Become a Better Investor Newsletter – 14 October 2023

Noteworthy this week

- 50% of listed US firms are lossmaking

- Runner-up issuance year for US Treasuries

- Unemployment points to recession

- Stock market bottoms when unemployment races up

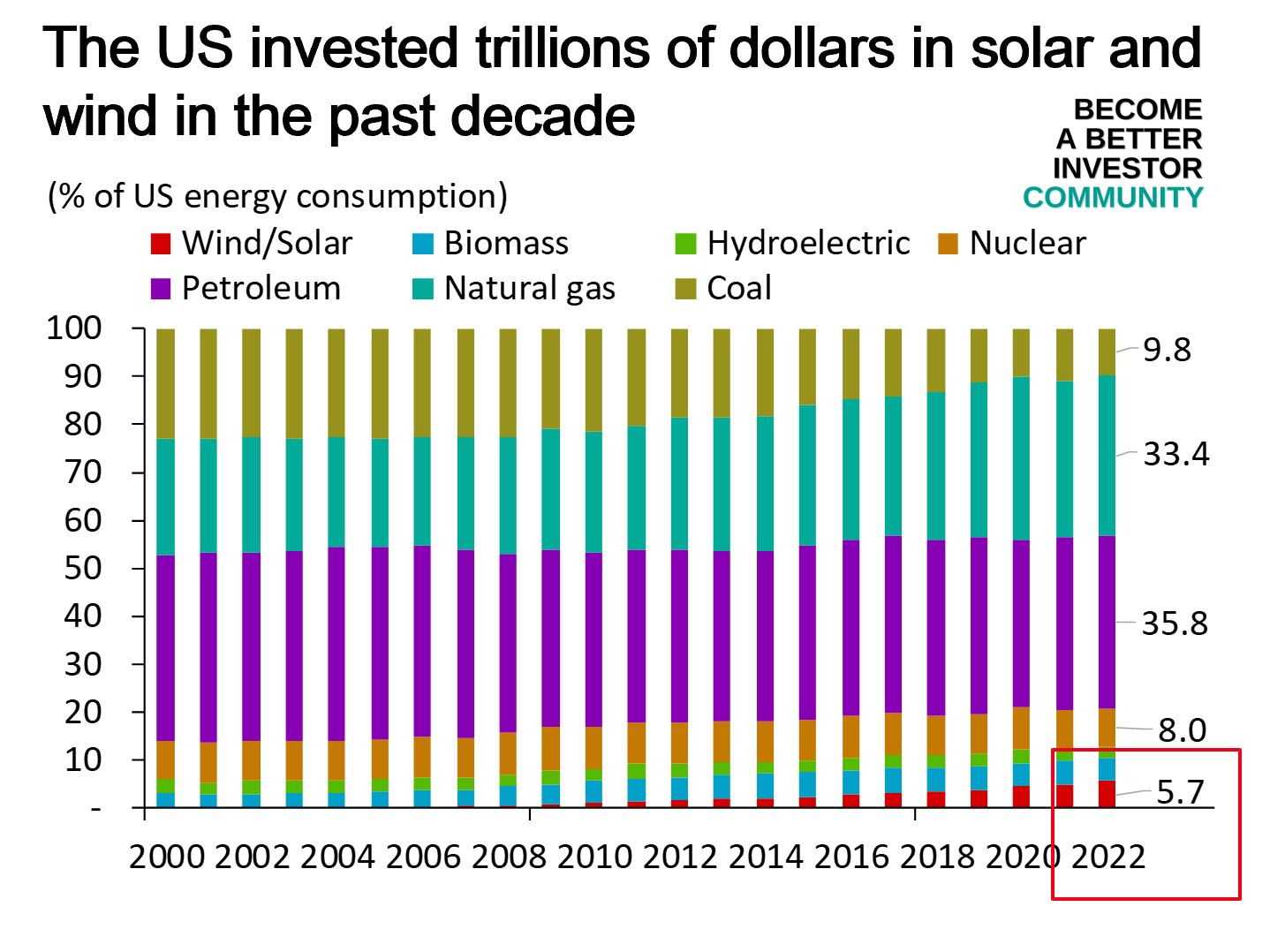

- Investors flee renewables

50% of listed US firms are lossmaking: Almost 50% of listed US firms are not making a profit. The proportion of listed unprofitable firms has been in a rising trend since 1960.

Almost half of US listed firms have negative profit margins. They have been able to survive in artificially low interest rates and ample liquidity environment. Things have changed though. pic.twitter.com/scXZWqIvzN

— Michael A. Arouet (@MichaelAArouet) October 10, 2023

Runner-up issuance year for US Treasuries: Treasury issuance is heading for >US$2trn in 2023; only the COVID shutdown in 2020 has been higher. Given the economic and political situation, 3Q23 could surprise on the upside.

The US has already issued $1.76 trillion in net Treasury securities through September. Will be well over $2 trillion by year-end, trailing only 2020 for the largest net debt issuance of any year in history. pic.twitter.com/B7fqb49Lb6

— Charlie Bilello (@charliebilello) October 9, 2023

Unemployment points to recession: “Typical macro cycle turns are slow to start, but they all end in recession.” It takes time for interest rates to impact employment, but historically, unemployment rises, and we get a recession.

Typical macro cycle turns are slow to start, but they all end in recession.

The current modest rise in unemployment is about median for a year in since YC inversion compared to post-war cycles. But it’s usually in this time frame where things start to get interesting: pic.twitter.com/nmXW32YZAj

— Bob Elliott (@BobEUnlimited) October 10, 2023

Stock market bottoms when unemployment races up: Looking at the stock market relative to unemployment, it appears that the stock market bottoms as unemployment spikes.

The stock market bottoms AFTER the unemployment rate rises sharply pic.twitter.com/MDrcQt6Bor

— Game of Trades (@GameofTrades_) October 10, 2023

Investors flee renewables: Renewable energy funds globally saw a net outflow of US$1.4bn in 3Q23. The 10 worst-performing funds in the category lost >35% YTD.

Renewable energy funds globally suffered a net outflow of $1.4 billion in the July-September quarter, the biggest ever quarterly outflow, according to LSEG Lipper data. – Reuters pic.twitter.com/Sv9WQ8NLdo

— Tracy (𝒞𝒽𝒾 ) (@chigrl) October 10, 2023

Careers in Finance – Live Streaming

Thaksapohn Peerapatpokin – October 23, 16:00 (GMT+7/ICT)

Thaksapohn Peerapatpokin is a Vice President at MQDC Idyllias Mettaverse and an engineer with a decade of experience in Turbomachinery equipment. She also runs the popular Facebook Page DinoTech5.0. Thaksapohn has attended the Valuation Master Class, has a Master in Finance, and passed CFA level 3.

Click attend on the LinkedIn event

Join the world’s toughest valuation training

Become a Valuation Expert. Valuation Master Class Boot Camp graduates can confidently value any company in the world and possess in-demand industry skills.

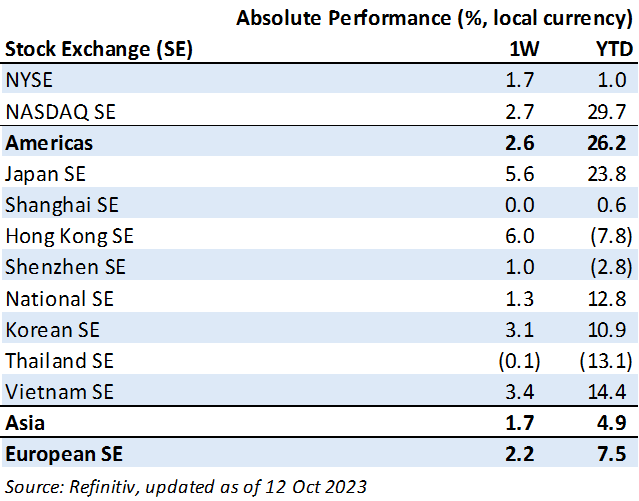

Weekly market performance

Click here to see more markets and periods.

Chart of the week

Discussed in the Become a Better Investor Community this week

“I’d like to invite you to tomorrow’s live session of the Become a Better Investor Community.

We will discuss the 5 very expensive wars the US is fighting and the implications of the 6th war.”

Try 1 month of the Become a Better Investor Community for FREE today!

You can cancel at any time. Click here to learn more.

Podcasts we listened to this week

The Joe Rogan Experience #2045 – Jimmy Carr

“Jimmy Carr is a stand-up comic, writer, actor, and television host. Carr’s most recent special, “His Dark Material,” is available on Netflix.”

Listen to the episode on Spotify.

Readings this week

INTERNATIONAL VALUE STOCKS OFFERING “MORE BANG FOR THE BUCK”

“Over the very long term, while value stocks have been less profitable and have had slower growth in earnings than growth stocks, they have provided higher returns. Among the reasons are that value stocks have traded at substantial valuation discounts compared to growth stocks, and reversion to the mean of abnormal (both abnormally high and abnormally low) growth in earnings has been greater than the market anticipated.”

Book recommendation

Perfectly Confident: How to Calibrate Your Decisions Wisely by Don A. Moore

“Moore reminds us that the key to success is to avoid being both over- and under-confident. In this essential guide, he shows how to become perfectly confident—how to strive for and maintain the well-calibrated, adaptive confidence that can elevate all areas of our lives.”

Get the book on Audible or Kindle.

Audible is great; have you tried it? If not, click here to get 2 books for free.

Memes of the week

U.S. defense companies after they hear “long war” pic.twitter.com/0OcjjL1cA2

— Not Jerome Powell (@alifarhat79) October 10, 2023

Vibe pic.twitter.com/lldBivbXox

— poordart (@poordart) October 10, 2023

New My Worst Investment Ever episodes

Ep737: Jeremy Deal – Use Differentiated Insight to Evaluate an Investment

BIO: Jeremy Deal manages the Survivor & Thriver Fund LP, a private investment partnership for high-net-worth families globally.

STORY: In 2012, Jeremy bought Tesla for about $2 a share and sold it eight months later for 50% more. He didn’t have a real differentiated insight to continue believing in Elon Musk’s ability to convince consumers to keep buying Teslas even though the product was of mediocre quality initially.

LEARNING: Use differentiated insight to evaluate an investment. When evaluating a company, see the bigger picture and look at it for what it is, not just how expensive or cheap it is.

Access the episode’s show notes and resources

Ep736: William Bernstein – Never Invest Based on the Headlines

BIO: William Bernstein is a neurologist, a co-founder of Efficient Frontier Advisors – an investment management firm, and has written several titles on finance and economic history.

STORY: William lost money after investing in palladium futures under the belief that a couple of physicists had perfected the technique of cold fusion to get helium.

LEARNING: Never invest based on the headlines. Something that everyone knows isn’t worth knowing.

Access the episode’s show notes and resources

ISMS 32: 5 Signs of Impending Recession

5 Warning signs of impending recession

Warning Sign #1 – Inverted yield curve

Warning Sign #2 – Peak employment

Warning Sign #3 – Slowdown in bank lending

Warning Sign #4 – Leading indicators falling & bankruptcies rising

Warning Sign #5 – Weakening consumer

Access the episode’s show notes and resources

Published on Become a Better Investor this week

In this episode, John Dues and host Andrew Stotz discuss points 2 and 3 of Dr. Deming’s 14 Points for Management – translated for people in education: adopt the new philosophy and cease dependence on inspection to achieve quality.

Will the global CPI slowdown continue? Or will it rebound?

Read ISMS 31: Global CPI saw 2nd MoM uptick in August

Pegatron Corporation (4938 TT): Profitable Growth rank of 8 was same compared to the prior period’s 8th rank. This is below average performance compared to 660 large Info Tech companies worldwide.

Read Pegatron – World Class Benchmarking

Central banks’ aggressive rate hikes and QT crash the stock markets. Continued rate hikes globally could lower bond yields (as higher rates mean lower bond prices). If inflation reaccelerates, we could miss out on rising commodities prices.

Read A. Stotz All Weather Strategies – September 2023

In preparation for an impending recession, business leaders are expected to lead! Leading means being proactive.

Read Is Your Company Prepared for an Upcoming Recession?

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.