A. Stotz All Weather Strategies – May 2023

The All Weather Strategy is available in Thailand through FINNOMENA. If you’re interested in our allocation strategy, you can also join the Become a Better Investor Community. Please note that this post is not investment advice and should not be seen as recommendations. Also, remember that backtested or past performance is not a reliable indicator of future performance.

What happened in world markets in May 2023

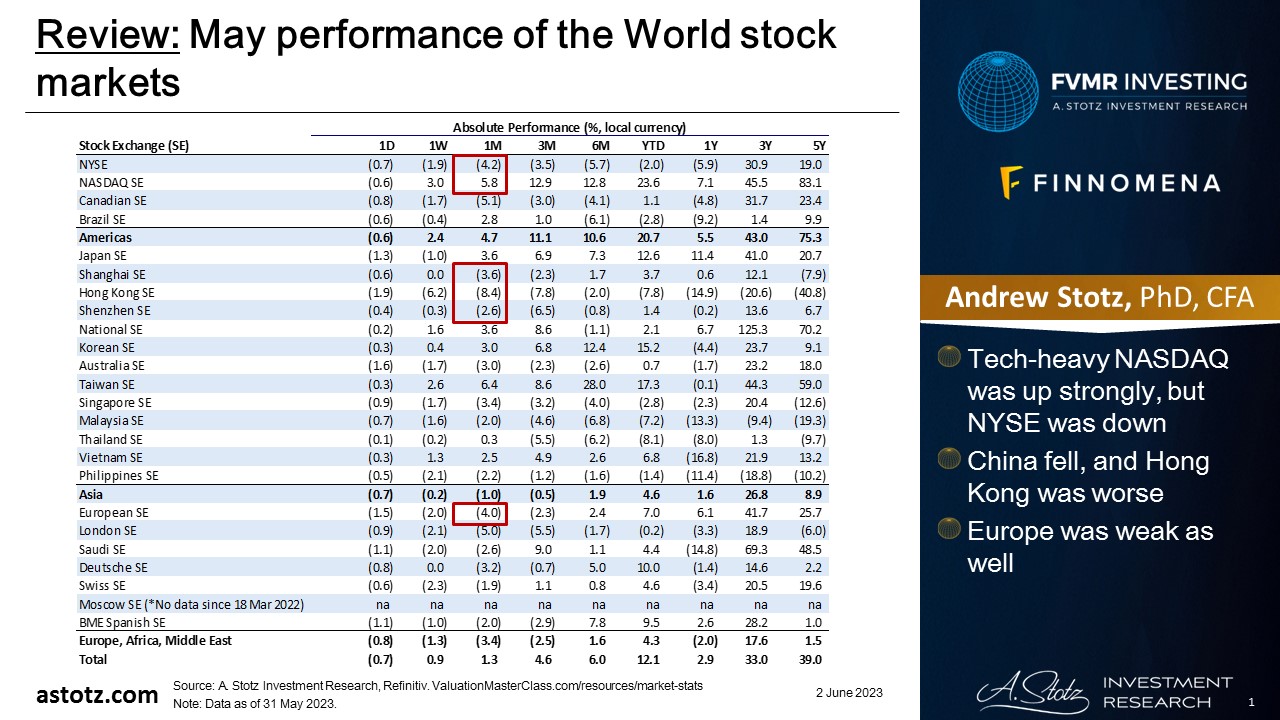

Performance of the World stock markets

- Tech-heavy NASDAQ was up strongly, but NYSE was down

- China fell, and Hong Kong was worse

- Europe was weak as well

Find the updated Performance of the World stock markets here.

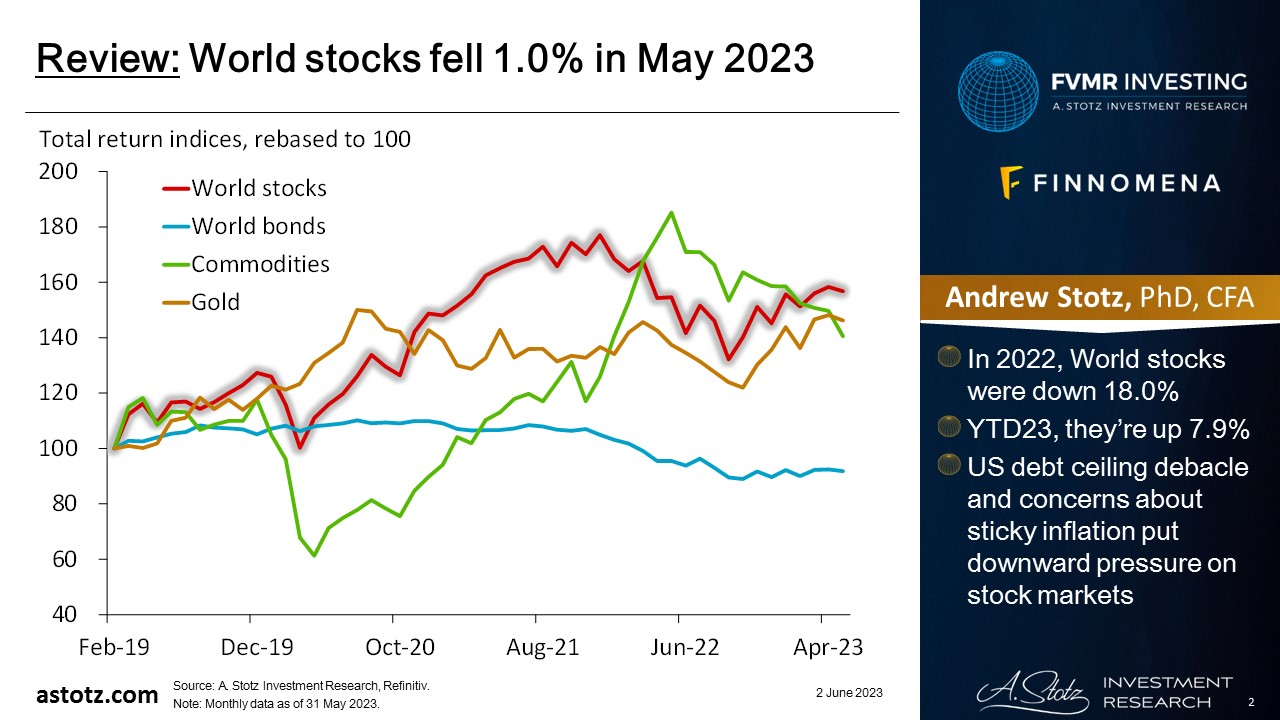

World stocks fell 1.0% in May 2023

- In 2022, World stocks were down 18.0%

- YTD23, they’re up 7.9%

- US debt ceiling debacle and concerns about sticky inflation put downward pressure on stock markets

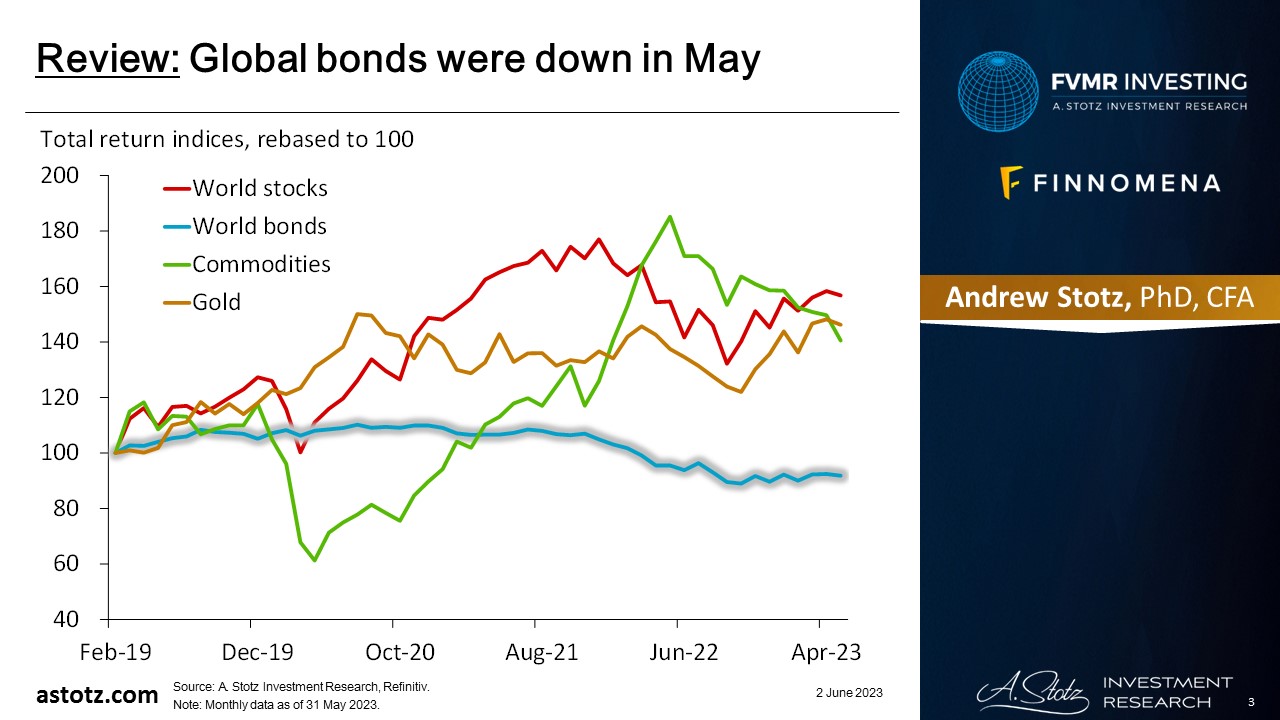

Global bonds were down in May

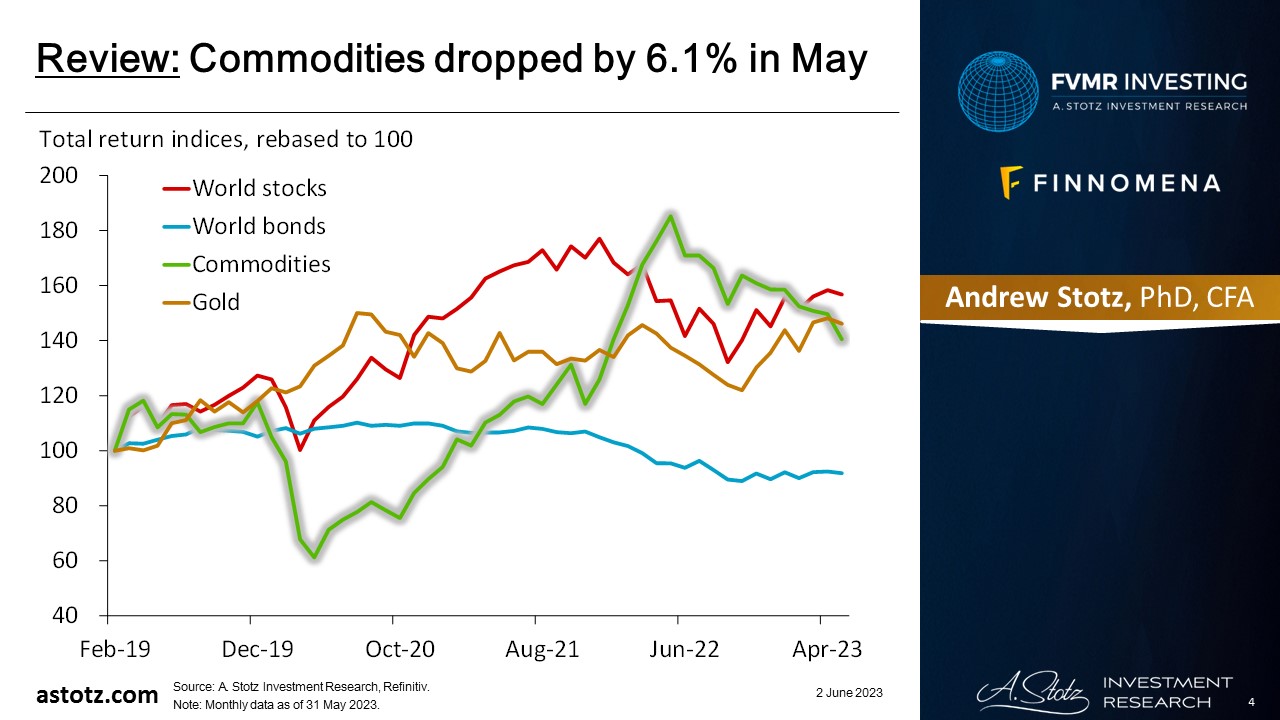

Commodities dropped by 6.1% in May

WTI oil closed May 2023 at US$68/bbl

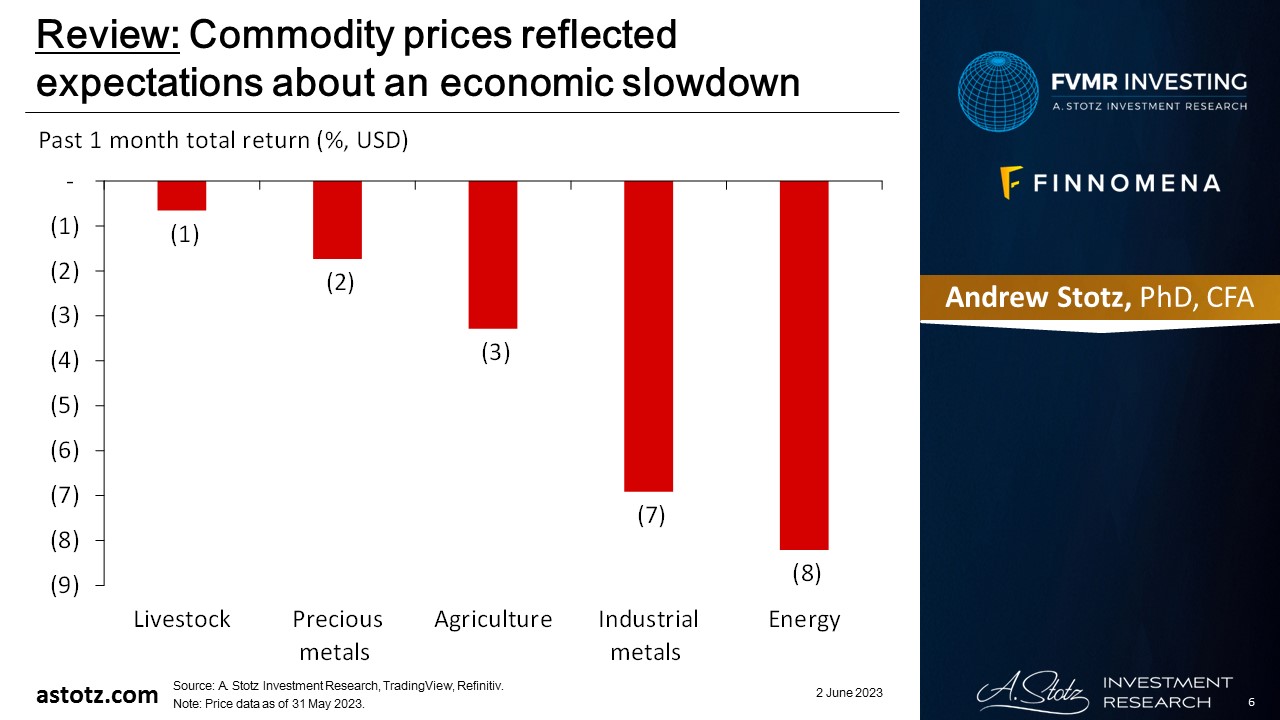

Commodity prices reflected expectations about an economic slowdown

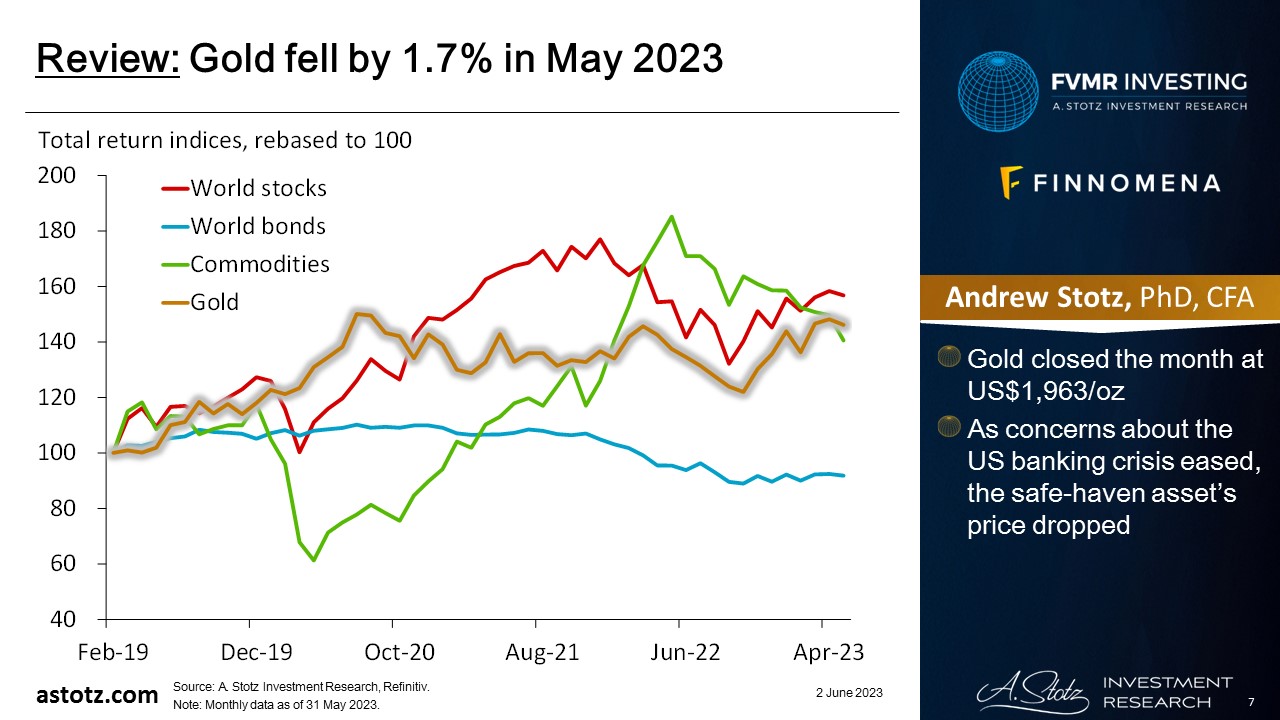

Gold fell by 1.7% in May 2023

- Gold closed the month at US$1,963/oz

- As concerns about the US banking crisis eased, the safe-haven asset’s price dropped

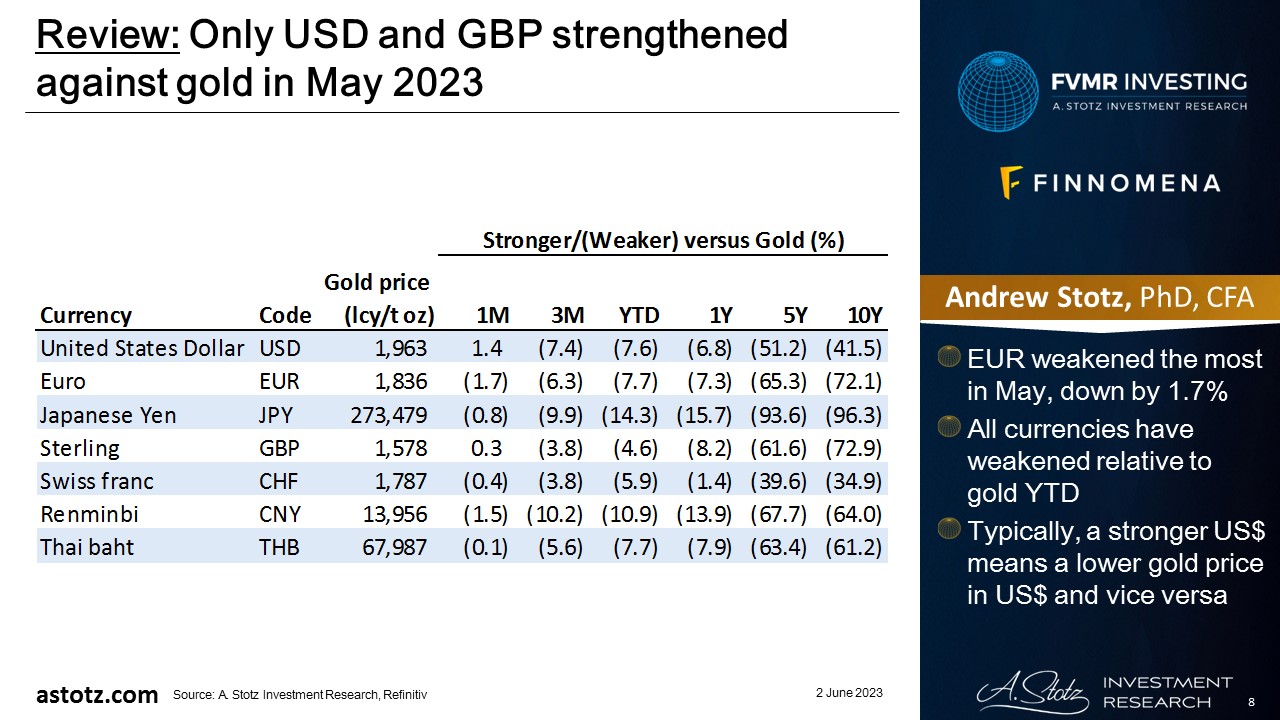

Only USD and GBP strengthened against gold in May 2023

- EUR weakened the most in May, down by 1.7%

- All currencies have weakened relative to gold YTD

- Typically, a stronger US$ means a lower gold price in US$ and vice versa

US inflation slowed in April

Headline CPI for April came in at 4.9% this morning, which continues the disinflationary trend. pic.twitter.com/e5MResLeKC

— Lyn Alden (@LynAldenContact) May 10, 2023

Fed hiked another 0.25% in May

This sentence is GONE from the statement

“The Committee anticipates that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.”

Bottomline: 25bp today + pause

— AndreasStenoLarsen (@AndreasSteno) May 3, 2023

- Many are now expecting a pause in June 2023

Large banks are buying failing banks and with guarantees from the gov’t

First Republic seized by California regulator, JPMorgan to assume all deposits. First Republic is 2nd largest Bank Failure in US history. FDIC estimates a $13bn loss to deposit insurance fund. First Republic’s 84 offices to reopen on Mon as JPMorgan Chase. https://t.co/QBKxbAj76M pic.twitter.com/zqlPRFcGUg

— Holger Zschaepitz (@Schuldensuehner) May 1, 2023

US bonds are still below their peak

US Bonds are still 11.5% below their peak from the summer of 2020 (total return including interest). pic.twitter.com/DMXS8sYrMS

— Charlie Bilello (@charliebilello) May 4, 2023

- While US bonds have rebounded, they were still 11.5% below their 2020 peak as of early May 2023

As a result of the debt ceiling issues in the US, the risk of a US default shot up

It’s like buying insurance against nuclear war. Who is supposed to pay it out when peanut butter hits the fan? (BBG) pic.twitter.com/pp4wW5KbfW

— Michael A. Arouet (@MichaelAArouet) May 10, 2023

The proposed solution is that the US will run with an uncapped debt ceiling for 19 months

The most ironic part of the debt ceiling deal is that it will literally accelerate the federal debt crisis.

With an UNCAPPED debt ceiling for 19 months, there is UNLIMITED borrowing capacity.

Conservatively speaking, federal debt will cross $36 trillion by 2025.

The “debt…

— The Kobeissi Letter (@KobeissiLetter) May 29, 2023

CBs’ balance sheets grow again; it’s hard to treat a liquidity addict in withdrawal

Btw, so everyone is clear: Central banks have been bullshitting everyone with their grand monetary tightening narrative.

Fact is global central banks balance sheet reductions ended in October of 2022 and surprise! Markets bottomed in October. pic.twitter.com/6s5v5HMNL1— Sven Henrich (@NorthmanTrader) May 17, 2023

Japanese stocks are on a roll

Buffett’s investment in Japan’s trading houses continues to print money

💰💰💰🇯🇵 Shares of the Japanese companies surged to record levels this week after announcing blockbuster earnings & buybacks

📈 Energy crisis and weak yen benefited the firmshttps://t.co/90ZBc4X1Wi pic.twitter.com/154pz3eHlO— Stephen Stapczynski (@SStapczynski) May 10, 2023

Tech, and NVIDIA in particular, has driven the US market recovery

NVIDIA ($NVDA) is now trading at 37 times its revenue (P/S) and 202 times its earnings (P/E)!

Now’s the right time to remember what Scott McNealy, CEO of Sun Microsystems told Bloomberg just after the dot-com collapse 👇 pic.twitter.com/YMGFf4ein1

— Market Sentiment (@mkt_sentiment) May 29, 2023

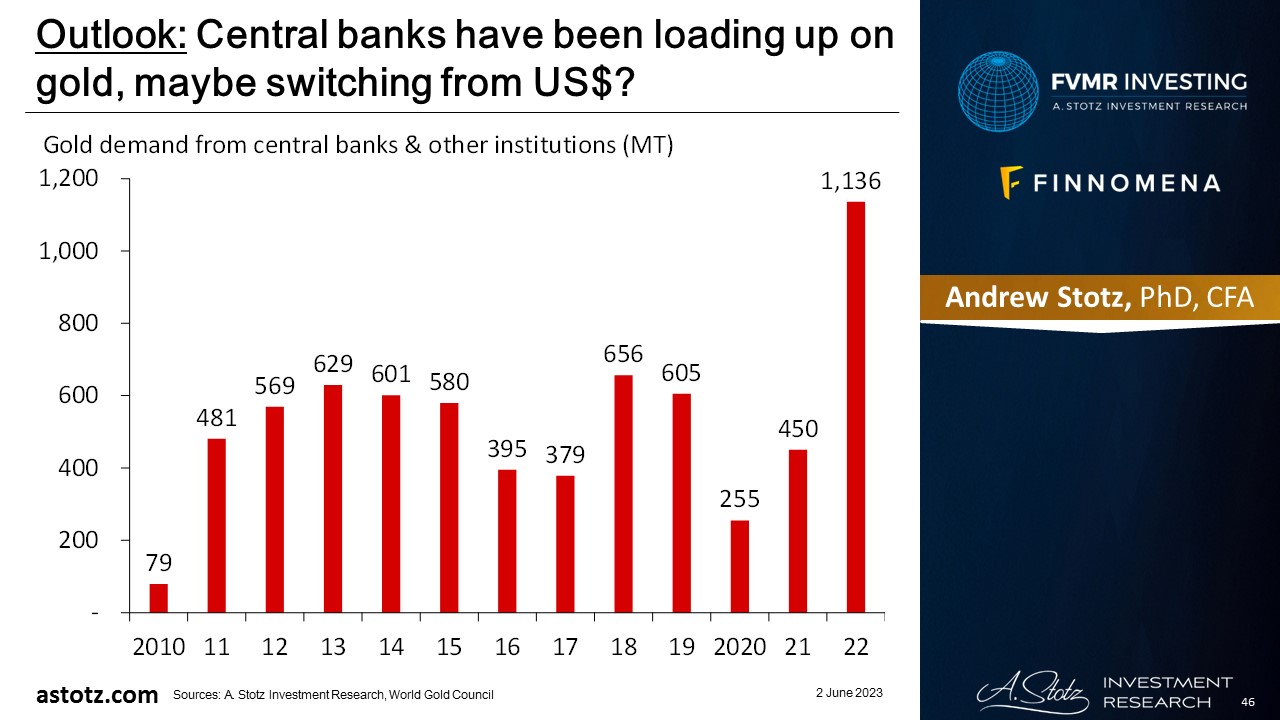

Central bank demand for gold continues to rise

The Chart The Market Doesn’t Want You To See…

East is increasing its De-Dollarization Hedge by moving into Gold, while the West, mostly Institutions & High Net Investors, move out of Gold ETFs.

This will take some time to occur, but there is a major factor that will push… pic.twitter.com/fXZOnteFdl

— SRSrocco Report (@SRSroccoReport) May 30, 2023

Key takeaways

- Inflation slowed in the US

- Fed announced a further 0.25% rate hike

- The US debt ceiling debacle likely leads to an uncapped debt ceiling until 2025

- Central banks’ balance sheets grow again

- Japanese stocks are on a roll

Performance review: All Weather Inflation Guard

All Weather Inflation Guard was down 0.6%

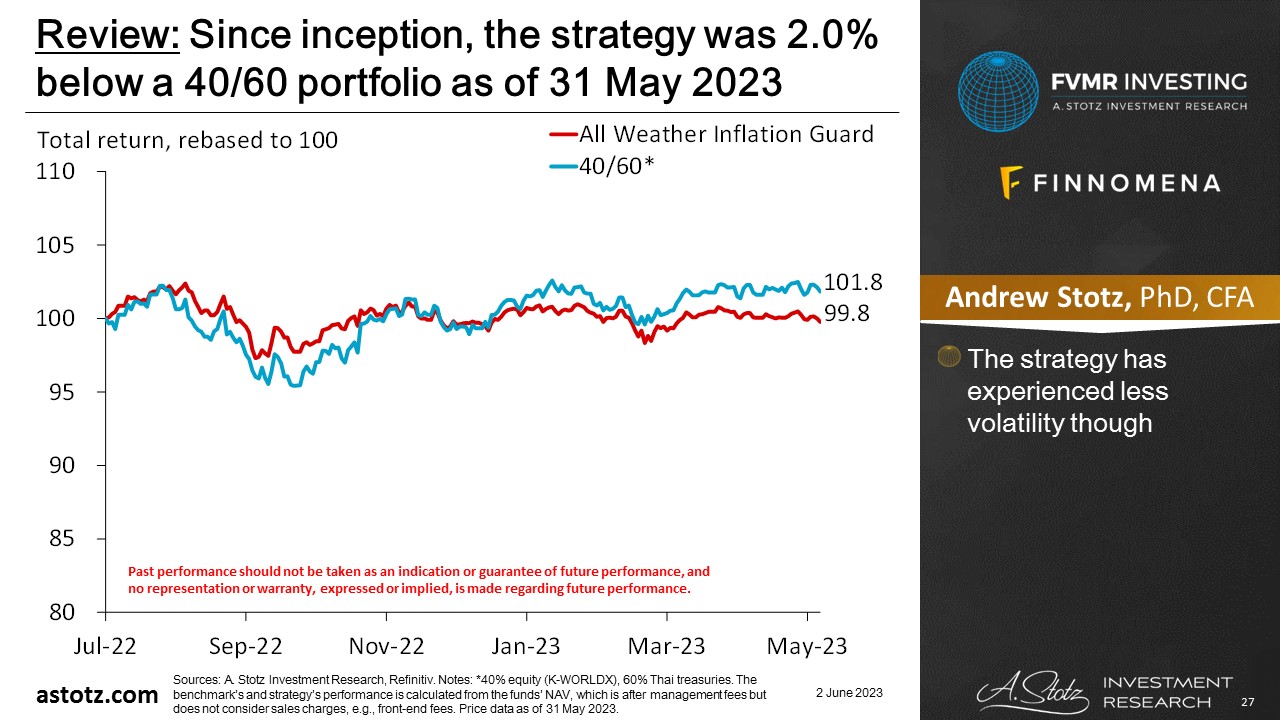

Since inception, the strategy was 2.0% below a 40/60 portfolio as of 31 May 2023

- The strategy has experienced less volatility though

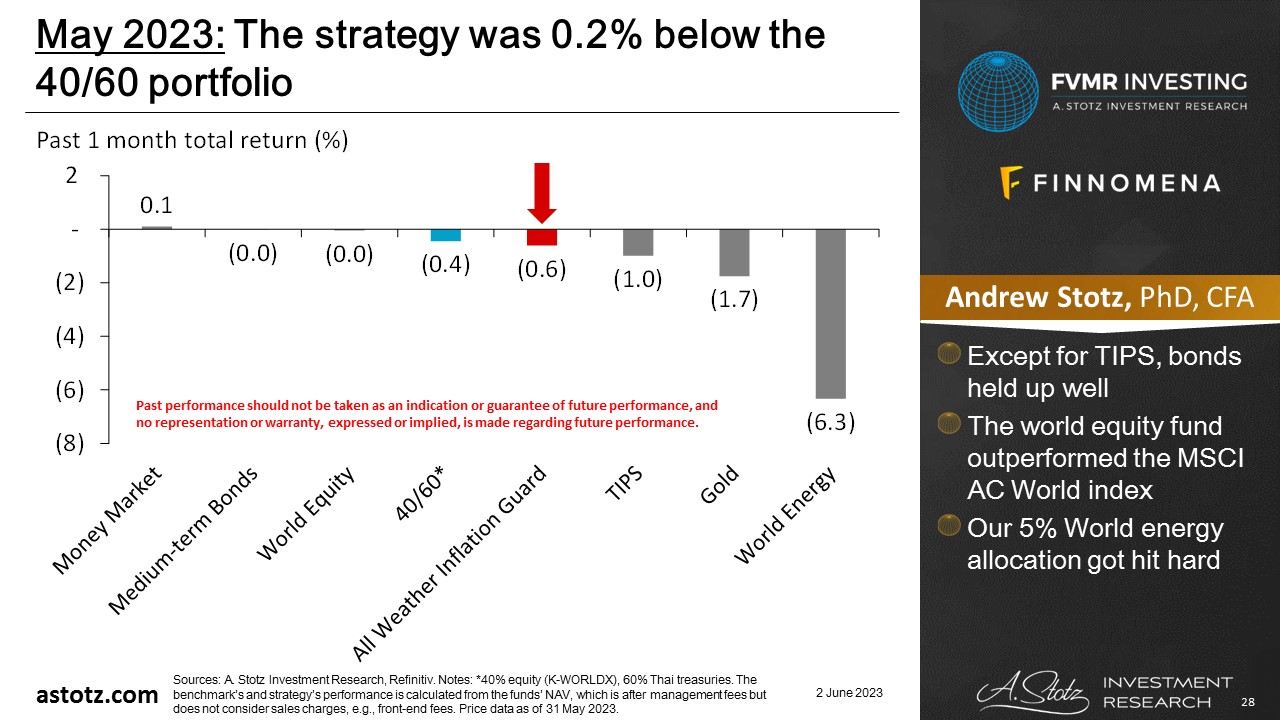

The strategy was 0.2% below the 40/60 portfolio

- Except for TIPS, bonds held up well

- The world equity fund outperformed the MSCI AC World index

- Our 5% World energy allocation got hit hard

Performance review: All Weather Strategy

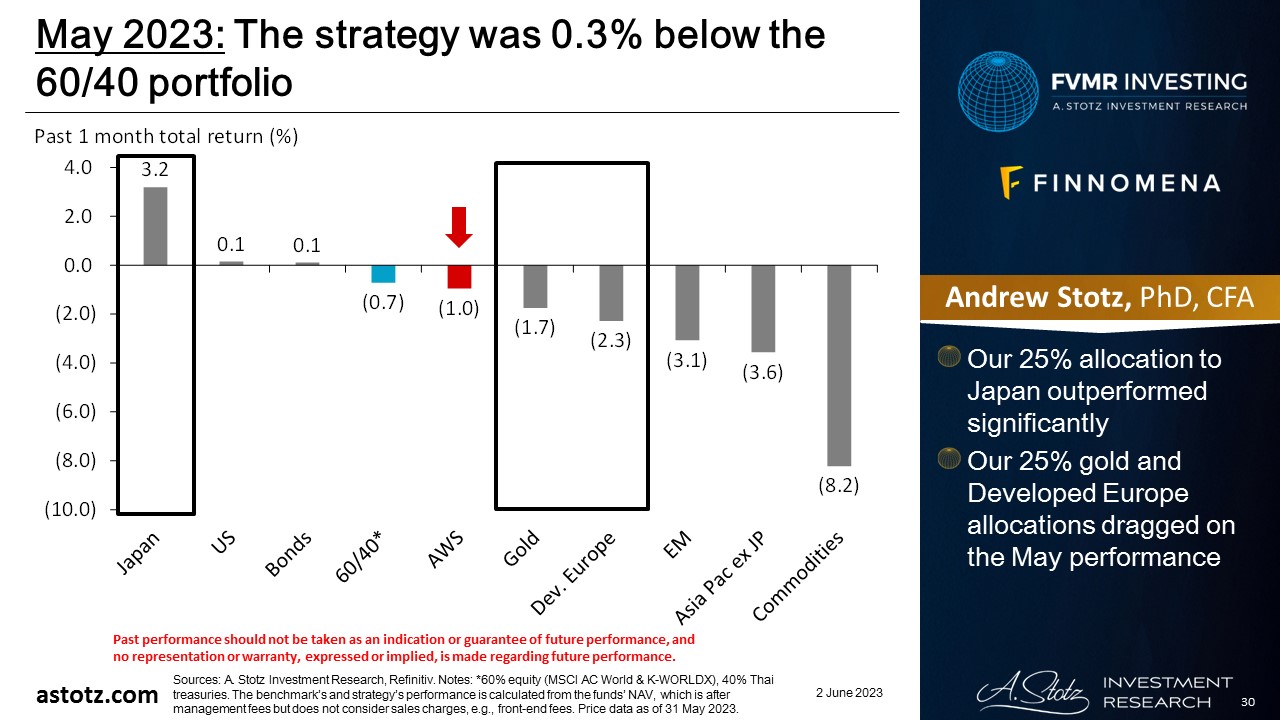

All Weather Strategy was down 1.0%

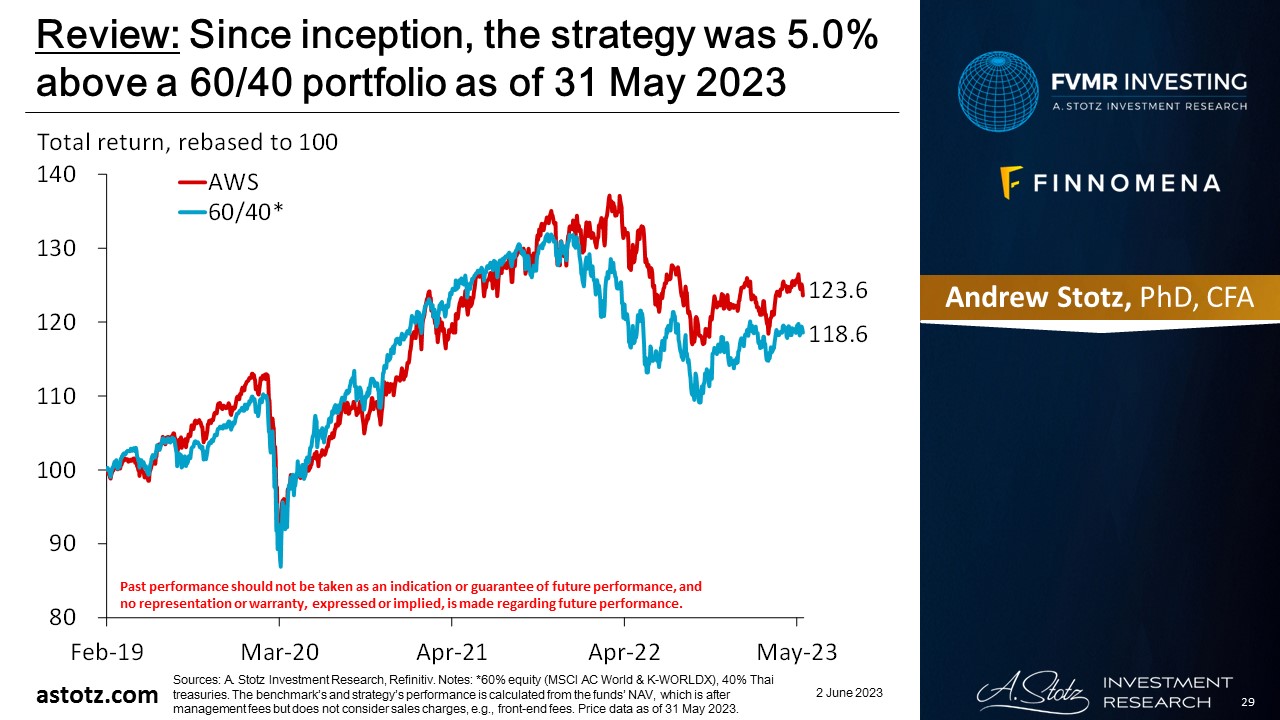

Since inception, the strategy was 5.0% above a 60/40 portfolio as of 31 May 2023

The strategy was 0.3% below the 60/40 portfolio

- Our 25% allocation to Japan outperformed significantly

- Our 25% gold and Developed Europe allocations dragged on the May performance

Performance review: All Weather Alpha Focus

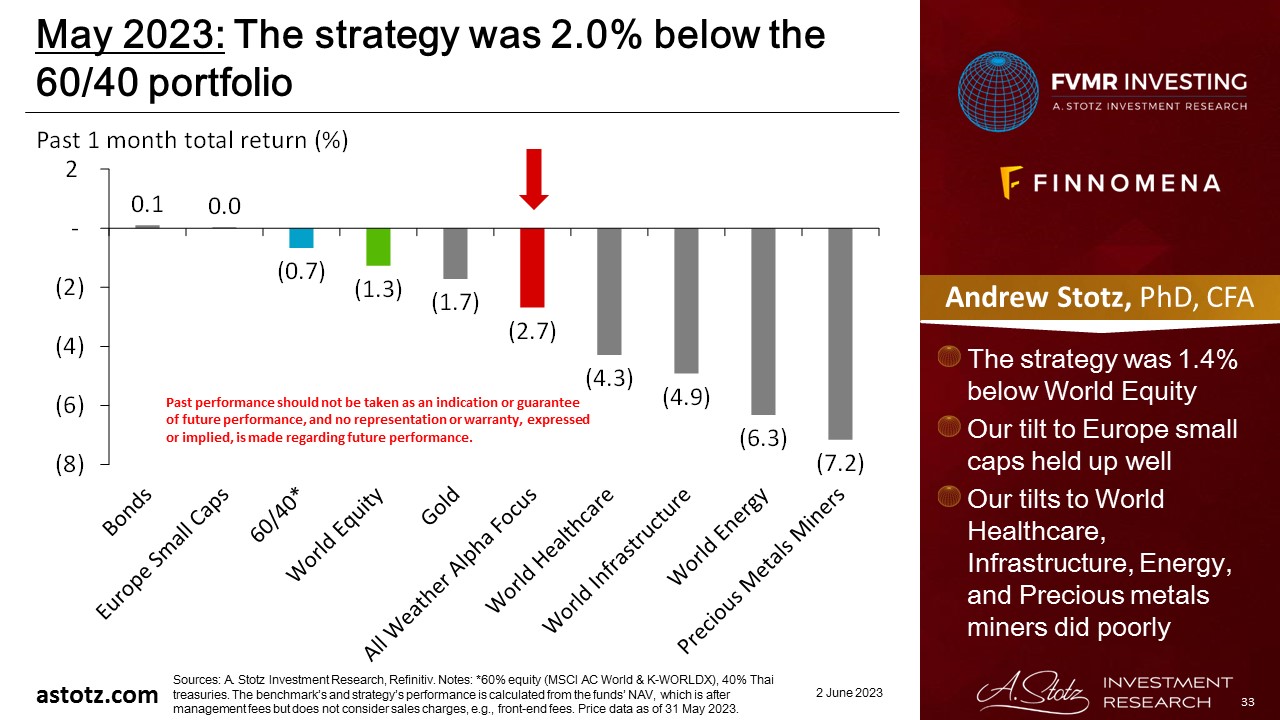

All Weather Alpha Focus was down 2.7%

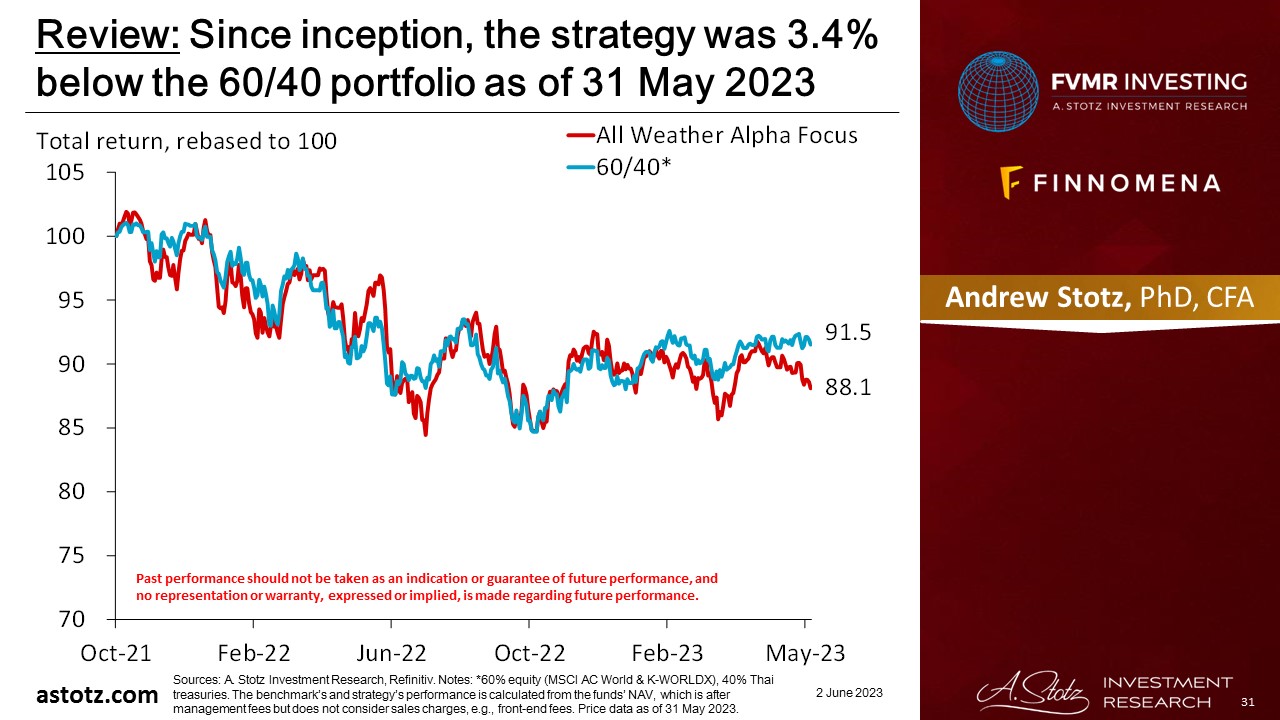

Since inception, the strategy was 3.4% below the 60/40 portfolio as of 31 May 2023

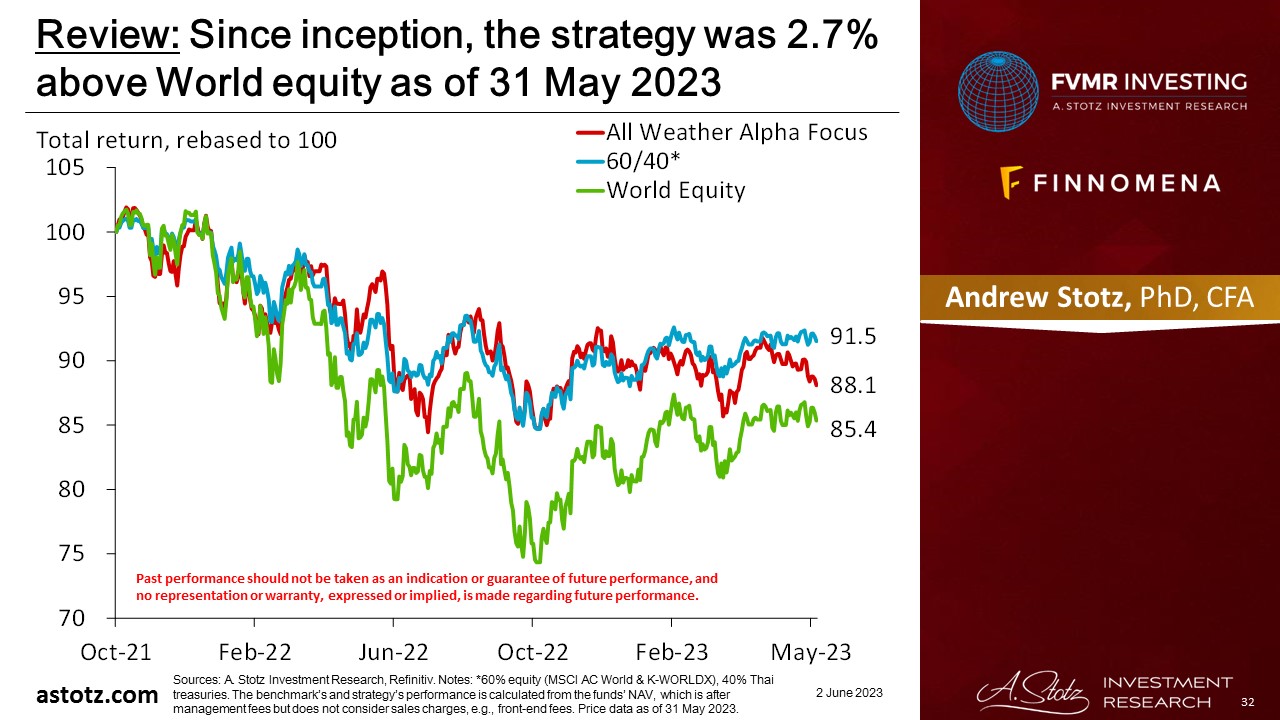

Since inception, the strategy was 2.7% above World equity as of 31 May 2023

The strategy was 2.0% below the 60/40 portfolio

- The strategy was 1.4% below World Equity

- Our tilt to Europe small caps held up well

- Our tilts to World Healthcare, Infrastructure, Energy, and Precious metals miners did poorly

Global outlook that guides our asset allocation

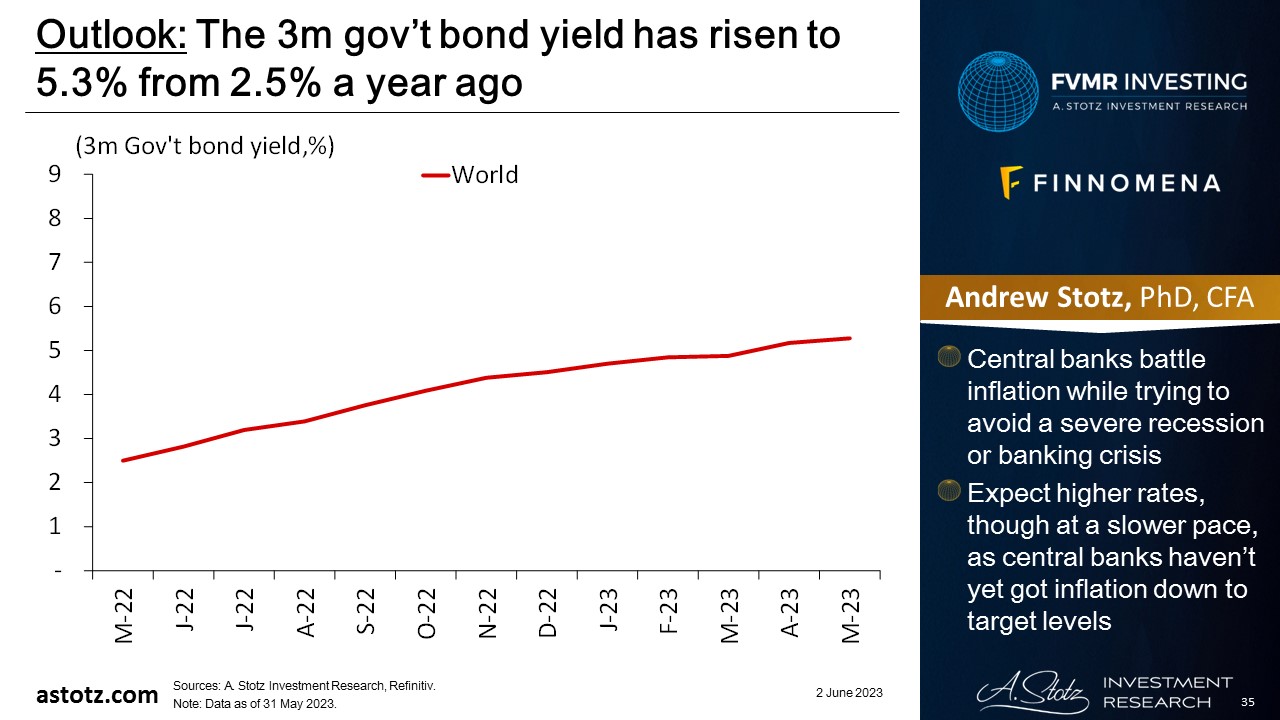

The 3m gov’t bond yield has risen to 5.3% from 2.5% a year ago

- Central banks battle inflation while trying to avoid a severe recession or banking crisis

- Expect higher rates, though at a slower pace, as central banks haven’t yet got inflation down to target levels

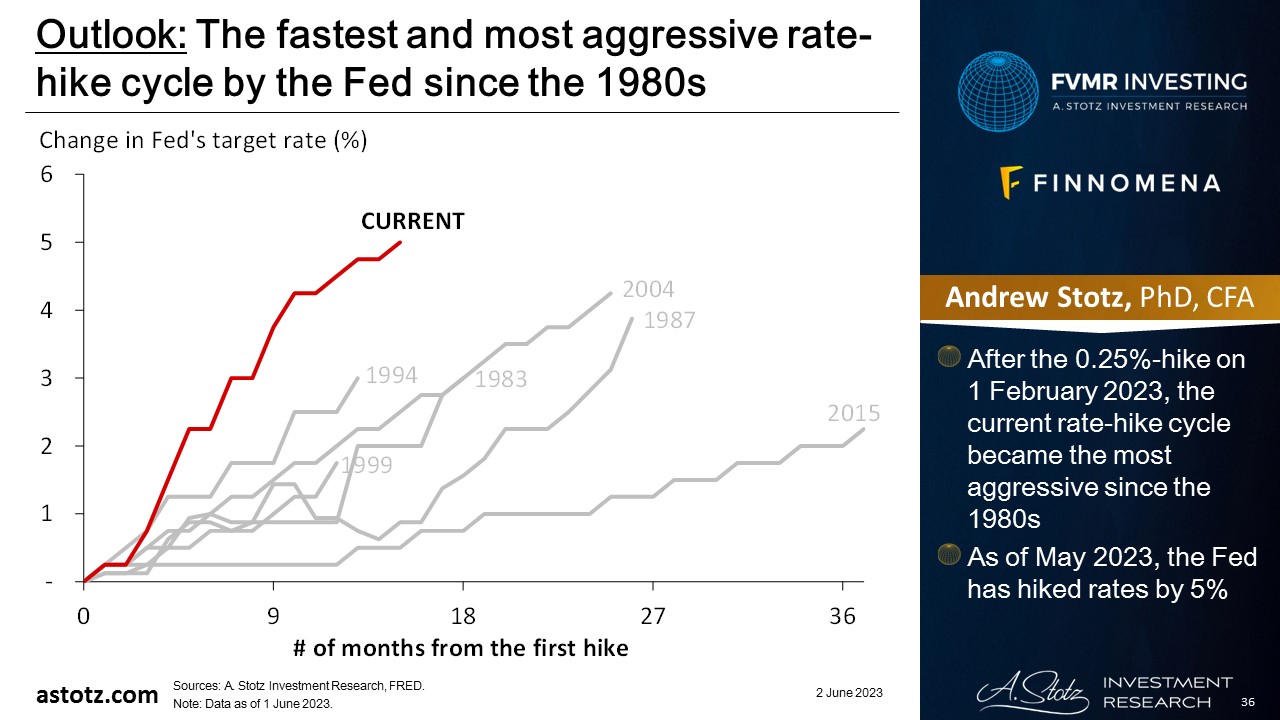

The fastest and most aggressive rate-hike cycle by the Fed since the 1980s

- After the 0.25%-hike on 1 February 2023, the current rate-hike cycle became the most aggressive since the 1980s

- As of May 2023, the Fed has hiked rates by 5%

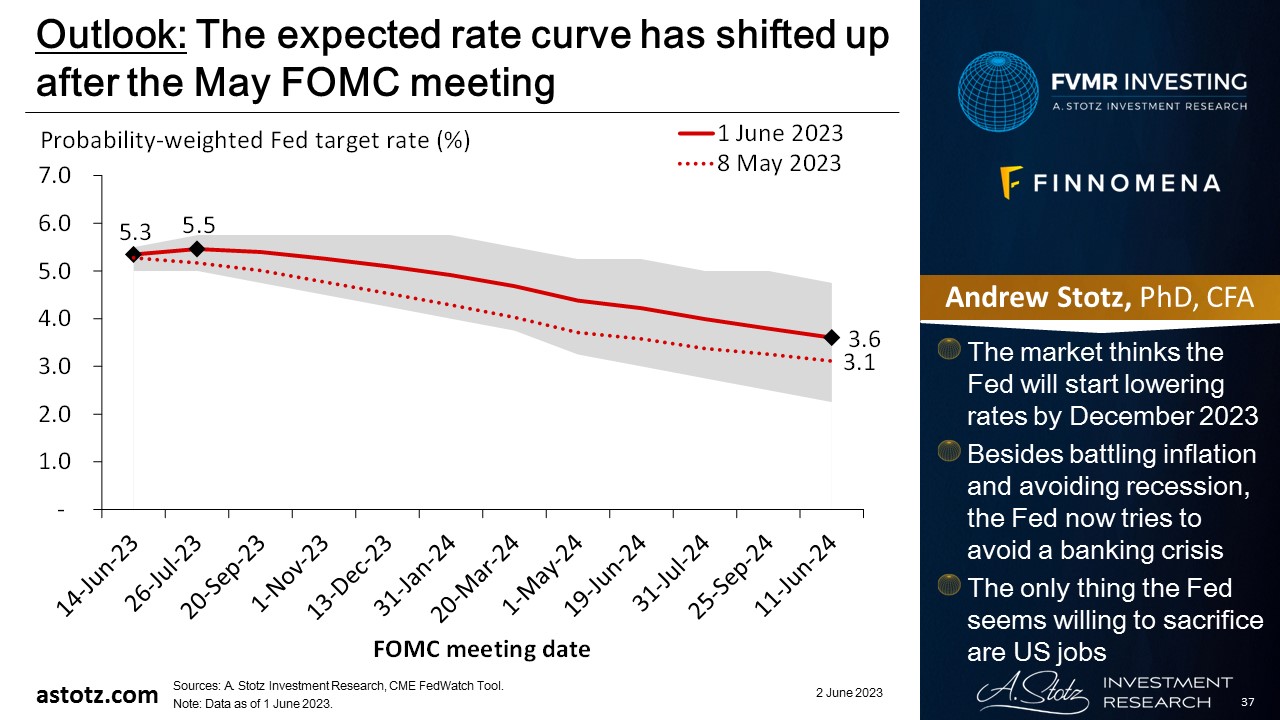

The expected rate curve has shifted up after the May FOMC meeting

- The market thinks the Fed will start lowering rates by December 2023

- Besides battling inflation and avoiding recession, the Fed now tries to avoid a banking crisis

- The only thing the Fed seems willing to sacrifice are US jobs

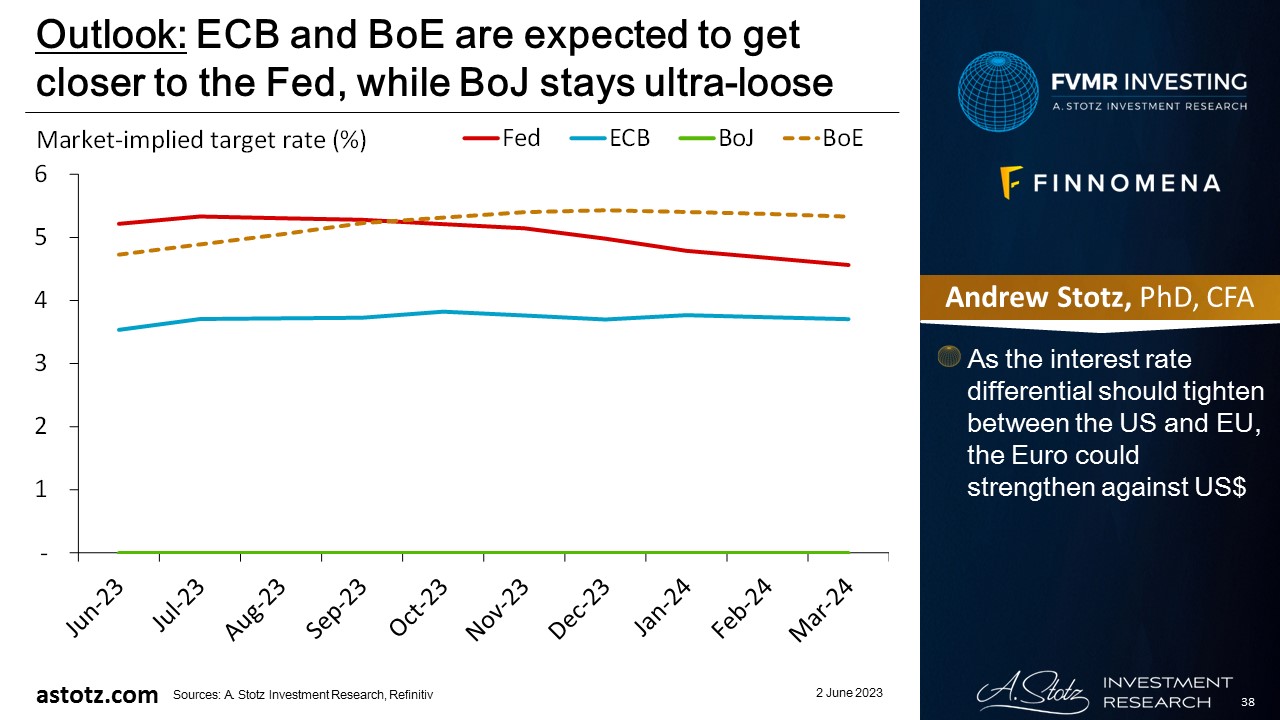

ECB and BoE are expected to get closer to the Fed, while BoJ stays ultra-loose

- As the interest rate differential should tighten between the US and EU, the Euro could strengthen against US$

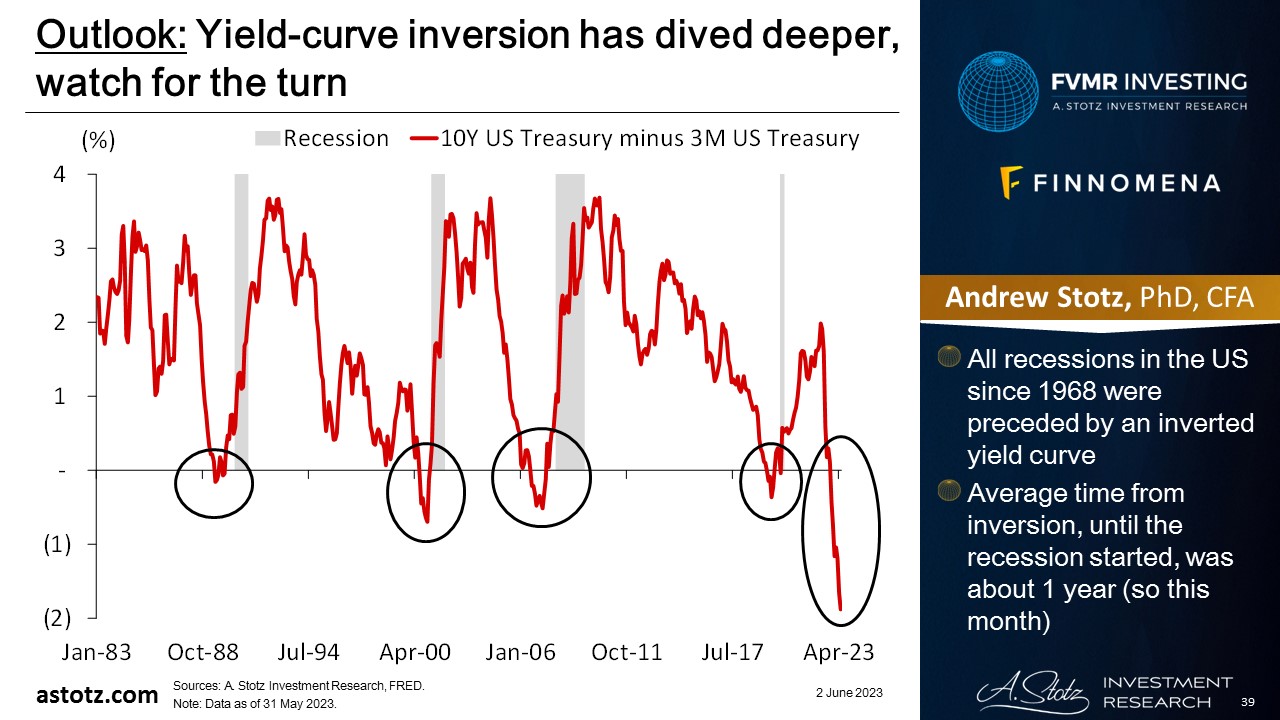

Yield-curve inversion has dived deeper, watch for the turn

- All recessions in the US since 1968 were preceded by an inverted yield curve

- Average time from inversion, until the recession started, was about 1 year (so this month)

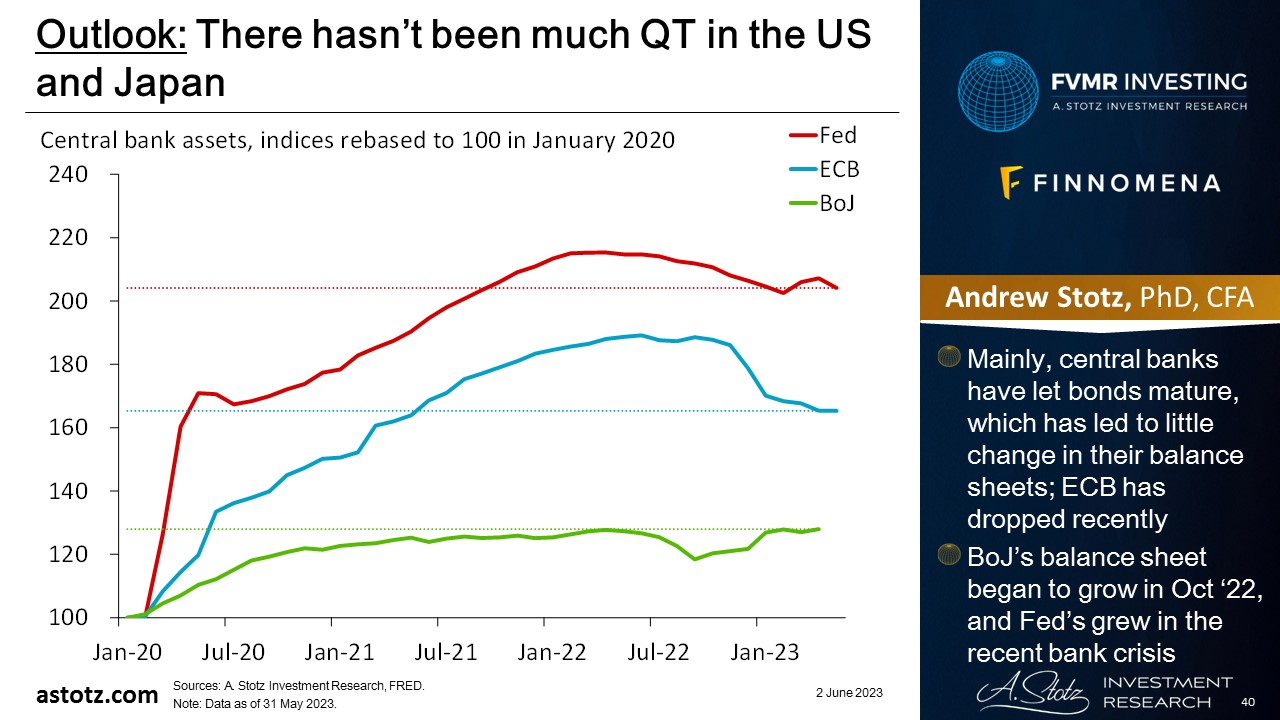

There hasn’t been much QT in the US and Japan

- Mainly, central banks have let bonds mature, which has led to little change in their balance sheets; ECB has dropped recently

- BoJ’s balance sheet began to grow in Oct ‘22, and Fed’s grew in the recent bank crisis

For the past year, we’ve said that we think the course will eventually be reversed

- We still think central bankers and politicians will change course and return to accommodative policies as soon as something “breaks”

- And we do think central bankers are going to break things

Bonds are typically a safe place to be, even though 2022 was exceptionally bad

- In recessions, safer assets like government bonds typically have performed well

- Though with high inflation, low yields could still lead to negative real returns

- We generally don’t allocate to bonds to speculate on the upside but rather use it to protect capital over time

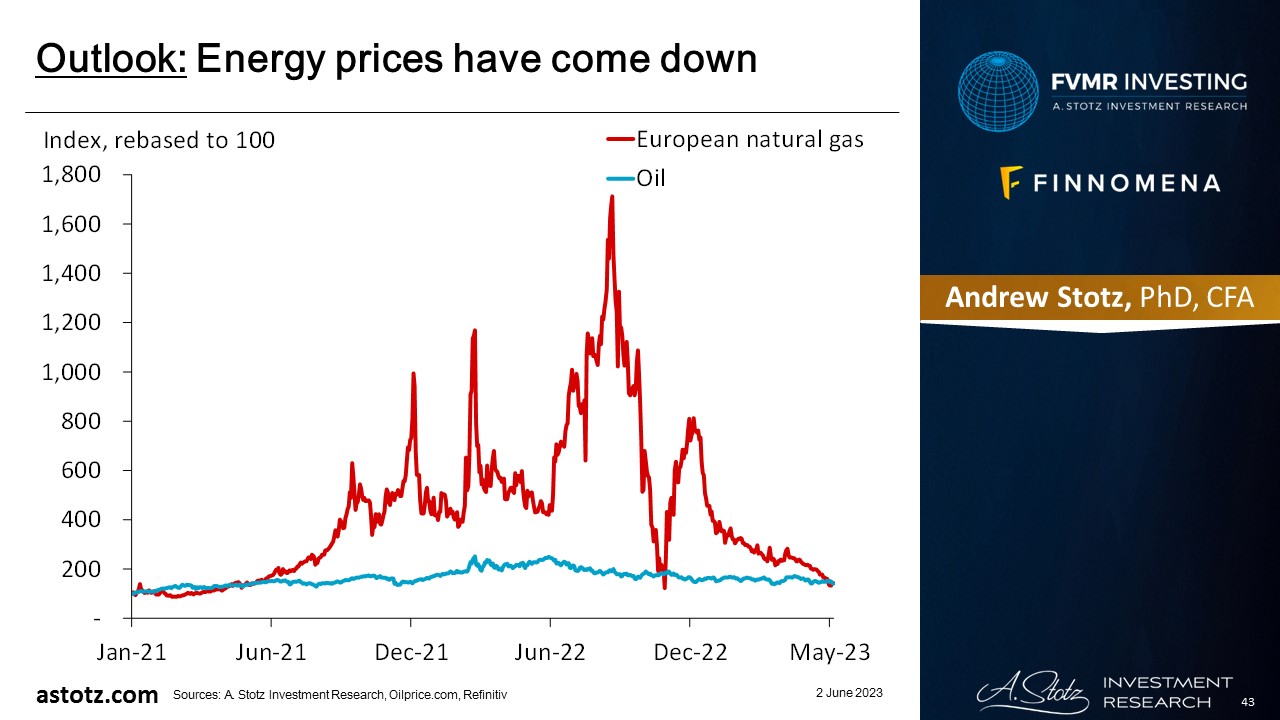

Energy prices have come down

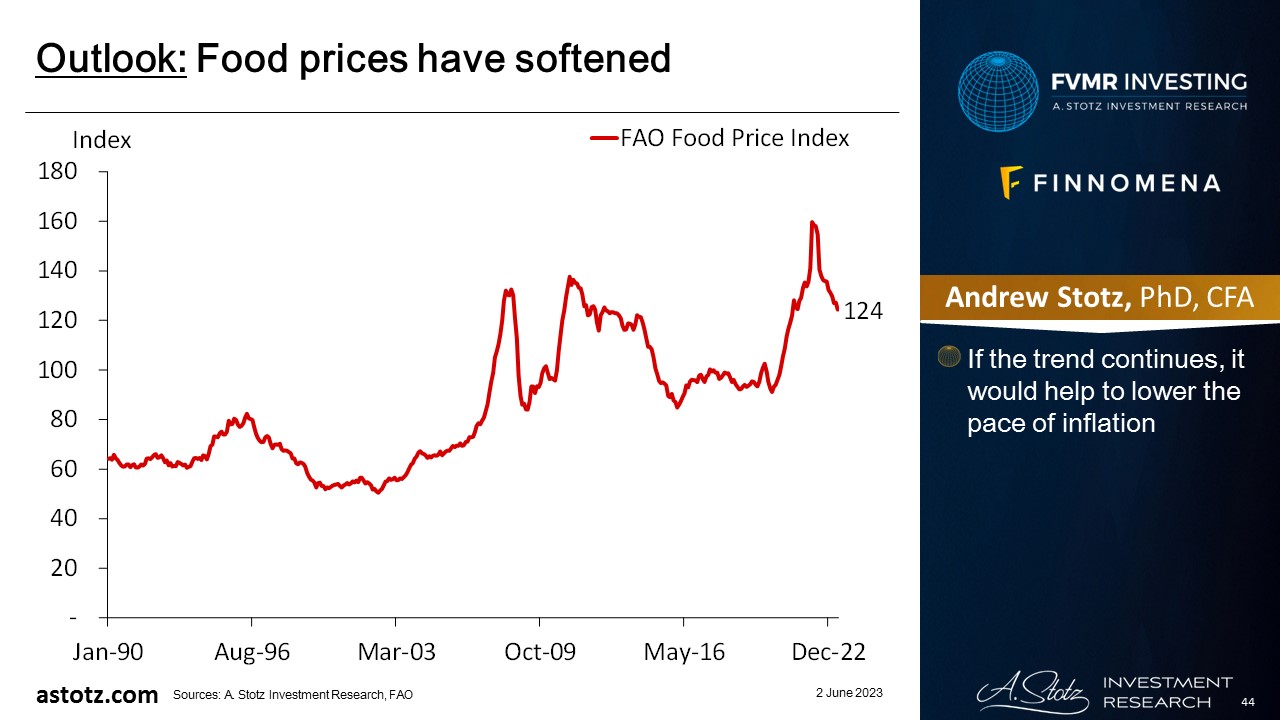

Food prices have softened

- If the trend continues, it would help to lower the pace of inflation

Commodities have lost momentum as the global economic outlook has worsened

- We currently don’t see a clear catalyst for energy prices to go significantly higher

- The main upside in commodities would come from a supply shock, adverse weather conditions, or significantly higher demand due to an improved growth outlook

Central banks have been loading up on gold, maybe switching from US$?

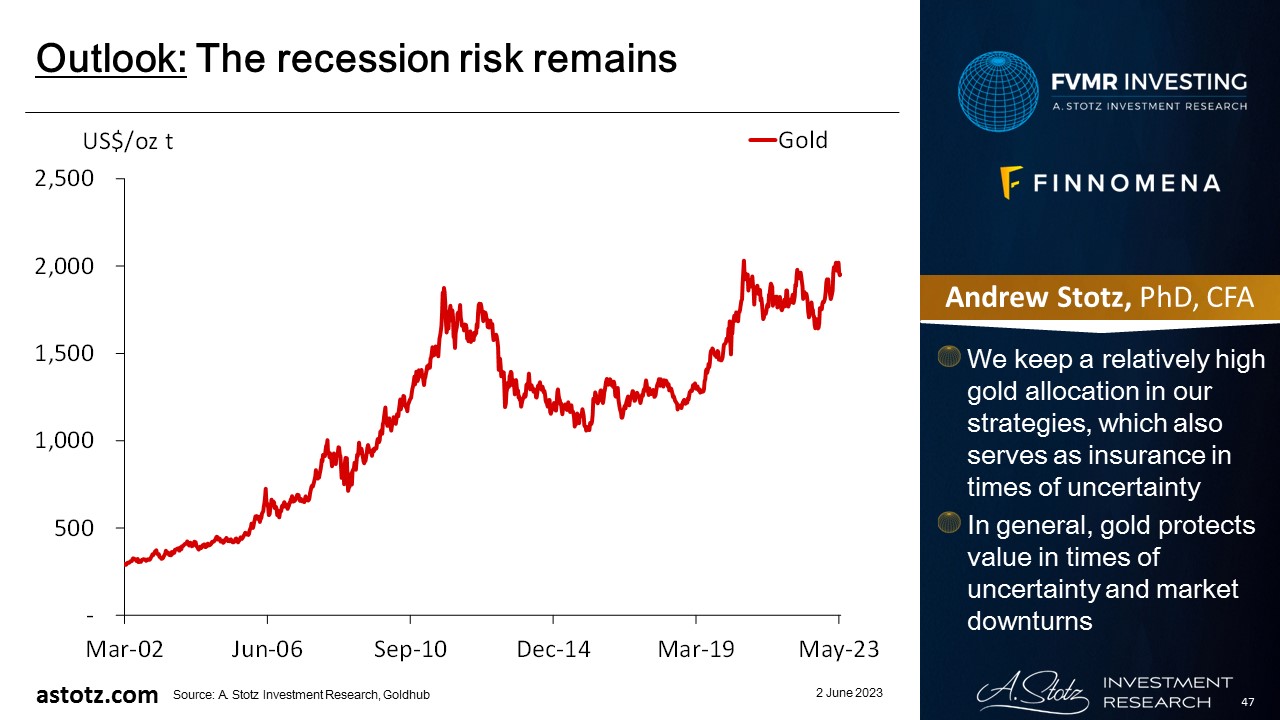

The recession risk remains

- We keep a relatively high gold allocation in our strategies, which also serves as insurance in times of uncertainty

- In general, gold protects value in times of uncertainty and market downturns

Risk: Inflation reaccelerates

- Central banks’ aggressive rate hikes and QT crash the stock markets

- If inflation reaccelerates, we could miss out on rising commodities prices

- Our high gold allocation could get hit by higher rates or improved market sentiment

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.