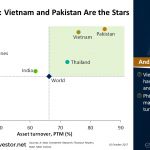

FVMR details of 5 select Asian markets: India appears expensive and poor momentum, Pakistan has strong fundamentals, the Philippines is unattractive, Thailand is neutral, and Vietnam looks attractive.

Read MoreFVMR review of 5 select Asian markets: Vietnam and Pakistan both have high net profit margin and asset turnover. The Philippines has high net margin, but lowest asset turnover.

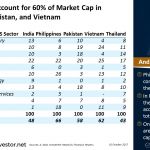

Read MoreThis post focuses on market basics of five select markets in Asia: India, Pakistan, Philippines, Thailand, and Vietnam.

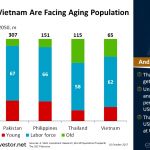

Read MoreChina has the largest labor force, however, India, Pakistan, and the Philippines have a large share of young dependents to join the labor force in the future. Thailand and Vietnam are getting old, but not rich.

Read MoreThis post focuses on economic and population basics of five select markets in Asia: India, Pakistan, Philippines, Thailand, and Vietnam.

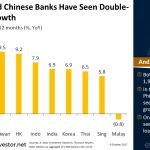

Read MoreChart of the Day: In the past 12 months, the Philippines and China have seen double-digit net loan growth. Only Malaysian banks have seen a decrease in net loans.

Read MoreIn our Top 5 this week, we explore Warren Buffett’s Dow 1 million prediction, look at investing approaches in a low-return market, and examine why private equity managers should be worried. All this and more…

Read MoreChart of the Day: Emerging Asia offers the highest EPS growth and a relatively cheap valuation. Developed Pacific, which includes Hong Kong and Singapore, offers the second highest growth and attractive valuation as well.

Read MoreChart of the Day: In 2016, the four largest stock markets accounted for 63% of the world market capitalization. 2017YTD the market cap in these four stock markets have seen double-digit growth.

Read MoreChart of the Day: Of the last three stock market rallies, this is the longest at 103 months. US CAPE moved from 13x to darn expensive at 30x. Rally was partially fuelled by near-zero interest rates.

Read More