Thailand Equity FVMR Snapshot: ‘Thailand in Your Hand—Every Week’

Watch the video with Andrew Stotz or read about how to use the Thailand Equity FMVR Snapshot below.

Thailand in Your Hand—Every Week

The Thailand Equity FVMR Snapshot uses the same format we first introduced with our Global Equity FVMR Snapshot.

When you sign up, every week you will receive our Thailand Equity FVMR Snapshot, you will always be up to date. You’re going to know all your numbers, as this one-page document covers Fundamentals, Valuation, Momentum, and Risk—our FVMR framework.

You’re going to be professional as this is the same information used by institutional investors and fund managers.

And here’s the best part: You do nothing because after signing up, you’re going to receive a one-page PDF every Monday with updated numbers.

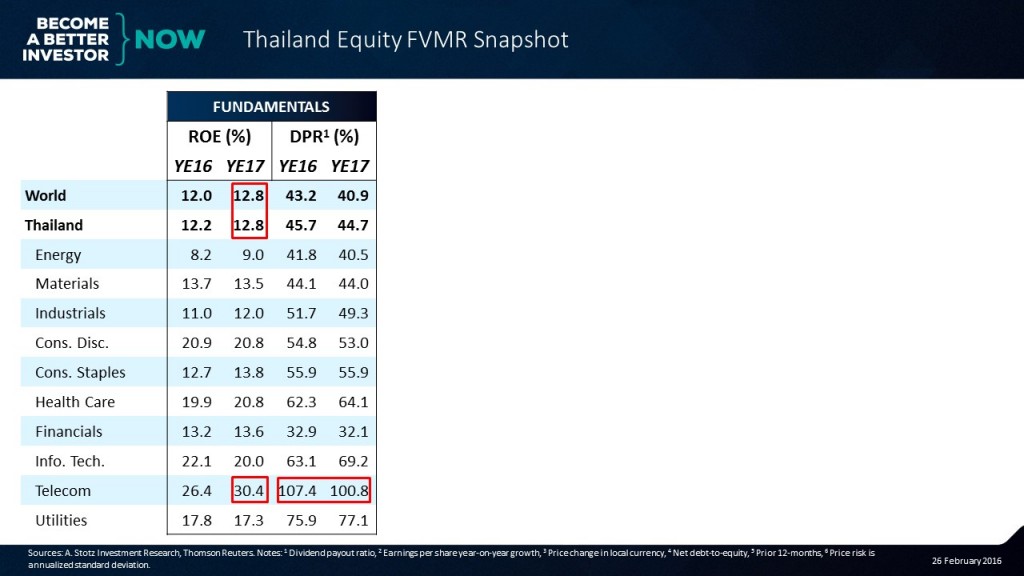

Fundamentals

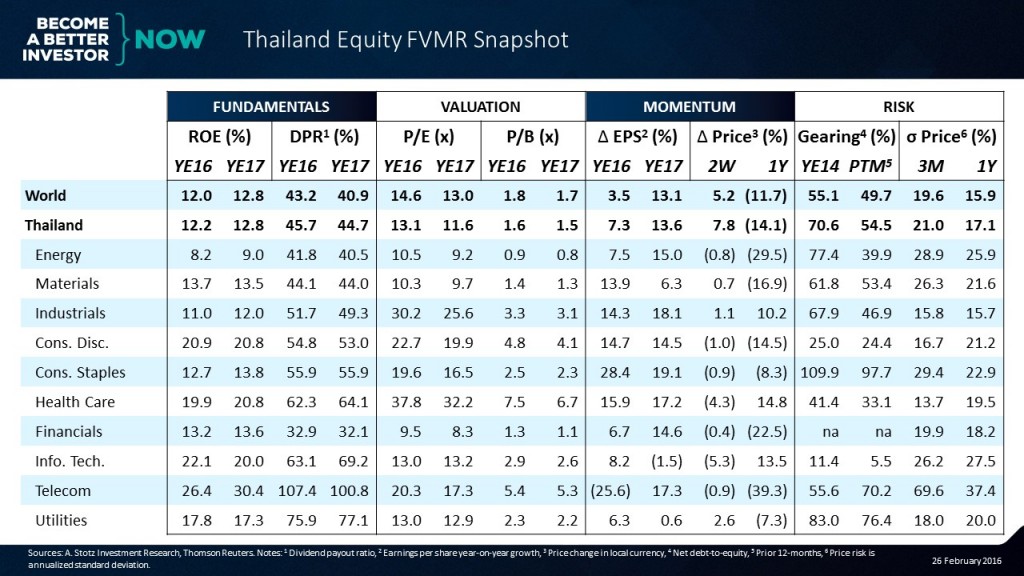

Let’s start with looking at fundamentals. When we look at Thailand, we can see that the profitability, return on equity, of Thailand is about in line with the rest of the world.

There are some sectors with very high profitability such as the telecom sector, and that’s even after the sector is paying out a massive dividend to restructure the balance sheet. In other words, they have way too much cash so they’re paying it out here.

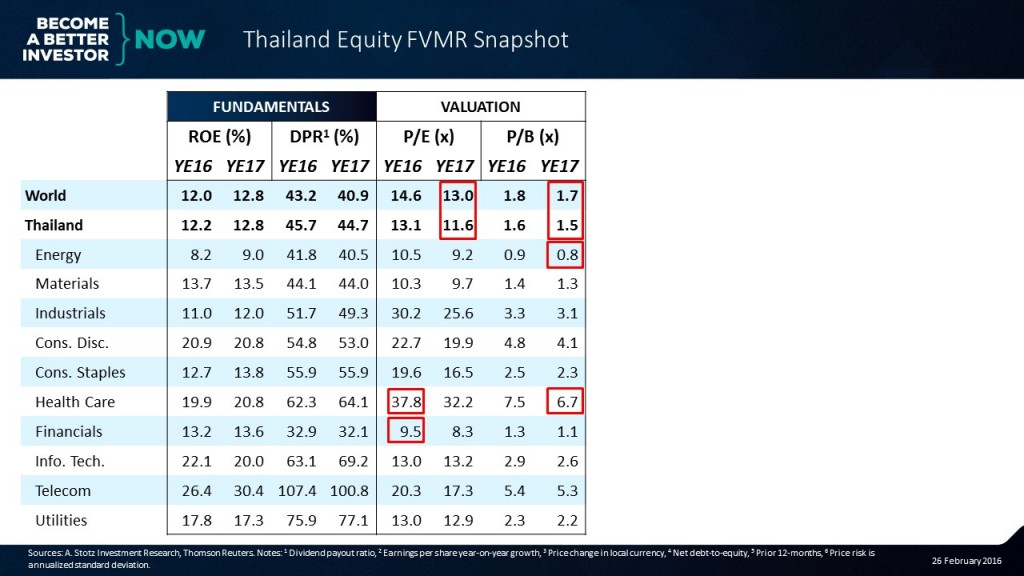

Valuation

If we look at the next measure which is valuation, we can get a picture that the Thai market is cheap relative to the rest of the world.

Thailand has been suffering for a while. The world has just really starting to suffer.

We can see that some sectors in Thailand are very expensive such as health care; some are very cheap such as banks although we know that around the world, banks don’t trade on very high P/E so 9.5x is not dirt cheap. Dirt-cheap banks are in other places in Asia right now.

If we look at price-to-book, we can see, again, slightly below the global average and some sectors such as energy are now trading below their book value.

What does that mean?

It means that you’re buying their current assets that are in place at a 20% discount to their value in the balance sheet. That also means that all future cash flows to this company are not accounted for in this valuation. You get them free.

Health care are very highly valued but they’ve been producing returns and growth for a while.

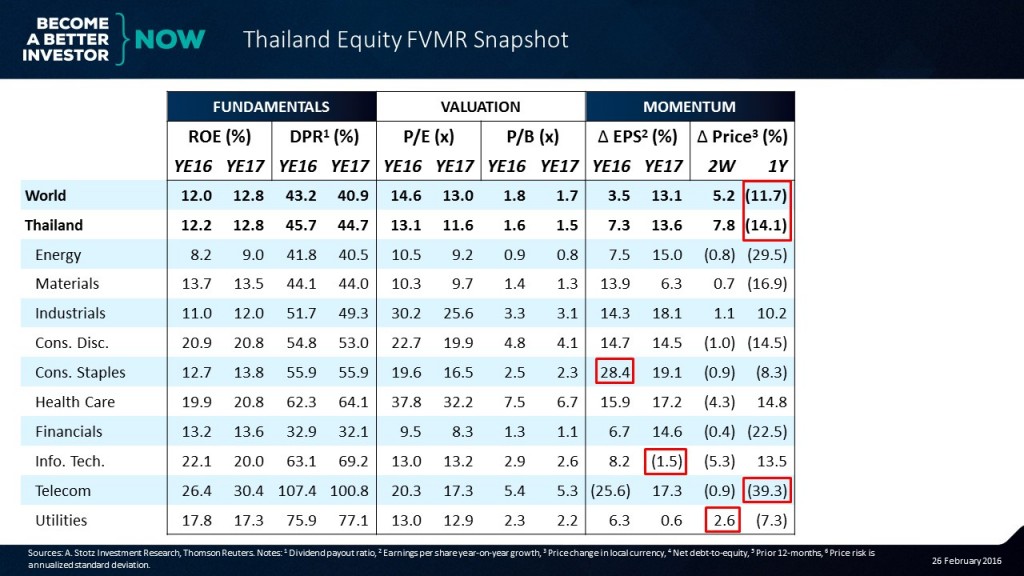

Momentum

If we look at the next element which is momentum, what we’re going to see is that the earnings momentum in the consumer staples companies’ is very high.

Why?

Because even though the economy has been bad in Thailand, these companies are selling staple products that people have to buy.

If we look at some of the other industries such as the information technology which is not as high tech as in other places in Asia, we’re starting to see analysts downgrading; and they’re looking for a negative earnings momentum in 2016.

Let’s move on to price and we can see that utilities companies have actually been up 2.6% in a rough time; and so, which shows that this is a very defensive sector in a tough market.

If we look at over the last year, the share price of Thailand has been down by 14% versus the rest of the world at 11.7%, so we’ve fallen a little bit more than the rest of the world. And some sectors—in this case, telecoms—have really collapsed.

Remember, we saw very high valuations in telecoms so it can be painful, sometimes, when stocks are really highly valued.

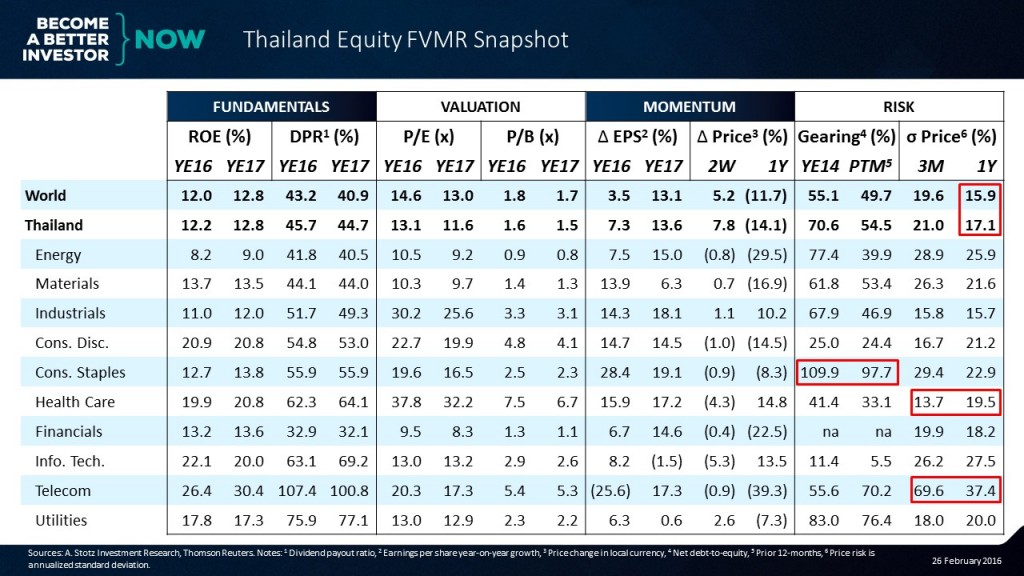

Risk

Lastly, let’s look at risk. We look at gearing or net debt-to-equity and price risk.

We can look at gearing and see that the consumer staple sector actually has a high level of gearing right now which is a warning sign from a risk perspective.

Finally, we look at price risk. We know that in general an individual market will have higher volatility than the world. We can see right here that Thailand is slightly higher at 17.1% versus 15.9% for the overall world for the last year which means that the share price hasn’t been that volatile. In fact, it has fallen pretty steadily.

We can look at some sectors such as telecoms where there has been a lot of volatility; and much of that volatility in price followed the recent 4G auctions in Thailand.

Thailand in Your Hand

With our Thailand Equity FVMR Snapshot, you’ll get a weekly update like the one below covering the Thai stock market.

You’re going to understand fundamentals, valuation, momentum, and risk, and the way we look at them.

After signing up, YOU will:

-

Always be up to date: Every week you will receive the updated Thailand Equity FVMR Snapshot

-

Know all the numbers: One page covers Fundamentals, Valuation, Momentum, and Risk (FVMR)

-

Be professional: Use the same information as institutional investors and fund managers

-

Not have to do anything else to stay informed: After signing up you will receive a one-page PDF every Monday

The Thailand Equity FVMR Snapshot is free for everyone signing up within a limited time period. Sign up now to not miss out on getting it for free.

NOTE: You’ll have to fill in the form below to receive the Thailand Equity FVMR Snapshot even if you’re already subscribing to other Equity FVMR Snapshots and/or is a founding member that get our newsletter.

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.