Become a Better Investor Newsletter – 24 September 2022

Noteworthy this week

- Fed hiked 0.75%

- The stock market fell as a reaction to the hike

- JPMorgan Chase CEO criticized ESG

- European energy costs have more than quadrupled

- Energy policies are a matter of national security

Fed hiked 0.75%: The big event of the week was the FOMC meeting, where the Fed decided to hike 0.75% in line with market expectations.

— Lyn Alden (@LynAldenContact) January 26, 2022

The stock market fell as a reaction to the hike: A higher interest rate is typically negative for risky assets like stocks. Ben Carlson put the falling market in a time perspective.

If you’re a boomer you should probably be mad at the Fed for trying to move the stock market lower

If you’re a young person you should be thanking the Fed for providing you a lower entry point

— Ben Carlson (@awealthofcs) September 22, 2022

JPMorgan Chase CEO criticized ESG: Jamie Dimon pointed out that the ESG agenda is hurting rather than helping the climate (click below to watch the video).

JPMorgan Chase CEO Jamie Dimon confirms that the ESG agenda is hurting the American economy and that MORE oil and natural gas production is needed: pic.twitter.com/16DLzHr0Td

— Consumers’ Research (@ConsumersFirst) September 21, 2022

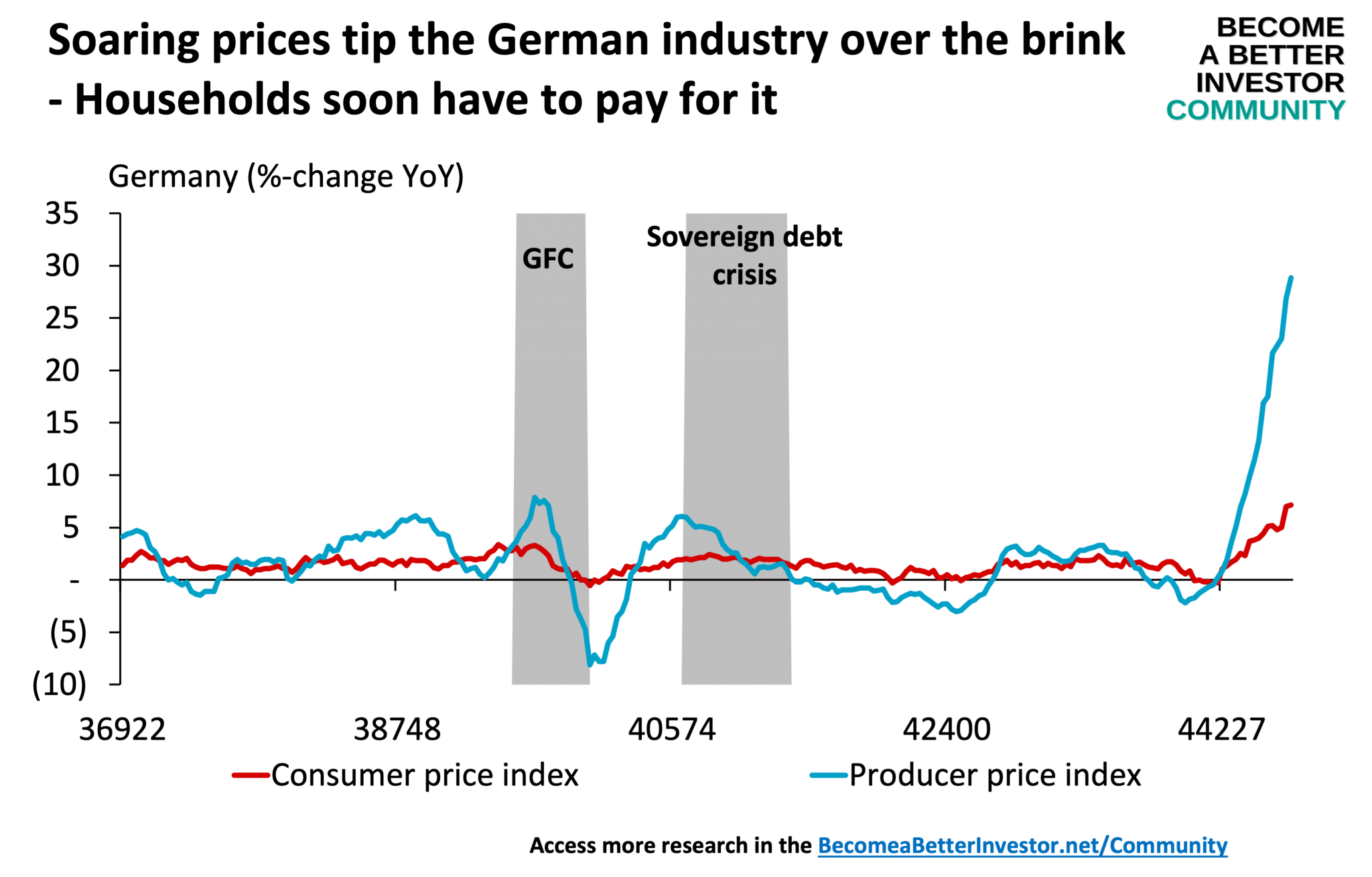

European energy costs have more than quadrupled: European nations are paying 8%+ of GDP for energy, compared to only around 2% of GDP in 2020.

Energy costs as % of GDP in 2022 compared to 2021 and 2020

A semi-permanent GDP shock ahead in Europe?

I look at the numbers in my free newsletter pic.twitter.com/25VrbEIxRu

— AndreasStenoLarsen (@AndreasSteno) September 22, 2022

Energy policies are a matter of national security: While all eyes are on Europe’s energy dependency on Russia, few consider the green transition leading to increased dependence on China.

The green transition will make us 100% dependent on China instead of Russia

And China knows.. pic.twitter.com/f8vBKNTYFi

— AndreasStenoLarsen (@AndreasSteno) September 19, 2022

Poll of the week

Vote on LinkedIn or

What do you expect the world equity return will be in the next 12 months?#stocks #stockmarkets #Equities

— Andrew “The Worst” Stotz (

@andrew

) September 23, 2022

Results from last week’s poll

Join the world’s toughest valuation training

The Valuation Master Class Boot Camp is a 6-week intensive company valuation boot camp for a successful career in finance.

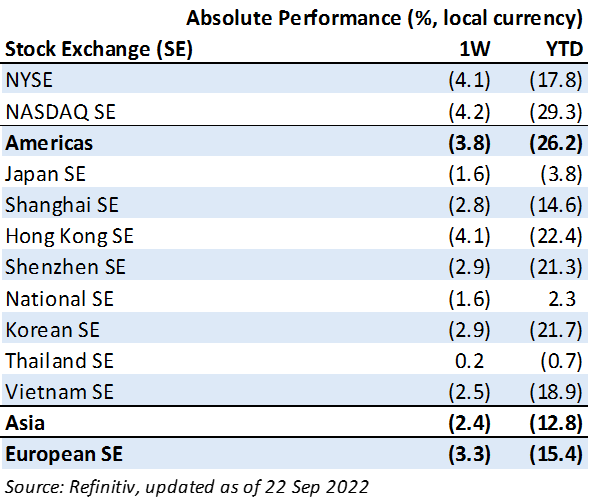

Weekly market performance

Click here to see more markets and periods.

Chart of the week

Discussed in the Become a Better Investor Community this week

“About 6 hours left to the FOMC meeting. The market has an 82% probability of a 0.75% hike. What do you guys think?”

“I have a feeling they are going to go for the 1%”

“1.00%”

“Another hike in line with the market expectations from Fed. Still, S&P closed down 1.7%.”

Join the Become a Better Investor Community today! You can cancel any time, and as a newsletter reader you get a massive discount when you use this coupon code: READER

Podcasts we listened to this week

This is a great discussion about YouTube as a marketing strategy. The fascinating thing out of this one was when he talked about how he got 50 million YouTube short views, but that he felt like almost none of them converted into customers and long-form YouTube video viewers.

Listen on: Apple

This podcast was excellent and I immediately went to the supermarket to get all 10 of these vegetables and create a daily salad for mom and me.

Listen on: Web

Readings this week

“The findings of the studies discussed support the view that the market may be undervaluing branding—while companies invest billions to build brand equity, this intangible asset does not appear on balance sheets.”

Memes of the week

Physics > Ideology … pic.twitter.com/OsKxVtHdcn

— Wall Street Silver (@WallStreetSilv) September 22, 2022

Fact Check : TRUE pic.twitter.com/Tc8ifWJZmY

— Wall Street Silver (@WallStreetSilv) September 21, 2022

New My Worst Investment Ever episodes

Ep596: Vijay Pravin Maharajan – Spend Time, Not Money Before You Invest

BIO: Vijay Pravin Maharajan is the Founder and CEO of bitsCrunch GmbH, a Blockchain Analytics company focused on securing the NFT ecosystem.

STORY: Vijay lost over 90% of his savings after investing blindly in cryptocurrency.

LEARNING: Do thorough due diligence before investing in anything. Don’t follow people blindly.

Ep595: Taimur Baig – Don’t Let the Upsides Distract You From the Downsides

BIO: Taimur Baig heads global economics and macro strategy for interest rate, credit, and currency at DBS Group Research.

STORY: Taimur invested in his friend’s hedge fund that was dealing with Iraqi stocks. He lost 50% of his investment after the country entered a war three years later.

LEARNING: Don’t get swayed by the upside and forget about the downside. Always analyze the risks, especially when the deal seems too good.

Ep594: Jem Bourouh – Know What You Want to Do and Who You’re Doing It For

BIO: Jem Bourouh is 24 years old and a serial entrepreneur from Germany. With his Google Ads agency Adcubator, Jem and his team have spent more than $318 million profitably.

STORY: Jem’s worst investment ever was enrolling for a Bachelor’s degree without thinking clearly about what he wanted to do with his life after university. This saw him try out many things that failed due to a lack of proper focus. He is yet to finish his degree.

LEARNING: Understand what you want to do and for who you’re doing it. Focus on the journey to get to the goal.

Published on Become a Better Investor this week

Sino Land Company Limited (83 HK): Profitable Growth rank of 1 was same compared to the prior period’s 1st rank. This is World Class performance compared to 250 large Real Estate companies worldwide.

Read Sino Land – World Class Benchmarking

Chongqing Department Store Company Limited (600729 SH): Profitable Growth rank of 6 was down compared to the prior period’s 5th rank. This is below average performance compared to 1,030 large Cons. Disc. companies worldwide.

Read Chongqing Department Store – World Class Benchmarking

Saras SpA (SRS MI): Profitable Growth rank of 7 was up compared to the prior period’s 9th rank. This is below-average performance compared to 330 large Energy companies worldwide.

Read Saras SpA – World Class Benchmarking

Sino Wealth Electronic Limited (300327 SZ): Profitable Growth rank of 1 was same compared to the prior period’s 1st rank. This is World Class performance compared to 900 medium Info Tech companies worldwide.

Read Sino Wealth Electronic – World Class Benchmarking

Bumitama Agri Limited (BAL SP): Profitable Growth rank of 2 was up compared to the prior period’s 5th rank. This is World Class performance compared to 610 large Cons. Staples companies worldwide.

Read Bumitama Agri – World Class Benchmarking

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.