Become a Better Investor Newsletter – 17 June 2023

Noteworthy this week

- EU enters recession

- Inflation is coming down in the US

- Fed pauses rate hikes

- Only 24% of stocks outperform

- Tech is heading for new highs

EU enters recession: But, but Lagarde said it wouldn’t happen?! Time to quote John Kenneth Galbraith: “The only function of economic forecasting is to make astrology look respectable.”

https://t.co/DrfFBzgipf pic.twitter.com/PBnktbsUtW

— Sven Henrich (@NorthmanTrader) June 8, 2023

Inflation is coming down in the US: Has JPow broken the back of inflation? It currently appears so.

The US PPI suprised massively on the downside again today in the US..

PPI now hints that CPI is back below the target already before the end of summer…

PAUSE pic.twitter.com/jsphlkHKMc

— AndreasStenoLarsen (@AndreasSteno) June 14, 2023

Fed pauses rate hikes: In line with market expectations, JPow kept the target range unchanged at 5-5.25%. Though, he didn’t want this to be interpreted as an end to rate hikes.

Powell:

”We have actually paused but I am going to gaslight you with as much hawkish talk as I can so you don’t send Spooz to 4,600 and start trading JPEGs again”.

”Thank you for listening to my hawkish rant more than watching my actual pause”.

— Alf (@MacroAlf) June 14, 2023

Only 24% of stocks outperform: Over the last 20 years, only 24% of the S&P 500’s constituents outperformed the average stock. This reminds me of what Mauboussin says that as market participants get more skilled, the more important luck becomes.

Over the last 20 years, only 24% of the S&P 500’s constituents outperformed the average stock. Stock picking is hard because most stocks underperform and by not owning everything, you’re more likely to miss the big winners. Indexing wins. pic.twitter.com/mRDGFGXd5r

— Peter Mallouk (@PeterMallouk) June 14, 2023

Tech is heading for new highs: The AI hype has revived the Tech sector, which has fully recovered, and could soon see new ATHs.

The S&P tech sector ETF has rallied 48% from its October low and is now only 1% away from hitting a new all-time high. $XLK pic.twitter.com/0k6OonqSyo

— Charlie Bilello (@charliebilello) June 14, 2023

Join the world’s toughest valuation training

Become a Valuation Expert. Valuation Master Class Boot Camp graduates can confidently value any company in the world and possess in-demand industry skills.

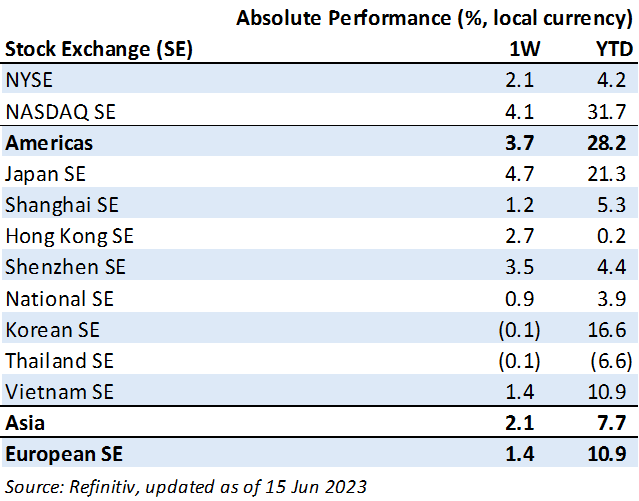

Weekly market performance

Click here to see more markets and periods.

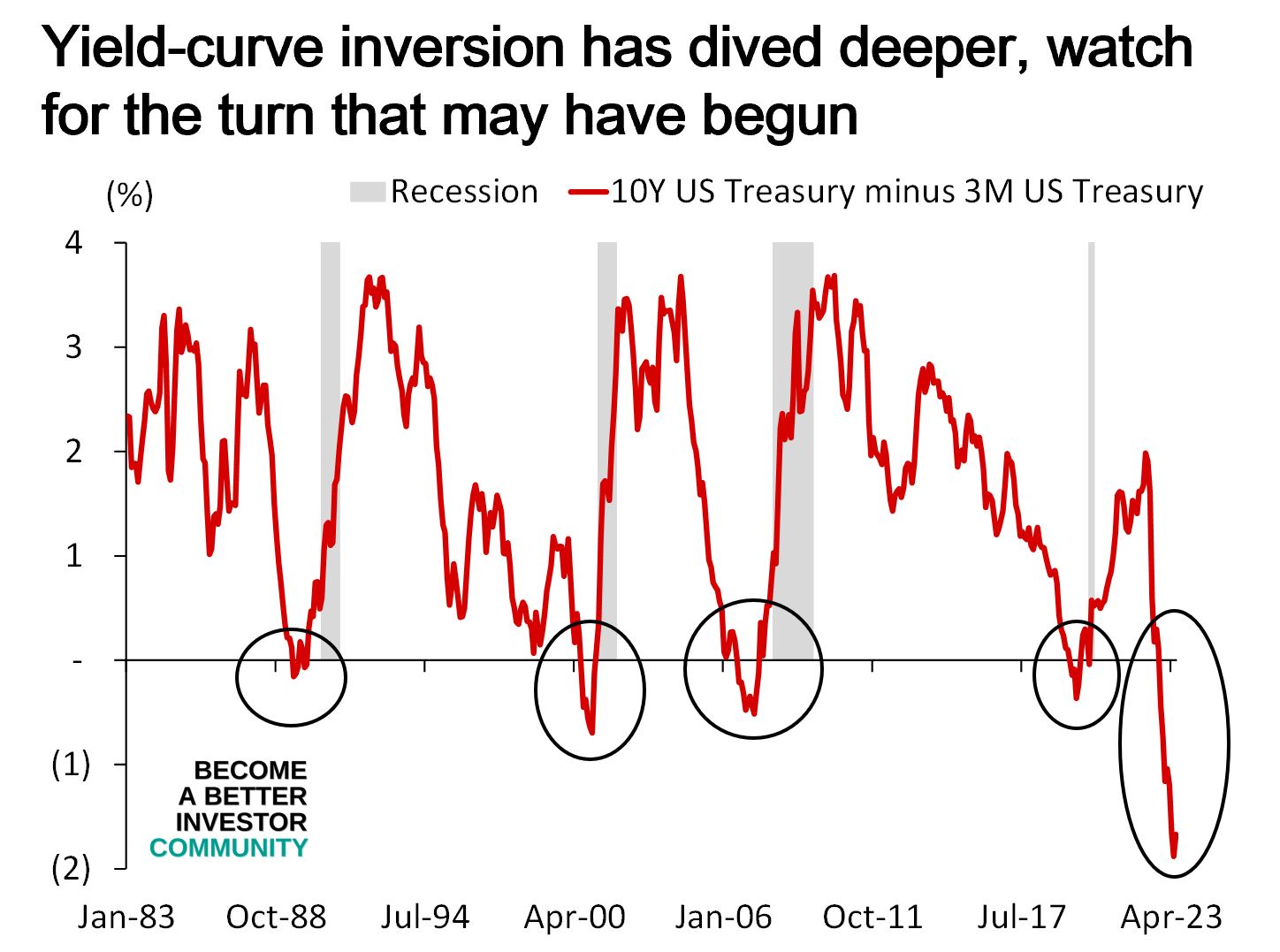

Chart of the week

Discussed in the Become a Better Investor Community this week

“Will we see a pause by the Fed tomorrow @channel? Have we reached the peak in rates already? Or do you think there will be further hikes?”

“No more hike but QT instead which might be more painful.”

Try 1 month of the Become a Better Investor Community for FREE today!

You can cancel at any time. Click here to learn more.

Podcasts we listened to this week

MacroVoices #379 Bill Blain: Inflation, Central Banks, BRICS, Geopolitics, Alternative Assets & more

“Inflation outlook. Geopolitics and trade. Consequences and implications of inflation. China and BRICS alliance. ‘Virtuous Sovereign Trinity.’ Artificial intelligence – where is it headed?”

Readings this week

Compounding Optimism

“Let me share a little theory I have about optimism, and why progress is so easy to underestimate.”

Book recommendation

The Lords of Easy Money: How the Federal Reserve Broke the American Economy by Christopher Leonard

“The Lords of Easy Money tells the shocking, riveting tale of how quantitative easing is imperiling the American economy through the story of the one man who tried to warn us. This will be the first inside story of how we really got here—and why we face a frightening future.”

Get the book on Audible or Kindle.

Audible is great; have you tried it? If not, click here to get 2 books for free.

Memes of the week

“Is the soft landing in the room with us right now, Jerome?” pic.twitter.com/ptXirrZGoU

— Chamath Palihapitiya’s burner (parody) (@ChamathWarriors) June 14, 2023

— Wall Street Memes (@wallstmemes) June 14, 2023

New My Worst Investment Ever episodes

ISMS 25: Larry Swedroe – Admit Your Mistakes and Don’t Listen to Fake Experts

In this episode of Investment Strategy Made Simple (ISMS), Andrew and Larry discuss two chapters of Larry’s book Investment Mistakes Even Smart Investors Make and How to Avoid Them. In this sixth episode, they talk about mistake number 9: Do you avoid admitting your investment mistakes? And mistake number 10: Do you pay attention to the experts?

LEARNING: You’ll only learn from mistakes if you admit that you made them. Just because someone is famous and confident in what they’re saying doesn’t mean they’re experts who know what they’re saying.

Access the episode’s show notes and resources

Ep699: Steven Wilkinson – Your Success Is 100% Dependent on You

BIO: Sir Steven Wilkinson is the founder and CEO of Good & Prosper and has been involved in business finance and investment for the best part of 30 years, having started working for Merrill Lynch Investment Bank in Munich, Germany, in 1987 at the age of 24.

STORY: Steven entered a successful partnership that saw them take a stock from 50 cents to 400 euros. They made so much money from their business, but the problem was Steve wasn’t ready for that kind of success. He had no system for dealing with the wealth he created and eventually lost all his money.

LEARNING: Being successful is 100% dependent on you. Working on yourself is the key to having whatever it is that you want to have.

Access the episode’s show notes and resources

Ep698: Shawn O’Malley – Geopolitics Can Take Your Investment to Zero

BIO: Shawn O’Malley is the chief editor and writer of the We Study Markets newsletter from The Investor’s Podcast Network, the world’s largest stock-investing podcast with over 110 million downloads.

STORY: Shawn wanted to hedge inflation during the COVID pandemic, so he invested in the Russian ETF at the end of 2021. The ETF performed well, and Shawn was happy. Then rumors of Russia invading Ukraine started. The invasion happened in February, and the Russian ETF stopped trading, taking Shawn’s investment to zero.

LEARNING: Understand how geopolitical events and domestic politics affect investments. You won’t be compensated for lack of knowledge.

Access the episode’s show notes and resources

Ep697: Peter Saddington – I Got Fired From My Own Company

BIO: Peter Saddington is a software developer, a multi-founder, an author, and a VC. He founded a $2.5M BTC mining fund, a $10M IoT fund, and a$50M Web3 fund in 2022.

STORY: Peter hired an engineer who had impeccable technical skills. Peter was so impressed by the guy that he decided to make him the CEO of his startup. Six months later, the guy fired Peter from his own company.

LEARNING: It takes more than technical skills to be a leader. A leader needs to be a person that can be led and can lead others.

Access the episode’s show notes and resources

Published on Become a Better Investor this week

In this episode, Bill and Andrew discuss variation, the impossibility of true interchangeability and why we need to apply “shades of gray” thinking at work. Bill shares the key question that will take your organization beyond “meets specifications” and help improve your processes, so you can delight your customers.

Listen to Why Variation Matters: Awaken Your Inner Deming (Part 3)

What’s interesting about Toyota is that if you buy today, you get its future growth for free

Read Toyota vs. EV Extremists – Who is right?

Anhui Xinhua Media Company Limited (601801 SH): Profitable Growth rank of 6 was same compared to the prior period’s 6th rank. This is below average performance compared to 960 large Cons. Disc. companies worldwide.

Read Anhui Xinhua Media – World Class Benchmarking

Central banks’ aggressive rate hikes and QT crash the stock markets. If inflation reaccelerates, we could miss out on rising commodities prices. Our high gold allocation could get hit by higher rates or improved market sentiment.

Read A. Stotz All Weather Strategies – May 2023

Spark New Zealand Limited (SPK NZ): Profitable Growth rank of 1 was up compared to the prior period’s 2nd rank. This is World Class performance compared to 260 large Comm. Serv. companies worldwide.

Read Spark New Zealand – World Class Benchmarking

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.