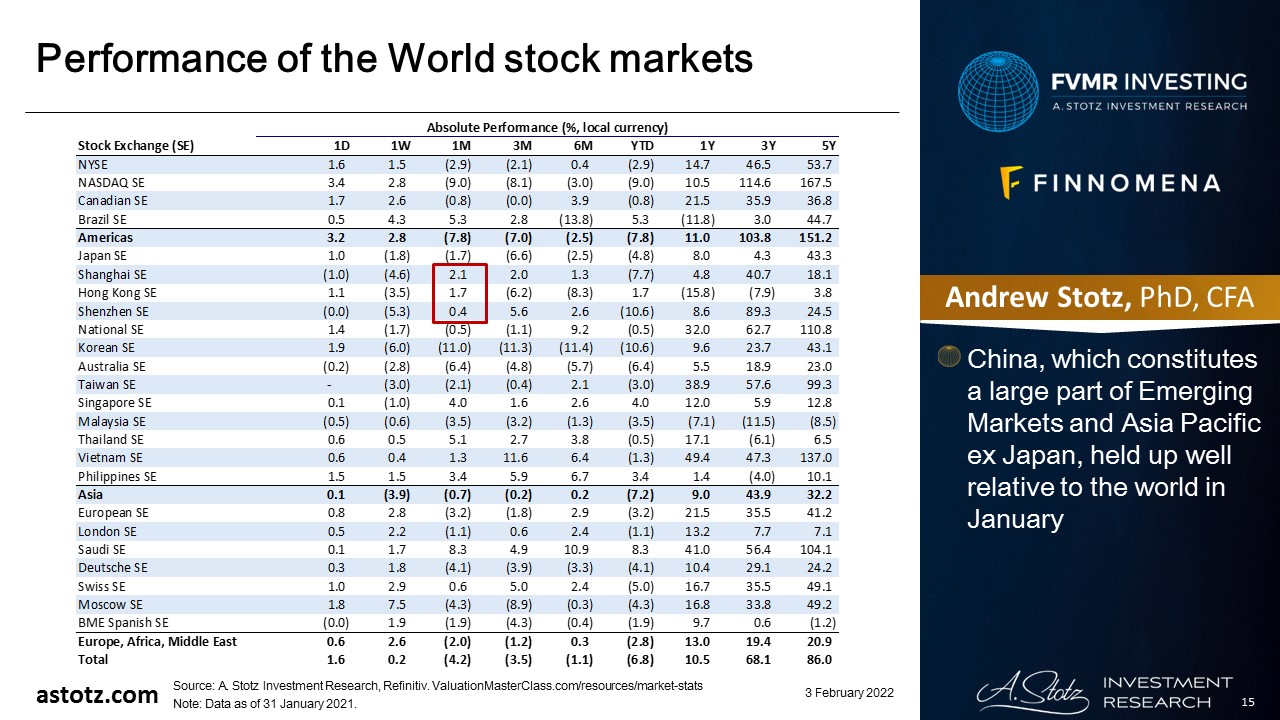

Performance of the World stock markets

- China, which constitutes a large part of Emerging Markets and Asia Pacific ex Japan, held up well relative to the world in January

Low bond target allocation at 5%

- We have a bond target allocation of 5% as they appeared less attractive relative to equity

- The strategy is to hold only Thai government bonds, rather than a mix of global government and corporate bonds

- Most other assets were down in the past month; hence, a bigger allocation to bonds would have been better

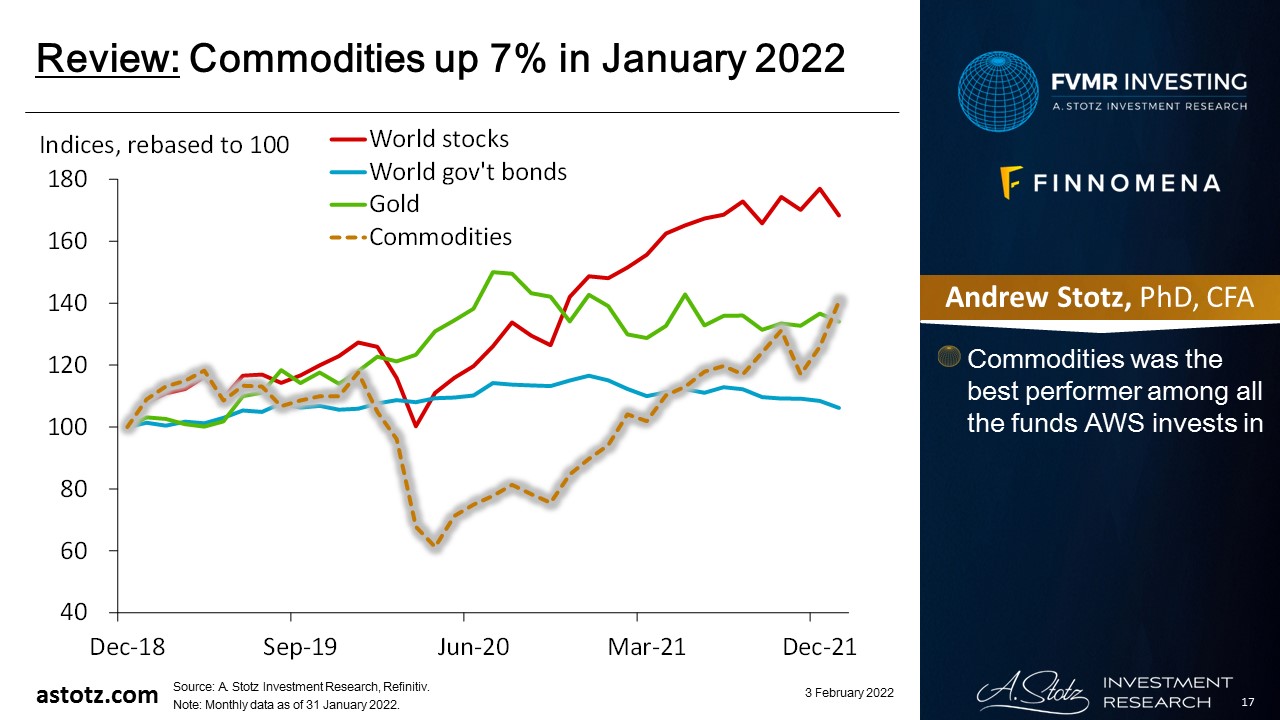

Commodities up 7% in January 2022

- Commodities was the best performer among all the funds AWS invests in

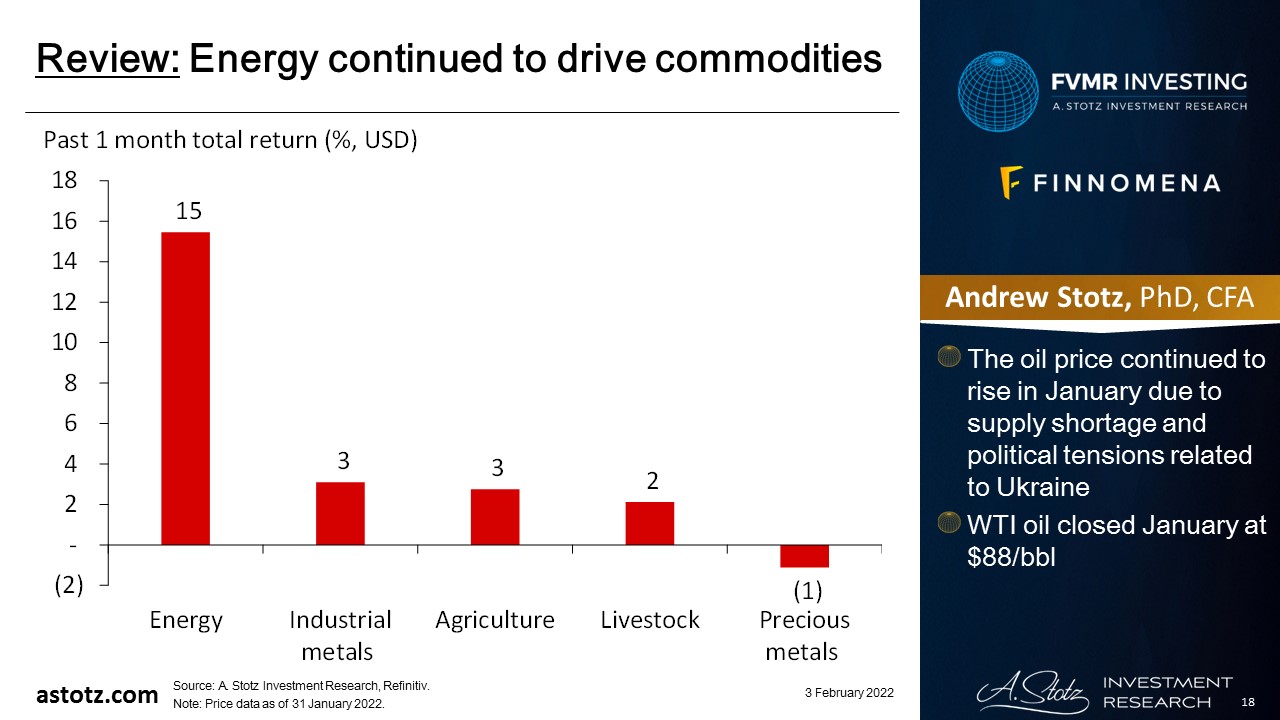

Energy continued to drive commodities

- The oil price continued to rise in January due to supply shortage and political tensions related to Ukraine

- WTI oil closed January at $88/bbl

Gold affected by signaled rate hikes too

- Gold initially did well in January due to the stock market turmoil and geopolitical games

- However, as the Fed signaled more aggressive rate hikes, the US$ strengthened, and the gold price fell back sharply

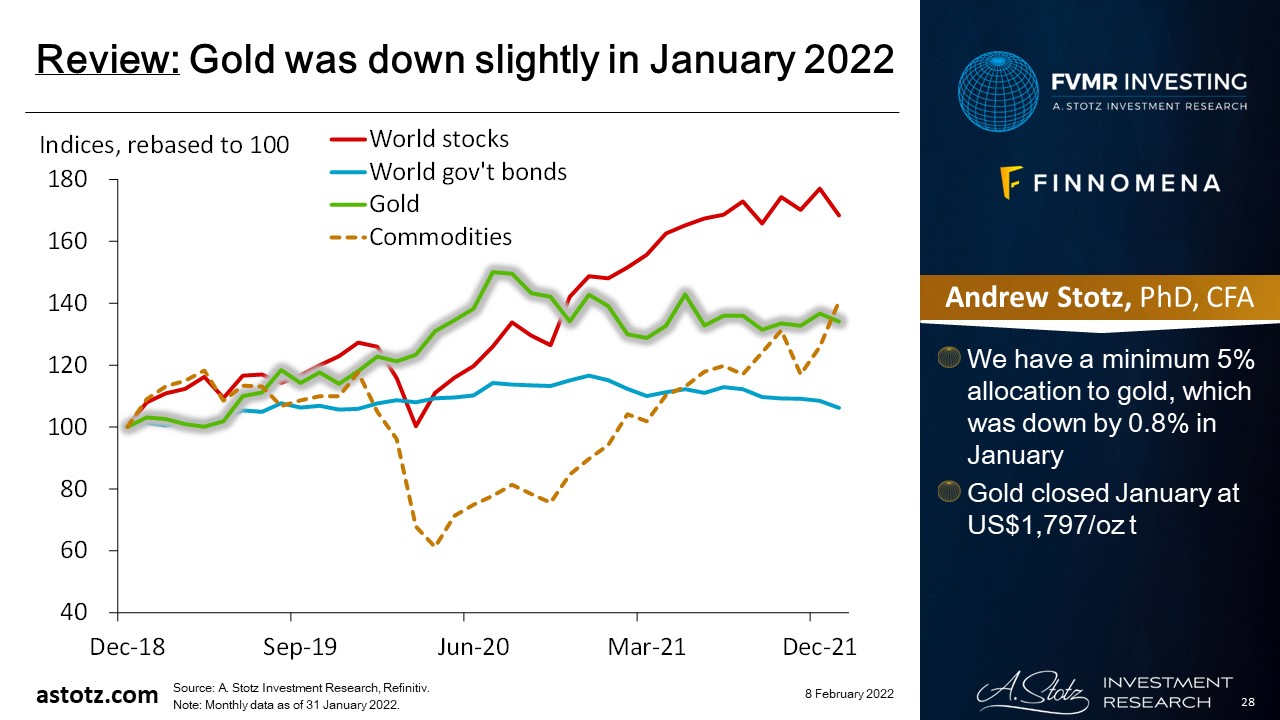

Gold was down slightly in January 2022

- We have a minimum 5% allocation to gold, which was down by 0.8% in January

- Gold closed January at US$1,797/oz t

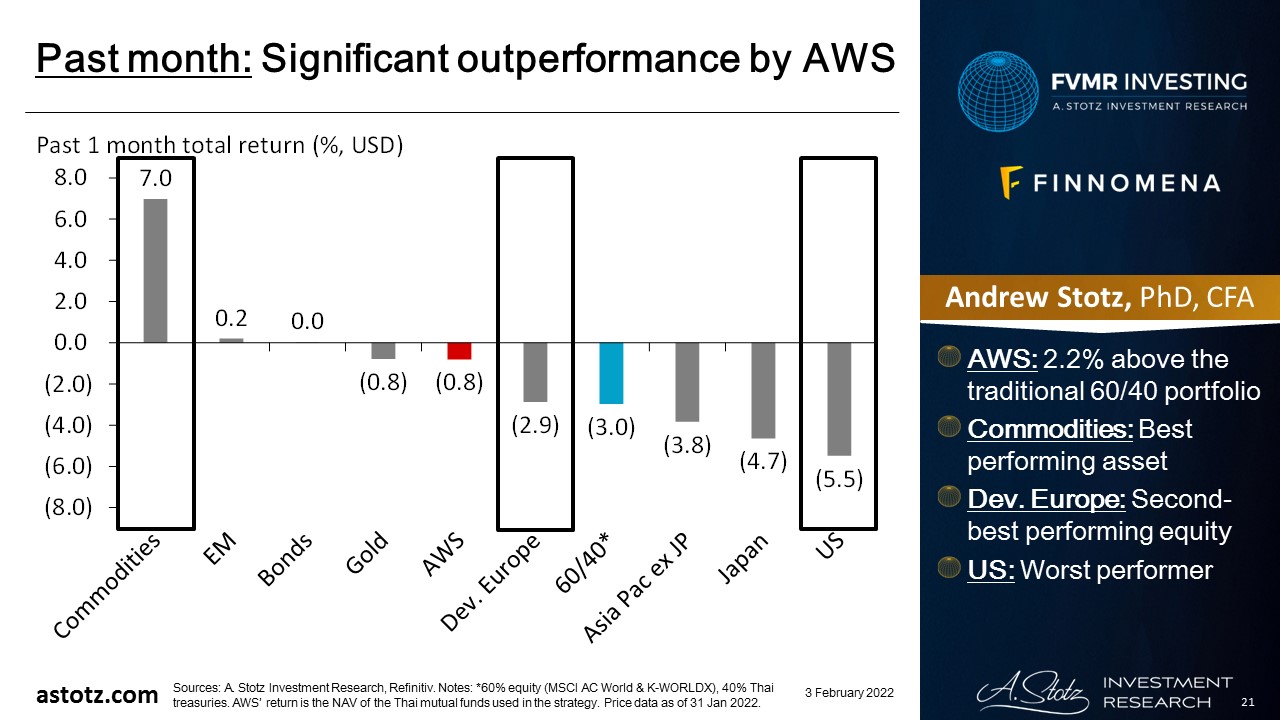

January 2022: Significant outperformance by AWS

Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, expressed or implied is made regarding future performance.

- AWS: 2.2% above the traditional 60/40 portfolio

- Commodities: Best performing asset

- Dev. Europe: Second-best performing equity

- US: Worst performer

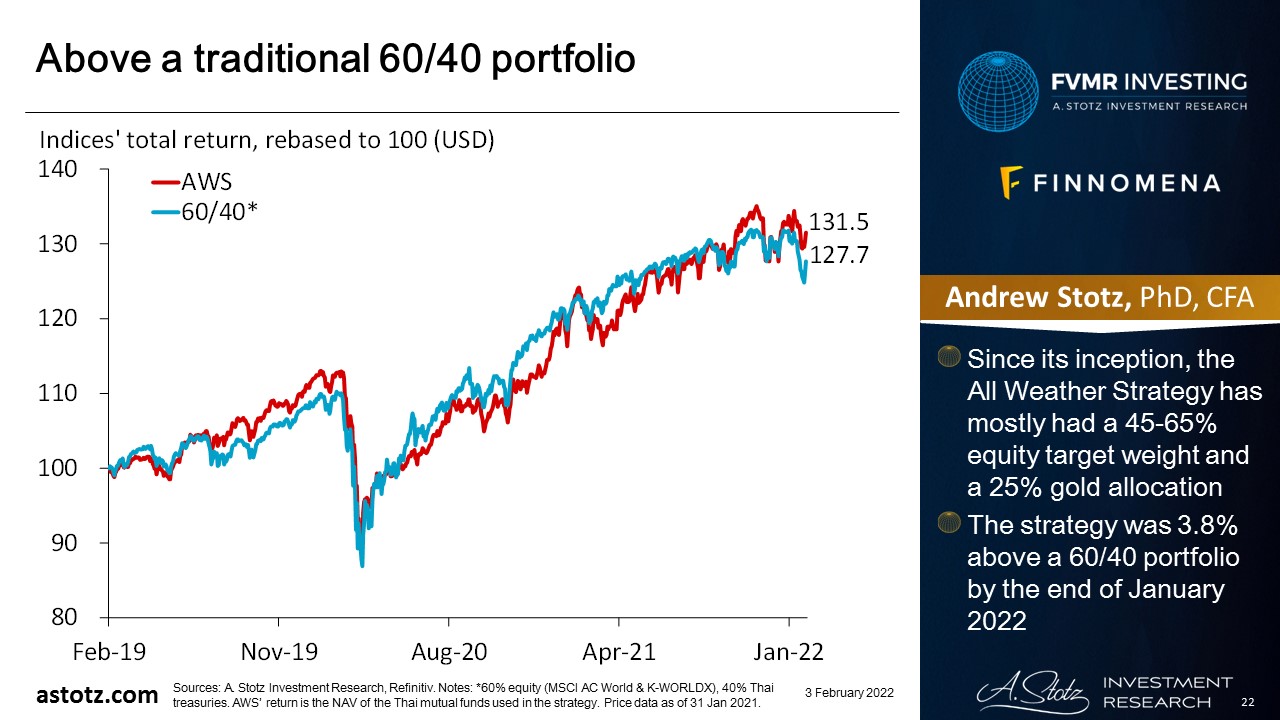

Above a traditional 60/40 portfolio

Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, expressed or implied is made regarding future performance.

- Since its inception, the All Weather Strategy has mostly had a 45-65% equity target weight and a 25% gold allocation

- The strategy was 3.8% above a 60/40 portfolio by the end of January 2022

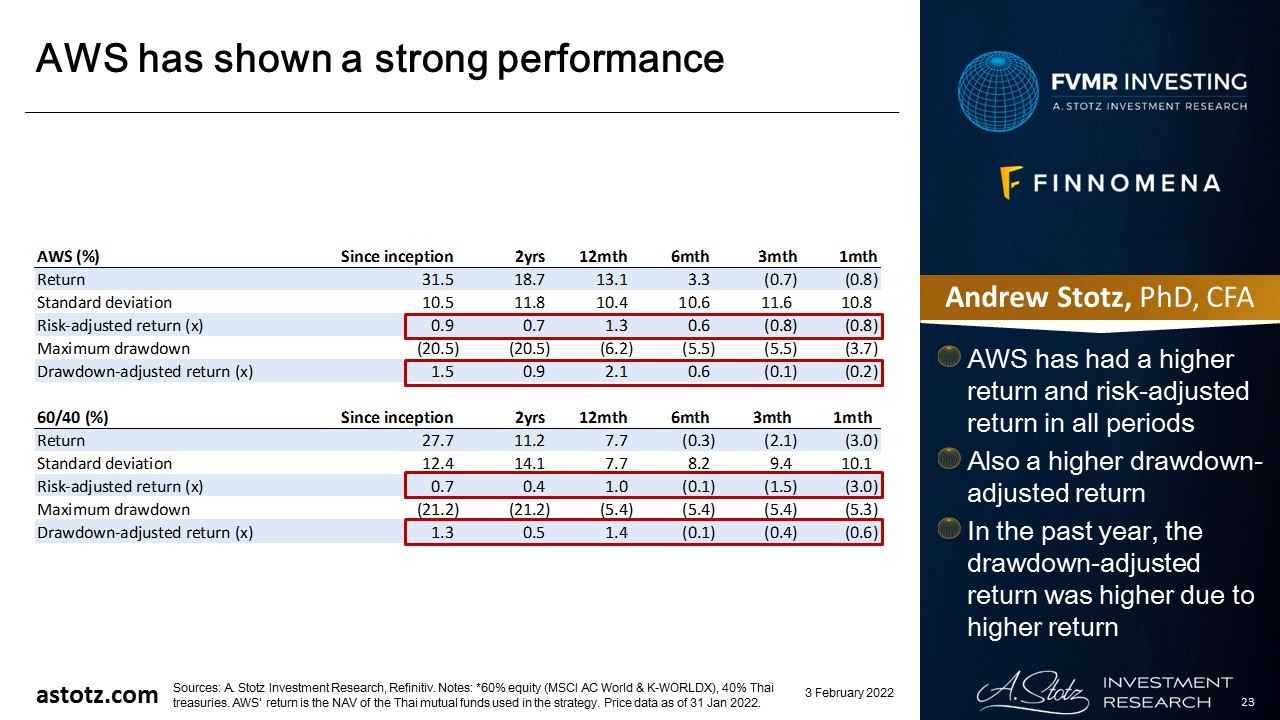

AWS has shown a strong performance

Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, expressed or implied is made regarding future performance.

- AWS has had a higher return and risk-adjusted return in all periods

- Also a higher drawdown-adjusted return

- In the past year, the drawdown-adjusted return was higher due to higher return

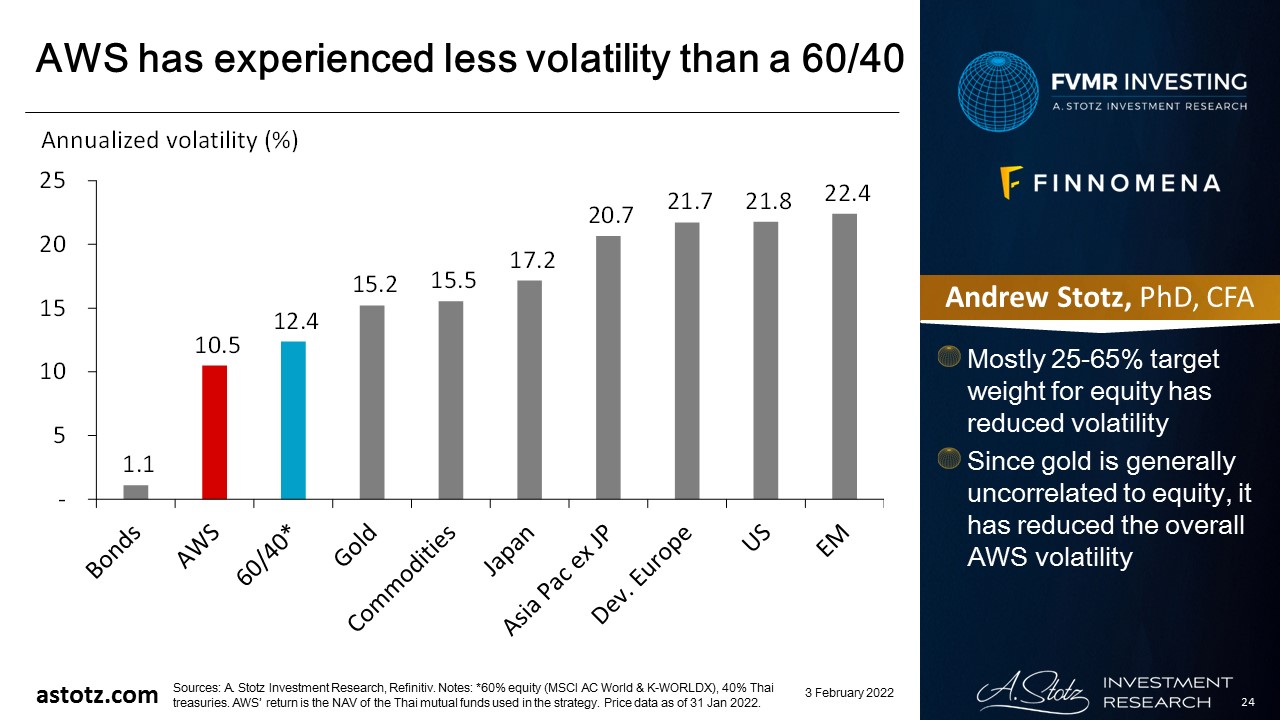

AWS has experienced less volatility than a 60/40

Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, expressed or implied is made regarding future performance.

- Mostly 25-65% target weight for equity has reduced volatility

- Since gold is generally uncorrelated to equity, it has reduced the overall AWS volatility

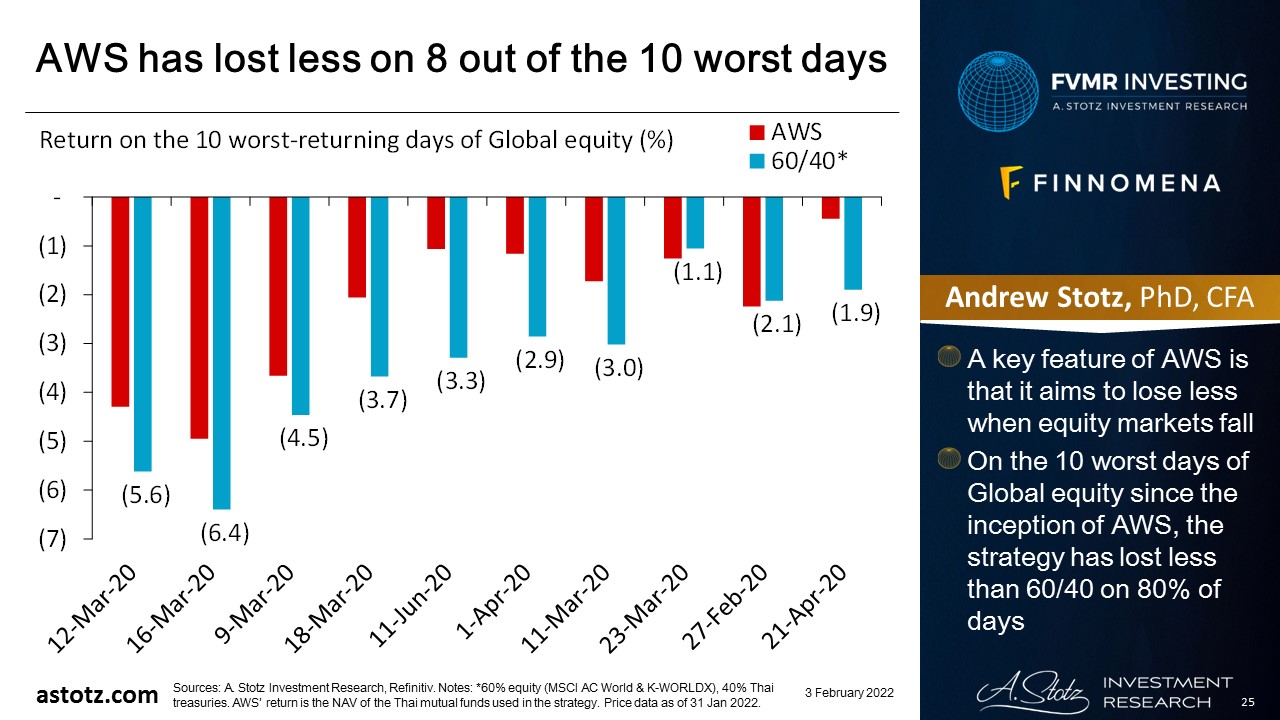

AWS has lost less on 8 out of the 10 worst days

Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, expressed or implied is made regarding future performance.

- A key feature of AWS is that it aims to lose less when equity markets fall

- On the 10 worst days of Global equity since the inception of AWS, the strategy has lost less than 60/40 on 80% of days

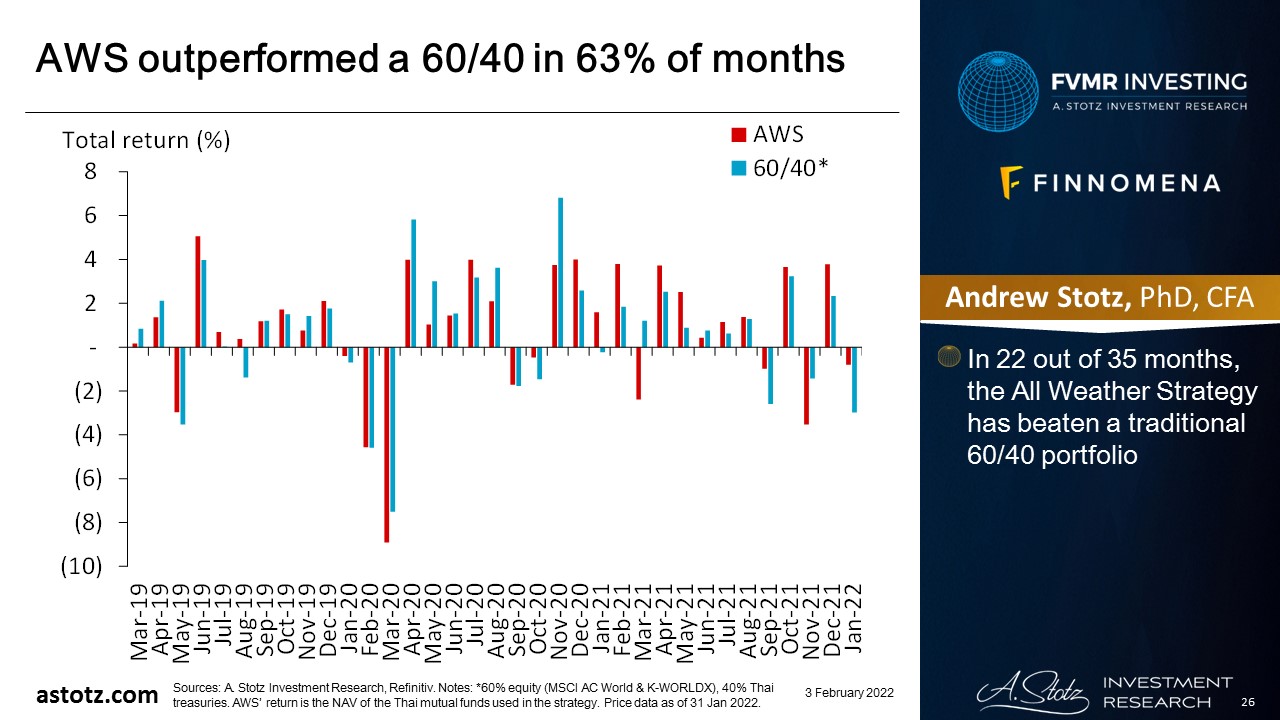

AWS outperformed a 60/40 in 63% of months

Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, expressed or implied is made regarding future performance.

- In 22 out of 35 months, the All Weather Strategy has beaten a traditional 60/40 portfolio

Outlook

Expect Fed to support the US market if needed

- American companies are doing well and have global pricing power

- US economy to remain strong thanks to Gov’t spending

- Biden and the Democrats need Powell to prop up markets ahead of the November mid-terms

- Even if the Fed tapers and hikes rates, we expect the course to be reversed as soon as markets start falling

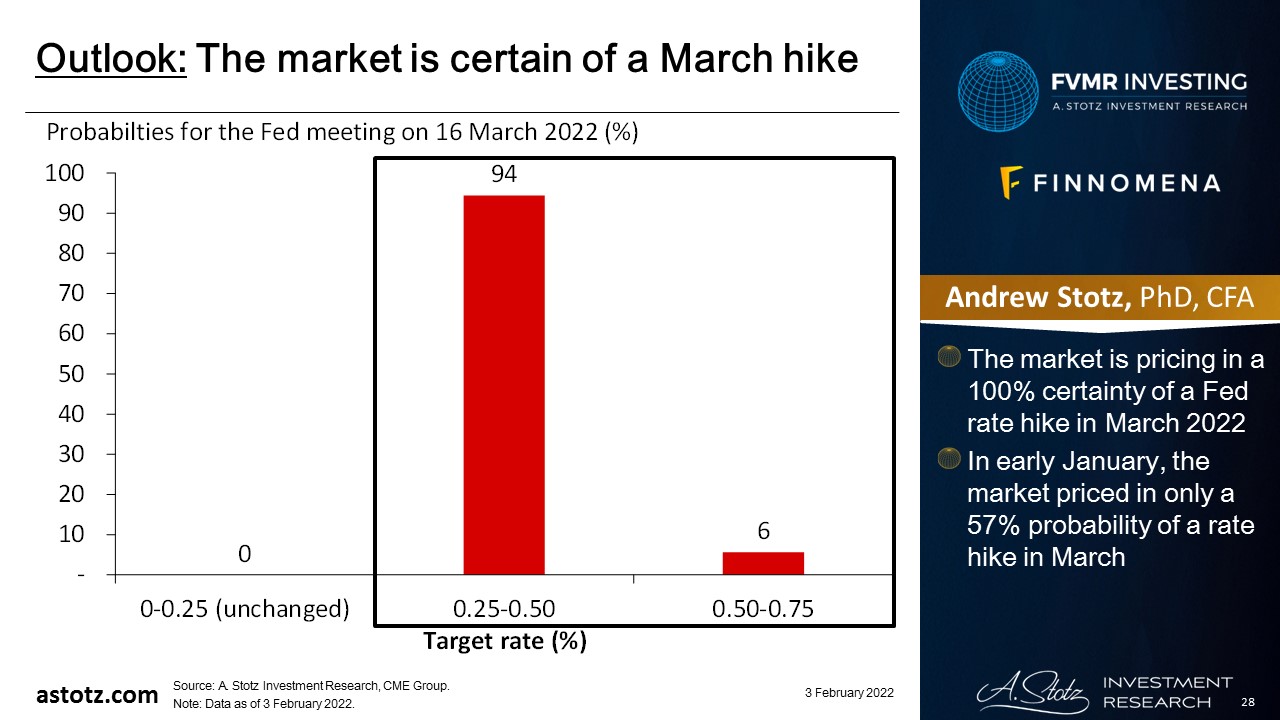

The market is certain of a March hike

- The market is pricing in a 100% certainty of a Fed rate hike in March 2022

- In early January, the market priced in only a 57% probability of a rate hike in March

European recovery set to continue

- Europe appears to be in continued recovery, as shown by, e.g., Spain and France’s GDP growth numbers

- More countries are easing or completely dropping COVID restrictions

- The ECB has announced to start tapering, but rate hikes may not happen in 2022

- Even though both Fed and ECB talk about tapering and rate hikes, we think the central banks are going to have to support equities

Fed actions hurtful to Emerging markets

- Fed rate hikes and tapering are likely to result in a stronger US$ and less global liquidity, which could hurt Emerging markets

- While China showed some recent strength before the January drop, it’s too early to say we’ll see a strong rebound in China equity

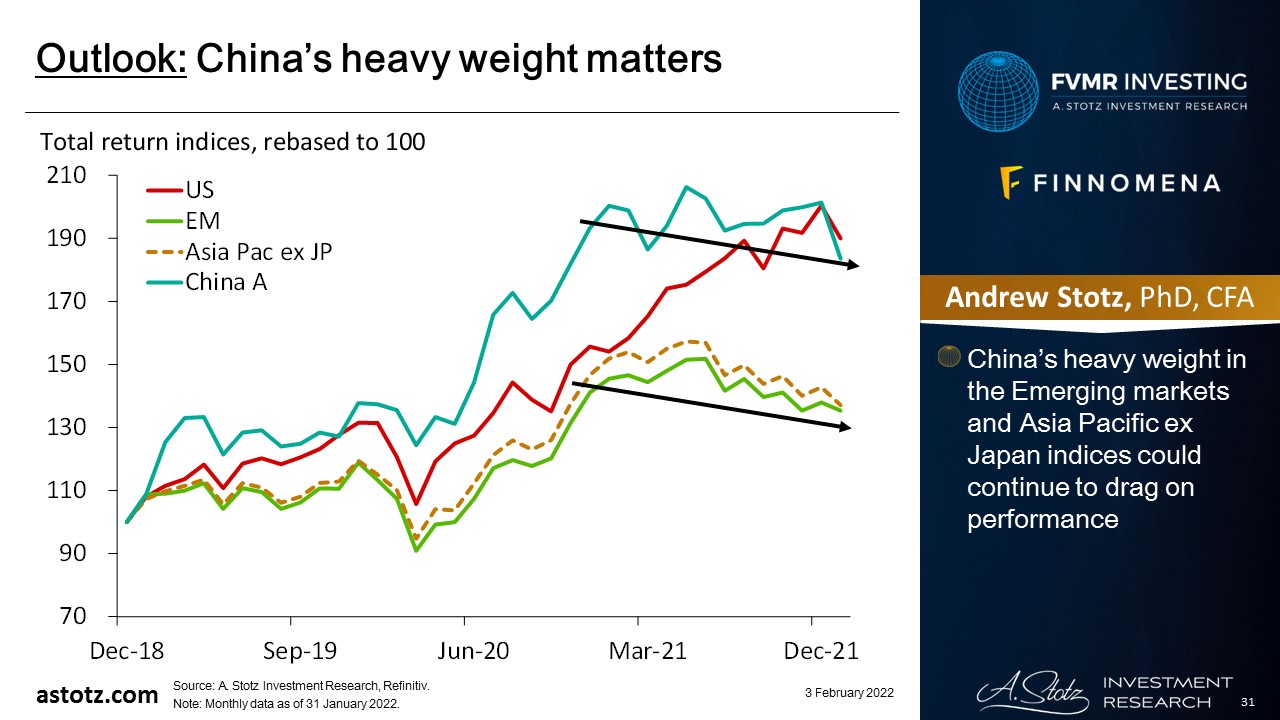

China’s heavy weight matters

- China’s heavy weight in the Emerging markets and Asia Pacific ex Japan indices could continue to drag on performance

Bonds to remain flat

- In the near-term, we think bonds will underperform equity

- This is reflected in our 5% target allocation

Commodities still attractive

- Energy prices should remain strong, as the supply-demand imbalance is likely to stay at least at the beginning of 2022

- Geopolitical tensions around Ukraine may drive up oil prices further

- Global supply bottlenecks seem to remain for a while more

- Inflation (which is not over yet) and recovery demand should be supportive of Energy and Industrial metals

Still unclear outlook for gold

- Unexpected or higher rate hikes from the Fed and other central banks could depress gold price; we expect central banks to be cautious with rate hikes

- Though, if inflation expectations remain high, it could be supportive of the gold price

- More stock market turmoil could support gold

- We see pressures from both directions, represented in our low gold allocation

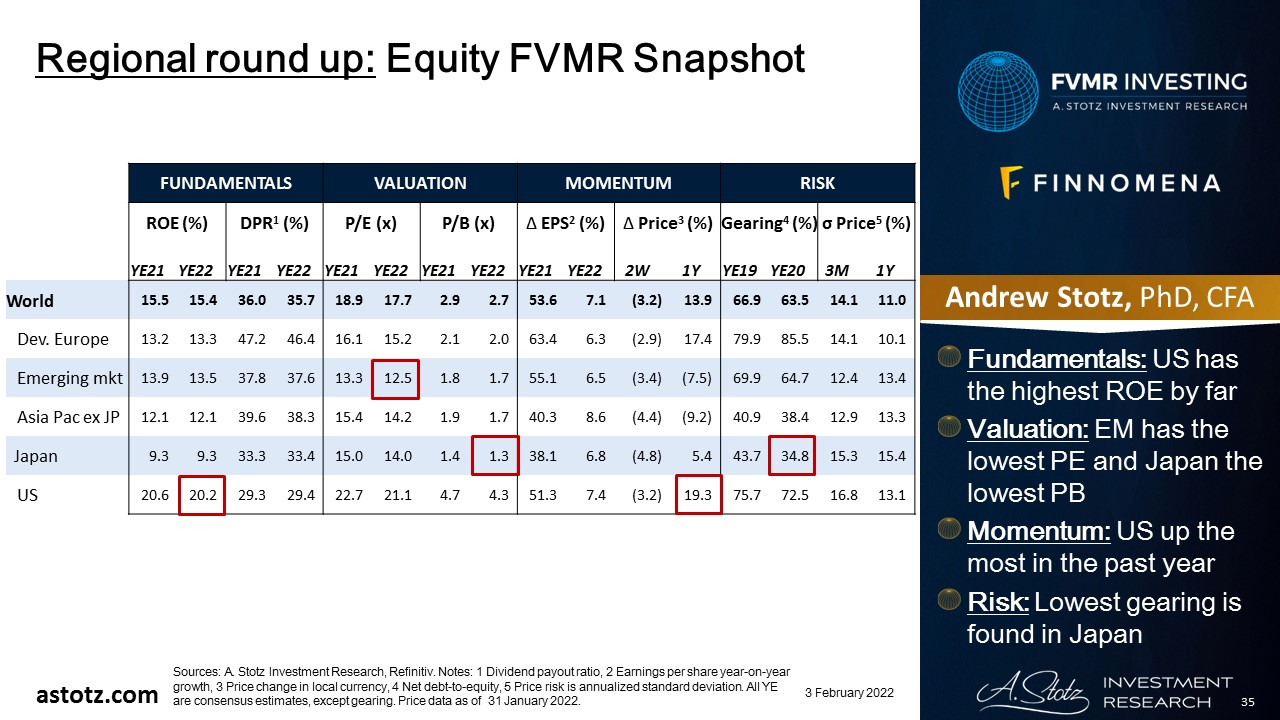

Regional Equity FVMR Snapshot

- Fundamentals: US has the highest ROE by far

- Valuation: EM has the lowest PE and Japan the lowest PB

- Momentum: US up the most in the past year

- Risk: Lowest gearing is found in Japan

Risks

Inflation quickly gets under control

- The All Weather Strategy is still positioned to benefit from rising inflation at the beginning of 2022

- There’s a risk that inflation is transitory and falls faster than we expect, which could hurt our performance

New variants could still lead to shutdowns

- Even though we think most countries will be less likely to lock down due to Omicron, it could change quickly

- New mutations could also arise, leading to new shutdowns globally or in specific countries, which would be negative for the related equity markets

Fed rate hikes crashing the US market

- If the Fed would surprise and not be cautious about rate hikes, it could impact the US stock market negatively

- The US stock market usually has a global impact; hence, it would hurt other equity markets too

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.