Become a Better Investor Newsletter – 10 August 2024

Noteworthy this week

- Bloody start to the week

- BoJ got to pay

- Fed is expected to come to the rescue

- 10%+ drawdowns are common

- US adds unproductive debt

Bloody start to the week: The week began with a free fall in Japanese stocks and crypto; Tech got hit hard, too.

This image will go down in history.

The largest assets and indices in the world trading like meme stocks.

How is this a “soft landing?” pic.twitter.com/BTPw0G6Eo2

— The Kobeissi Letter (@KobeissiLetter) August 5, 2024

BoJ got to pay: This week, the Bank of Japan got a taste of the negative consequences it has created with decades of money printing.

Bank of Japan

1. Prints insane amounts of money.

2. Becomes largest holder of ETFs in the Nikkei, incentivizing investors to purchase Japanese ETFs borrowing in yen.

3. Yen falls to 40-year lows

4. BOJ blames “speculators”. A classic.

5. BOJ spends billions stabilizing the yen… pic.twitter.com/Kq6xxnb7yp— Daniel Lacalle (@dlacalle_IA) August 6, 2024

Fed is expected to come to the rescue: Market participants are now expecting the Fed to start cutting rates earlier than before to support financial markets.

The market is now pricing in an almost 100% probability of a 50 bps cut in September, up from 11% a week ago. pic.twitter.com/XRmoAoW9pr

— Charlie Bilello (@charliebilello) August 5, 2024

10%+ drawdowns are common: Every other year, the US stock market has experienced drawdowns of >10%, and every fourth year, the market has suffered drawdowns of >20%.

From 1928-2023 the S&P 500 experienced drawdowns of:

10% or worse in 64% of all years

15% or worse in 40% of all years

20% or worse in 26% of all years

Losses are normalhttps://t.co/nFQvHIyWzK pic.twitter.com/aWYghZhgyt

— Ben Carlson (@awealthofcs) August 5, 2024

US adds unproductive debt: Debt can be good if it enhances growth. At a minimum, you’d want US$1 in debt to generate >US$1 in GDP (probably quite a bit more). However, for every US$1 the US currently adds to the national debt, it only generates $0.6 in GDP. Sustainable? Unlikely.

Every new dollar of debt generates just $0.58 of GDP pic.twitter.com/54jbK7FP9i

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) July 16, 2024

Join the world’s toughest valuation training

Become a Valuation Expert. Valuation Master Class Boot Camp graduates can confidently value any company in the world and possess in-demand industry skills.

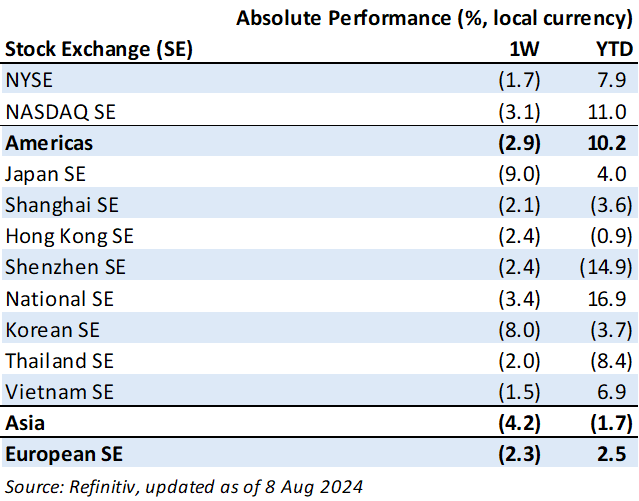

Weekly market performance

Click here to see more markets and periods.

Chart of the week

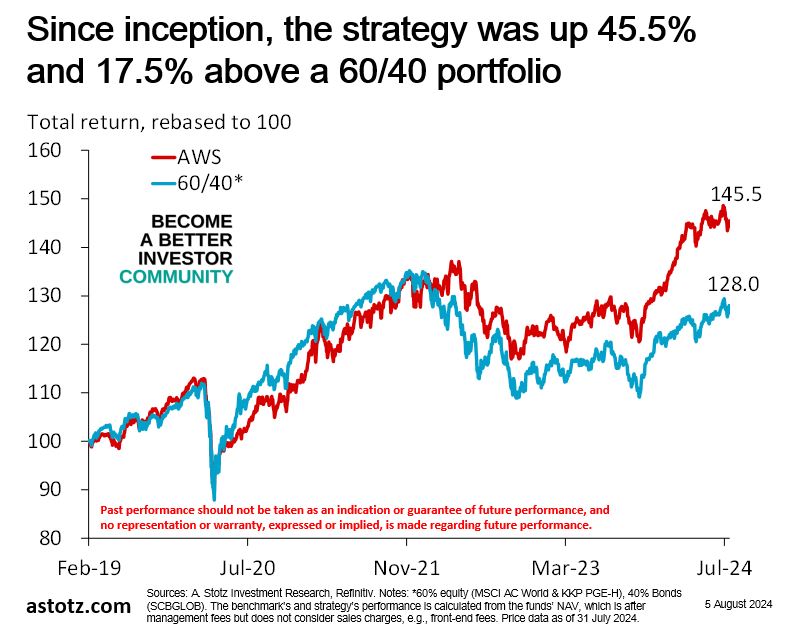

Discussed in the Become a Better Investor Community this week

“We just uploaded the performance review of our Global Asset Allocation Strategy.”

Try 1 month of the Become a Better Investor Community for FREE today!

You can cancel at any time. Click here to learn more.

Podcasts we listened to this week

Abundance, Generosity, and the State with Guido Hulsmann SLP589

(Thanks for the tip, you know who you are!)

“We discuss the way gratuitous benefits come to us in a free market capitalist society, and the many ways government intervention can interrupt this process. Instead of having strong families, communities and private clubs that assist in making our lives better, the state disrupts this process and makes society poorer.”

Readings this week

Which One Is It? Equity Issuance and Retirement

“This report reflects on companies that both issue and retire shares around the same time, a topic that is relevant for corporate leaders and investors who think carefully about capital allocation.”

Book recommendation

When Money Dies: The Nightmare of Deficit Spending, Devaluation, and Hyperinflation in Weimar, Germany by Adam Fergusson

“When Money Dies is the classic history of what happens when a nation’s currency depreciates beyond recovery. In 1923, with its currency effectively worthless (the exchange rate in December of that year was one dollar to 4,200,000,000,000 marks), the German republic was all but reduced to a barter economy.”

Get the book on Audible or Kindle.

Audible is great; have you tried it? If not, click here to get 2 books for free.

Memes of the week

Yes pic.twitter.com/jJcjMtYYgA

— Not Jerome Powell (@alifarhat79) August 3, 2024

Message to all my stock market warriors pic.twitter.com/Y1KNmmQEcY

— Dr. Parik Patel, BA, CFA, ACCA Esq. (@ParikPatelCFA) August 5, 2024

New My Worst Investment Ever episodes

Ep789: Pavan Sukhdev – Don’t Make Exceptions Rules Are the Essence

BIO: Pavan Sukhdev’s remarkable journey from scientist to international banker to environmental economist has brought him to the forefront of the sustainability movement.

STORY: Pavan ignored his investment rules and invested in a bond, which caused him to lose almost his entire investment.

LEARNING: Don’t make exceptions; the rules are the essence. Set up concentration risk limits. Diversify.

Access the episode’s show notes and resources

Enrich Your Future 08: High Economic Growth Doesn’t Always Mean High Stock Market Return

In this episode of Enrich Your Future, Andrew and Larry Swedroe discuss Larry’s new book, Enrich Your Future: The Keys to Successful Investing. In this series, they discuss Chapter 08: High Economic Growth Doesn’t Always Mean High Stock Market Return.

LEARNING: High growth rates don’t always mean high stock returns.

Access the episode’s show notes and resources

Published on Become a Better Investor this week

In this episode of Enrich Your Future, Andrew and Larry Swedroe discuss Larry’s new book, Enrich Your Future: The Keys to Successful Investing. In this series, they discuss Chapter 07: The Value of Security Analysis.

Listen to Enrich Your Future 07: The Value of Security Analysis

Gold was the best and Global Bonds were strong as well. Performance review of our strategies in July 2024 – All Weather Inflation Guard gained 1.0%, All Weather Strategy gained 0.2%, All Weather Alpha Focus gained 1.6%.

Read A. Stotz All Weather Strategies – July 2024

Hengtong Optic-Electric Company Limited (600487 SH): Profitable Growth rank of 7 was up compared to the prior period’s 8th rank. This is below average performance compared to 640 large Info Tech companies worldwide.

Read Hengtong Optic-Electric – World Class Benchmarking

Colgate-Palmolive (India) Limited (CLGT IN): Profitable Growth rank of 1 was same compared to the prior period’s 1st rank. This is World Class performance compared to 420 medium Cons. Staples companies worldwide.

Read Colgate-Palmolive (India) – World Class Benchmarking

Radiant Opto-Electronics Corporation (6176 TT): Profitable Growth rank of 3 was up compared to the prior period’s 5th rank. This is above average performance compared to 640 large Info Tech companies worldwide.

Read Radiant Opto-Electronics Corp – World Class Benchmarking

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.