Become a Better Investor Newsletter – 15 June 2024

Noteworthy this week

- Fed keeps rate unchanged

- Invest like the US Congress

- India appears pretty expensive

- The Canadian real estate bubble

- Flying is back

Fed keeps rate unchanged: The Federal Reserve keeps the policy rate unchanged at 5.25%-5.50%. New dot plots show one rate cut in 2024 (earlier this year, it was three).

BREAKING! The #FederalReserve keeps rates unchanged at 5.25%-5.50%.

New dots show ONE rate cut in 2024 (was three)

New dots show FOUR rate cuts in 2025 (was three) pic.twitter.com/vbwgSvlkHK— jeroen blokland (@jsblokland) June 12, 2024

Invest like the US Congress: Tuttle Capital just filed for a Congressional Trading ETF $NPEL. The ETF will invest in the stocks that sitting members of US Congress and/or their spouses have reported owning through public disclosure filings. The ticker $NPEL refers to the no.1 trader in Congress, Nancy Pelosi.

JUST IN: Tuttle Capital just filed for a Congressional Trading ETF $NPEL

The ETF will invest in the stocks that sitting members of 🇺🇸 Congress and/or their spouses have reported owning through public disclosure filings – Bloomberg pic.twitter.com/wPoBwhJtsa

— Evan (@StockMKTNewz) June 11, 2024

India appears pretty expensive: Looking at a 12-month forward PE, India is trading at a massive premium to other peers, particularly in Emerging Markets and Asia ex Japan.

You’ve probably heard “India is expensive”. Just how much more expensive, see below

Trading at a massive premium to other peers, particularly in EM and Asia Pac. Comparatively to China, it’s trading at 130% premium to MSCI China (based on 12-month forward P/E) pic.twitter.com/PEEqlLSOaO

— David Ingles (@DavidInglesTV) June 10, 2024

The Canadian real estate bubble: In the 1990s, Japan’s massive real estate bubble popped, and it still hasn’t recovered. It’s known as one of the largest real estate bubbles ever. Canada is the orange line. It’s literally twice as big.

In the 1990s, Japan’s massive real estate bubble popped and it still hasn’t recovered.

It’s known as one of the largest real estate bubbles ever.

Canada is the orange line.

It’s literally twice as big. pic.twitter.com/2H15JVeN3K

— red pill rick (@igetredpilled) June 12, 2024

Flying is back: International travel is set to see the biggest surge. International flights from Asia should climb by 23%, but there are substantial gains almost everywhere. Guess people aren’t feeling Greta’s flight shame after all.

Flying is back

International travel is set to see the biggest surge. That’ll grow by 9.7% this year with huge increases in Asia, Europe and North America. International flights from Asia should climb by 23% but there are substantial gains almost everywhere. -Bloomberg pic.twitter.com/62gIysO7ic

— Tracy (𝒞𝒽𝒾 ) (@chigrl) June 10, 2024

Join the world’s toughest valuation training

Become a Valuation Expert. Valuation Master Class Boot Camp graduates can confidently value any company in the world and possess in-demand industry skills.

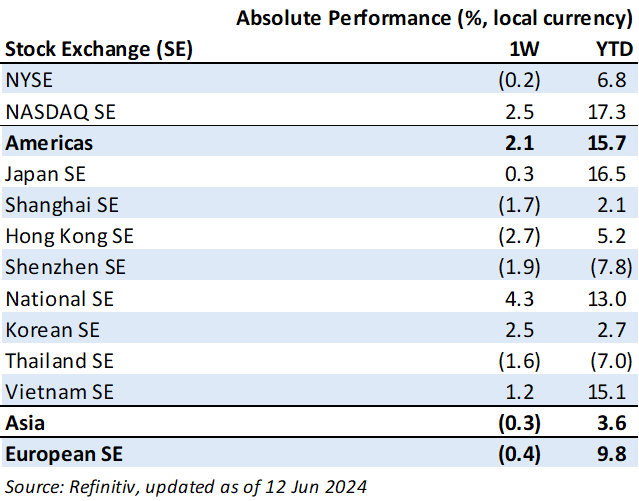

Weekly market performance

Click here to see more markets and periods.

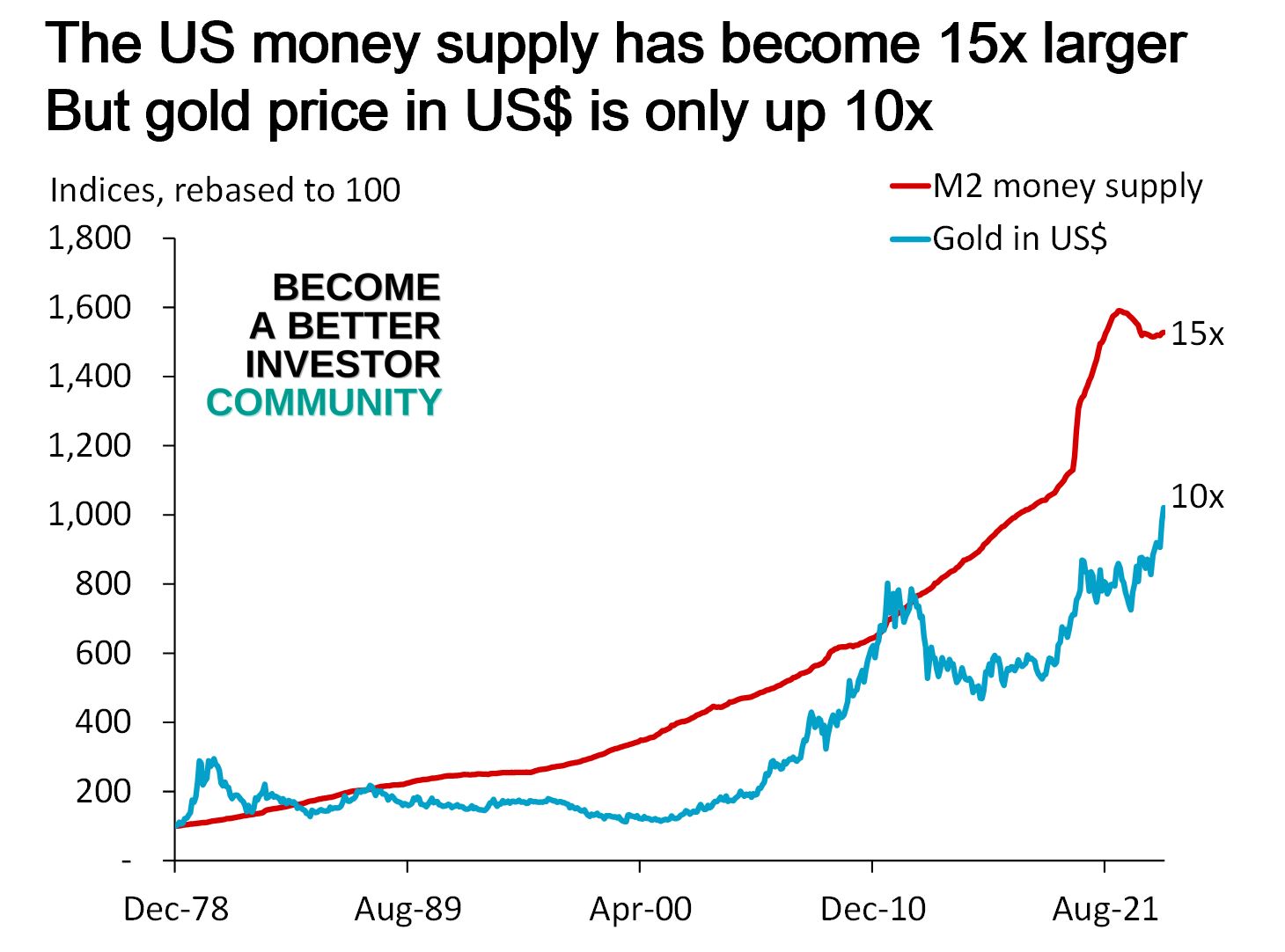

Chart of the week

Discussed in the Become a Better Investor Community this week

“A good summary of the EU parliament election.”

Try 1 month of the Become a Better Investor Community for FREE today!

You can cancel at any time. Click here to learn more.

Podcasts we listened to this week

New Money Review podcast – How the Stoics viewed money

“The Stoic philosophers said we should manage our emotions when it comes to money and wealth. But is this a realistic goal? How can we resist the siren call of riches? How can we persevere and stay positive through tough economic times?”

Readings this week

Financial Statement Analysis with Large Language Models

“University of Chicago published a paper of a study comparing the accuracy of financial estimates & stock picking performance of Equity Analysts vs Large Language Models. The conclusion is at first shocking as the study shows LLMs are better than Human Analysts even with no industry background/context.”

Book recommendation

Right Thing, Right Now: Good Values. Good Character. Good Deeds. by Ryan Holiday

“If we do what is right, everything else will follow: happiness, success, meaning, reputation, love. This is central to Stoic wisdom. The path isn’t always easy, but it is essential, and the alternative – taking the easy route – leads only to cowardice and folly.”

Get the book on Audible or Kindle.

Audible is great; have you tried it? If not, click here to get 2 books for free.

Memes of the week

🎯🎯🎯 pic.twitter.com/xNSiw7kybf

— Not Jerome Powell (@alifarhat79) June 7, 2024

POWELL: “I DONT THINK ANYONE KNOWS WHY PEOPLE AREN’T HAPPY ABOUT THE ECONOMY”

Americans: pic.twitter.com/6rHmVKuloO

— Geiger Capital (@Geiger_Capital) June 12, 2024

New My Worst Investment Ever episodes

Ep787: Rizwan Memon – Have Enough Liquidity When Shorting Naked Calls

BIO: Rizwan Memon is the Founder and President of Riz International, a Canada-based financial education firm that helps thousands worldwide maximize their financial success through trading.

STORY: Rizwan shorted GameStop’s stock, believing the price wouldn’t exceed $300. However, when Elon Musk tweeted about GameStop, the price increased to $500. Rizwan suffered a $160,000 loss on a single trade.

LEARNING: When shorting naked calls, make sure you have enough liquidity. Control the amount of money you bet on any particular position. Don’t trade on emotions.

Access the episode’s show notes and resources

Published on Become a Better Investor this week

In this episode of Enrich Your Future, Andrew and Larry Swedroe discuss Larry’s new book, Enrich Your Future: The Keys to Successful Investing. In this series, they discuss Chapter 01: The Determinants of the Risk and Return of Stocks and Bonds.

Listen to Enrich Your Future 01: The Determinants of the Risk and Return of Stocks and Bonds

Hubei Jumpcan Pharmaceutical Company Limited (600566 SH): Profitable Growth rank of 1 was same compared to the prior period’s 1st rank. This is World Class performance compared to 360 large Health Care companies worldwide.

Read Hubei Jumpcan Pharmaceutical – World Class Benchmarking

Nvidia Corporation (NVDA US): Profitable Growth rank of 1 was up compared to the prior period’s 2nd rank. This is World Class performance compared to 630 large Info Tech companies worldwide.

Read Nvidia Corp – World Class Benchmarking

Unilever PLC (ULVR LN): Profitable Growth rank of 3 was down compared to the prior period’s 2nd rank. This is above average performance compared to 550 large Cons. Staples companies worldwide.

Read Unilever – World Class Benchmarking

Strong stock rebound led by US and Developed Europe. Performance review of our strategies in May 2024 – All Weather Inflation Guard gained 1.2%, All Weather Strategy gained 1.6%, All Weather Alpha Focus gained 1.3%.

Read A. Stotz All Weather Strategies – May 2024

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.