The Ruling Top 5 Stocks

Top 5 of the Week of August 20

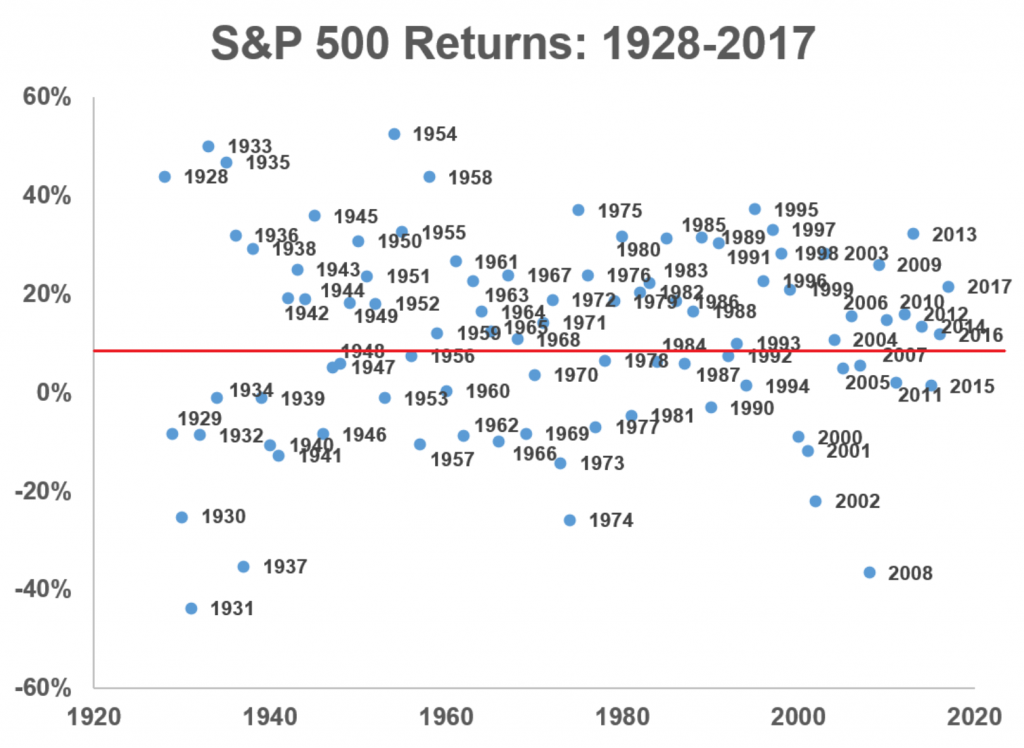

A Wealth of Common Sense’s Ben Carlson kicks off our Top 5 this week with a look at his updated S&P 500 returns chart. Mark Rzepczynski, on his blog, charges us to start identifying our purposeful mistakes. And The Irrelevant Investor Michael Batnick considers overestimation at the bottom and the top.

Factor Investor Ehren Stanhope discusses false investing promises. And Urban Carmel from The Fat Pitch examines the impact of the top 5 stocks on the market…

The Improved Performance Chart

- Showing the returns from the last 89 years, the updated chart displays an average performance line to demonstrate how wide the fluctuations are annually

- The visualization in chart form depicts the irregularity which lies at the heart of much investor confusion surrounding the market

- The number of negative years is what happens with above average inflation, so if you want the chance for better expected returns, you just have to put up with the volatility

Identifying Purposeful Mistakes

- Mistakes are an inherent part of being human, we all make them and will continue to—the difference is if you make one on purpose

- Anything that could have been avoided or identified as a mistake in advance counts as being a purposeful one—these are markedly different though to calculated bets with an unfavorable outcome

- Not gathering information before making an investment decision and making sized bets that will potentially cause financial harm are both purposeful mistakes—avoid this behavior

Are you prone to purposeful mistakes? Share your comments in the section below

Challenging the Rules

- It’s logical to question the ideas that “the more you pay for stocks, the safer they are” and “credit spreads are safe when they’re low and risky when they’re high”

- But, there is a certain level of accuracy behind these claims, and while it scares us to buy at the top, it doesn’t kill you, and the odds are more in your favor

- Yes, it goes against the first rule of investing, the idea that the less you pay, the more chances there are for greater returns long-term—but it’s a much harder strategy to hold onto

Don’t Get Caught up in False Market Spin

- Recent market spin is going around that portfolios based on market-cap weights—indexes—work because investors own a greater selection of companies that are successful only

- This ‘approach’ is essentially a diluted form of momentum investing which only looks to invest in stocks that have appreciated recently, avoiding those that haven’t

- Ignore the hype, passive market cap-weighted portfolios are for market exposure, momentum investing is something else entirely

The Ruling Top 5 Stocks

- Back in the 1970s, the top 5 stocks were much more important than they are today—currently, the 5 largest make up for 16% of the market, and they’re known as FAAMG

- Time travel through history shows dramatic changes in who tops the stock leaderboard—in the 80s, it was oil and gas firms, and in the 2000s, companies from the tech bubble

- While it may seem unnatural for a handful of companies to account for the majority of the market returns, historical evidence shows us it’s actually perfectly normal

Top 5 of the Week is a summarized collection of financial investment articles that we like and think you might like too. Having written thousands of pages of equity strategy and company research between us, we understand the allure of the ever-changing world of finance. Investing is an art form—and like everything, something you can work on and improve at. There are some excellent writers out there on the finance web, some offer a running commentary on today’s market, some are doing research, some have tips on how to Become a Better Investor, and some just lift the cloud of fog behind a lot of financial jargon. Each week we will keep you up to date with the top 5 articles worthy of your attention.

Anything you would like to discuss about this week’s top 5? Do you have another favorite that isn’t mentioned here? Feel free to add it below. Let’s start a discussion in the comments section!

Do you like Top 5 of the Week? Feel free to share it with your friends.

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article. The Become a Better Investor Team doesn’t necessarily endorse any stocks or shares mentioned in the articles or the author of such articles linked to and summarized in Top 5 of the Week and cannot guarantee the accuracy of its information.