Become a Better Investor Newsletter – 3 September 2022

Noteworthy this week

- The market expects the Fed to hike faster and higher

- Investors are pessimistic about Europe

- German inflation saw new records

- The French energy crisis appears worse than the German

- High gas prices could hit farm yields

The market expects the Fed to hike faster and higher: After JPow’s speech at the Jackson Hole Economic Symposium US stocks were blood red.

No one:

Jerome Powell today: pic.twitter.com/D6BZByV07p

— Wall Street Memes (@wallstmemes) August 26, 2022

Investors are pessimistic about Europe: Energy crisis and rampant inflation has led to increased short interest in European equities.

🇪🇺 Investors increase bets against #euro – FT

*Net short positions hit their highest levels since the start of the pandemic

*Link: https://t.co/L0cInFilaf pic.twitter.com/lMz3DdnaqQ— Christophe Barraud🛢🐳 (@C_Barraud) August 29, 2022

OPEC+ continues to miss output targets: While the energy crisis hits the globe, OPEC+ continues to underdeliver on its output targets.

Woozer#OPEC+ missed output targets by 2.9 million barrels per day in July

Compliance with the production targets stood at 546% in July vs 320% in Junehttps://t.co/TWB5dbtltV

— Tracy (𝒞𝒽𝒾 ) (@chigrl) August 22, 2022

German inflation saw new records: New month, new record for the German CPI. Food prices are up by 17%!

To put things into perspective: Supermarket prices in #Germany are rising at a record pace. Food CPI jumped 16.6% YoY in August, the highest food price #inflation since the start of the statistic. pic.twitter.com/fNmSxRg5g1

— Holger Zschaepitz (@Schuldensuehner) August 30, 2022

The French energy crisis appears worse than the German: The French gov’t prepares its people for a tough winter.

🇫🇷 FRENCH FINANCE MINISTER BRUNO LE MAIRE SAYS WE NEED TO PREPARE FOR HARD WINTER WITH LESS GAS AVAILABLE AND NEED TO THINK ABOUT RATIONING OF GAS TO INDUSTRY – RTRS

— Christophe Barraud🛢🐳 (@C_Barraud) August 30, 2022

High gas prices could hit farm yields: With crazy high natural gas prices, it stops making sense to use and produce fertilizer. This could lead to lower yields among farmers.

European fertilizer giant Yara International says that record gas prices are forcing it to cut its European ammonia capacity utilization to about 35% https://t.co/ZHBqVUozsi

— Bloomberg Energy (@BloombergNRG) August 25, 2022

Poll of the week

Over the past five years, the US stock market has had an average annual return of about 11%. What do you expect it will be over the next five years?

Vote on LinkedIn or

Over the past five years, the US stock market has had an average annual return of about 11%. What do you expect it will be over the next five years?#stocks #StockMarket

— Andrew “The Worst” Stotz (@andrew) September 2, 2022

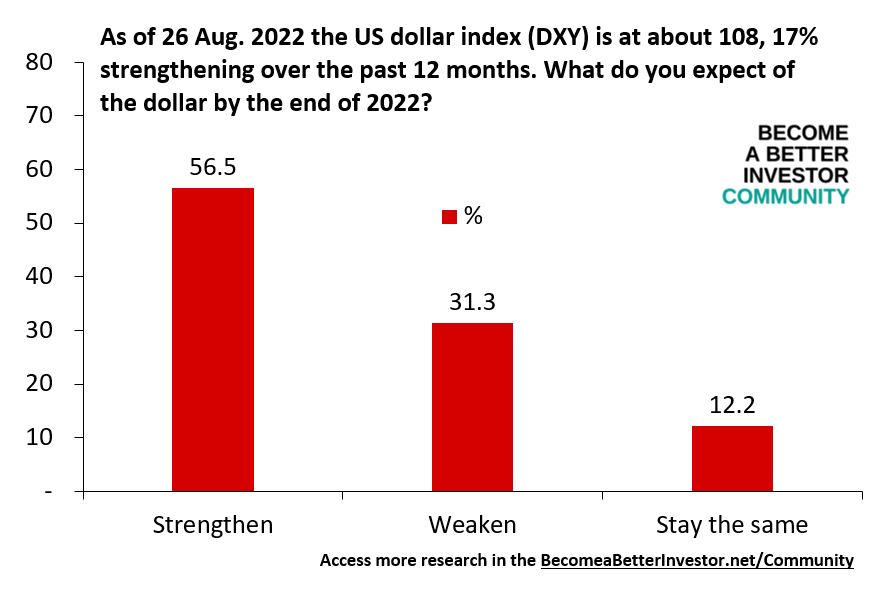

Results from last week’s poll

Join the world’s toughest valuation training

The Valuation Master Class Boot Camp is a 6-week intensive company valuation boot camp for a successful career in finance.

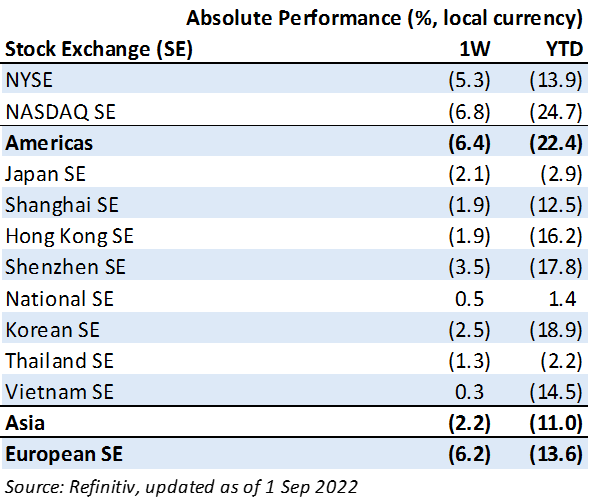

Weekly market performance

Click here to see more markets and periods.

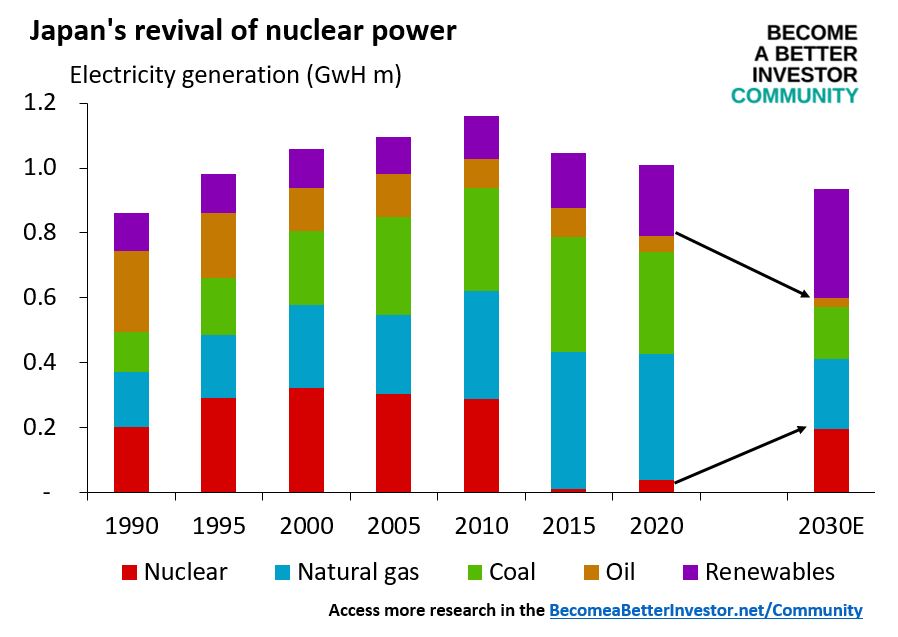

Chart of the week

Discussed in the Become a Better Investor Community this week

“’Prior to the Covid outbreak, the average foreign tourist spent about 50,000 baht per visit to the Land of Smiles. But in the second quarter of 2022, tourists spent just 31,735 baht each.’ The strategy to attract the really rich tourist seems to have failed so far.]”

“for us, I would same it’s the same style of guest, but with a more stringent spending style honestly not sure nationwide – on a micro level, I see the same blend of guests.”

“Micro sometimes represents the big picture too.”

Join the Become a Better Investor Community today! You can cancel any time, and as a newsletter reader you get a massive discount when you use this coupon code: READER

Podcasts we listened to this week

One of the toughest questions these days is whether the Democrats in the US will hold on to their very slim majority in the House of Representatives. Up until now I was expecting a sweep by the Republicans. But this podcast sowed doubts. What do you think? Listen on Apple, Stitcher, Spotify, Web.

Readings this week

It’s only about 15% of the time in the markets where outperformance is created. A good reminder from legendary Jeremy Grantham. Read the full piece here.

Memes of the week

#Bidenomics pic.twitter.com/FgEfXOdNLp

— AndreasStenoLarsen (@AndreasSteno) August 8, 2022

— black bartleby (@ElderBartleby) August 24, 2022

New My Worst Investment Ever episodes

Ep587: Vitaliy Katsenelson – Be Willing to Endure Short Term Pain for Long Term Gain

BIO: Vitaliy has written two books on investing and is an award-winning writer. Known for his uncommon common sense, Forbes Magazine called him “The New Benjamin Graham.”

STORY: Vitaliy bought stocks in a company that had been named the worst company ever. He bought the stock at $16, it went to $10, and then up to $26. Vitaliy sold, and this is a decision that he regrets. Today, the stock is at $120.

LEARNING: Be willing to endure short-term pain for long-term gain. Don’t stop researching. Use stop losses to exit bad investments.

Ep586: Marylen Ramos-Velasco – Strike a Balance Between Taking Care of Yourself and Others

BIO: Marylen Ramos-Velasco is the Founder and CEO of Customized Training Solutions (CTS) Pte. Ltd. – “Asia’s Most Trusted Customized Solutions Provider.”

STORY: Marylen spent her life doing too much for people who didn’t deserve her time and effort at the expense of her health. She started taking better care of herself and creating boundaries when she suffered several gastritis attacks.

LEARNING: Strike a balance between taking care of yourself and others. Prioritize self-love and self-care. Always think about your value.

Ep585: Ted Leverette – Buy Businesses That Have Fixable Problems

BIO: For more than 30 years, Ted Leverette, The Original Business Buyer Advocate, has been helping people worldwide find and buy the right businesses the right way.

STORY: Ted bought a business for eight figures only to discover it was sinking in debt.

LEARNING: Hire the right kind of advisors when buying a business. Do your due diligence and get to know how the business works before you buy it.

Published on Become a Better Investor this week

In August 2022, we published 11 new episodes of the My Worst Investment Ever podcast. Listen to all of them here.

Read My Worst Investment Ever August 2022

What’s interesting about Adobe is that >90% of the world’s creative professionals use its software.

Watch Will Adobe Continue to Disappoint Expectations?

Centre Testing International Group Company Limited (300012 SZ): Profitable Growth rank of 1 was same compared to the prior period’s 1st rank. This is World Class performance compared to 1,530 large Industrials companies worldwide.

Read Centre Testing International Group – World Class Benchmarking

What’s interesting about Li Ning is that its net profit in 2021 rose by 136%.

Watch Can Li Ning Become a Sportswear Heavyweight?

PT Mitra Adiperkasa Tbk (MAPI IJ): Profitable Growth rank of 6 was up compared to the prior period’s 7th rank. This is below-average performance compared to 1,030 large Cons. Disc. companies worldwide.

Read Mitra Adiperkasa – World Class Benchmarking

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.