Sweden Equity FVMR Snapshot: ‘Sweden in Your Hand—Every Week’

Sweden Equity FVMR Snapshot – August 2016

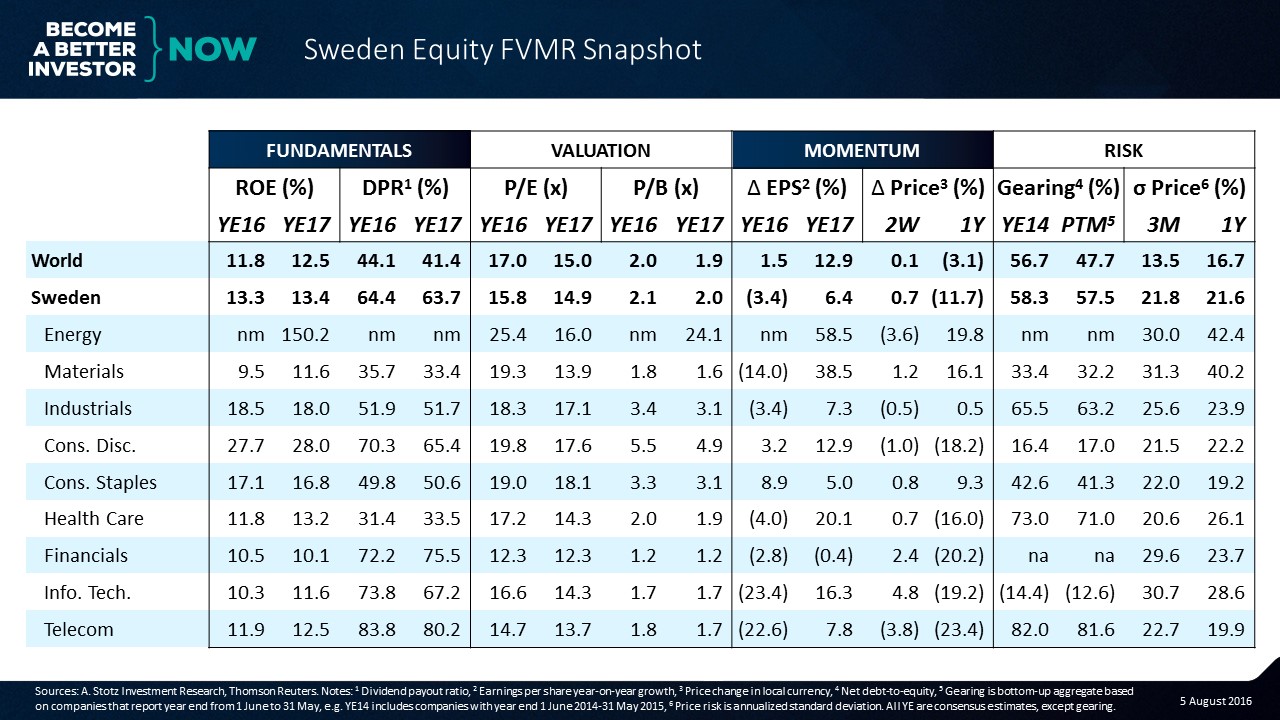

Fundamentals

Sweden’s ROE is slightly above the World at 13%. Consumer Discretionary deliver the highest ROE. The DPR in Sweden is well above the World at roughly 65%.

Valuation

Sweden is trading below the World on PE and just above on PB. Financials is cheapest on PE and PB. Energy is most expensive on PE and Consumer Discretionary on PB.

Momentum

Earnings in Sweden are expected to fall in 2016 and grow slower than the World in 2017. Earnings are expected to rebound strongly in Energy and Materials during 2017. Sweden’s 1Y performance has been well below the World.

Risk

Telecom and Health Care have the highest gearing in Sweden. Consumer Discretionary has low gearing in addition to the highest ROE. Sweden has been much more volatile than the World.

Sign up for free and YOU will:

-

Always be up to date: Every week you will receive the updated Sweden Equity FVMR Snapshot

-

Know all the numbers: One page covers Fundamentals, Valuation, Momentum, and Risk (FVMR)

-

Be professional: Use the same information as institutional investors and fund managers

-

Not have to do anything else to stay informed: After signing up you will receive a one-page PDF every Monday

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.