Lessons Learned from the 1997 Asian Financial Crisis

Watch the video with Andrew Stotz or read a summary of it below.

What happened in the 1997 Asian Financial Crisis

Thailand was the epicenter of the 1997 Asian Financial Crisis. I had moved to Thailand in 1992, become a bank analyst in 1993 so I lived through the boom of that time.

Not only was I working as an analyst in an investment bank. I was also working on my side hustle of setting up our CoffeeWORKS coffee roasting factory in Bangkok with my best friend, Dale Lee.

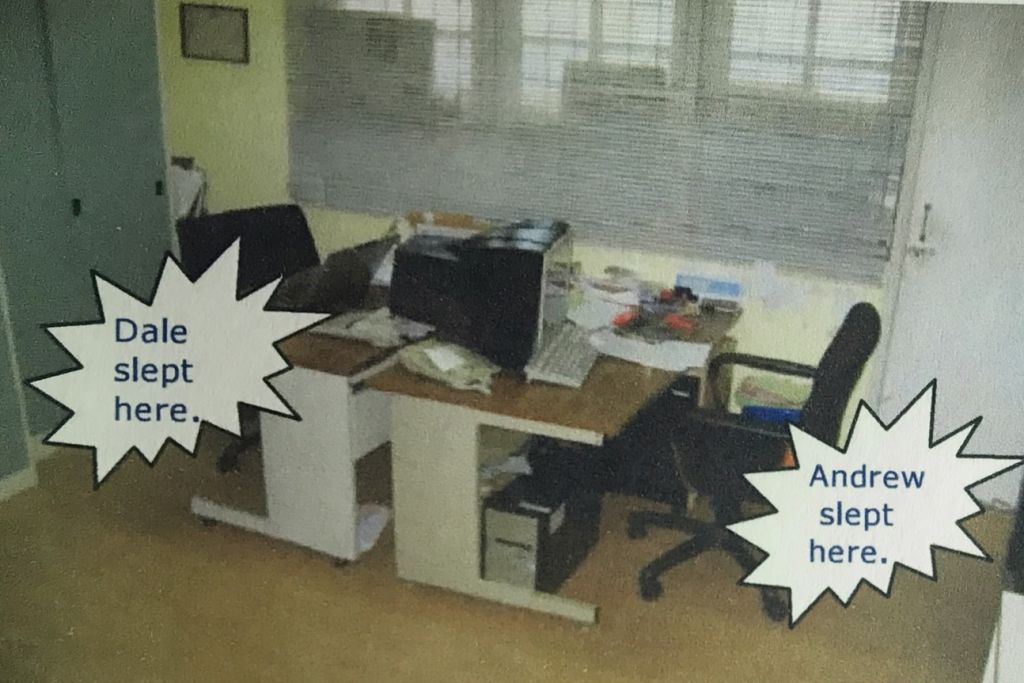

This was our factory 20 years ago

The 1997 Asian Financial Crisis was triply painful for me. I lost my job at Peregrine when the company went bust, we nearly lost our coffee business, and I lost my older sister in 1998. Definitely one of the lowest periods of my life.

From 1985 to 1995 was ten years of unstoppable growth. On 2 July 1997 the Thai government admitted that it ran out of reserves and that the baht would flow freely from its Bt25/US$ level. By the end of 1997 it was at Bt56.7/US$. In 1998 the Thai economy collapsed 11%. By 2001 the Stock Exchange of Thailand had fallen 88% to 211 (from its 1,789 peak in Jan 1993). Non-performing loans of the banking sector rose to a high of 55%.

Lessons learned from the 1997 Asian Financial Crisis

What follows are my random musings on what I learned from that experience. The downturn in the economy can last longer than you think. Accept this reality first.

Working harder may not bring in any additional revenue. People just don’t have the money to spend. Not understanding this can lead to unproductive stress for you and your team. The repayment of debt by overleveraged businesses and individuals takes years, decades.

The taxpayer ultimately pays

In a debt driven crisis such as the 1997 Asian Financial Crisis, indebted individuals and businesses inevitably default; this shifts the problem to the banks, which start going bust. Governments try to get the private sector to bear this, but this is usually not going to happen. Ask yourself, why did the US Gov’t double its total debt to US$20bn after the 2008 financial crisis?

Almost all financial crises start with the property sector, its boom and eventual bust. Why?

Because property is the ultimate collateral for loans. As a side note, continually rising property prices is a key element as to how China can, in the mid-term, avoid a financial crisis. Despite limits on deposit guarantees, political pressure usually demands that the government repays depositors of these bust banks or the whole social system collapses

Despite limits on deposit guarantees, political pressure usually demands that the government repays depositors of these bust banks or the whole social system collapses. Governments step in to deal with these bad debts (either through direct purchase or other methods).

Spending and losses by the government mount and then eventually the money is recovered through taxpayers (either directly, through slower economic growth, or through extremely low deposit rates for decades).

Here are some examples of ways that bad debts to be worked out. The government sets up a “bad bank” and moves bad assets of the banks there, allowing the banks to get on with their business of lending. This is usually done only with government-owned banks and was done it Thailand with the state-owned banks, such as Krung Thai Bank

Government encouragement of foreign banks to come and buy struggling banks. In Thailand, two examples were DBS’ purchase of Thai Danu Bank and Standard Chartered Bank’s (SCB) purchase of Nakornthon Bank Assist the private banks to offload their bad debts. In the case of DBS’ purchase of TDB the government did not take responsibility for the NPLs since TDB did not yet collapse.

For SCB’s acquisition of NTB the government gave some guarantees on the NPLs since NTB had already done to the government for help.

The taxpayer pays through these general methods

Direct taxes, allowing the banks to have exceptionally low deposits rates for a long time to recover their profits, charging surviving banks higher insurance fees (which the banks pass on to the taxpayer bundled with higher lending rates). In your own business, the ONLY thing you can immediately control is costs. Cut them deeper than you thought possible. Then cut them again!

The accounting office at CoffeeWORKS where we bunked

CoffeeWORKS today

Trust is the foundation of business

Companies trust each other that they will pay their bills. Banks trust companies that they will repay their borrowings. Equity investors trust boards and management that they will do their best job to make the most out of the money they invest. That trust is truly tested when things go bad.

Trust lasts a lifetime

Photo credit: Seed & Tell

Money does not bring happiness

Money does not bring happiness and the loss of nearly all of your wealth, though extremely painful, is not the end of the world. When you feel depressed, help other people, really get into their situation and help them out. Donating your time is much more powerful (to both the giver and receiver) than just giving money.

Pain is a partner of growth, the pain and struggles that I faced helped me to be a stronger and better person. The pain also forced me into action to solve my problem and to build a more diversified life and revenue stream.

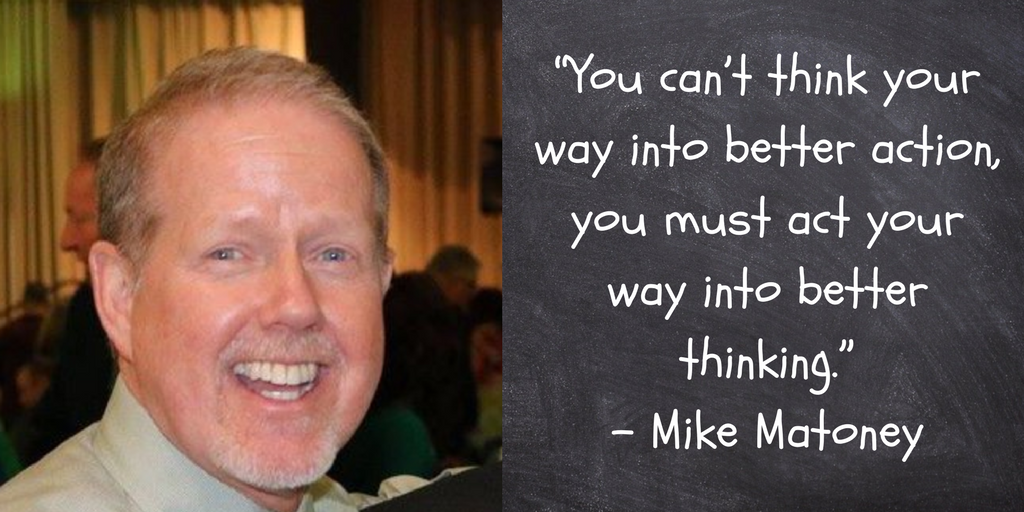

This brings me to my last life lesson; it is something that a man named Mike Matoney taught me in 1983 when I was just 17 and I really learned to put it into action after the 1997 Asian financial crisis. Mike said,

“You can’t think your way into better action, you must act your way into better thinking.”

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.