Summary of the Fed’s Moves to Avert a Collapse

Here’s a summary of the Fed’s moves to avert a collapse:

- Buy bonds of government, companies, states, and cities

- Cut interest rates to zero and keep them there for a long time

- Relax banking regulations to prevent bank collapse and to encourage lending

- Temporarily pay living expenses of citizens

- Provide dollar liquidity to other countries

The latest update from Chairman Powell on 16 September 2020:

- Zero to 0.25% interest rates until 2023

- 2023 is when they think inflation will be continuously above 2% (using their new average inflation methodology)

- Re-iterated that they are using the growth in consumption expenditures, not CPI

- Fed expects US 2020 GDP contraction of 3.7%, not the 6.5% that they forecasted in June

Now, let’s take a look at what the implications of the Fed’s moves could be.

Fed’s policy rate is likely to stay at zero for a long time to come. The government benefits as it pays less interest expense. Low, but not falling, nominal interest rate depresses bond yields, making bonds a less attractive investment.

The inflation target is changed to an average 2% approach. This allows inflation to rise without requiring the Fed to adjust nominal interest rates. Inflation overshooting might occur in the short run.

Normally, the Fed would respond to inflation by increasing the interest rate. But the Fed now has an average interest target. Gold price benefits from higher inflation, while the value of savings diminishes.

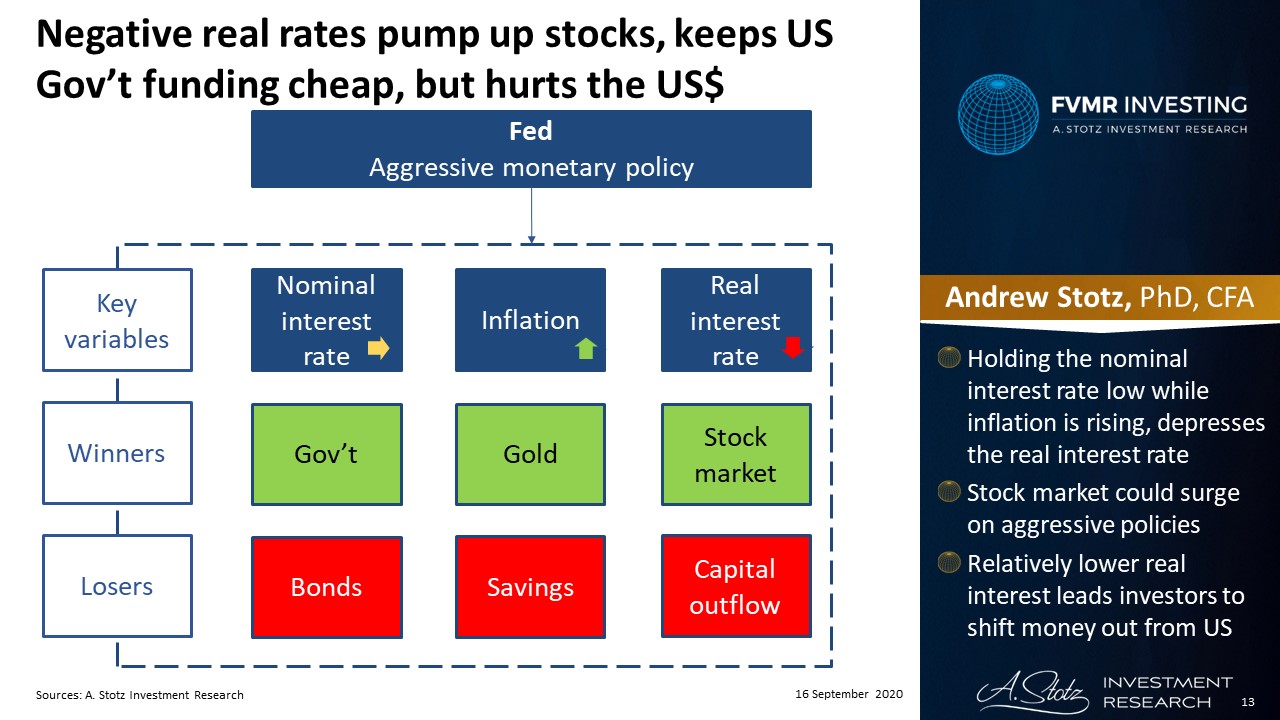

Holding the nominal interest rate low while inflation is rising depresses the real interest rate. The stock market could surge on aggressive policies. Relatively lower real interest leads investors to shift money out from the US.

Negative real rates pump up stocks, keeps US government funding cheap, but hurts the US dollar

Aggressive monetary policy has reduced the interest rate differential relative to other countries. Inflation puts additional pressure on the US dollar and depreciation of the US dollar is a likely outcome.

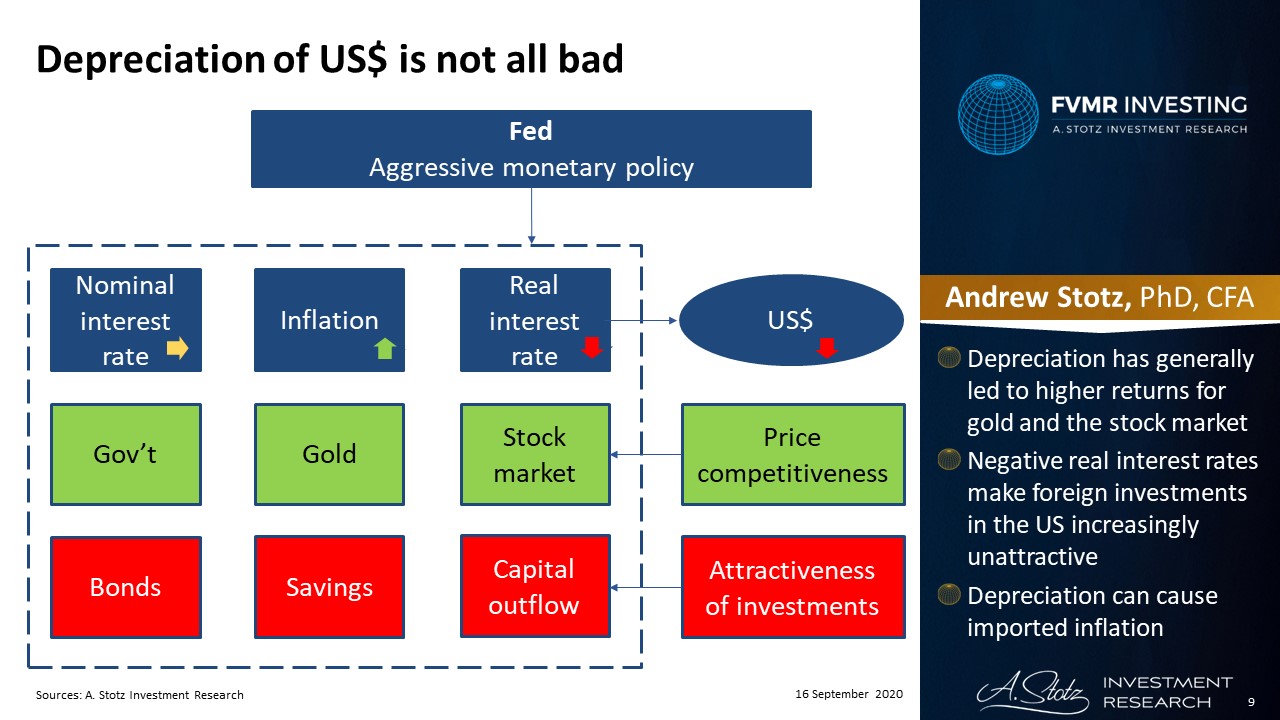

Depreciation has generally led to higher returns for gold and the stock market. Negative real interest rates make foreign investments in the US increasingly unattractive. Depreciation can cause imported inflation.

Depreciation of the US dollar is not all bad

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.