Become a Better Investor Newsletter – 24 February 2024

Noteworthy this week

- The top 10% is 75% of the market

- Market concentration got Druck out in 1987

- Investors remain bullish

- BoA says the market can run further

- 9.5 weeks to balance the government budget

The top 10% is 75% of the market: The top 10% of US stocks now account for 75% of the entire market. This is the highest concentration since the Great Depression in 1931. On average, the top 10% of stocks reflect 64% of the whole stock market.

The top 10% of stocks in the US now reflect ~75% of the entire market.

This is, by far, the most concentrated stock market since the Great Depression in 1931.

In the Dot-com bubble of 2001, concentration of the top 10% of stocks peaked at ~72%.

Even prior to the 2008 Financial… pic.twitter.com/75XWStLX4Y

— The Kobeissi Letter (@KobeissiLetter) February 21, 2024

Market concentration got Druck out in 1987: The excerpt shows that Stanley Druckenmiller shifted to bearish around the 1987 collapse because the market’s strength was concentrated in just a few stocks. Will this time be different?

Druckenmiller on 1987 collapse pic.twitter.com/Uf92Wmctox

— Don Johnson (@DonMiami3) October 28, 2023

Investors remain bullish: Goldman Sach’s client poll finds that bullish sentiment is at levels not seen since 2021, with 44% being slightly bullish or bullish. Euphoria?

It’s not just FMS: here is Goldman’s own client poll, it finds that bullish sentiment is at levels not seen since 2021 pic.twitter.com/CPKnrCRvpz

— zerohedge (@zerohedge) February 19, 2024

BoA says the market can run further: Bank of America chief strategist Michael Hartnett compares the current stock market run to previous bubbles, and based on that, there could be room for the market to run further.

If history is any indication, the current tech bubble still has room left to run according to Bank of America chief strategist Michael Hartnett pic.twitter.com/rP62g8K0Yu

— Barchart (@Barchart) February 20, 2024

9.5 weeks to balance the government budget: That’s how long it took President Javier Milei to balance Argentina’s government budget. Maybe some nations running at massive deficits should take note.

It took Libertarian President Javier Milei nine and a half weeks to balance the budget and create a surplus.

NINE. AND A HALF. WEEKS. pic.twitter.com/P3gIDn8XYW

— The Redheaded libertarian (@TRHLofficial) February 20, 2024

Join the world’s toughest valuation training

Become a Valuation Expert. Valuation Master Class Boot Camp graduates can confidently value any company in the world and possess in-demand industry skills.

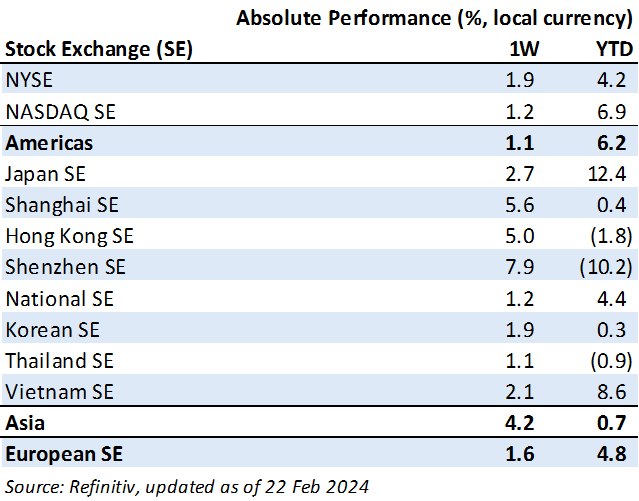

Weekly market performance

Click here to see more markets and periods.

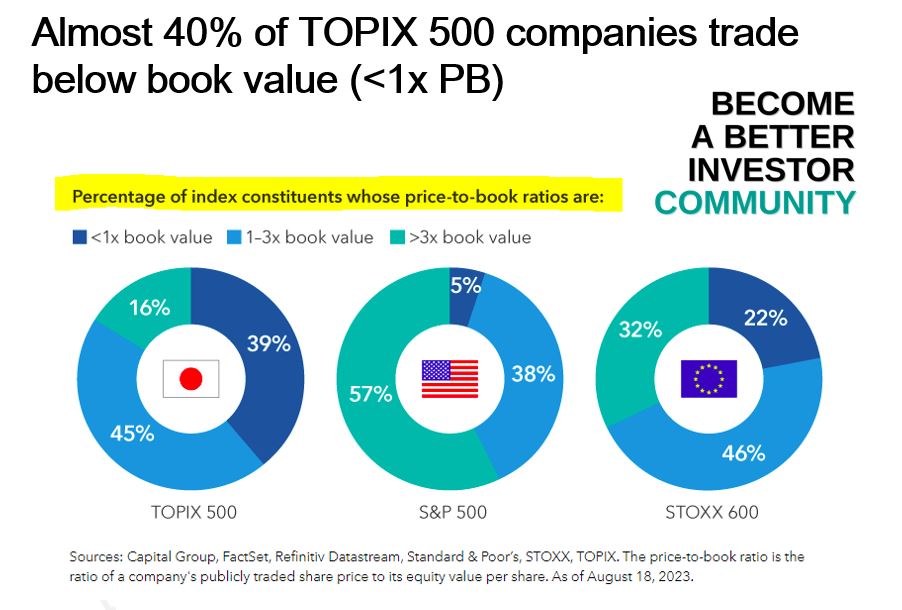

Chart of the week

Discussed in the Become a Better Investor Community this week

“We had an exciting discussion about how the stock exchange reform in Japan awakens the power of Capitalism.”

Try 1 month of the Become a Better Investor Community for FREE today!

You can cancel at any time. Click here to learn more.

Podcasts we listened to this week

Talkin Billions – EP. 70: Vishal Khandelwal: The Sketchbook of Wisdom, A Hand-Crafted Manual on the Pursuit of Wealth and Good Life

“Vishal Khandelwal is the founder of Safal Niveshak, an investor education initiative. He is an independent analyst and financial writer. He says that he spends 75% of his waking time reading.”

Talkin Billions – EP. 71: Christian Billinger: Investing a Family Fortune with the Soul in the Game

“His investment philosophy is focused on owning a small number of great businesses for the long run, and the structure of a private investment company is, in his view, the ideal environment for pursuing this style of investing.”

Readings this week

Failing Imperium

“Trade is the core of civilized life. As Sir William Ridgeway noted in 1892: ‘Amongst the lowest races of savages such as the aborigines of Australia, even barter is almost unknown. Each man makes his own stone implements from the greenstone which is everywhere in abundance, his own clubs and boomerangs, whilst Nature supplies all his other wants.’ Members of civilized society, by contrast, are not self-sufficient, participating instead in the division of labor and then trading their productions.”

Pods, Passive Flows, and Punters

“I’ve banged on about the market being a voting machine in the short term for years. I’ve tried considering about how long that short term actually is, and how it isn’t necessarily as short as many of us would like.”

Book recommendation

The End of the World is Just the Beginning: Mapping the Collapse of Globalization by Peter Zeihan

“For generations, everything has been getting faster, better, and cheaper. Finally, we reached the point that almost anything you could ever want could be sent to your home within days – even hours – of when you decided you wanted it. America made that happen, but now America has lost interest in keeping it going.”

Get the book on Audible or Kindle.

Audible is great; have you tried it? If not, click here to get 2 books for free.

Memes of the week

Retail investors coming to invest in chip manufacturers at the top of the market…pic.twitter.com/qackQxh65s

— Douglas A. Boneparth (@dougboneparth) February 20, 2024

Legendary! pic.twitter.com/9qniFK9h3z

— Not Jerome Powell (@alifarhat79) February 21, 2024

New My Worst Investment Ever episodes

Ep773: Coach JV – Diversify Inside and Outside the Asset Class

BIO: Coach JV believes that what you believe in your heart and what you think in your mind will eventually become your words and reality.

STORY: Coach JV was introduced to cryptocurrency and decided to invest without an exit plan. In just a year, his investment had fallen by 85%.

LEARNING: Diversify inside and outside the asset class. Pull out your money and play on the house money. When you make massive gains, take some profit.

Access the episode’s show notes and resources

Published on Become a Better Investor this week

Many businesses equate “manager” with “leader,” excluding potential leaders from across the organization. In this episode, Bill Bellows and host Andrew Stotz talk about leadership in Deming organizations – with a great story about senior “leaders” making a huge error in judgment at a conference of auditors.

Listen to Eliminate Management by Extremes: Awaken Your Inner Deming (Part 14)

In this episode of Investment Strategy Made Simple (ISMS), Andrew gets into part two of his discussion with Larry Swedroe: Ignorance is Bliss. Today, they discuss Larry’s recent piece, The Self-healing Mechanism of Risk Assets.

Read ISMS 38: Larry Swedroe – The Self-healing Mechanism of Risk Assets

Jinyu Bio-Technology Company Limited (600201 SH): Profitable Growth rank of 5 was up compared to the prior period’s 6th rank. This is average performance compared to 410 medium Health Care companies worldwide.

Read Jinyu Bio-Technology – World Class Benchmarking

StarHub Limited (STH SP): Profitable Growth rank of 7 was up compared to the prior period’s 9th rank. This is below average performance compared to 260 large Comm. Serv. companies worldwide.

Read StarHub – World Class Benchmarking

Matrix Concepts Holdings Berhad (MCH MK): Profitable Growth rank of 2 was same compared to the prior period’s 2nd rank. This is World Class performance compared to 310 medium Real Estate companies worldwide.

Read Matrix Concepts Holdings – World Class Benchmarking

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.