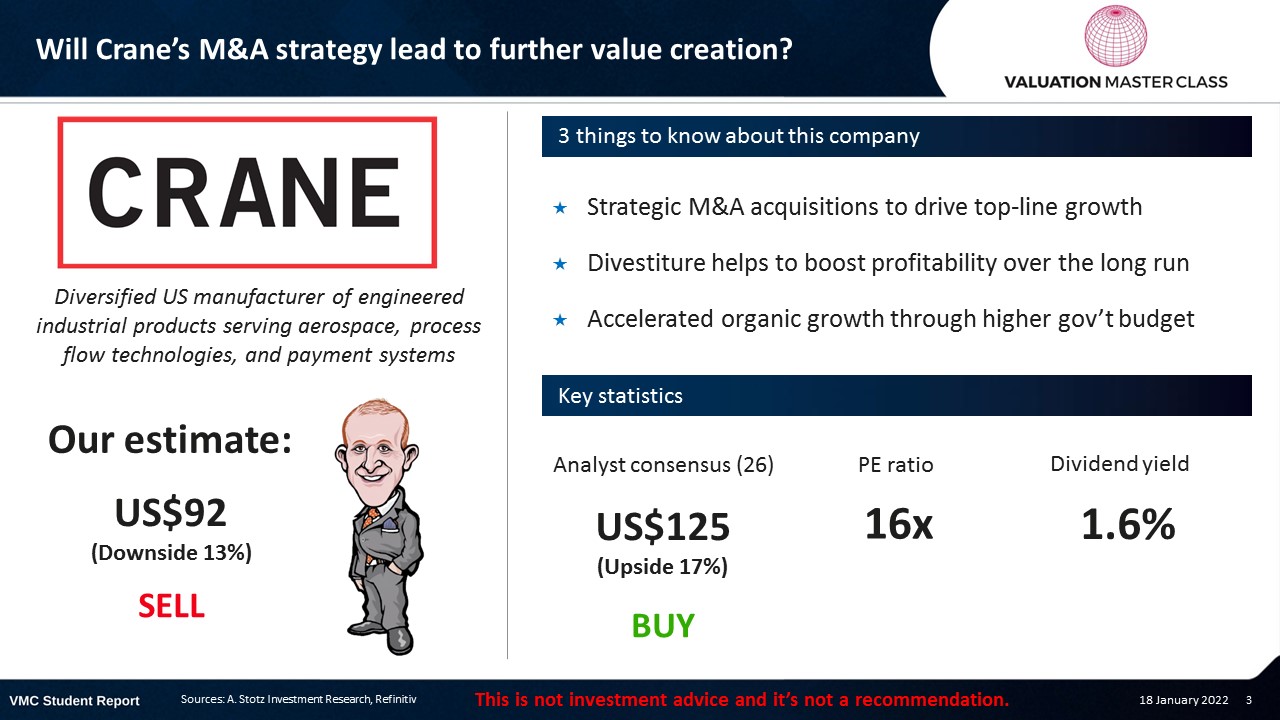

Will Crane’s M&A Strategy Lead To Further Value Creation?

The post was originally published here.

Highlights:

- Strategic M&A acquisitions to drive top-line growth

- Divestiture helps to boost profitability over the long run

- Accelerated organic growth through higher gov’t budget

Download the full report as a PDF

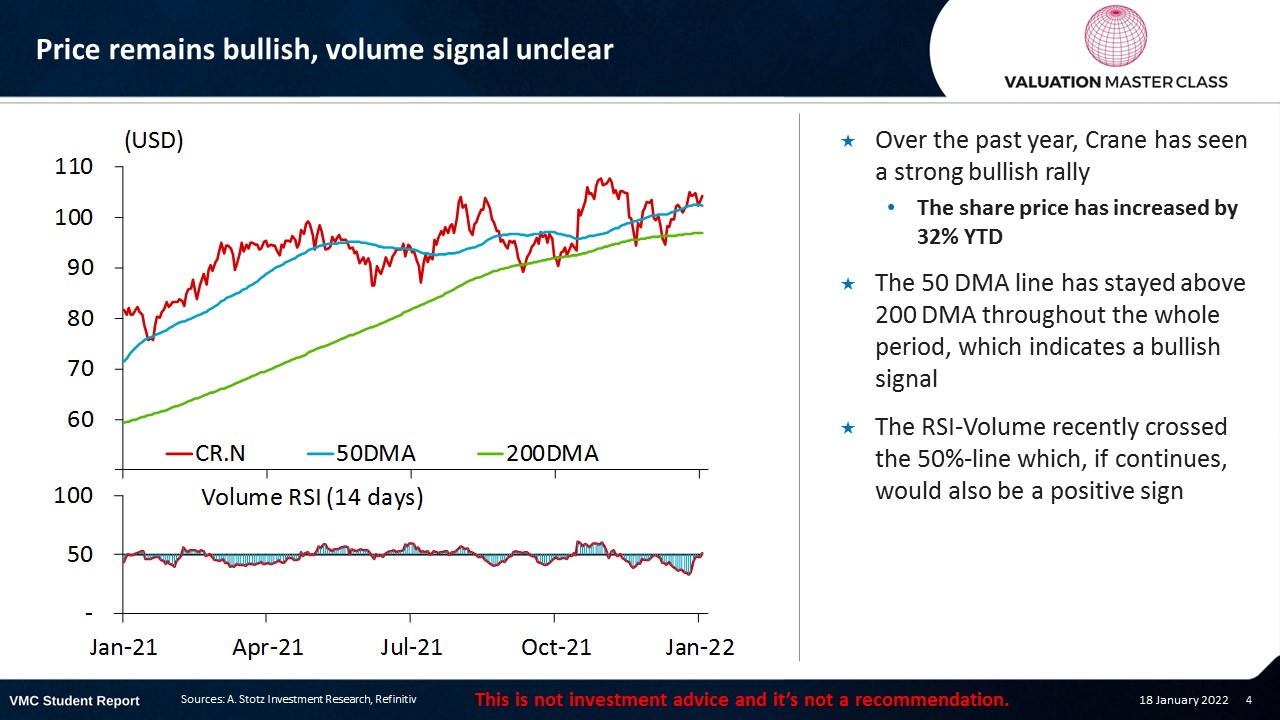

Price remains bullish, volume signal unclear

- Over the past year, Crane has seen a strong bullish rally

- The share price has increased by 32% YTD

- The 50 DMA line has stayed above 200 DMA throughout the whole period, which indicates a bullish signal

- The RSI-Volume recently crossed the 50%-line which, if continues, would also be a positive sign

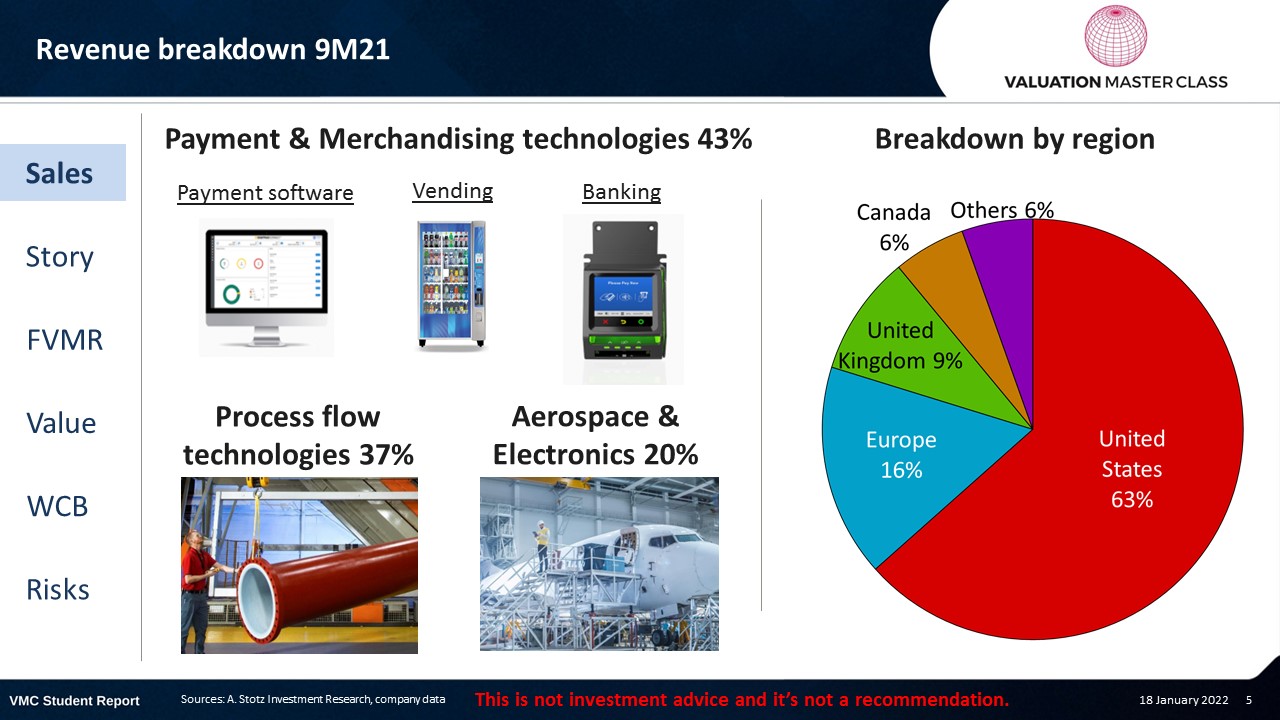

Crane’s revenue breakdown 9M21

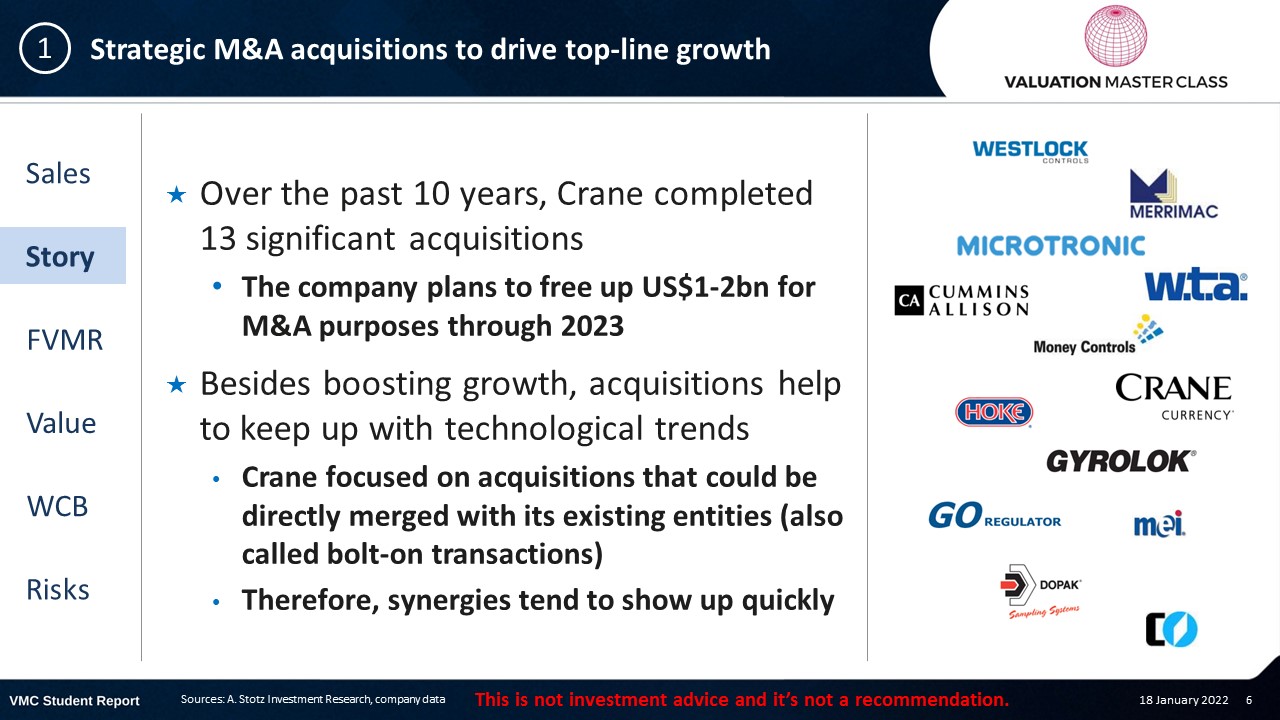

Strategic M&A acquisitions to drive top-line growth

- Over the past 10 years, Crane completed 13 significant acquisitions

- The company plans to free up US$1-2bn for M&A purposes through 2023

- Besides boosting growth, acquisitions help to keep up with technological trends

- Crane focused on acquisitions that could be directly merged with its existing entities (also called bolt-on transactions)

- Therefore, synergies tend to show up quickly

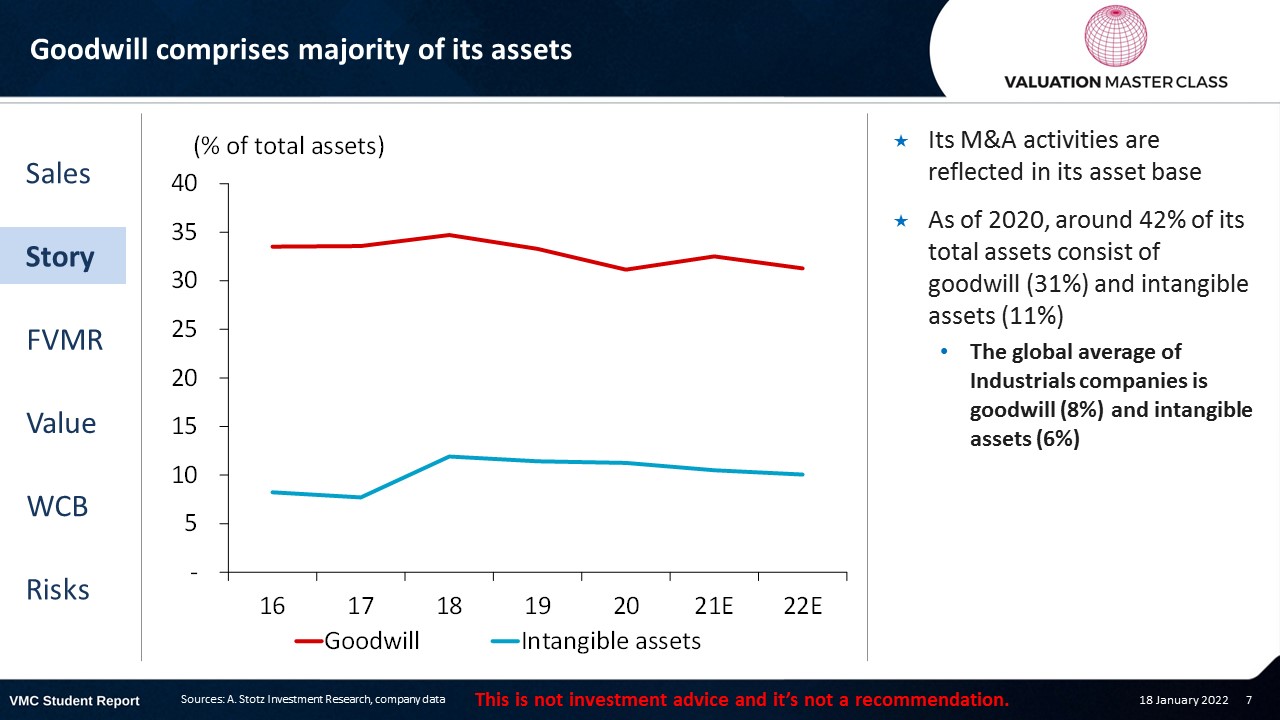

Goodwill comprises majority of its assets

- Its M&A activities are reflected in its asset base

- As of 2020, around 42% of its total assets consist of goodwill (31%) and intangible assets (11%)

- The global average of Industrials companies is goodwill (8%) and intangible assets (6%)

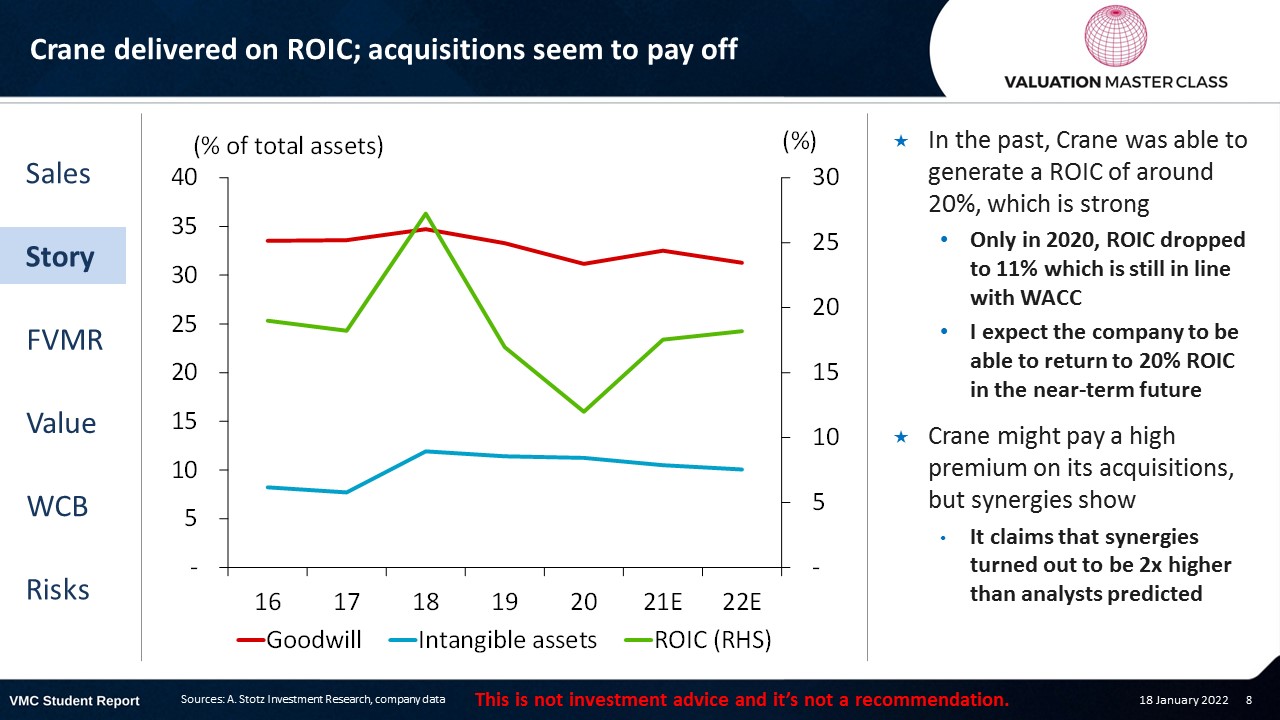

Crane delivered on ROIC; acquisitions seem to pay off

- In the past, Crane was able to generate a ROIC of around 20%, which is strong

- Only in 2020, ROIC dropped to 11% which is still in line with WACC

- I expect the company to be able to return to 20% ROIC in the near-term future

- Crane might pay a high premium on its acquisitions, but synergies show

- It claims that synergies turned out to be 2x higher than analysts predicted

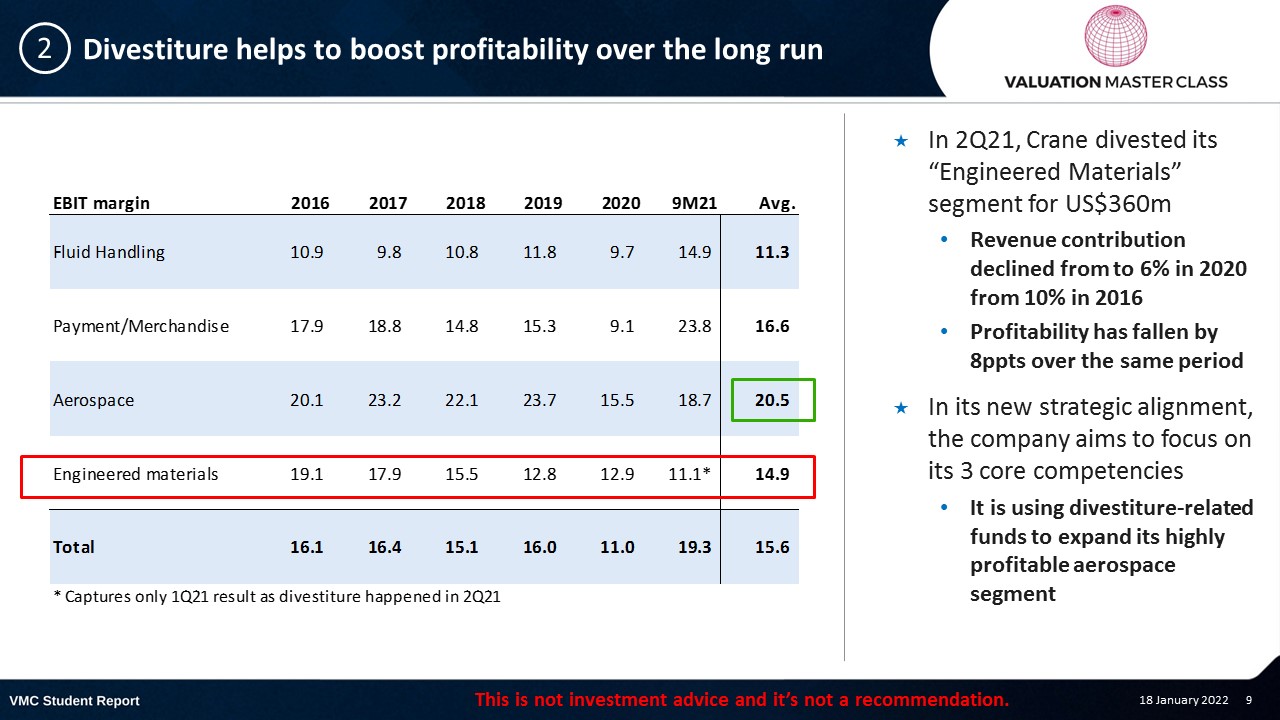

Divestiture helps to boost profitability over the long run

- In 2Q21, Crane divested its “Engineered Materials” segment for US$360m

- Revenue contribution declined from to 6% in 2020 from 10% in 2016

- Profitability has fallen by 8ppts over the same period

- In its new strategic alignment, the company aims to focus on its 3 core competencies

- It is using divestiture-related funds to expand its highly profitable aerospace segment

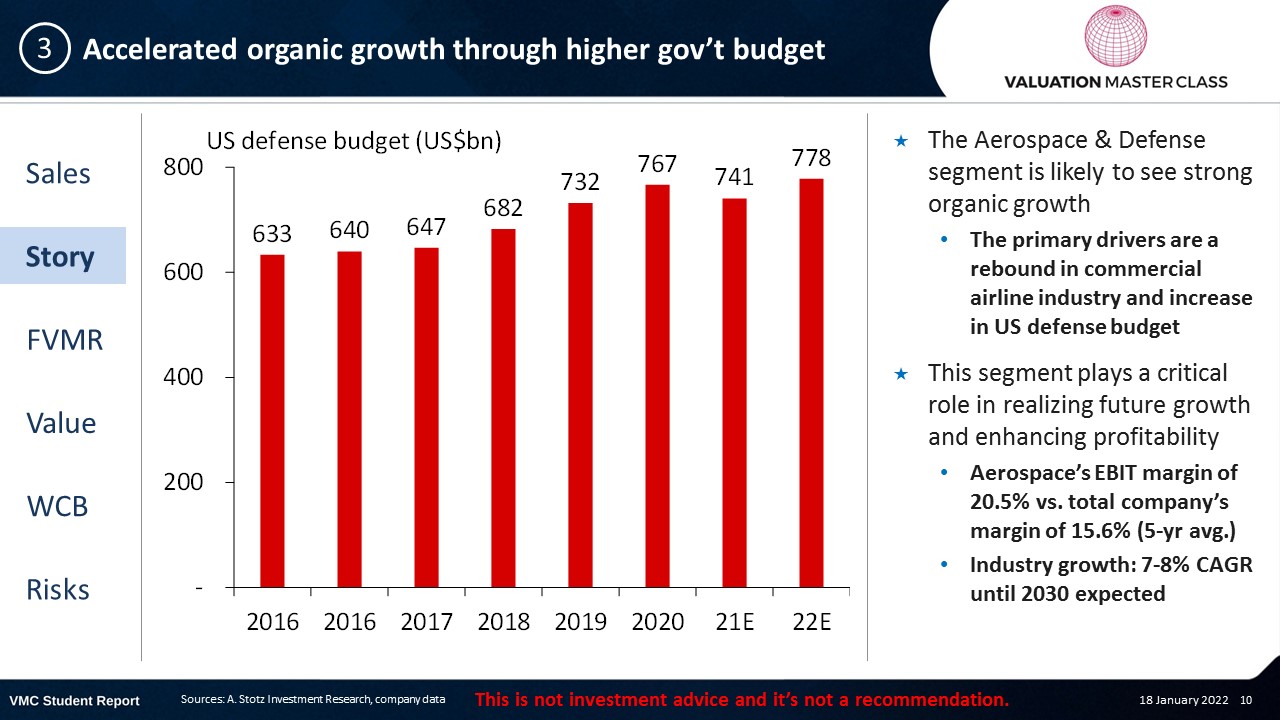

Accelerated organic growth through higher gov’t budget

- The Aerospace & Defense segment is likely to see strong organic growth

- The primary drivers are a rebound in commercial airline industry and increase in US defense budget

- This segment plays a critical role in realizing future growth and enhancing profitability

- Aerospace’s EBIT margin of 20.5% vs. total company’s margin of 15.6% (5-yr avg.)

- Industry growth: 7-8% CAGR until 2030 expected

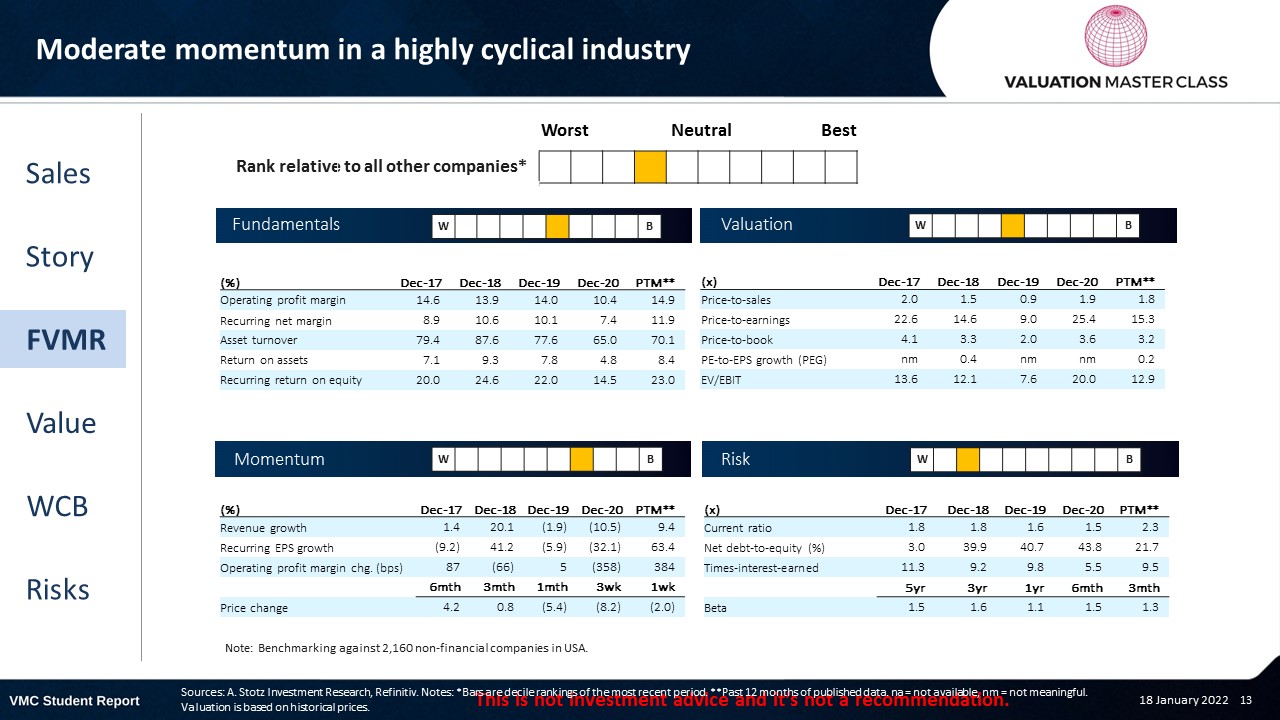

FVMR Scorecard – Crane

- A stock’s attractiveness relative to stocks in that country or region

- Attractiveness is based on four elements

- Fundamentals, Valuation, Momentum, and Risk (FVMR)

- Scale from 1 (Best) to 10 (Worst)

Consensus still sees upside after recent price rally

- 4 analysts expect the company to outperform while 3 analysts still stay cautious

- Analysts expect a strong margin expansion in line with the company’s strategy to focus on its highly profitable segments

Get financial statements and assumptions in the full report

P&L – Crane

- Net profit sees a strong rebound in 21E and could lead to a record

- The strong bottom-line is mainly driven by the margin expansion, but also strong growth prospects

Balance sheet – Crane

- Goodwill is the primary asset on the company’s balance sheet

- Given its past M&A history and relevance for growth generation, I assume further acquisitions to take place over the next years

- The company recently agreed on resuming its share repurchase program

- The total confirmed budget of US$300m is spread over the following years

Ratios – Crane

- Asset base shrinks in 21E due to the divestiture of its 4th segment

- Beyond 2022, I see a strong asset growth, providing the basis for revenue to grow in a similar direction

- The margin expansion is also reflected in higher return on assets, which is likely to double in 21E

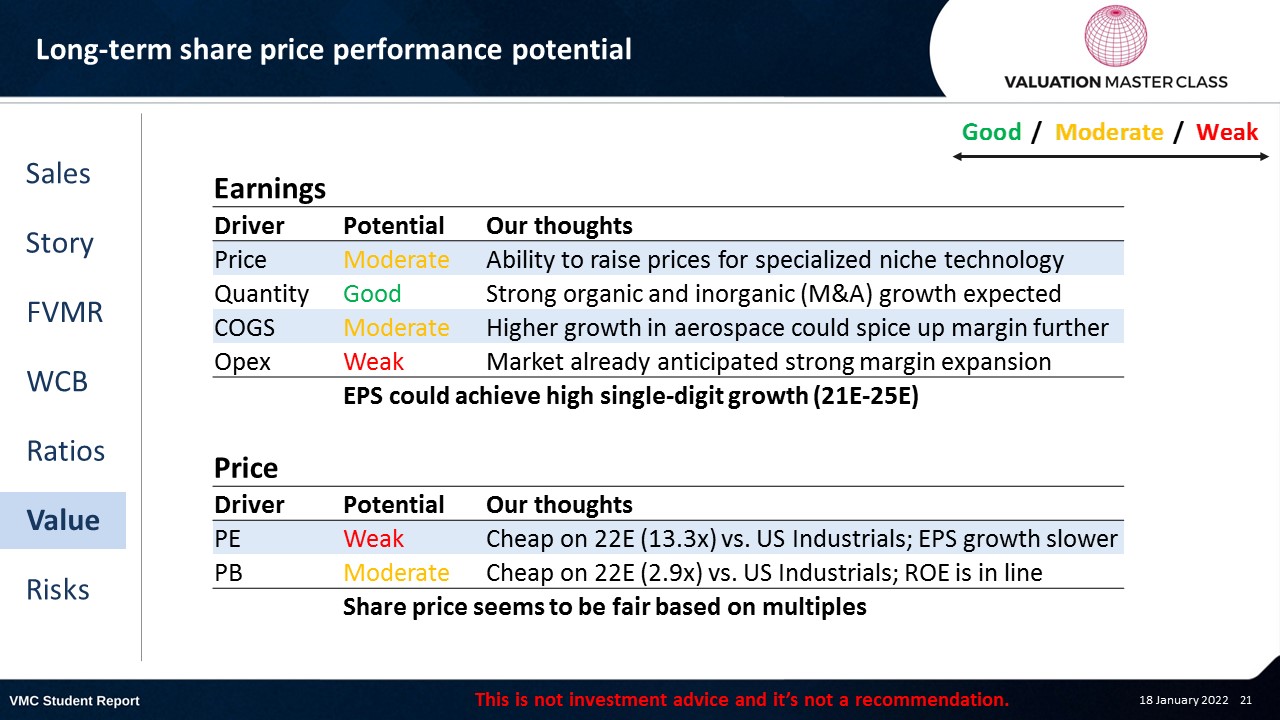

Long-term share price performance potential

Free cash flow – Crane

- Strong cash flow generation is crucial for pursuing its M&A strategy

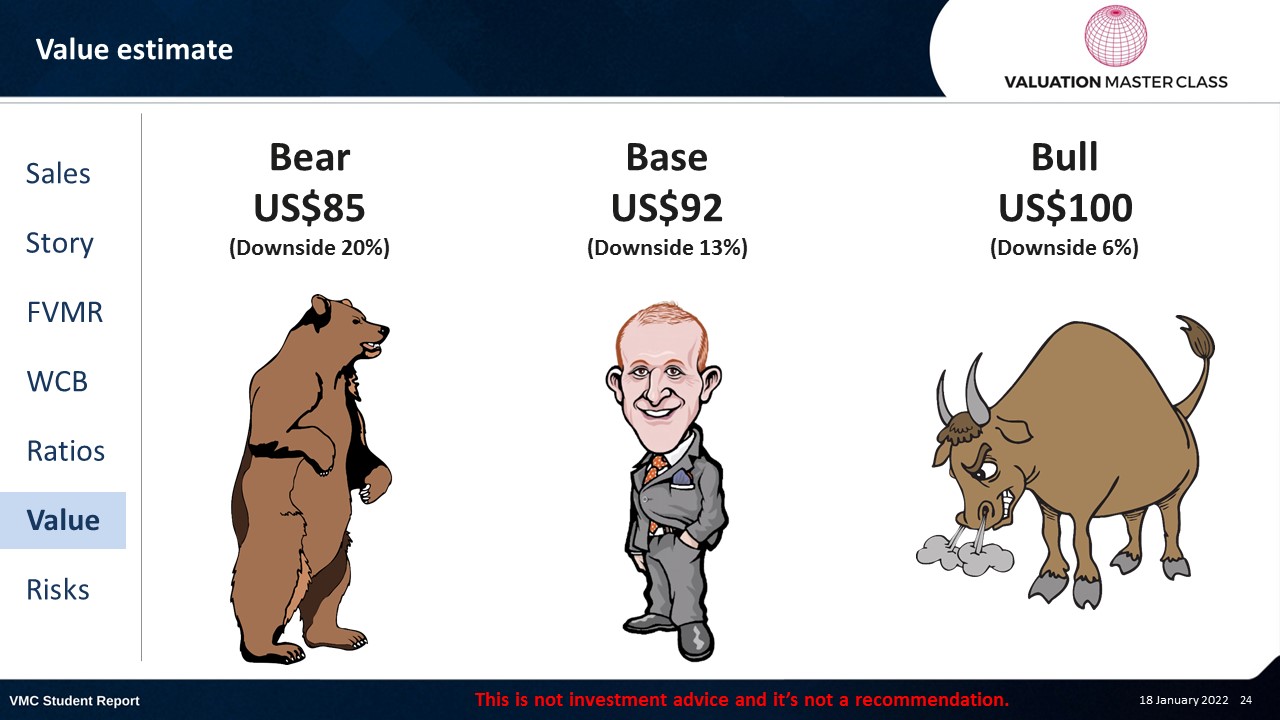

Value estimate – Crane

- I see a slightly higher revenue growth than consensus

- Despite acknowledging the recent margin expansion, it will be difficult for Crane to maintain it forever

- Aerospace and defense segment becomes increasingly competitive

- My long-term assumptions are relatively optimistic with regards to maintaining high profitability

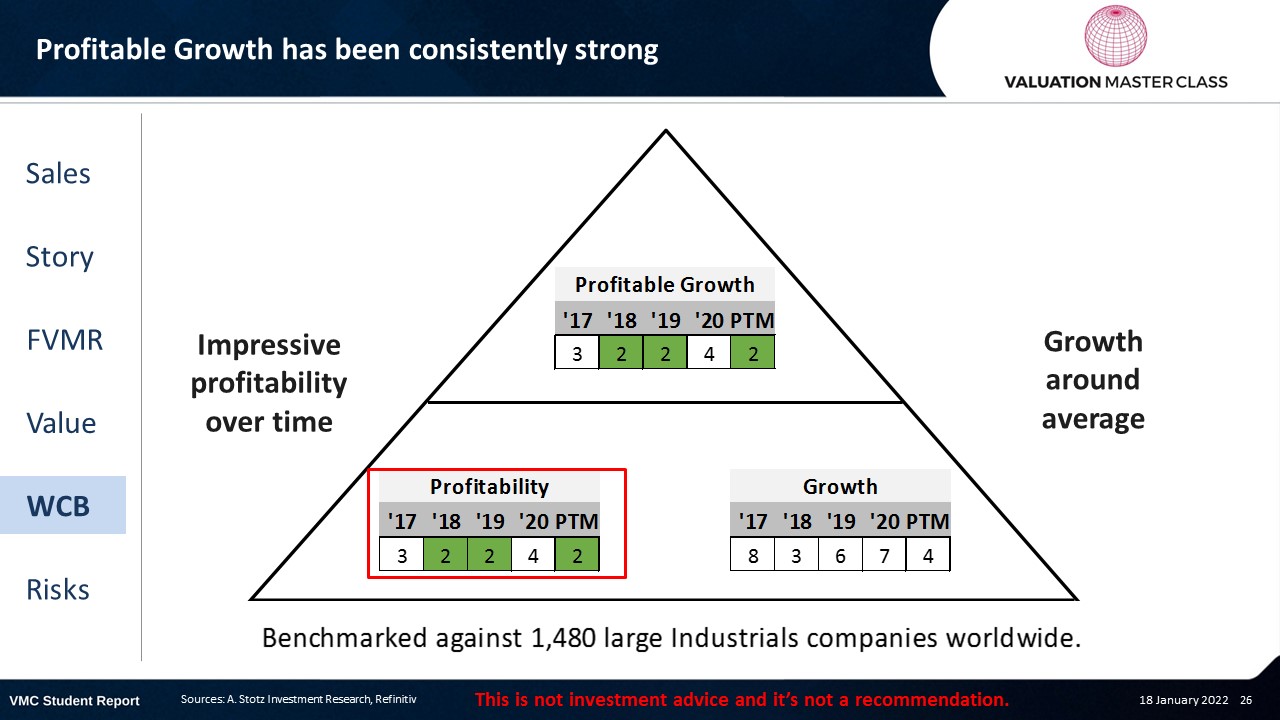

World Class Benchmarking Scorecard – Crane

- Identifies a company’s competitive position relative to global peers

- Combined, composite rank of profitability and growth, called “Profitable Growth”

- Scale from 1 (Best) to 10 (Worst)

Key risk is intensified competition in local markets

- Risk of overpaying acquisitions, impairment charges or failure to integrate the business

- Inability to protect intellectual property or lacking innovative ideas

- Adverse regulatory changes and environmental liabilities

Conclusions

- Strong ability to grow organically and through strategic acquisitions

- Focus on profitable segments could bring ROIC back to 20%

- Stock trades in line with industry multiples

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.