Become a Better Investor Newsletter – 17 December 2022

Noteworthy this week

- US inflation was “only” at 7.1%

- Seems like the CPI numbers were leaked

- It’s worth keeping an eye on Real Estate

- EIA forecasts solar power to be no. 1 by 2027

- Vanguard is getting out of climate alliance

US inflation was “only” at 7.1%: The YoY CPI measure came in below consensus, leading to asset prices shooting up. Fed then delivered a 0.5% hike as expected. This bear market isn’t over.

US #inflation undershot St consensus for Nov, w/headline +7.1% YoY (down from +7.7% in prior month & below St’s +7.3% forecast) and core +6% (down from +6.3% in the prior month and below the St’s +6.1% forecast). Stocks & bonds rally w/US 10y yields down 14bps, 2y ylds down 15bps pic.twitter.com/pV2gvfbEci

— Holger Zschaepitz (@Schuldensuehner) December 13, 2022

Seems like the CPI numbers were leaked: Of course, this was denied. But if you click below and check the thread, you can see some strange behavior in treasuries about an hour before the CPI release.

“I can tell you definitively, or at least I am not aware of any leaks.”

LOL. Nice to know that the non-denial denial is still a thing. https://t.co/jruOMrDAZ0

— Ben Hunt (@EpsilonTheory) December 14, 2022

It’s worth keeping an eye on Real Estate: Given it is the largest asset class by far, any substantial issues in the Real Estate market can have massive knock-on effects.

A gentle reminder that the biggest asset class in the world is not bonds or equities.

It’s real estate.

And by far.

Watch it closely, guys. pic.twitter.com/lm2hyyb45Y

— Alf (@MacroAlf) December 12, 2022

EIA forecasts solar power to be no. 1 by 2027: If these forecasts turn out to be correct, the green transition will continue at rapid speed. As the tweeter notes, interesting that they haven’t included nuclear.

This is a powerful chart.

In a few years, solar PV will be the biggest generation technology in terms of installed capacity, the IEA predicts.

(The IEA seems to have forgotten nuclear. It’s below 400 GW and will hardly grow in the years to come.) pic.twitter.com/unAQ7by7aV

— Lion Hirth (@LionHirth) December 7, 2022

Vanguard is getting out of climate alliance: Let’s see what they do instead, but it could be a step in the right direction for getting away from the woke ESG movement.

WOW! We just talked about this “shift” in my spaces today…

Vanguard quits net zero climate alliancehttps://t.co/FdKus39Cqz pic.twitter.com/c2UrmB72HV

— Tracy (𝒞𝒽𝒾 ) (@chigrl) December 7, 2022

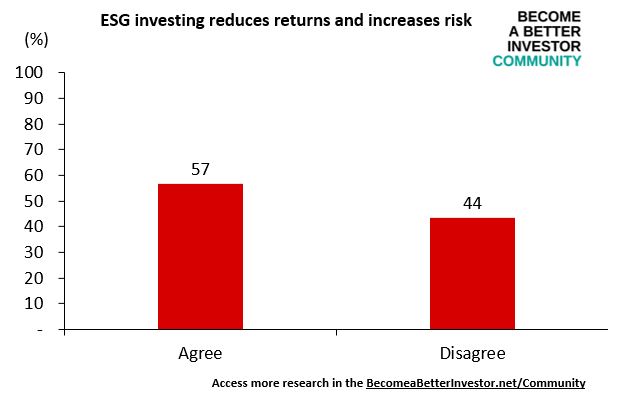

Results from last week’s poll

Join the world’s toughest valuation training

The Valuation Master Class Boot Camp is a 6-week intensive company valuation boot camp for a successful career in finance.

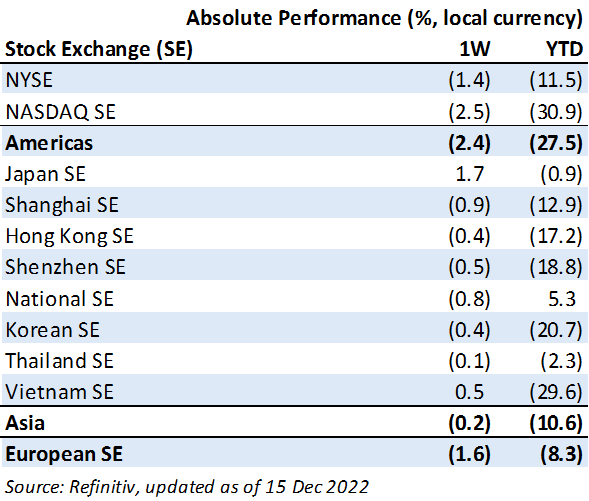

Weekly market performance

Click here to see more markets and periods.

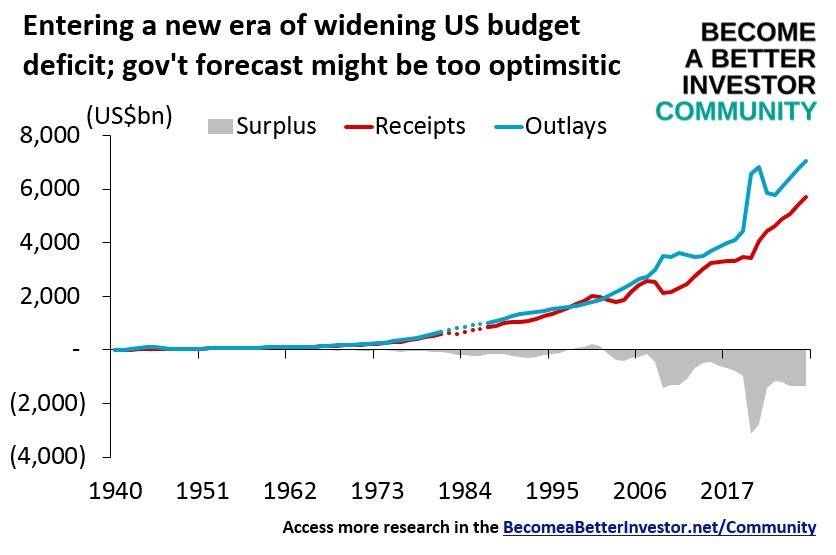

Chart of the week

Discussed in the Become a Better Investor Community this week

“US inflation undershot consensus. Everything up. More noise than signal, though is my guess.”

“andrew: Here’s an interesting map I have created for the strategy piece we are working on.”

Join the Become a Better Investor Community today! You can cancel any time, and as a newsletter reader you get a massive discount when you use this coupon code: READER

Podcasts we listened to this week

Sea Change – The Memo by Howard Marks

“In his latest memo, Howard Marks writes that the investment world may be experiencing the third major sea change of the last 50 years. Events in recent years – especially the spike in inflation and the Federal Reserve’s response – appear to have caused a reversal of the market conditions that prevailed after the Global Financial Crisis and for much of the last four decades. Howard discusses what this potentially new era could mean for lenders, especially bargain hunters.”

Readings this week

Myth-Busting: Alts’ Uncorrelated Returns Diversify Portfolios

“Correlations are the hallmark of alternative investments. Generating uncorrelated returns in a year when the traditional 60/40 equity-bond portfolio has posted double digit losses is a quick way to capture investor interest and capital. However, correlations are like icebergs floating in the sea, there is a lot hiding beneath the surface.

So just what are the pitfalls of using correlations to choose alternative strategies?”

ESG Ratings Uncovered – What Wall Street Doesn’t Want You to Know

- Financially material ESG ratings impact the vast majority of ESG Equity ETFs.

- ESG ratings are NOT about protecting the planet.

- ESG ratings are about protecting the companies’ profits and enterprise value.

- For example, protecting companies’ Real Estate from Environmental risks like floods or hurricanes has a high impact on their ESG ratings.

- Failing to protect communities and biodiversity or releasing toxins that are not subject to regulations or fines may not negatively impact ESG ratings.

- A company that harms the Environment but is financially protected against it, for example, by taking insurance, may still have high ESG Ratings.

Book recommendation

Richer, Wiser, Happier: How the World’s Greatest Investors Win in Markets and Life by William Green

One of the best investment books out there.

“In Richer, Wiser, Happier, William Green draws on interviews that he’s conducted over twenty-five years with many of the world’s greatest investors. As he discovered, their talents extend well beyond the financial realm.”

Audible is great; have you tried it? If not, click here to get 2 books for free.

Memes of the week

The best meme I have seen on the recession priced in or not debate 😂 pic.twitter.com/pcLrhWS3zT

— AndreasStenoLarsen (@AndreasSteno) December 12, 2022

Name this album pic.twitter.com/341egt8W1N

— litquidity (@litcapital) December 14, 2022

New My Worst Investment Ever episodes

Ep632: Anna Rosling Rönnlund – You Don’t Always Have to Buy a Home

BIO: Anna Rosling Rönnlund is a Swedish designer who, with her husband Ola Rosling, developed Trendalyzer, interactive software for visualizing statistical information.

STORY: Anna and her husband bought a home after moving to the US. A while later, they had to move back to Sweden, so they decided to sell the house. This was during the financial crisis that hit the real estate market badly. So the couple lost a lot of money after the sale.

LEARNING: Keep your costs low. You don’t always have to buy a home.

Access the episode’s show notes and resources

Ep631: Susan Frew – Trust but Verify All Your Employees

BIO: Susan Frew is a renowned entertaining, and value-driven speaker and thought leader. She has coached hundreds of companies and non-profits to great success.

STORY: Susan left an unsupervised employee in charge of her coaching practice. This employee left her with a million dollars in debt.

LEARNING: Trust but verify every single employee. Get on-time and accurate monthly financial statements. Put in place metrics of accountability.

Access the episode’s show notes and resources

Ep630: Ridhi Bahl – Your Health Is More Important Than Wealth

BIO: Ridhi Bahl is a leading Astrologer in India with a Ph.D. in Astrology and Vastu.

STORY: It wasn’t until Ridhi was found to have an ovarian tumor that she started taking her health seriously.

LEARNING: Health is your biggest and best investment. If one door closes, another opens. Don’t let self-pity get out of hand.

Access the episode’s show notes and resources

Published on Become a Better Investor this week

In this episode, David and Andrew discuss going beyond solving problems in schools to preventing them from happening. David also shares a tool for finding the area where optimization of the system would have the greatest impact.

Listen to Optimization of a System: Deming in Education with David P. Langford (Part 7)

PT AKR Corporindo Tbk (AKRA IJ): Profitable Growth rank of 3 was up compared to the prior period’s 4th rank. This is above average performance compared to 1,590 large Industrials companies worldwide.

Read AKR Corporindo – World Class Benchmarking

Central bankers appear to be raising rates into a recession to stifle inflation; stagflation would be the worst outcome. Demand for necessities (food and energy), inflation, and supply-chain disruptions can drive commodities higher. Bonds and gold to protect capital.

Read A. Stotz All Weather Strategies – November 2022

Banpu Public Company Limited (BANPU TB): Profitable Growth rank of 3 was up compared to the prior period’s 6th rank. This is above-average performance compared to 320 large Energy companies worldwide.

Read Banpu – World Class Benchmarking

Central Pattana Public Company Limited (CPN TB): Profitable Growth rank of 5 was same compared to the prior period’s 5th rank. This is average performance compared to 230 large Real Estate companies worldwide.

Read Central Pattana – World Class Benchmarking

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.