Indonesia’s GDP has been growing at a rapid pace, 5% over the past year. Private consumption and investment have been the main contributors to GDP growth, while government consumption has been slightly reduced, despite the government’s big plans for infrastructure and energy investments over the next five years.

Read MoreIn our Top 5 this week, we discover the gray rhinos we all face, look at overcoming overconfidence bias, and examine the state of world debt. All this and more…

Read MoreOverall, Korea is the most attractive in Asia, driven by massive earnings growth and good price momentum. The “Korea discount” also remains, the market is still cheapest in Asia.

Read MoreChart of the Day: Info Tech is expected to grow the fastest in Asia, might be harder for US Tech giants to grow at 50%. Real Estate and Consumer Discretionary are contracting in the US but not in Asia.

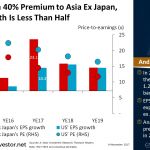

Read MoreChart of the Day: In 2015, US traded at 1.4x the Asia ex Japan PE, it narrowed to 1.25x in 2016, and then back to 1.4x in 2017. Analysts expect this 40% PE premium for US to persist in 2018-2019, do YOU?

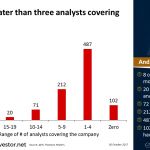

Read MoreChart of the Day: A review of the top 900 largest and most liquid companies in China. Even the group with zero coverage has an average USD2bn market cap and USD26m ADTO.

Read MoreIn our Top 5 this week, we discuss the future of active management, compare the same side of two coins, and examine the intangible nature of risk. All this and more…

Read MoreHow to Become Financially World Class, Part 5: Results at the top of the triangle are explained by the two items below. Profitable Growth is explained by the company’s rank against global peers on six different measures in total.

Read MoreHow to Become Financially World Class, Part 4: Compare to your nearest competitor? To other competitors in your country? To other companies in your region? To assure you are truly Financially World Class compare to global peers.

Read MoreHow to Become Financially World Class, Part 3: Why does Profitable Growth matter? We did a study to find out! High “Profitable Growth” companies generated 10X market return over the past 20 years.

Read More