PT PP (Persero) Tbk, established in 1961, is an Indonesian state-owned enterprise mainly operating in five segments: Construction; EPC; Property; Precast and Equipment. In the past 12 months, Profitable Growth returned to the average rank.

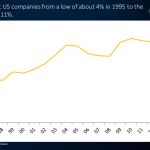

Read MoreOver the last few weeks, we have been considering the causes of the rising cash levels at US companies from a low of about 4% in 1995, to the currently very high 11%. Let’s have a look at what academia say about it.

Read MoreIn our Top 5 this week, we learn how not to invest, explore the curious world of micro caps, and find the ‘active’ in low-cost passive investing. All this and more…

Read MoreS P Setia’s core business, property development carries out residential projects such as Setia Sky Residences and commercial projects such as SetiaWalk. Profitable Growth saw a great improvement to #2 in 2015 but has fallen back to #4 in the past 12 months.

Read MoreInternational Container Terminal Services, Inc. (ICT), is an international operator of common user container terminals and serves the global container shipping industry. Profitable Growth for ICT has dropped to the average rank from #3 in 2013.

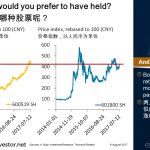

Read MoreChart of the Day: Two stocks returned the same, more than 300% in 3.5 years. The stocks had very different paths, but they both ended up yielding the same price return. Which stock would you prefer to have held?

Read MoreMK Restaurant Group Public Company Limited is a Thailand-based restaurant chain company. It franchises MK Suki (Japanese-style hot pot) restaurants in Japan, Vietnam, Indonesia and Singapore. MK outlets account for 80% of revenues and Yayoi restaurants account for 18% of revenues.

Read MoreIn our Top 5 this week, we look at how to avoid overpriced winners, discover the confidence trick the fund industry is playing, and explore Fundamental Investing. All this and more…

Read MoreDelta Electronics Public Company Limited is a Thai-based manufacturer and exporter of electronic components and power supplies. Profitable Growth has been in the green since 2013 but fell slightly to #2 from #1 in 2016.

Read MoreAgripure Holdings Public Company Limited is a Thai producer of sweet corn and other processed, vacuum-packed, canned and fresh vegetables. All of its vegetables are grown and processed locally at its owned or contracted farms, but most of its output is sold and marketed overseas under the brands, Tastee and River Kwai.

Read More