Become a Better Investor Newsletter – 30 March 2024

Noteworthy this week

- Fed has US$1trn in unrealized losses

- The 2nd wave of inflation

- China is buying gold

- Japan’s 34-year drawdown is rookie numbers

- Daniel Kahneman has left us

Fed has US$1trn in unrealized losses: The Fed has US$948 billion in unrealized losses on their Treasury/mortgage-backed securities holdings.

The Fed has $948 billion in unrealized losses on their Treasury/MBS holdings.https://t.co/zo1in1gNBs pic.twitter.com/3CdwcUZdE9

— Charlie Bilello (@charliebilello) March 27, 2024

The 2nd wave of inflation: Agricultural commodities are now up 21% annually. According to the chart, there is a 3-month lead on CPI. Are we going to see a second wave of inflation?

Agricultural commodities are now up 21% annually.

That has a 3-month lead on CPI.

A second wave of inflation is emerging. pic.twitter.com/gCq8C3hxkF

— Otavio (Tavi) Costa (@TaviCosta) March 27, 2024

China is buying gold: We’ve seen gold surpass US$2,200/oz t, and China is one of the big buyers. Are they diversifying from US$?

Is this the most important chart in finance…?? pic.twitter.com/CLWKyWLGhT

— Kuppy (@hkuppy) March 25, 2024

Japan’s 34-year drawdown is rookie numbers: It can always be worse; that’s a good thing to remember. Though looking for patterns, like our brain normally does, it seems like the drawdowns are getting shorter.

If you thought Japan’s 34yr drawdown was long, just think, it could have been worse…

Kinda amazing how many manias existed in the mid/late-19th century economies. pic.twitter.com/9yi4da1OV5

— Bob Elliott (@BobEUnlimited) March 27, 2024

Daniel Kahneman has left us: Another great thinker has left us in 2024. Kahneman made foundational research creating the field of behavioral economics.

Daniel Kahneman passed away today.

His work on behavioral economics was groundbreaking. His fantastic book “Thinking Fast & Slow” will provide the world with insights for decades to come.

Here’s a wonderful infographic summary:

May he rest in peace. pic.twitter.com/cVzKZlqDwI

— Brian Feroldi (@BrianFeroldi) March 27, 2024

Join the world’s toughest valuation training

Become a Valuation Expert. Valuation Master Class Boot Camp graduates can confidently value any company in the world and possess in-demand industry skills.

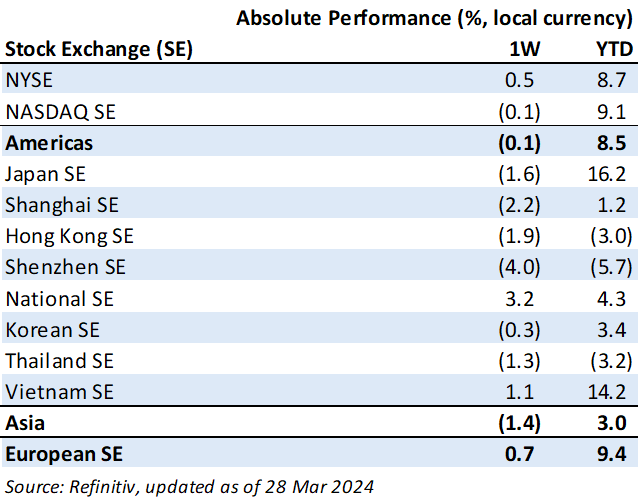

Weekly market performance

Click here to see more markets and periods.

Chart of the week

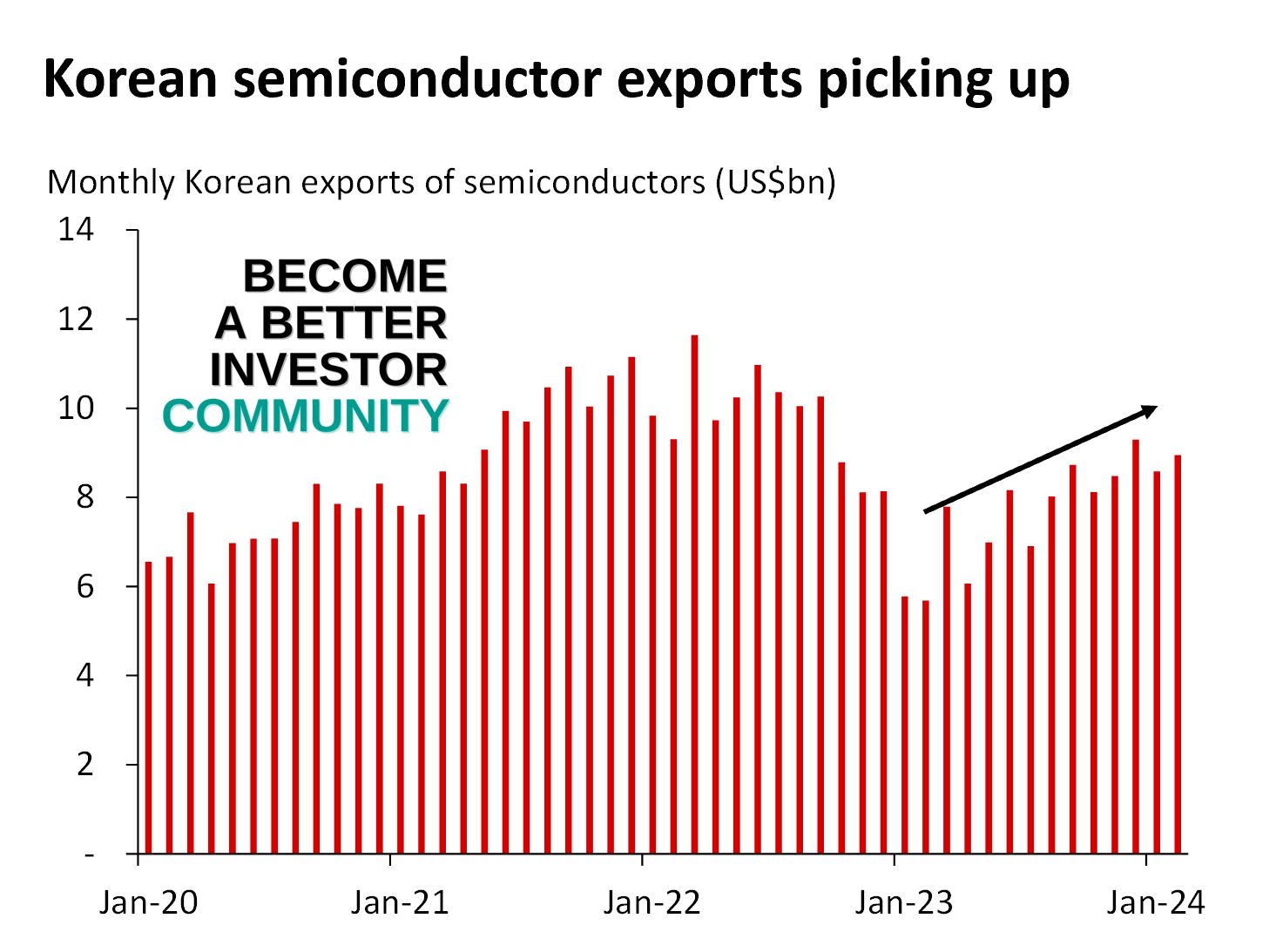

Discussed in the Become a Better Investor Community this week

“We had an exciting discussion about why we think China should be treated separately from the Asia Pacific region due to its size and political risk.”

Try 1 month of the Become a Better Investor Community for FREE today!

You can cancel at any time. Click here to learn more.

Podcasts we listened to this week

Forward Guidance – Russell Napier On The Rise And Fall Of The Age Of Debt And China’s Choice Between Deflation and Devaluation

“Russell Napier, founder of Orlock Advisors and publisher of The Solid Ground Newsletter, returns to Forward Guidance to share how China’s decision to peg its currency the Chinese Yuan in 1994 at an artificially low rate had enormous consequences on world’s monetary system, and why China may be soon be forced to make a monetary policy decision regarding its currency which may have similarly large consequences for the globe.”

Readings this week

Smart Words From Smart People

“’People in their 30s know where the world is going because they’re going to do it. I’m in my 80s so I have no idea.’ – Daniel Kahneman.”

Book recommendation

A Thousand Brains: A New Theory of Intelligence by Jeff Hawkins

“A bestselling author, neuroscientist, and computer engineer unveils a theory of intelligence that will revolutionize our understanding of the brain and the future of AI.”

Get the book on Audible or Kindle.

Audible is great; have you tried it? If not, click here to get 2 books for free.

Memes of the week

— Elon Musk (@elonmusk) March 26, 2024

🎯🎯🎯 pic.twitter.com/rS3IKUp64z

— Not Jerome Powell (@alifarhat79) March 27, 2024

New My Worst Investment Ever episodes

Ep779: Tony Fish – Be Brave to Ask the Unsaid Questions

BIO: Tony Fish is a neuro-minority and a leading expert on decision-making, governance, and entrepreneurship in uncertain environments. His 30-year sense-making and foresight track record means he has been ahead on several technical revolutions.

STORY: In this episode, Tony talks about his newest book, Decision Making in Uncertain Times. How can we become more aware of the consequences of our actions tomorrow?

LEARNING: Ask better questions.

Access the episode’s show notes and resources

Published on Become a Better Investor this week

“The Cloud” is a metaphor for the top level of corporate authority – the CEO, CFO, CTO and maybe some Vice President positions. And if you’re trying to transform an organization, your ideas need to penetrate the Cloud – but how? In this episode, Bill Bellows and host Andrew Stotz talk about influencing others with the aim of transformation.

Listen to Get Off Of My Cloud: Awaken Your Inner Deming (Part 16)

In this episode of Investment Strategy Made Simple (ISMS), Andrew gets into part two of his discussion with Larry Swedroe: Ignorance is Bliss. Today, they discuss two chapters of Larry’s book Investment Mistakes Even Smart Investors Make and How to Avoid Them. In this series, they discuss mistake 30: Do You Fail to Understand the Tyranny of the Efficiency of the Market? And mistake 31: Do You Believe Hedge Fund Managers Deliver Superior Performance?

Read ISMS 40: Larry Swedroe – Market vs. Hedge Fund Managers’ Efficiency

LVMH Moet Hennessy Louis Vuitton SE (MC FP): Profitable Growth rank of 2 was same compared to the prior period’s 2nd rank. This is World Class performance compared to 880 large Cons. Disc. companies worldwide.

Read LVMH Moet Hennessy Louis Vuitton SE – World Class Benchmarking

Hermès International SCA (RMS FP): Profitable Growth rank of 1 was same compared to the prior period’s 1st rank. This is World Class performance compared to 880 large Cons. Disc. companies worldwide.

Read Hermès International SCA – World Class Benchmarking

Hankook Tire & Technology Company Limited (161390 KS): Profitable Growth rank of 4 was same compared to the prior period’s 4th rank. This is above average performance compared to 960 large Cons. Disc. companies worldwide.

Read Hankook Tire & Technology – World Class Benchmarking

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.