Toyota vs. EV Extremists – Who is right?

The post was originally published here.

What’s interesting about Toyota is that if you buy today, you get its future growth for free

The right time to buy might be now

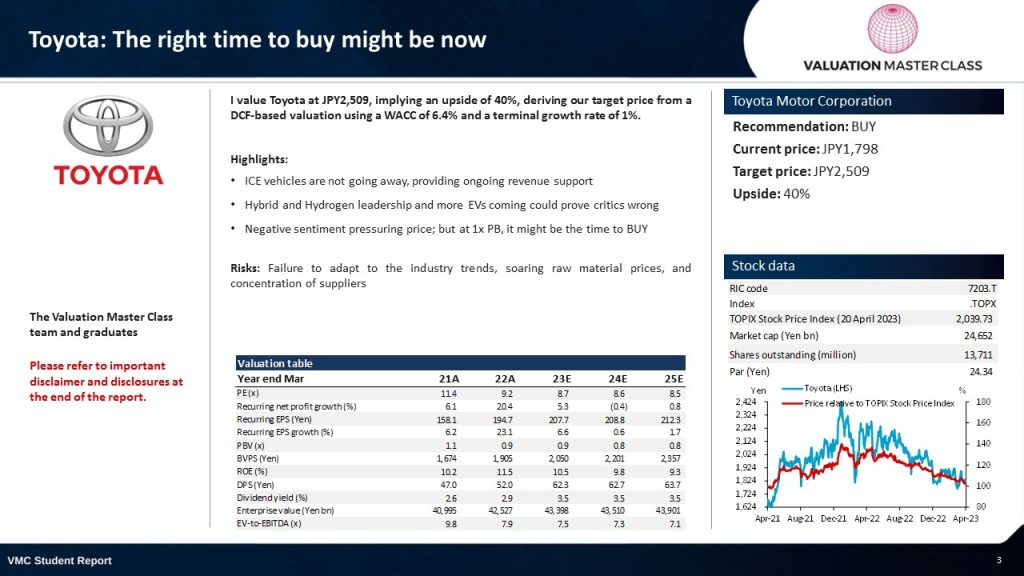

Toyota’s share price is up about 17% from pre-Covid days, much better than GM, which is down 48%, but not as strong as Ford and Mercedes-Benz, which are up about 35%. The share price is now trading at book value, and I see about a 40% upside using a DCF-based valuation based on a WACC of 6.4% and a terminal growth rate of 1%.

Highlights:

- ICE vehicles are not going away, providing ongoing revenue support

- Hybrid and Hydrogen leadership and more EVs coming could prove critics wrong

- Negative sentiment pressuring price; but at 1x PB, it might be the time to BUY

Download the full report as a PDF

Heads or Tails? EVs, Hybrids, or ICE?

ICE vehicles are not going away, providing ongoing revenue support

Toyota is the world’s largest car manufacturer, ranked by a composite of market cap, revenue, and employees. The company has been a leader in alternative energy solutions such as hybrids and hydrogen-powered vehicles. The prior president has said that the company will “not simply repeat the approach of other companies” when it comes to electric vehicles (EV). Toyota points out the limited battery range, scarcity of lithium resources, lack of a charging network, and consumer preferences towards internal combustion engines (ICE). And developing markets in South America, Asia, and Africa could be decades away from having the infrastructure to implement a massive EV rollout; Toyota is well positioned to grow with these markets. Over the next five years, we expect Toyota to return to its pre-pandemic average growth level and achieve a CAGR of 6.9%.

Hybrid and Hydrogen leadership and more EVs coming could prove critics wrong

Toyota is a pioneer in the mass production of hybrid technology, having rolled out its hybrid “Prius” model in 1997, since selling more than 5m. Currently, hybrids account for about 27% of total vehicle sales. Toyota is pushing ahead with hydrogen-powered cars, currently selling its “Mirai” model. The beaten-down share price is some evidence that observers expect the company’s hydrogen offerings will eventually fail. But there is promise to the technology, and an investor could consider Toyota’s hydrogen to have an option value. Of course, Toyota has not turned its back on EVs; recently, announcing plans to invest US$70bn in electrifying part of its fleet by 2030. We appreciate Toyota’s diversified approach to transition to more carbon-neutral cars and expect total CAPEX spending of about JPY12trn over the next few years.

Negative sentiment pressuring price; but at 1x PB, it might be the time to BUY

The sector is unfavorable given recession fears, as well, investors doubts Toyota’s unconventional EV policies and its ability to defend its position as the world’s largest carmaker. The company’s price-to-book ratio (PB) dropped below 1x, which is 1x std dev below its long-term average. With an average net margin of 7.8% over the past 5 years, Toyota is among the most profitable automobile companies in the world. We believe negative sentiment has been too punishing, and the stock deserves a re-rating.

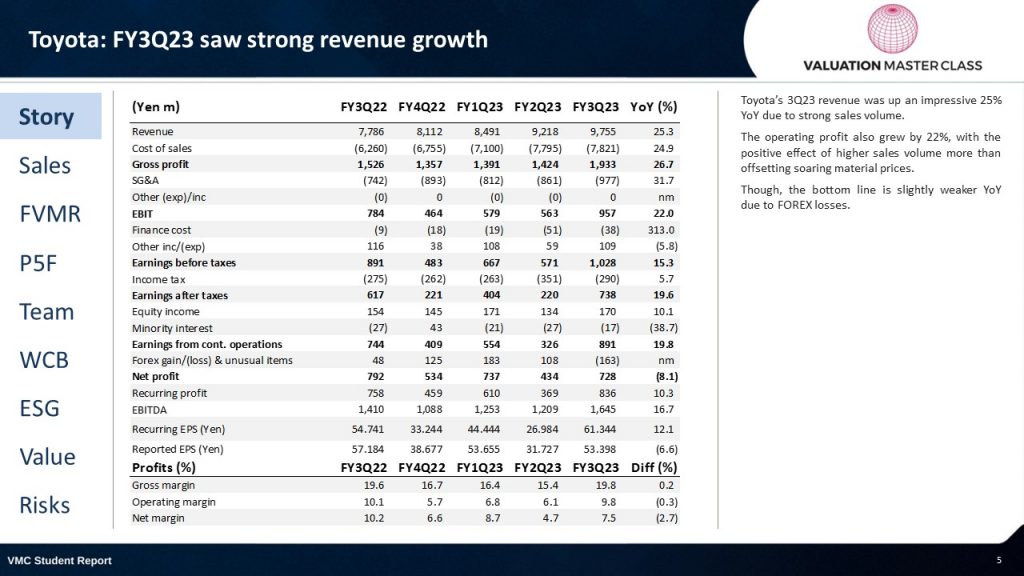

FY3Q23 saw strong revenue growth

- Toyota’s 3Q23 revenue was up an impressive 25% YoY due to strong sales volume.

- The operating profit also grew by 22%, with the positive effect of higher sales volume more than offsetting soaring material prices.

- Though, the bottom line is slightly weaker YoY due to FOREX losses.

Revenue structure

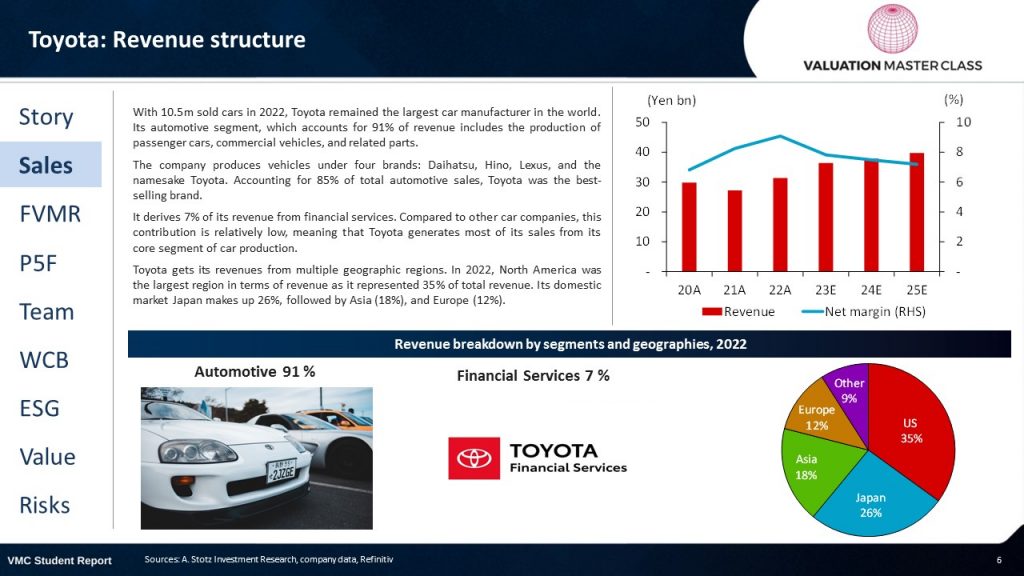

- With 10.5m sold cars in 2022, Toyota remained the largest car manufacturer in the world. Its automotive segment, which accounts for 91% of revenue includes the production of passenger cars, commercial vehicles, and related parts.

- The company produces vehicles under four brands: Daihatsu, Hino, Lexus, and the namesake Toyota. Accounting for 85% of total automotive sales, Toyota was the best-selling brand.

- It derives 7% of its revenue from financial services. Compared to other car companies, this contribution is relatively low, meaning that Toyota generates most of its sales from its core segment of car production.

- Toyota gets its revenues from multiple geographic regions. In 2022, North America was the largest region in terms of revenue as it represented 35% of total revenue. Its domestic market Japan makes up 26%, followed by Asia (18%), and Europe (12%).

A. Stotz Four Elements

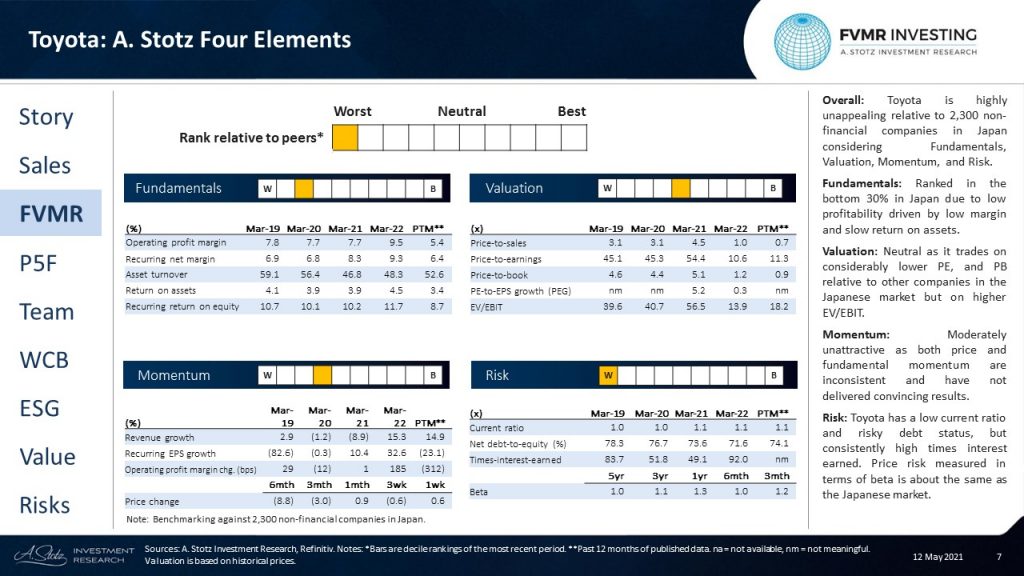

- Overall: Toyota is highly unappealing relative to 2,300 non-financial companies in Japan considering Fundamentals, Valuation, Momentum, and Risk.

- Fundamentals: Ranked in the bottom 30% in Japan due to low profitability driven by low margin and slow return on assets.

- Valuation: Neutral as it trades on considerably lower PE, and PB relative to other companies in the Japanese market but on higher EV/EBIT.

- Momentum: Moderately unattractive as both price and fundamental momentum are inconsistent and have not delivered convincing results.

- Risk: Toyota has a low current ratio and risky debt status, but consistently high times interest earned. Price risk measured in terms of beta is about the same as the Japanese market.

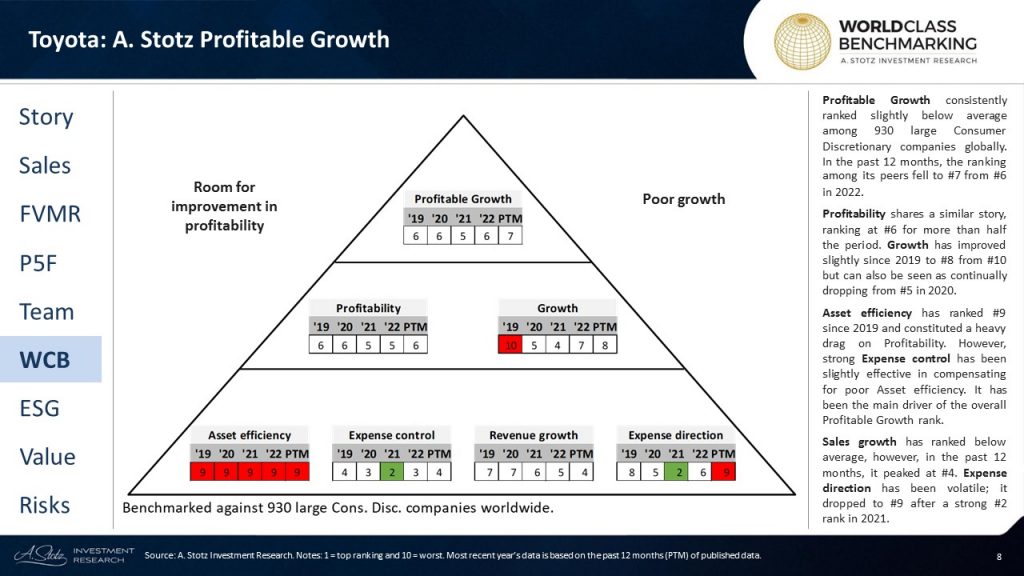

A. Stotz Profitable Growth

- Profitable Growth consistently ranked slightly below average among 930 large Consumer Discretionary companies globally. In the past 12 months, the ranking among its peers fell to #7 from #6 in 2022.

- Profitability shares a similar story, ranking at #6 for more than half the period. Growth has improved slightly since 2019 to #8 from #10 but can also be seen as continually dropping from #5 in 2020.

- Asset efficiency has ranked #9 since 2019 and constituted a heavy drag on Profitability. However, strong Expense control has been slightly effective in compensating for poor Asset efficiency. It has been the main driver of the overall Profitable Growth rank.

- Sales growth has ranked below average, however, in the past 12 months, it peaked at #4. Expense direction has been volatile; it dropped to #9 after a strong #2 rank in 2021.

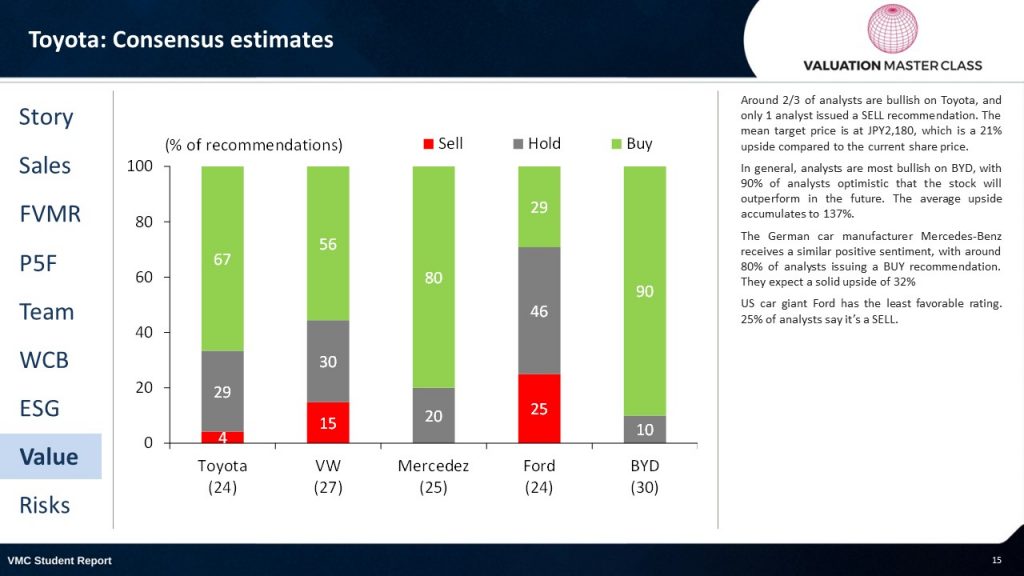

Consensus estimates

- Around 2/3 of analysts are bullish on Toyota, and only 1 analyst issued a SELL recommendation.

- The mean target price shows about a 21% upside.

- In general, analysts are most bullish on BYD, with 90% of analysts optimistic that the stock will outperform in the future. The average upside is 137%.

- The German car manufacturer Mercedes-Benz receives a similar positive sentiment, with around 80% of analysts issuing a BUY recommendation. They expect a solid upside of 32%

- US car giant Ford has the least favorable rating. 25% of analysts say it’s a SELL.

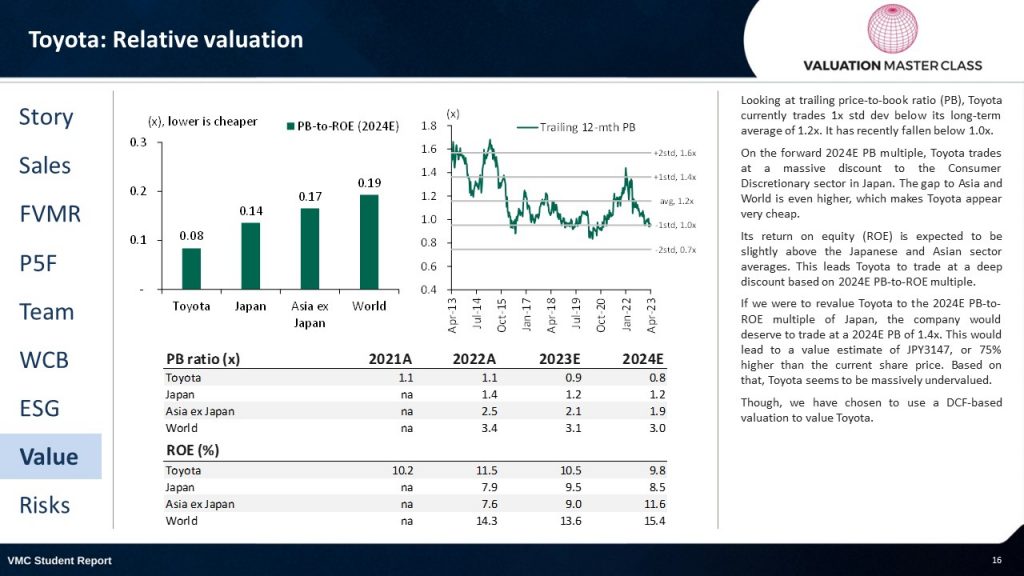

Relative valuation

- The trailing price-to-book ratio (PB) shows that Toyota is trading 1x std dev below its long-term average of 1.2x. And it has recently fallen below 1.0x.

- On the forward 2024E PB multiple, Toyota trades at a massive discount to the Consumer Discretionary sector in Japan. The gap between Asia and World is even higher, making Toyota appear cheap.

- I expect its return on equity (ROE) of 10% to be slightly above Japanese and Asian sector averages, which leads Toyota to trade at a deep discount based on the 2024E PB-to-ROE multiple.

- If we were to revalue Toyota to the 2024E PB-to-ROE multiple of Japan, the company would deserve to trade at a 2024E PB of 1.4x. This would lead to a value estimate of JPY3147, or 75% higher than the current share price. Based on that, Toyota seems to be massively undervalued.

- Though, we have chosen to use a DCF-based valuation to value Toyota.

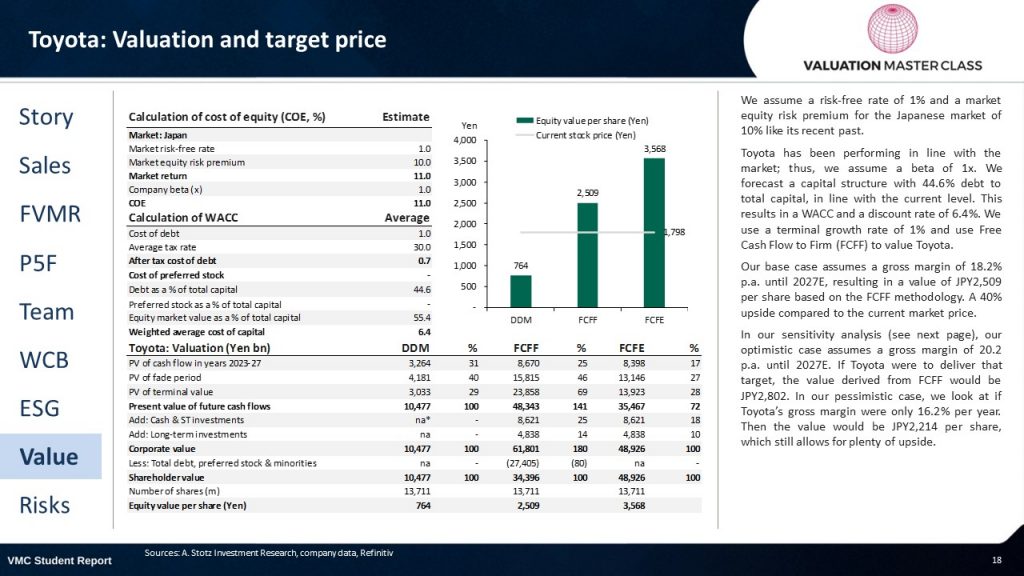

Valuation and target price

- We assume a risk-free rate of 1% and a market equity risk premium for the Japanese market of 10% like its recent past.

- Toyota has been performing in line with the market; thus, we assume a beta of 1x. We forecast a capital structure with 44.6% debt to total capital, in line with the current level. This results in a WACC and a discount rate of 6.4%. We use a terminal growth rate of 1% and use Free Cash Flow to Firm (FCFF) to value Toyota.

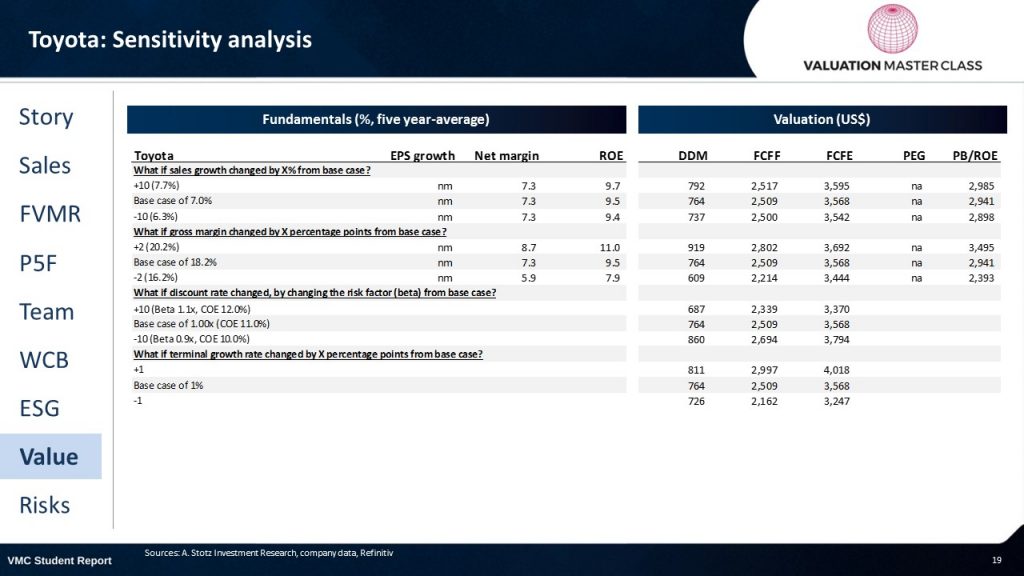

- Our base case assumes a gross margin of 18.2% p.a. until 2027E, resulting in a value of JPY2,509 per share based on the FCFF methodology. A 40% upside compared to the current market price.

- In our sensitivity analysis (see next page), our optimistic case assumes a gross margin of 20.2 p.a. until 2027E. If Toyota were to deliver that target, the value derived from FCFF would be JPY2,802. In our pessimistic case, we look at if Toyota’s gross margin were only 16.2% per year. Then the value would be JPY2,214 per share, which still allows for plenty of upside.

Sensitivity analysis

Get financial statements and assumptions in the full report

Main risk is the failure to adapt to the industry trends

Failure to adapt to the industry trends

We built our forecast around the fact that Toyota’s decision to delay the full shift to EVs is a wise decision and also around the fact that it would be successful in its endeavors toward hybrids, electric, and hydrogen fuel cars. Any sudden change in consumer preferences would hurt the company’s short-term results. Also, any failure in the production of its new hybrid, electric, or hydrogen fuel cars would hurt the automaker’s long-term results. Toyota recently offered to buy back its new electric SUV (BZ4X) from its owners because of a severe problem: the wheels could fall off while driving even after just a short time on the road! Anything like that would drag down our target price and affect the company’s position in the market.

Soaring raw material prices

Prices of raw materials such as cobalt, lithium, and nickel have surged. In May 2022, lithium prices were over seven times higher than at the start of 2021. Unprecedented battery demand and a lack of structural investment in new supply capacity are key factors. Russia’s invasion of Ukraine has created further pressure since Russia supplies 20% of global high-purity nickel. Also, China produces three-quarters of all lithium-ion batteries and is home to 70% of the production capacity for cathodes and 85% of the production capacity for anodes (both are key components of batteries), so if geopolitical tensions lasted long it would cause huge drops in the company’s margins and disruptions in its supply chain.

Concentration of suppliers

Automakers must rely on suppliers of cheaper raw materials to succeed in the automotive industry. But, Toyota depends on a limited number of suppliers, whose replacement with others may be difficult, exposing the company to a wide range of risks. Any loss of an important supplier or inability to obtain materials in a timely and cost-effective manner could lead to increased costs or delays in Toyota’s production and deliveries, which would hurt the company’s revenues and margins. Nonetheless, Toyota has managed to build great relationships with its suppliers which reduces the risk of losing them.

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.