Become a Better Investor Newsletter – 13 July 2024

Noteworthy this week

- US net liquidity has risen

- 45% of S&P 500 tech

- Is the AI bubble about to burst?

- Unfunded pension entitlements are massive in Europe

- European working population shrinks

US net liquidity has risen: US net liquidity has risen by US$270bn and is back above US$6trn, although the Fed’s balance sheet has shrunk slightly. Rising liquidity typically supports financial markets.

If you want to know why the markets have risen so sharply this week, you can also find an explanation in this chart: US Net Liquidity has risen significantly this week by $270bn back >$6tn, although the Fed’s balance sheet has continued to shrink slightly. pic.twitter.com/r0zBGKoDsR

— Holger Zschaepitz (@Schuldensuehner) July 5, 2024

45% of S&P 500 tech: Almost half of the S&P 500 market cap is now tech.

Almost half of the S&P 500 is now essentially tech pic.twitter.com/NLzI37tSh6

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) July 6, 2024

Is the AI bubble about to burst?: In the last couple of weeks, Goldman Sachs, Sequoia, and Barclays have published research that says the AI capex boom doesn’t make sense. Sequoia argues the tech industry needs US$600bn in AI revenue to justify the money spent on GPUs and data centers.

This is a great article from Sequoia which argues the tech industry needs $600B in AI revenue to justify the money spent on GPUs and data centers.

OpenAI is the biggest AI pure play and is at $3.4B annual run rate. This feels like a bubble unless products worth buying show up. pic.twitter.com/rsSbuajPc4

— Dare Obasanjo🐀 (@Carnage4Life) July 4, 2024

Unfunded pension entitlements are massive in Europe: In major European countries, they are between 300% and 500% of GDP. That will be tough to resolve.

That‘s the most scary chart I have seen in a while. Unfunded pension entitlements in major European countries between 300% and 500% of GDP. Mixed with collapsing demographics it’s a recipe for debt disaster. pic.twitter.com/pTRK9Ge6vn

— Michael A. Arouet (@MichaelAArouet) July 6, 2024

European working population shrinks: While the unfunded pension entitlements are massive, the working population is shrinking in big countries like Germany and Italy. This means fewer people should fund these entitlements.

Seriously, who is supposed to pay for pensions and healthcare entitlements in Germany and Italy as we go forward? pic.twitter.com/bebdcQyn6a

— Michael A. Arouet (@MichaelAArouet) July 3, 2024

Join the world’s toughest valuation training

Become a Valuation Expert. Valuation Master Class Boot Camp graduates can confidently value any company in the world and possess in-demand industry skills.

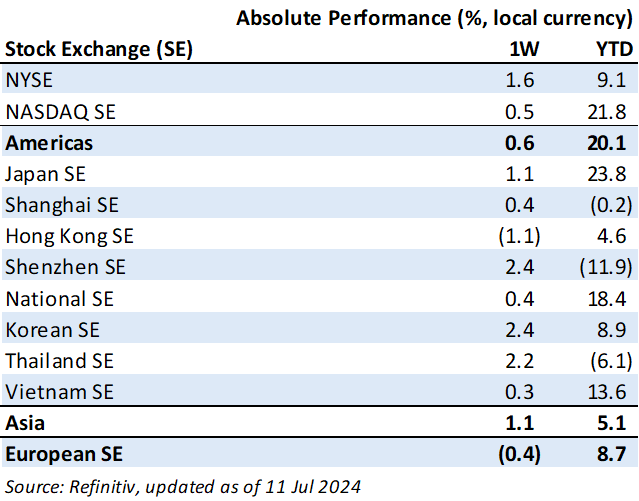

Weekly market performance

Click here to see more markets and periods.

Chart of the week

Discussed in the Become a Better Investor Community this week

“There are 2 main risks: 1) M2 supply and gold prices don’t have a strong or any relationship, and 2) our points for fair value are way off.”

Try 1 month of the Become a Better Investor Community for FREE today!

You can cancel at any time. Click here to learn more.

Podcasts we listened to this week

The Morgan Housel Podcast – I Have A Few Questions

“A few important money and life topics to make you ponder.”

Readings this week

Polluters Provide Higher Returns than Non-Polluters

“In our book, “Your Essential Guide to Sustainable Investing,” Sam Adams and I presented the evidence from about 60 studies that were entirely consistent with economic theory—sustainable investors should expect lower returns. However, their investments also entail less risk because companies with high sustainability scores have better risk management and compliance standards.”

Book recommendation

The Unaccountability Machine: Why Big Systems Make Terrible Decisions – and How The World Lost its Mind by Dan Davies

“When we avoid taking a decision, what happens to it? In The Unaccountability Machine, Dan Davies examines why markets, institutions and even governments systematically generate outcomes that everyone involved claims not to want.’”

Get the book on Audible or Kindle.

Audible is great; have you tried it? If not, click here to get 2 books for free.

Memes of the week

Robert Kiyosaki has claimed that the “biggest crash in history” is coming soon.

Here’s the advanced research tool he used to conduct his analysis. pic.twitter.com/JUxJZ15haM

— John W. Rich (Wealthy) (@Cokedupoptions) July 6, 2024

🤣🤣🤣 pic.twitter.com/9gKusz03r0

— Not Jerome Powell (@alifarhat79) July 6, 2024

New My Worst Investment Ever episodes

Enrich Your Future 05: Great Companies Do Not Make High-Return Investments

In this episode of Enrich Your Future, Andrew and Larry Swedroe discuss Larry’s new book, Enrich Your Future: The Keys to Successful Investing. In this series, they discuss Chapter 05: Great Companies Do Not Make High-Return Investments.

LEARNING: A higher PE doesn’t mean a higher expected return.

Access the episode’s show notes and resources

Published on Become a Better Investor this week

In this episode of Enrich Your Future, Andrew and Larry Swedroe discuss Larry’s new book, Enrich Your Future: The Keys to Successful Investing. In this series, they discuss Chapter 04: Why Is Persistent Outperformance So Hard to Find?

Listen to Enrich Your Future 04: Why Is Persistent Outperformance So Hard to Find?

Telekom Malaysia Berhad (T MK): Profitable Growth rank of 2 was up compared to the prior period’s 4th rank. This is World Class performance compared to 240 large Comm. Serv. companies worldwide.

Read Telekom Malaysia – World Class Benchmarking

Inner Mongolia Yili Industrial Group Company Limited (600887 SH): Profitable Growth rank of 3 was up compared to the prior period’s 4th rank. This is above average performance compared to 560 large Cons. Staples companies worldwide.

Read Inner Mongolia Yili Industrial Group – World Class Benchmarking

Toho Holdings Company Limited (8129 JP): Profitable Growth rank of 8 was same compared to the prior period’s 8th rank. This is below average performance compared to 360 large Health Care companies worldwide.

Read Toho Holdings – World Class Benchmarking

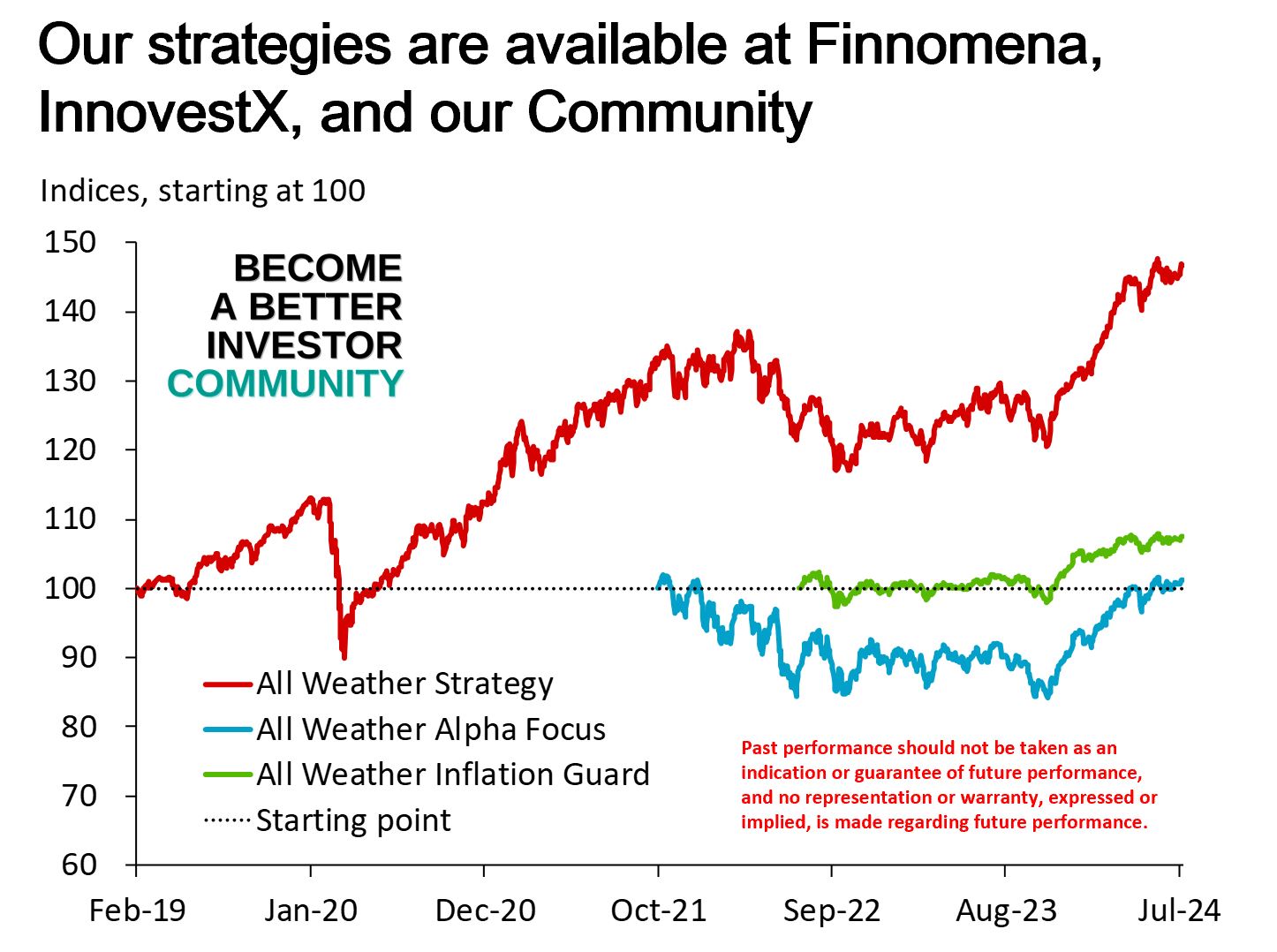

World Equity gained, led by Info. Tech.. Performance review of our strategies in June 2024 – All Weather Inflation Guard gained 0.3%, All Weather Strategy gained 0.2%, All Weather Alpha Focus gained 0.6%.

Read A. Stotz All Weather Strategies – June 2024

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.