Become a Better Investor Newsletter – 13 April 2024

Noteworthy this week

- US CPI higher than expected

- Yen records a 34-year low against US$

- Tech sits on loads of cash

- Go green, go nuclear

- Work brings meaning

US CPI higher than expected: CPI came in at 3.5% YoY, while the expectation was 3.4%, and core CPI came in at 3.8% YoY, while the expectation was 3.7%. Fed might keep rates high for longer.

CPI 0.4% MoM, Exp. 0.3%

CPI Core 0.4% MoM, Exp. 0.3%CPI 3.5% YoY, Exp. 3.4%

CPI Core 3.8% YoY, Exp. 3.7%— zerohedge (@zerohedge) April 10, 2024

Yen records a 34-year low against US$: Japanese Yen plummetted to a 34-year low against the US$ at >153 Yen/US$. Will BoJ intervene?

BREAKING 🚨: Japanese Yen

Japanese Yen plummets to a 34-year low against the U.S. Dollar pic.twitter.com/98Zgl0xrbL

— Barchart (@Barchart) April 10, 2024

Tech sits on loads of cash: These 6 US Tech companies sit on US$274bn in cash after paying back all debt. That’s almost as much as Finland’s GDP. If Google’s cash holding were a country’s GDP, it would rank as the 69th largest in the world.

Total Cash Net of Debt…

Google $GOOGL: $98 billion

Apple $AAPL: $65 billion

Meta $META: $47 billion

Amazon $AMZN: $28 billion

Microsoft $MSFT: $20 billion

Nvidia $NVDA: $16 billion pic.twitter.com/mb0It07Y87— Charlie Bilello (@charliebilello) April 9, 2024

Go green, go nuclear: France shows a good example of why nuclear power is the best-known way to greener energy. Hopefully, the rest of the West will realize this at some point.

Who would have thought that France switching to nuclear power was the fastest and most efficient way to fight climate change.

German ideological decision to close its nuclear power plants is the dumbest environmental, geopolitical and economical decision since WWII. pic.twitter.com/zRQXxt66qT

— Michael A. Arouet (@MichaelAArouet) April 5, 2024

Work brings meaning: Work is one of life’s most significant sources of meaning worldwide. Those with higher incomes and education tend to find more meaning at work. Retirement is seldom mentioned as a source of meaning.

Work is one of the most significant sources of meaning in life around the world.

Those with higher incomes and higher educational levels tend to find more meaning at work.

Retirement is seldom mentioned as a source of meaning (median = 2%).

via – https://t.co/RqVKHkwo2Z pic.twitter.com/wsqMexoOnM

— Daniel Crosby (@danielcrosby) April 9, 2024

Join the world’s toughest valuation training

Become a Valuation Expert. Valuation Master Class Boot Camp graduates can confidently value any company in the world and possess in-demand industry skills.

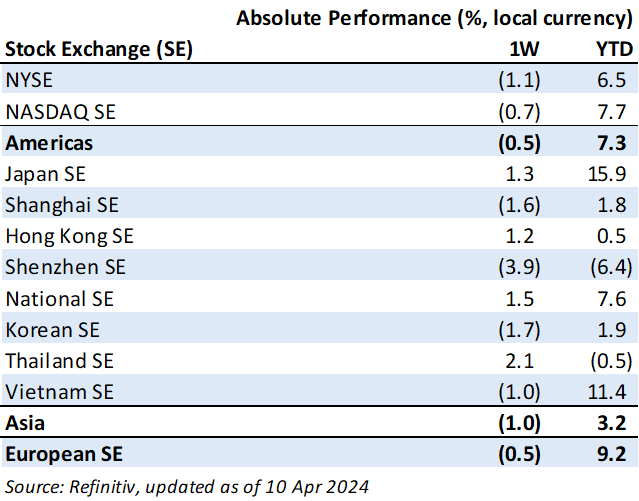

Weekly market performance

Click here to see more markets and periods.

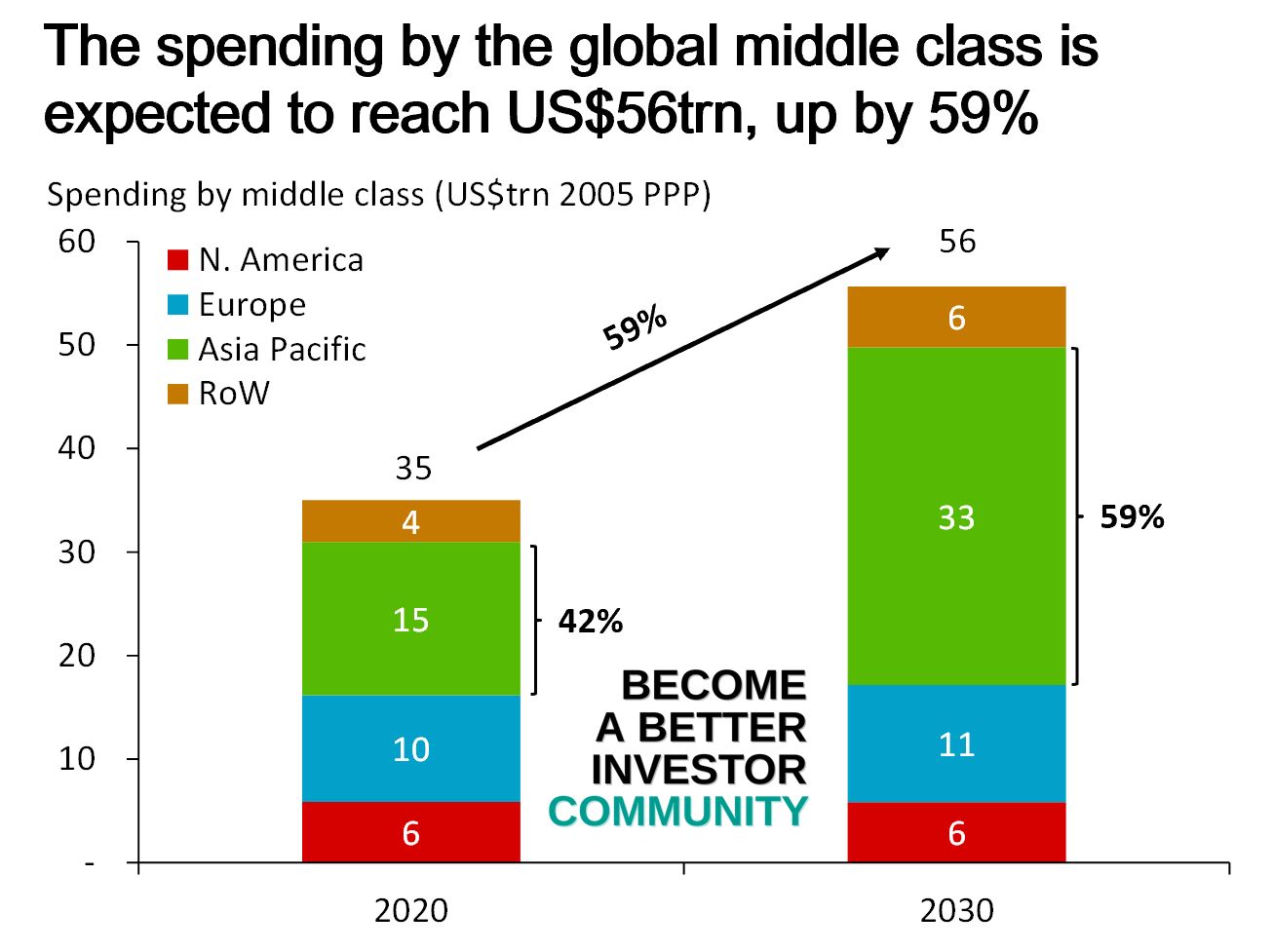

Chart of the week

Discussed in the Become a Better Investor Community this week

“We go live today @channel at 5 PM GMT+7 instead of 6 PM GMT+7. Our discussion will be about why we overweight Korea, Indonesia, and Malaysia in Asia.”

Try 1 month of the Become a Better Investor Community for FREE today!

You can cancel at any time. Click here to learn more.

Podcasts we listened to this week

The Morgan Housel Podcast – Lucky vs. Repeatable

“Luck plays such a big role in the world. But few people want to talk about it. If I say you got lucky, I look jealous. If I tell myself that I got lucky, I feel diminished. Maybe a better way to frame luck is by asking: what isn’t repeatable?”

Readings this week

I’ve Been at NPR for 25 Years. Here’s How We Lost America’s Trust.

“Uri Berliner, a veteran at the public radio institution, says the network lost its way when it started telling listeners how to think.”

Book recommendation

The Dealmaker: Lessons from a Life in Private Equity by Guy Hands

“The Dealmaker is a frank and honest account of how a severely dyslexic child who struggled at school went on to graduate from Oxford and become a serial entrepreneur. It describes Guy Hand’s career in private equity, first at Nomura and then as head of his own company, Terra Firma.”

Get the book on Audible or Kindle.

Audible is great; have you tried it? If not, click here to get 2 books for free.

Memes of the week

It’s a good thing that we don’t need food, energy, shelter or cars to survive https://t.co/IqcJneRuAz

— Dr. Parik Patel, BA, CFA, ACCA Esq. (@ParikPatelCFA) April 11, 2024

Who did this? pic.twitter.com/s4YGaDubvr

— Michael A. Arouet (@MichaelAArouet) April 6, 2024

New My Worst Investment Ever episodes

Ep780: William Cohan – Power Failure: The Rise and Fall of An American Icon

BIO: William D. Cohan, a former senior Wall Street M&A investment banker for 17 years at Lazard Frères & Co., Merrill Lynch, and JPMorgan Chase, is the New York Times bestselling author of seven nonfiction narratives, including his most recent book, Power Failure: The Rise and Fall of An American Icon.

STORY: William discusses lessons from his most recent book, which is a story of General Electric (GE), a former global company with facilities worldwide. In his book, William focuses on former GE CEO Jack Welch, who took over the company in 1981 and increased its market value from $12 billion to $650 billion. This company became one of the world’s most valuable and respected companies, and then it all fell apart.

LEARNING: Leadership matters. You are not always right. Achieve the numbers in an ethical manner.

Access the episode’s show notes and resources

Published on Become a Better Investor this week

In The New Economics, Deming said “The individual, transformed, will perceive new meaning to his life…” (3rd edition, page 63) But are we ever completely transformed? Discover why Bill Bellows believes that transformation is an ongoing process and how you can keep your learning journey going.

Listen to Transformation is Never Complete: Awaken Your Inner Deming (Part 17)

Compagnie Financiere Richemont SA (CFR SW): Profitable Growth rank of 2 was up compared to the prior period’s 3rd rank. This is World Class performance compared to 880 large Cons. Disc. companies worldwide.

Read Compagnie Financiere Richemont SA – World Class Benchmarking

Fast Retailing Company Limited (9983 JP): Profitable Growth rank of 7 was up compared to the prior period’s 8th rank. This is below average performance compared to 1,460 large Industrials companies worldwide.

Read Fast Retailing – World Class Benchmarking

Elan Microelectronics Corporation (2458 TT): Profitable Growth rank of 2 was same compared to the prior period’s 2nd rank. This is World Class performance compared to 810 medium Info Tech companies worldwide.

Read Elan Microelectronics Corp – World Class Benchmarking

Stocks continued strong; Developed markets outperformed. Performance review of our strategies in March 2024 – All Weather Inflation Guard gained 1.8%, All Weather Strategy gained 3.6%, All Weather Alpha Focus gained 3.1%.

Read A. Stotz All Weather Strategies – March 2024

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.