A. Stotz All Weather Strategy – December 2021

The All Weather Strategy outperformed a traditional 60/40 portfolio by 1.4% in December 2021. Fed/ECB unwillingness to crash markets could drive equities higher. Recovery demand and supply-chain disruption to drive commodities. Risks: Inflation turns out transitory, new lockdowns, US default.

The A. Stotz All Weather Strategy is Global, Long-term, and Diversified:

- Global – Invests globally, not only Thailand

- Long-term – Gains from long-term equity return, while trying to reduce a portion of losses during equity market downturns

- Diversified – Diversified globally across four asset classes

The All Weather Strategy is available in Thailand through FINNOMENA. Please note that this post is not investment advice and should not be seen as recommendations. Also, remember that backtested or past performance is not a reliable indicator of future performance.

Review

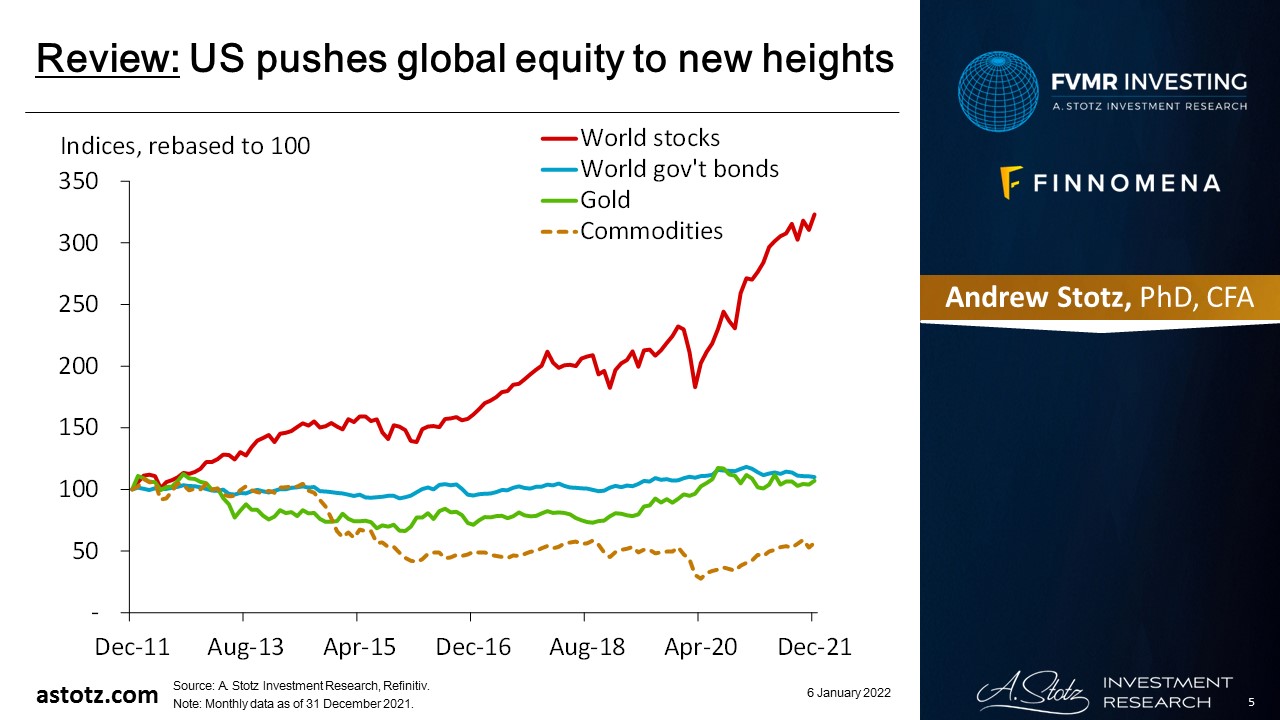

US pushes global equity to new heights

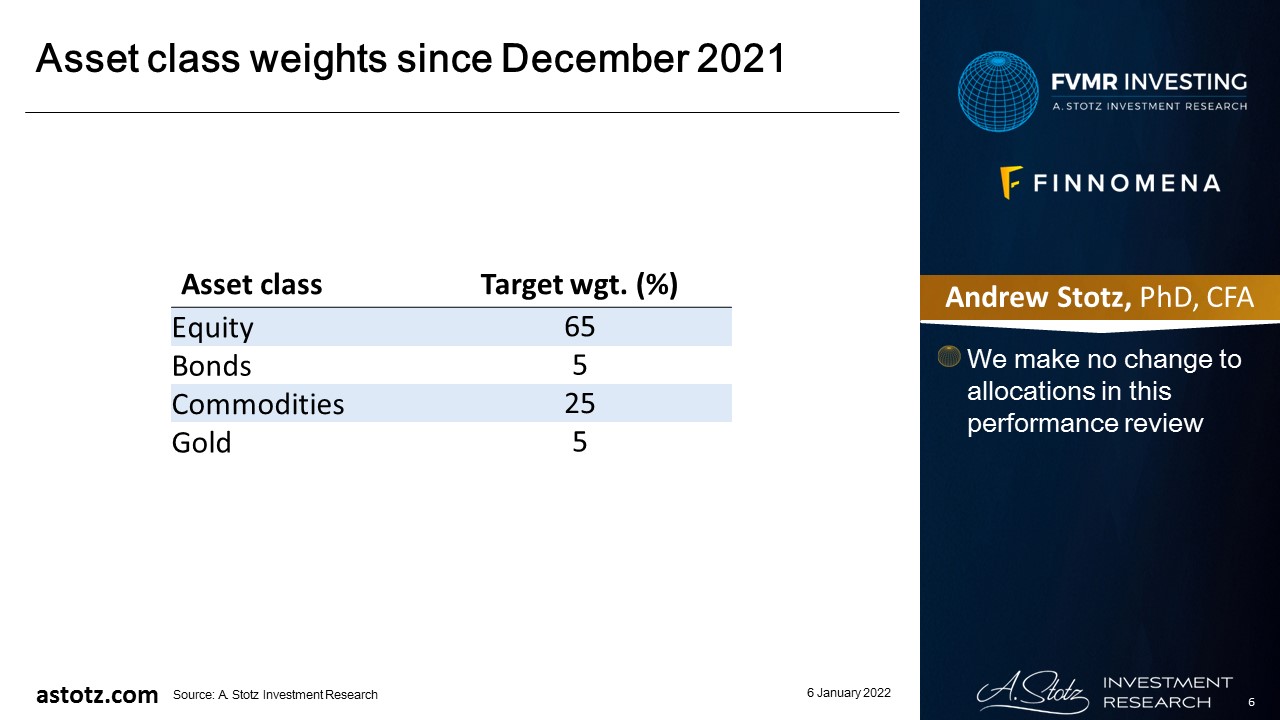

Asset class weights since December 2021

US has been the long-term clear leader

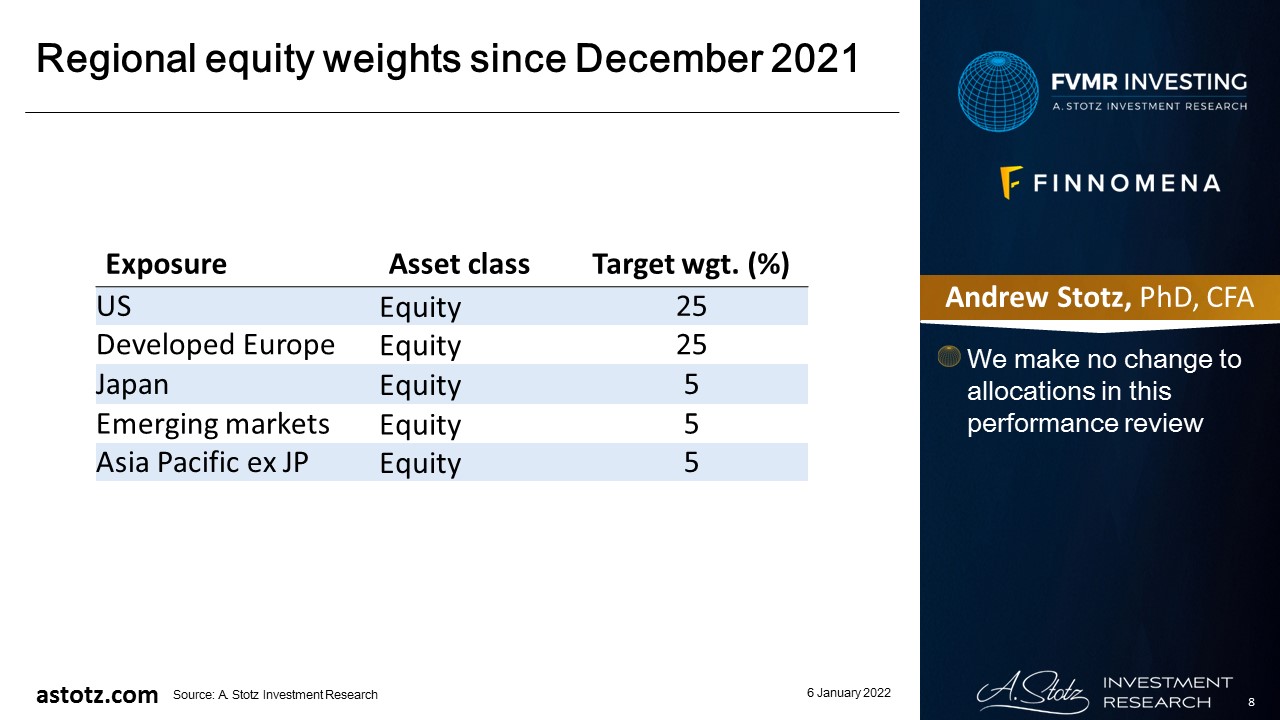

Regional equity weights since December 2021

Heavy in Western Developed markets

- In our June 2021 revision, we switched our 25% equity allocations to the US and Developed Europe from Emerging markets and Asia Pacific ex Japan

- We made no change in the September and December revisions

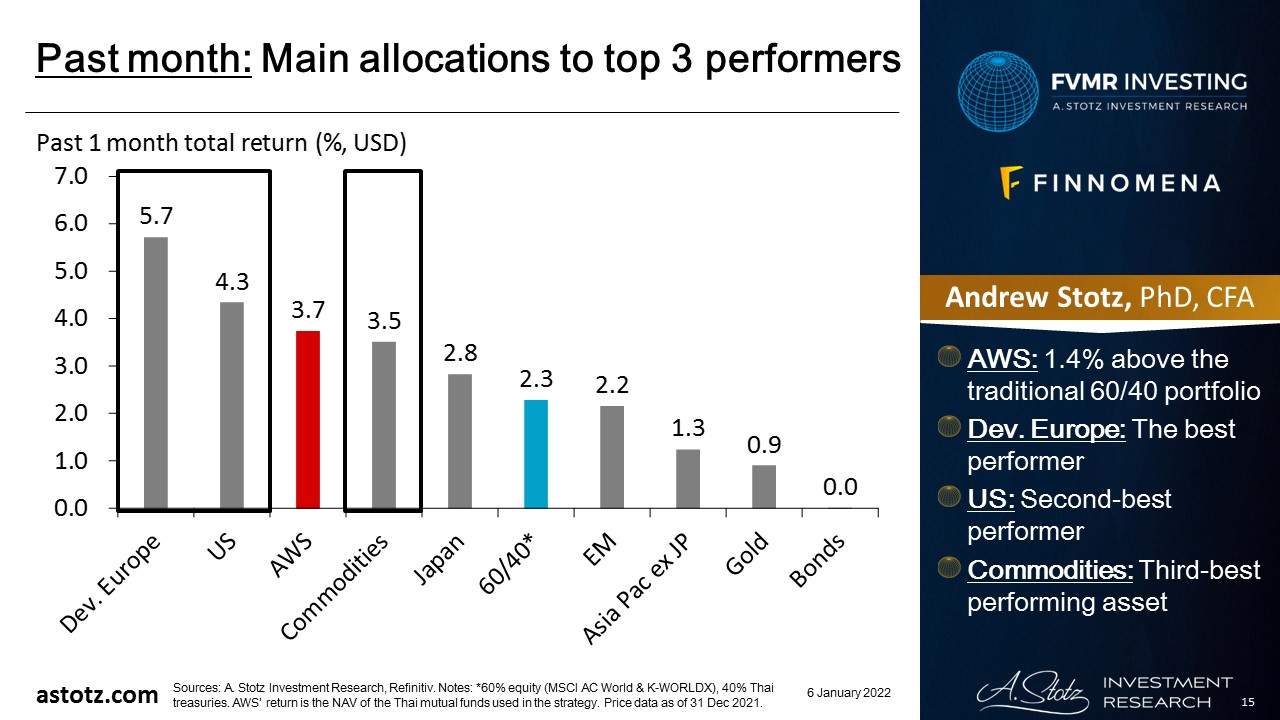

We got a Santa Claus rally

- Despite new fears of Omicron in the news, we got a Santa Claus rally, and all assets showed a positive return in December 2021

- Dev. Europe was the strongest equity market, followed by the US

- Strong US holiday shopping and approved big 2022 Gov’t budgets in Spain and Italy led to a solid performance for Western stocks

Emerging markets underperformed

- Worries about new lockdowns motivated by Omicron kept Emerging markets and Asia Pacific ex Japan behind Developed markets

- Expectations of a continued redistribution in China leading to a slowdown in the world’s second-largest economy dragged further

- China constitutes a large part of Emerging Markets and Asia Pacific ex Japan

Low bond target allocation at 5%

- We have a bond target allocation of 5% as they appeared less attractive relative to equity

- The strategy is to hold only Thai government bonds, rather than a mix of global government and corporate bonds

- Other assets were up in the past month; hence, a small allocation to bonds was good for the strategy’s performance

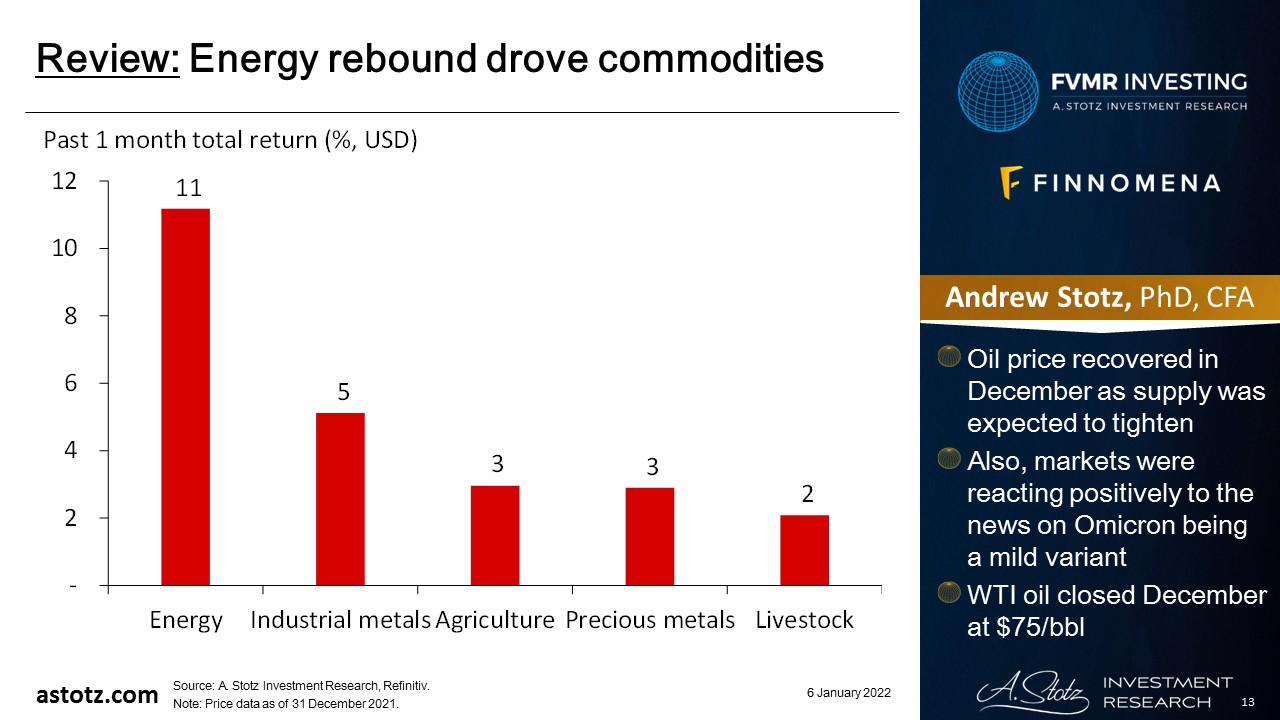

Energy rebound drove commodities

Gold was up a bit in December

- We have a minimum 5% allocation to gold

- Gold reacted to inflation expectations and rate hike by Bank of England and expected earlier hikes by the Fed, which led to relatively high price volatility

- While the price was volatile, it rose in the second half of December as the US Dollar weakened

- Gold closed December at US$1,829/oz t

December 2021: Main allocations to top 3 performers

- AWS: 1.4% above the traditional 60/40 portfolio

- Dev. Europe: The best performer

- US: Second-best performer

- Commodities: Third-best performing asset

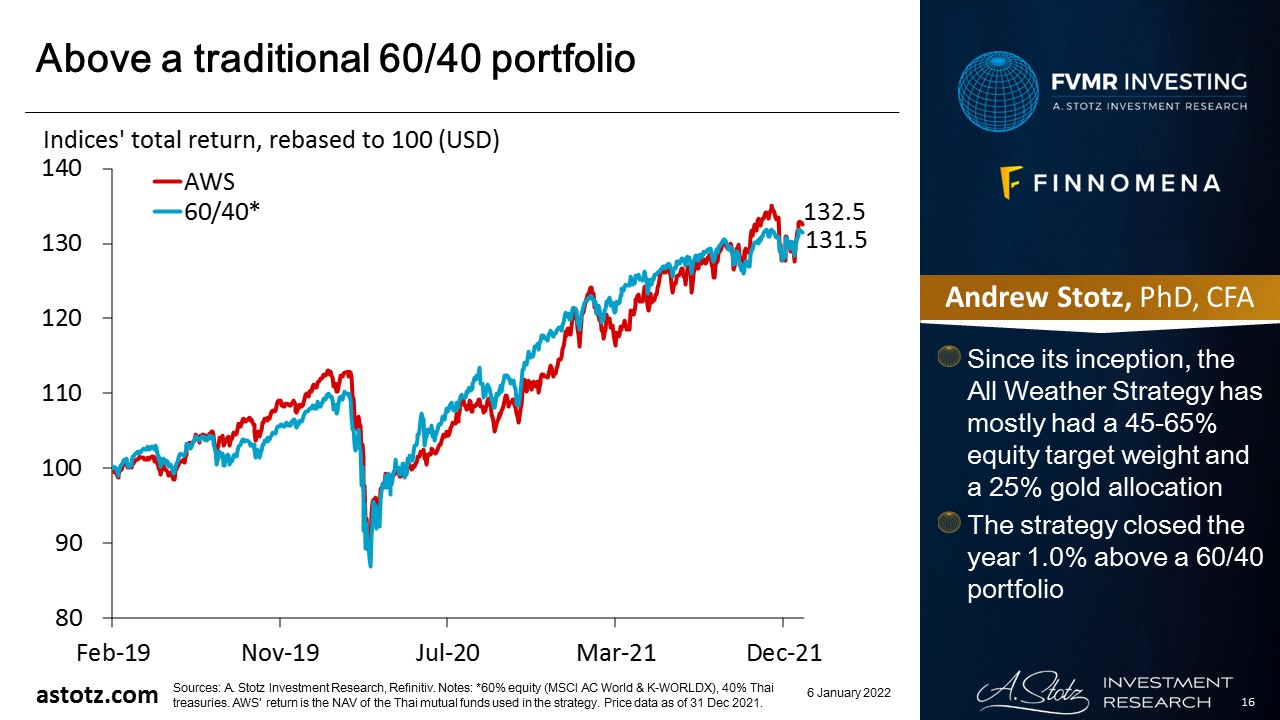

Above a traditional 60/40 portfolio

Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, expressed or implied is made regarding future performance.

- Since its inception, the All Weather Strategy has mostly had a 45-65% equity target weight and a 25% gold allocation

- The strategy closed the year 1.0% above a 60/40 portfolio

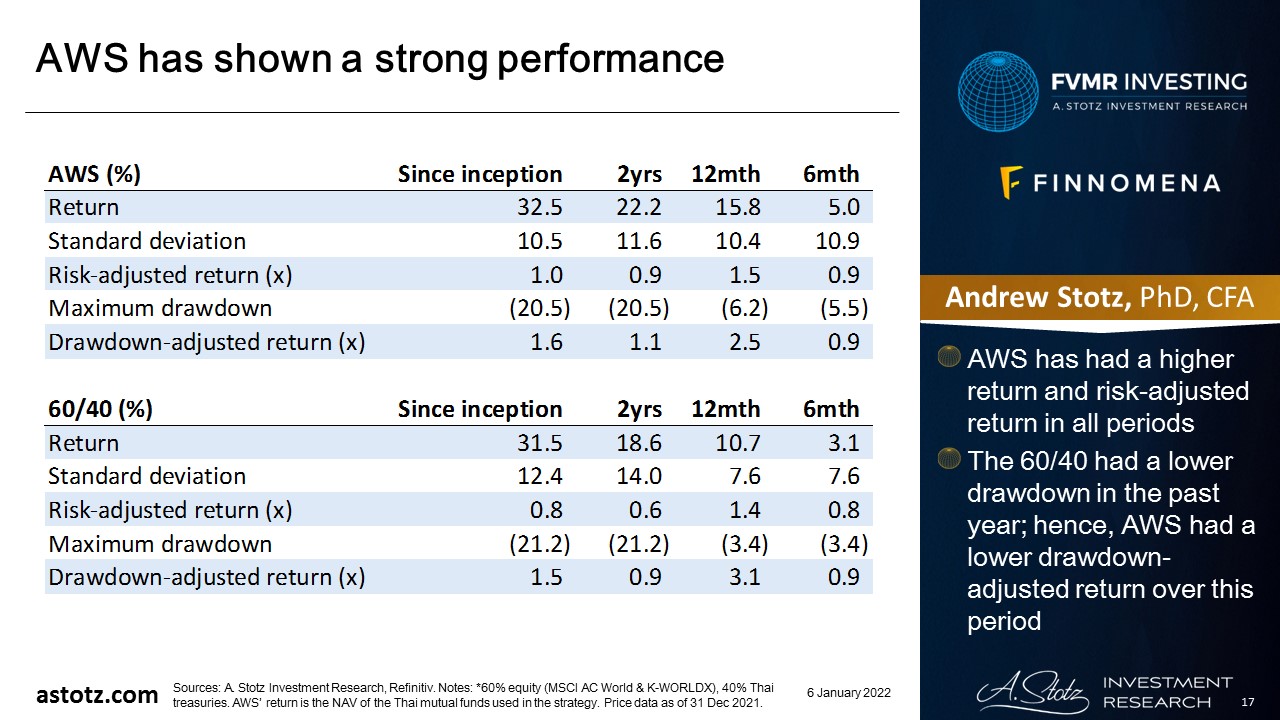

AWS has shown a strong performance

- AWS has had a higher return and risk-adjusted return in all periods

- The 60/40 had a lower drawdown in the past year; hence, AWS had a lower drawdown-adjusted return over this period

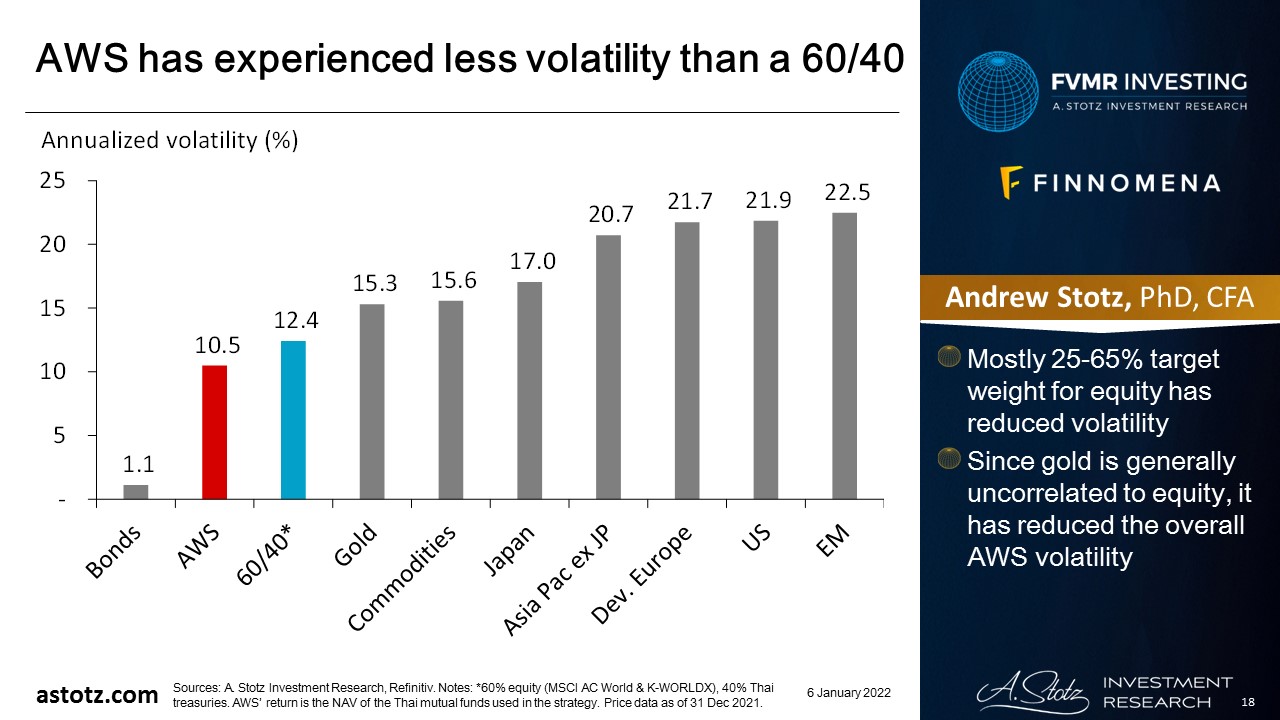

AWS has experienced less volatility than a 60/40

- Mostly 25-65% target weight for equity has reduced volatility

- Since gold is generally uncorrelated to equity, it has reduced the overall AWS volatility

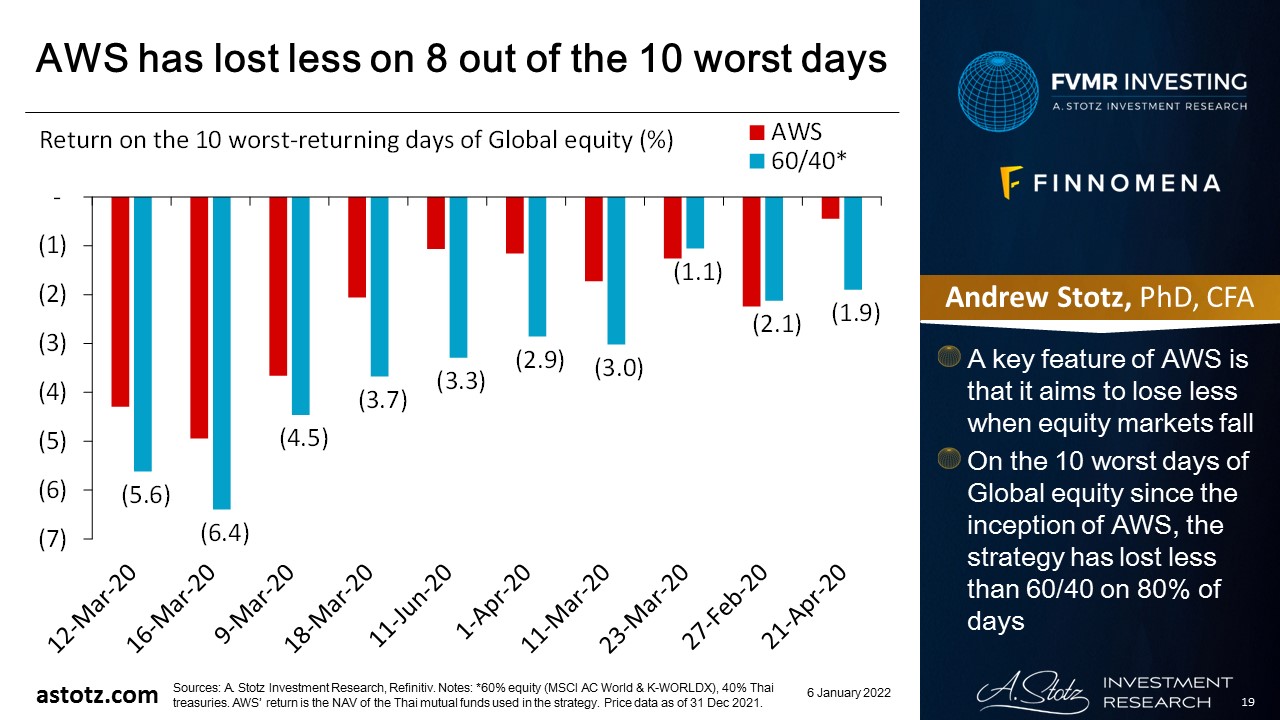

AWS has lost less on 8 out of the 10 worst days

- A key feature of AWS is that it aims to lose less when equity markets fall

- On the 10 worst days of Global equity since the inception of AWS, the strategy has lost less than 60/40 on 80% of days

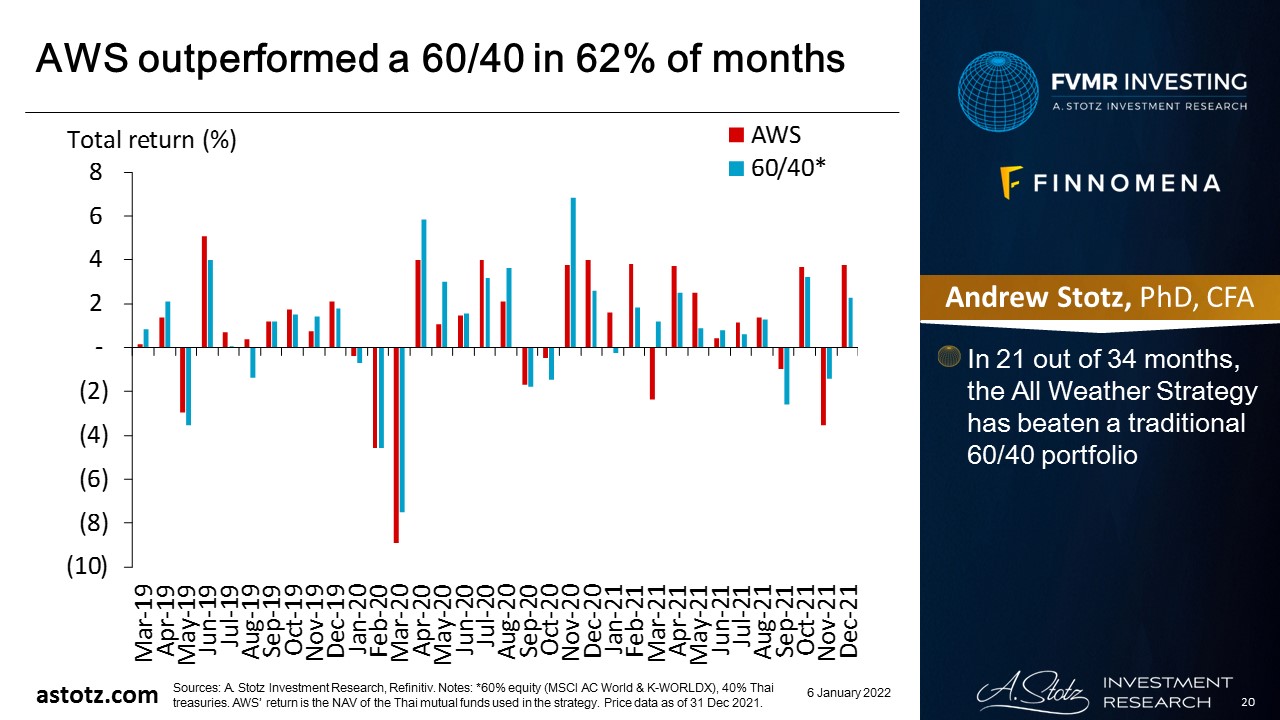

AWS outperformed a 60/40 in 62% of months

- In 21 out of 34 months, the All Weather Strategy has beaten a traditional 60/40 portfolio

Outlook

Fed supports the US market if needed

- American companies are doing well and have pricing power globally

- Even though Biden’s Build Back Better bill did not pass, we still expect some further attempt at economic stimulus in the US

- So, we expect the US economy to remain strong and be supported by Gov’t spending

Fed props up the US market

- Biden and the Democrats need Powell to prop up markets

- The market is currently pricing in a 57% chance of a Fed rate hike in March 2022

- Compare this to December when it priced in a 70% probability of a rate hike in but only by June 2022

- Even if the Fed tapers and hikes rates, we expect the course to be reversed as soon as it has a big adverse effect on markets

ECB is supportive of markets too

- Europe appears to be in a strong recovery

- The ECB has announced to start tapering, but rate hikes may not happen in 2022

- Even though both Fed and ECB talk about tapering and rate hikes, we think the central banks are going to have to support equities

- If their policy changes have a large negative effect on stock markets, we expect them to reverse course

China remains uncertain

- Investors are concerned about continued Chinese Gov’t clampdowns and the health of the Chinese Real Estate sector

- Continued uncertainty is negative for China equity, and its heavy weight in the Emerging markets and Asia Pacific ex Japan indices is likely to drag on performance

Bonds to remain flat

- In the near-term, we think bonds will underperform equity

- This is reflected in our 5% target allocation

Commodities can go further

- Energy prices should remain strong, as the supply-demand imbalance is likely to stay at least at the beginning of 2022

- Global supply-chain disruption due to government-mandated economic shutdowns could become more permanent, pushing prices up further

- Inflation and recovery demand should be supportive of Energy and Industrial metals

Still no near-term catalyst for gold

- In the longer term, as the inflation narrative spreads, it could lead to expectations of sustained negative real rates; supporting gold price

- Fed and ECB talk about tapering and Fed about rate hikes in early 2022, which would be negative for the gold price as real rates go up

- The timing of rate hikes in the US and EU remains uncertain; there hasn’t been much news to move gold in either direction

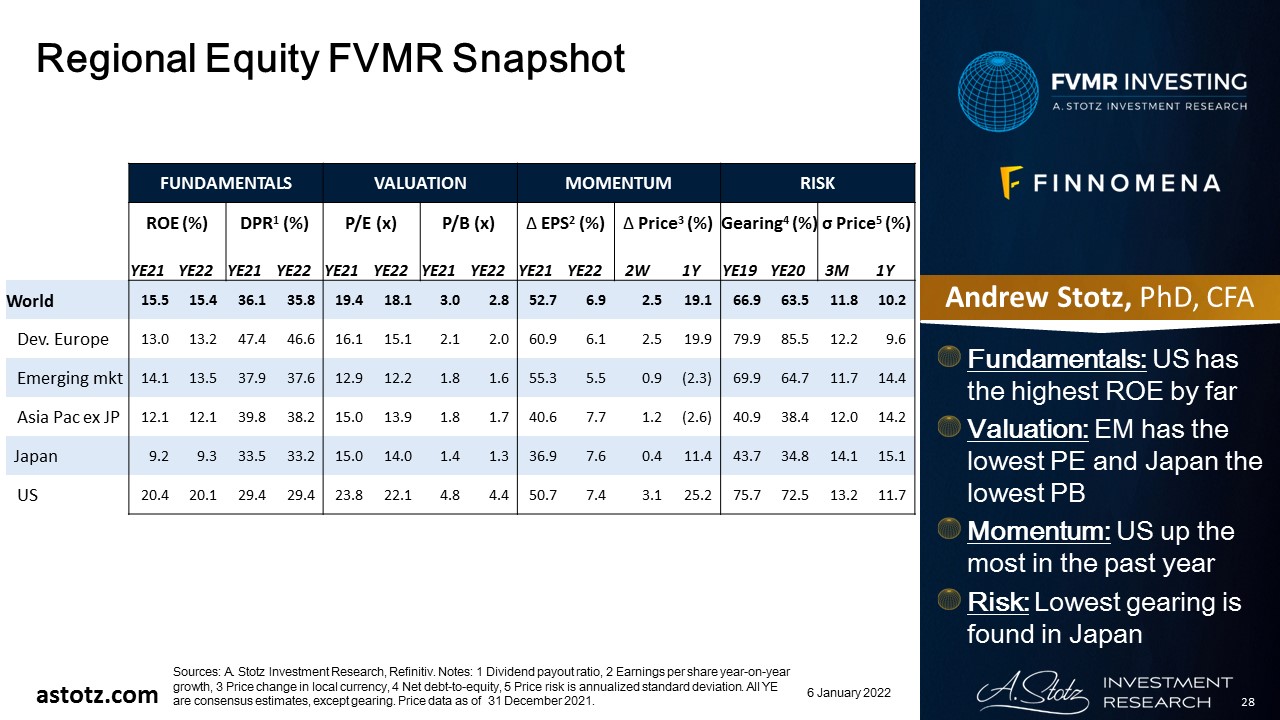

Regional Equity FVMR Snapshot

Fundamentals: US has the highest ROE by far

Valuation: EM has the lowest PE and Japan the lowest PB

Momentum: US up the most in the past year

Risk: Lowest gearing is found in Japan

Risks

Inflation turns out transitory

- The All Weather Strategy is still positioned to benefit from rising inflation at the beginning of 2022

- There’s a risk that inflation is transitory and falls faster than we expect, which could hurt our performance

New variants lead to new lockdowns

- If governments in countries with high vaccination rates return to lockdowns to battle new mutations of the virus, it would be negative for those equity markets

- If we see large parts of the world being shut down again, it could also reduce demand for commodities

US default

- While the American Congress has bought more time by raising the debt ceiling, it may need to deal with it again soon

- If the US defaults, this could have serious negative consequences for US equity, and possible global equities too

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.