Become a Better Investor Newsletter – 10 May 2025

Noteworthy this week

- Buffett steps down as CEO

- 100 years without return

- China’s coal power is massive

- China, Japan, Korea, and ASEAN team up

- Gold to surpass US$4,000/oz t?

Buffett steps down as CEO: After 55 years and a total return of more than 5,500,000%, Warren Buffett has decided to step down as the CEO of Berkshire Hathaway. His replacement will be Greg Abel.

The end of an era at Berkshire Hathaway:

“At year-end, Greg would be the CEO of Berkshire. I would still hang around and could conceivably be useful in a few cases. But the final word would be Greg’s…Greg doesn’t know anything about this until what he’s hearing right now.” pic.twitter.com/JY5KQXGJUy

— The Transcript (@TheTranscript_) May 3, 2025

100 years without return: Believe it or not, stock markets can go a long, long time with no returns. Austria holds the record at 98 years.

Stock markets can go a long, long time with no returns.

Decades, even.

via @UBS pic.twitter.com/D40bv7bwum

— Meb Faber (@MebFaber) May 5, 2025

China’s coal power is massive: China generates more electricity from coal than the US from all sources combined. Perspective.

Food for thought next time you chew on paper drinking straw. China generates more electricity from coal than the US from all sources combined. Throwing tomato soup at Mona Lisa will barely have any impact in this regard. pic.twitter.com/nhC6yRpVEa

— Michael A. Arouet (@MichaelAArouet) May 2, 2025

China, Japan, Korea, and ASEAN team up: The countries recently issued a joint statement in which they take a unified stance against Trump’s tariffs.

This is quite consequential.

China, Japan, South Korea and the countries of ASEAN just issued a joint statement (https://t.co/uk2upyisnt) in which they take a unified stance against “escalating trade protectionism”, a clear reference to Trump’s tariffs.

They write that their… pic.twitter.com/SIoV6jhCet

— Arnaud Bertrand (@RnaudBertrand) May 5, 2025

Gold to surpass US$4,000/oz t?: Goldman Sachs has a base case of gold at US$4,000/oz t by mid-2026. Just remember that analyst forecasts are seldom accurate.

GOLDMAN SACHS: “WE REITERATE OUR STRUCTURAL BULLISH GOLD VIEW WITH A BASE CASE OF $3,700/TOZ BY YEAR-END AND OF $4,000 BY MID-2026”

“IF RECESSION OCCURS, WE ESTIMATE THAT ACCELERATION IN ETF INFLOWS WOULD LIFT GOLD PRICE TO $3,880 BY YEAR-END”

“IN EXTREME TAIL SCENARIOS WHERE… pic.twitter.com/FT5K93kepJ

— CN Wire (@Sino_Market) May 5, 2025

Join the world’s toughest valuation training

Become a Valuation Expert. Valuation Master Class Boot Camp graduates can confidently value any company in the world and possess in-demand industry skills.

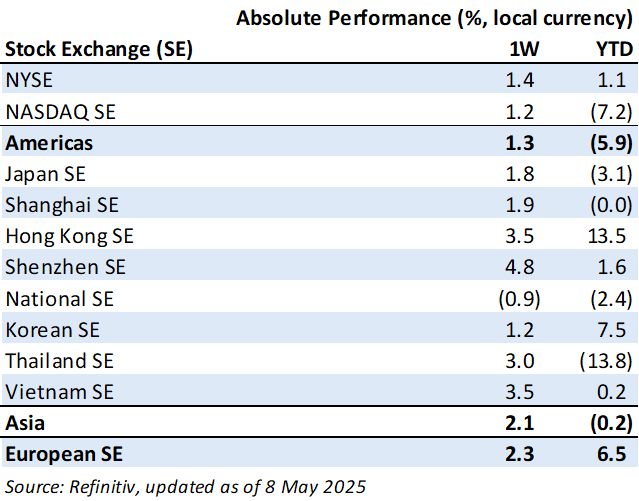

Weekly market performance

Click here to see more markets and periods.

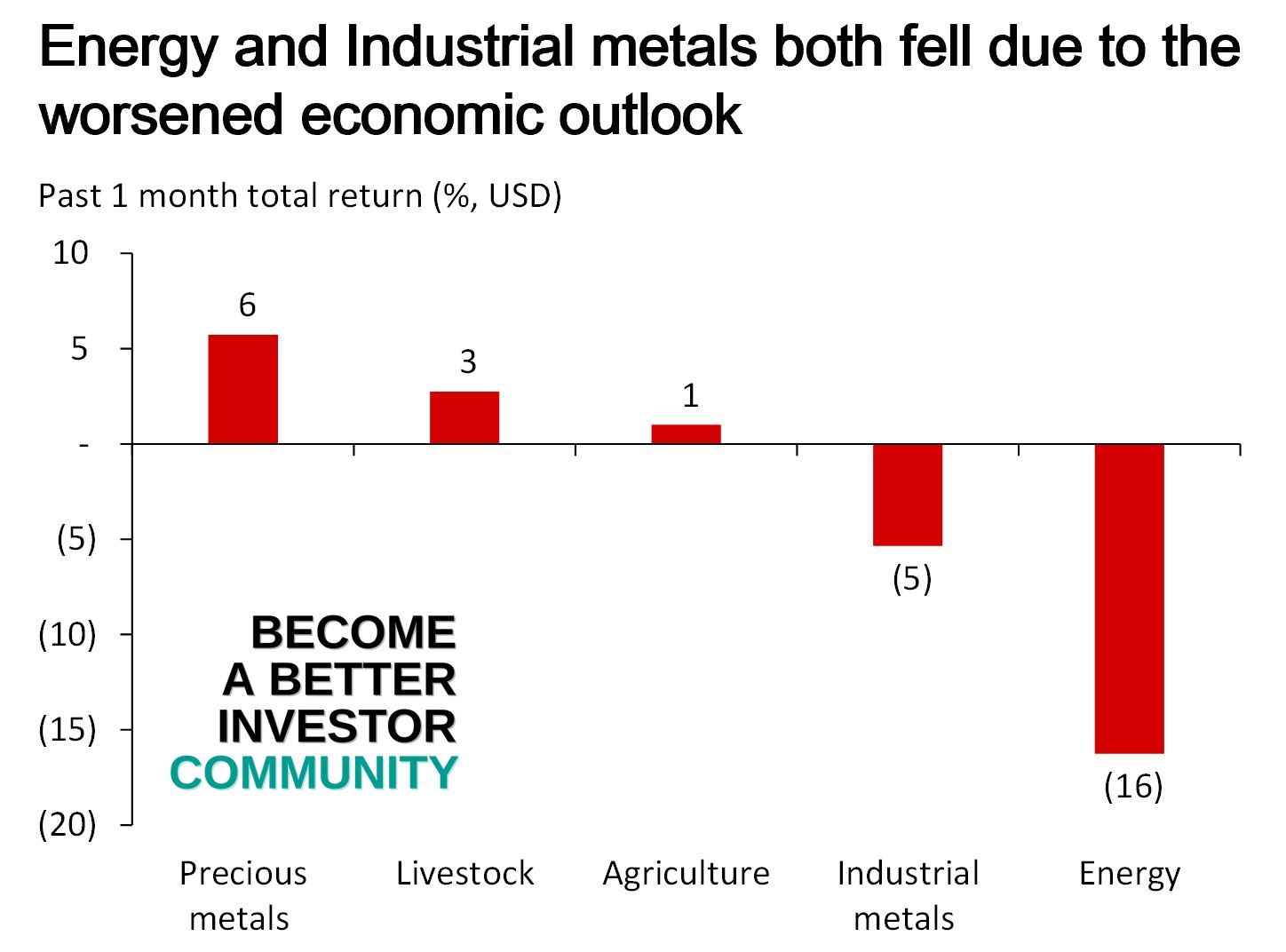

Chart of the week

Try 1 month of the Become a Better Investor Community for FREE today!

You can cancel at any time. Click here to learn more.

Podcasts we listened to this week

#255 Grant Williams on the 100-Year Pivot That’s Bigger Than Markets

“Williams warns that we’ve entered an “air pocket” where tariff impacts haven’t yet fully manifested in corporate earnings but will soon emerge with significant consequences. He emphasizes a crucial mindset shift from “getting rich” to “staying rich,” urging investors to prioritize capital preservation over chasing returns.”

Readings this week

Everyone Is Cheating Their Way Through College

“Chungin ‘Roy’ Lee stepped onto Columbia University’s campus this past fall and, by his own admission, proceeded to use generative artificial intelligence to cheat on nearly every assignment.”

Book recommendation

Peak Human: What We Can Learn from the Rise and Fall of Golden Ages by Johan Norberg

“Golden ages are marked by periods of spectacular cultural flourishing, scientific exploration, technological achievement and economic growth: Ancient Greece gave us democracy and the rule of the law; out of Abbasid Baghdad came algebra and modern medicine, and the Dutch Republic furnished us with Europe’s greatest artistic movements. As such, each has unique lessons to teach us about the world we live in today. But, all previous golden ages have proven finite, whether through external pressures or internal fracturing.”

Get the book on Audible or Kindle.

Audible is great; have you tried it? If not, click here to get 2 books for free.

Memes of the week

— Steve Stewart-Williams (@SteveStuWill) May 3, 2025

Oh no! pic.twitter.com/bH7H0UB21Z

— C-Bo the Eggman (@CBoTheEggman) May 3, 2025

New My Worst Investment Ever episodes

Why Family Businesses Stay Stuck in Survival Mode

If every week feels like a scramble, you’re missing structure. Without a precise rhythm, you’re starting from zero every Monday. That’s exhausting, and it keeps you stuck. Try this: start one monthly owner profit check-in, 60 minutes max.

Access the episode’s show notes and resources

Ep804: Jeff Holman – The Franchise Bubble That Burst Too Soon

BIO: Jeff Holman, founder of Intellectual Strategies, is revolutionizing legal support for startups and scaling businesses. His Fractional Legal Team model provides expert legal guidance without the cost of a full-time team.

STORY: Jeff started a cold plunge and sauna business during the pandemic. The company looked great, but he had employee issues, which affected its success. Soon, tens of other studios, brands, and franchises were all popping up within a mile of Jeff’s studio.

LEARNING: Create strategic alignment incrementally and iteratively.

Access the episode’s show notes and resources

Published on Become a Better Investor this week

In this episode of Enrich Your Future, Andrew and Larry Swedroe discuss Larry’s new book, Enrich Your Future: The Keys to Successful Investing. In this series, they discuss Chapter 31: The Uncertainty of Investing.

Listen to Enrich Your Future 31: Risk vs. Uncertainty: The Investor’s Blind Spot

Singapore Airlines Limited (SIA SP): Profitable Growth rank of 6 was down compared to the prior period’s 4th rank. This is below average performance compared to 1,380 large Industrials companies worldwide.

Read Singapore Airlines – World Class Benchmarking

Yutong Bus Company Limited (600066 SH): Profitable Growth rank of 1 was up compared to the prior period’s 2nd rank. This is World Class performance compared to 1,380 large Industrials companies worldwide.

Read Yutong Bus – World Class Benchmarking

Mega Lifesciences Public Company Limited (MEGA TB): Profitable Growth rank of 2 was same compared to the prior period’s 2nd rank. This is World Class performance compared to 350 medium Health Care companies worldwide.

Read Mega Lifesciences – World Class Benchmarking

Raffles Medical Group Limited (RFMD SP): Profitable Growth rank of 6 was down compared to the prior period’s 4th rank. This is below average performance compared to 350 medium Health Care companies worldwide.

Read Raffles Medical Group – World Class Benchmarking

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.