Can the World’s Largest Carmaker Handle the ESG Pressure?

Do you own Toyota?

The post was originally published here.

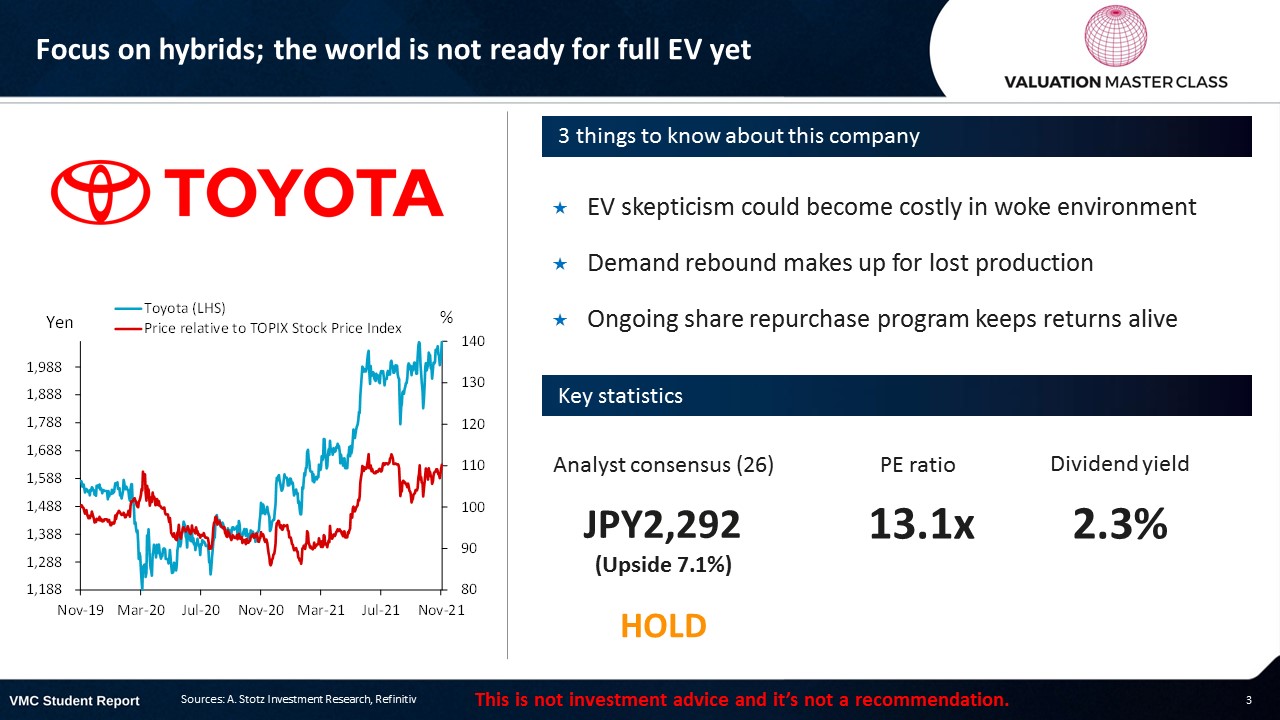

Highlights:

- EV skepticism could become costly in woke environment

- Demand rebound makes up for lost production

- Ongoing share repurchase program keeps returns alive

Download the full report as a PDF

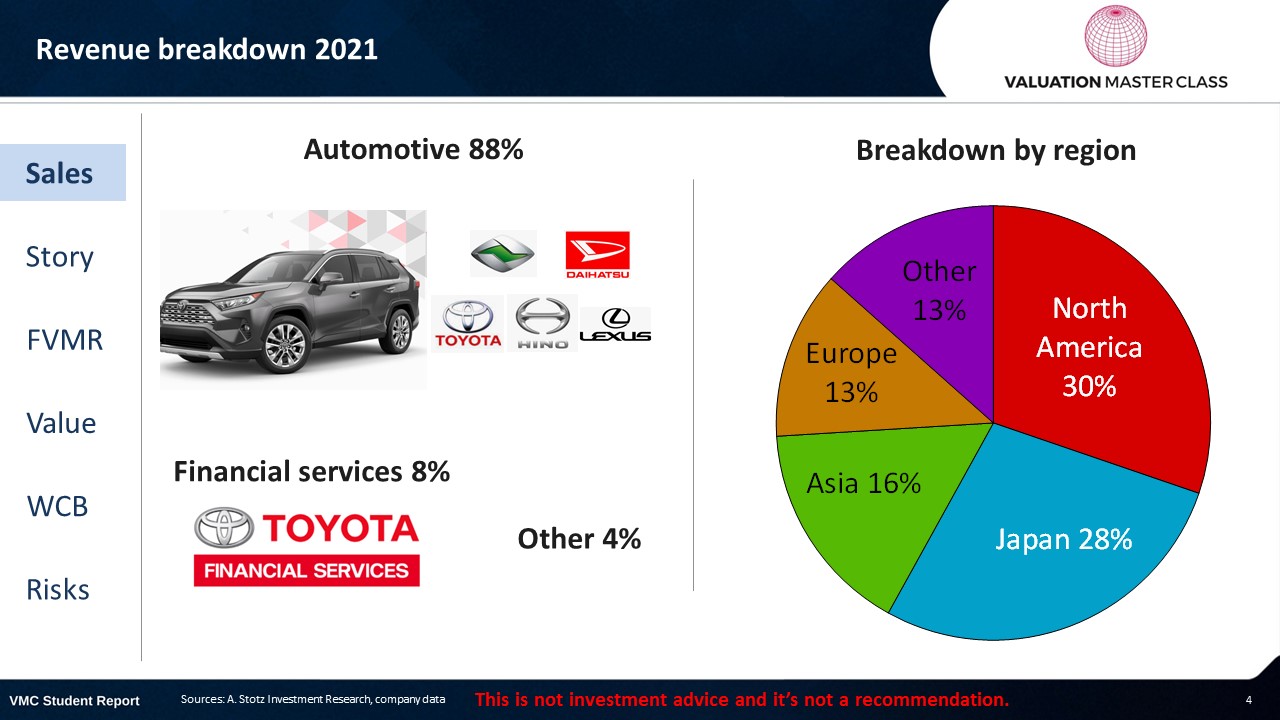

Toyota’s revenue breakdown 2021

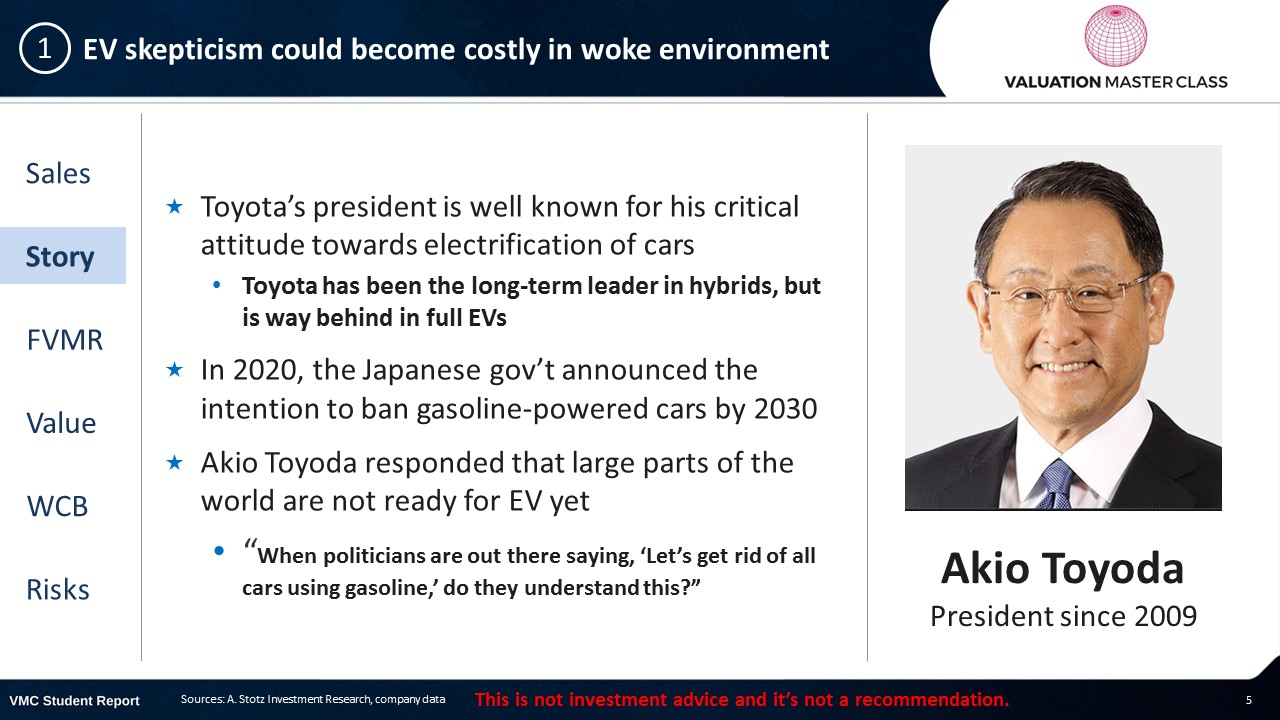

EV skepticism could become costly in woke environment

- Toyota’s president is well known for his critical attitude towards electrification of cars

- Toyota has been the long-term leader in hybrids, but is way behind in full EVs

- In 2020, the Japanese gov’t announced the intention to ban gasoline-powered cars by 2030

- Akio Toyoda responded that large parts of the world are not ready for EV yet

- “When politicians are out there saying, ‘Let’s get rid of all cars using gasoline,’ do they understand this?”

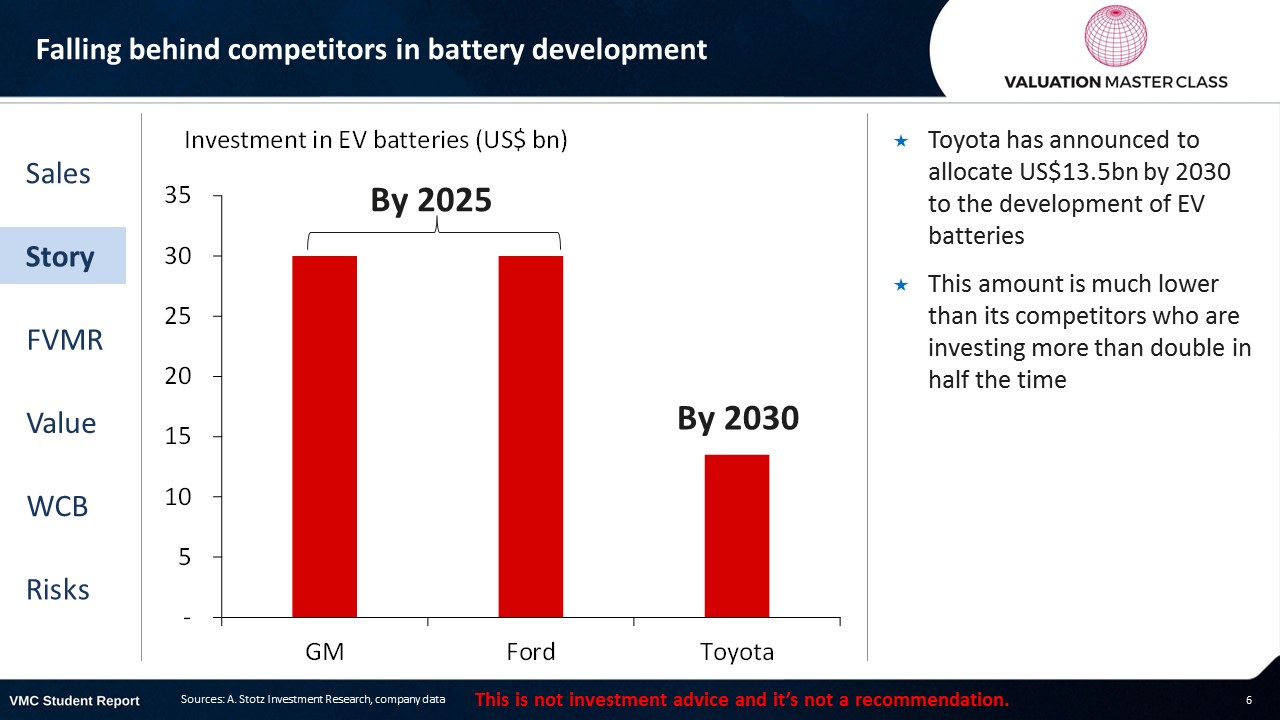

Falling behind competitors in battery development

- Toyota has announced to allocate US$13.5bn by 2030 to the development of EV batteries

- This amount is much lower than its competitors who are investing more than double in half the time

Betting on the wrong horse?

- The company continues to bet on hybrid models rather than full electric cars

- It argues that there is no difference in environmental benefits

- The manufacturing of batteries still causes too much pollution

- Most of energy cannot be supplied by renewable sources

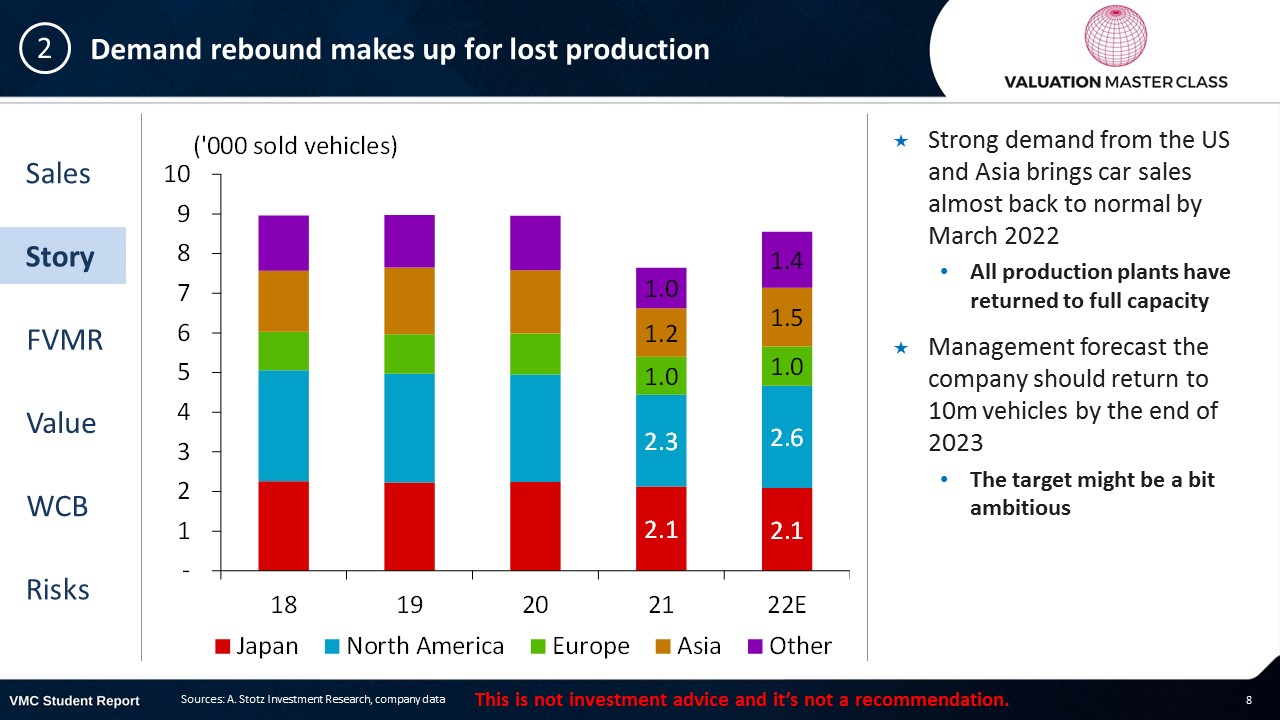

Demand rebound makes up for lost production

- Strong demand from the US and Asia brings car sales almost back to normal by March 2022

- All production plants have returned to full capacity

- Management forecast the company should return to 10m vehicles by the end of 2023

- The target might be a bit ambitious

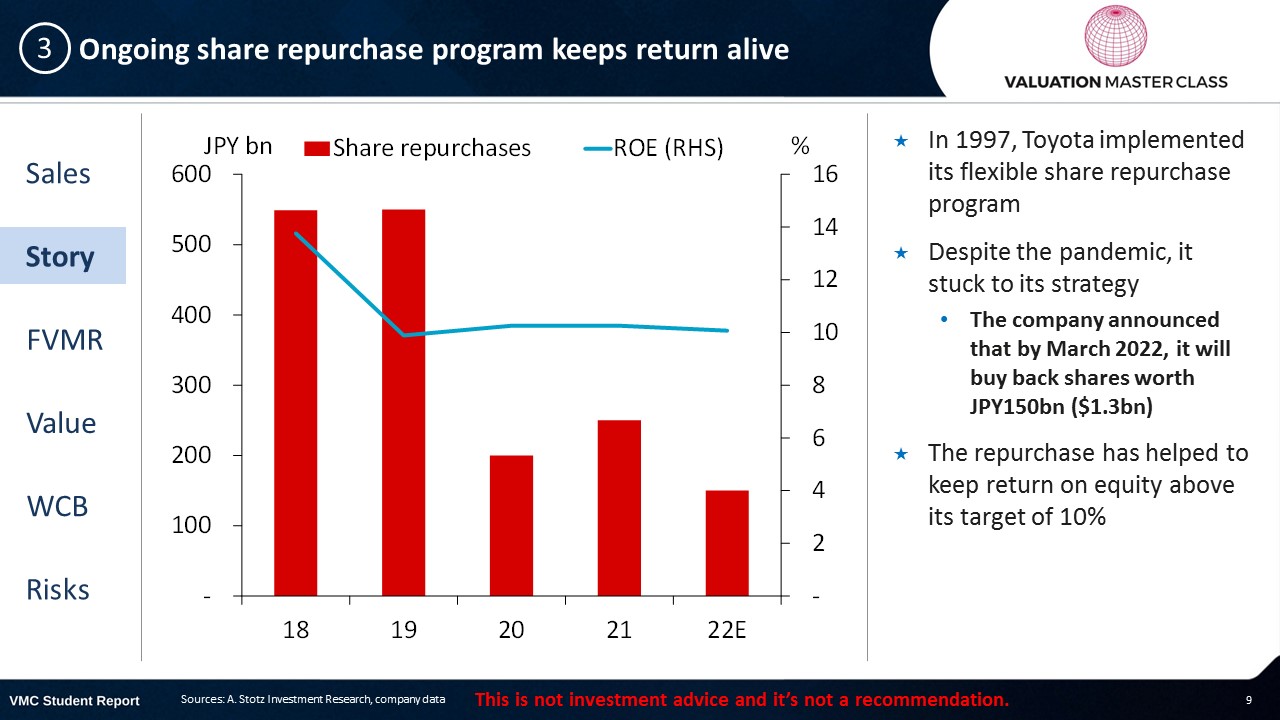

Ongoing share repurchase program keeps return alive

- In 1997, Toyota implemented its flexible share repurchase program

- Despite the pandemic, it stuck to its strategy

- The company announced that by March 2022, it will buy back shares worth JPY150bn ($1.3bn)

- The repurchase has helped to keep return on equity above its target of 10%

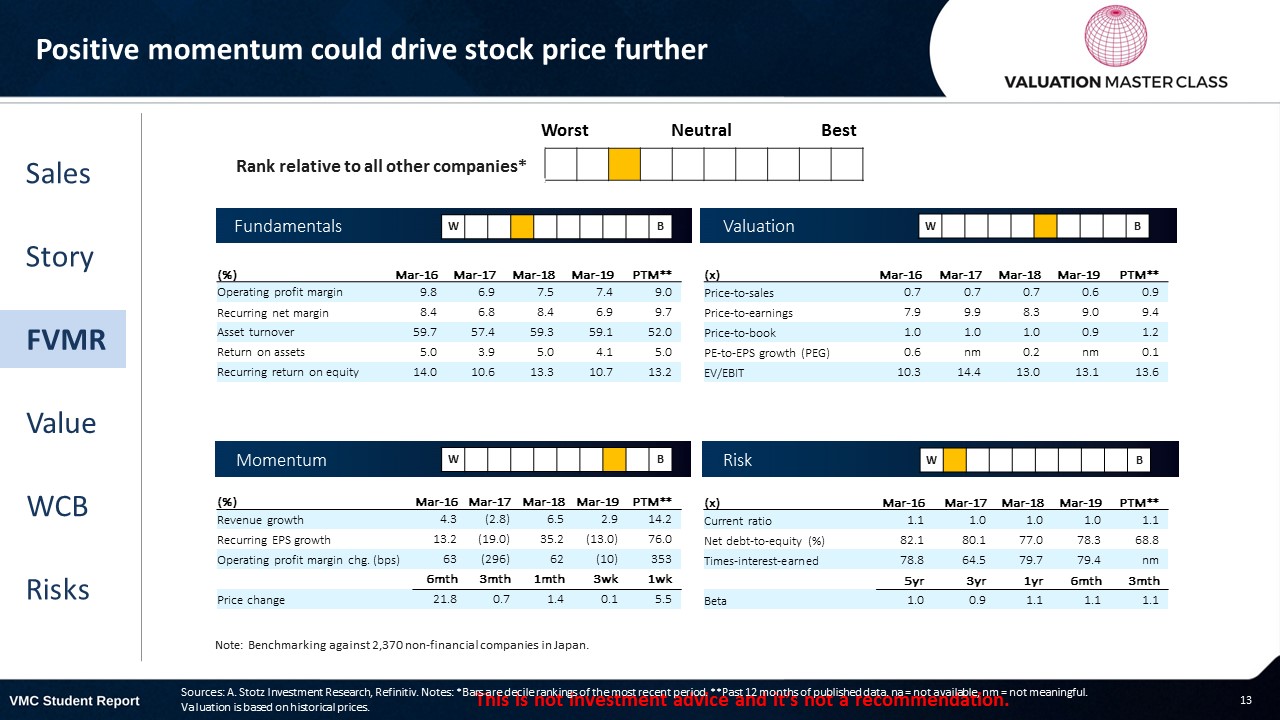

FVMR Scorecard – Toyota

- A stock’s attractiveness relative to stocks in that country or region

- Attractiveness is based on four elements

- Fundamentals, Valuation, Momentum, and Risk (FVMR)

- Scale from 1 (Best) to 10 (Worst)

Consensus remains optimistic regarding carmaker recovery

- Analyst consensus does not see much further upside

- The stock price has shown strong momentum recently

- They expect a strong recovery in global car sales

Get financial statements and assumptions in the full report

P&L – Toyota

- Toyota has shown a strong 1H22, with revenue aiming to hit JPY30trn by the end of the reporting period

- We expect that the company benefits further from post-pandemic recovery

Balance sheet – Toyota

- The company has a solid cash position, holding around 12.5% of its assets in cash

- Net fixed assets grow in line with revenue

- Expansion of its existing production plants

- Investment in battery development

- The item “Other” contains the treasury stock

- It is deducted from equity when the company buys back its own shares

- For 22E, the company set the buyback program to JPY 150bn

- We forecast buybacks to continue in the future as well

Cash flow – Toyota

- Operating cash flows were not able to cover investing activities in 2020 and 2021

- That should improve in 2022

- The company pays out dividends on a consistent basis

- Slowly growing over time

- Dividend payout ratio is almost constant around 30%

Ratios – Toyota

- Revenue was hit during the pandemic

- The global car industry rebounded; however, semiconductor shortages constrained growth in the short run

- This comprises a short-term drag on margins

- The company targets to keep its ROE around 10% (with the help of its buyback program)

- Toyota is among the most consistent and most profitable car makers in the world

- Competitors like VW and GM only achieve EBIT margin between 5 and 7%

- The company has moderately high leverage

Free cash flow – Toyota

- FCFF remained positive throughout the pandemic

- High investment expenditures require a consistent generation of strong operating cash flows

- It also needs recurring cash to continue its share buyback program which is an important element in the company’s strategy

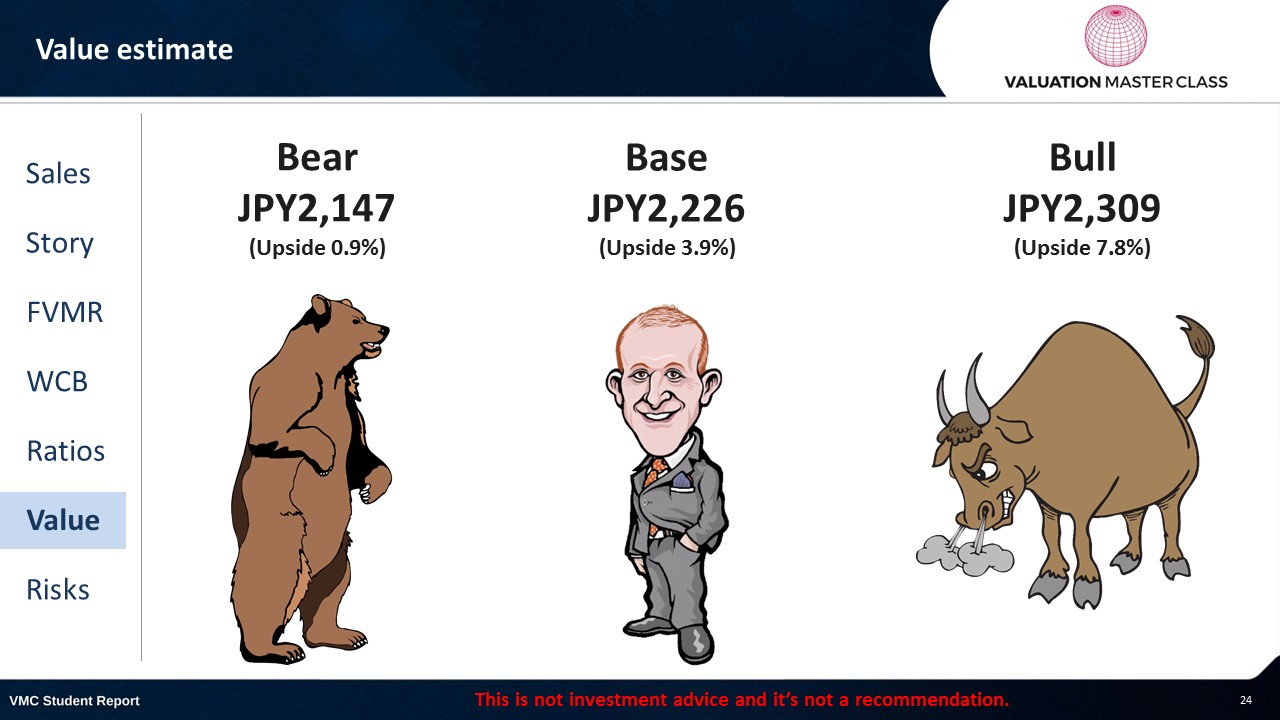

Value estimate – Toyota

- Global car sales likely to see strong rebound over the next 3 years

- Profitability is suppressed in the short run by higher raw material prices and semiconductor shortages

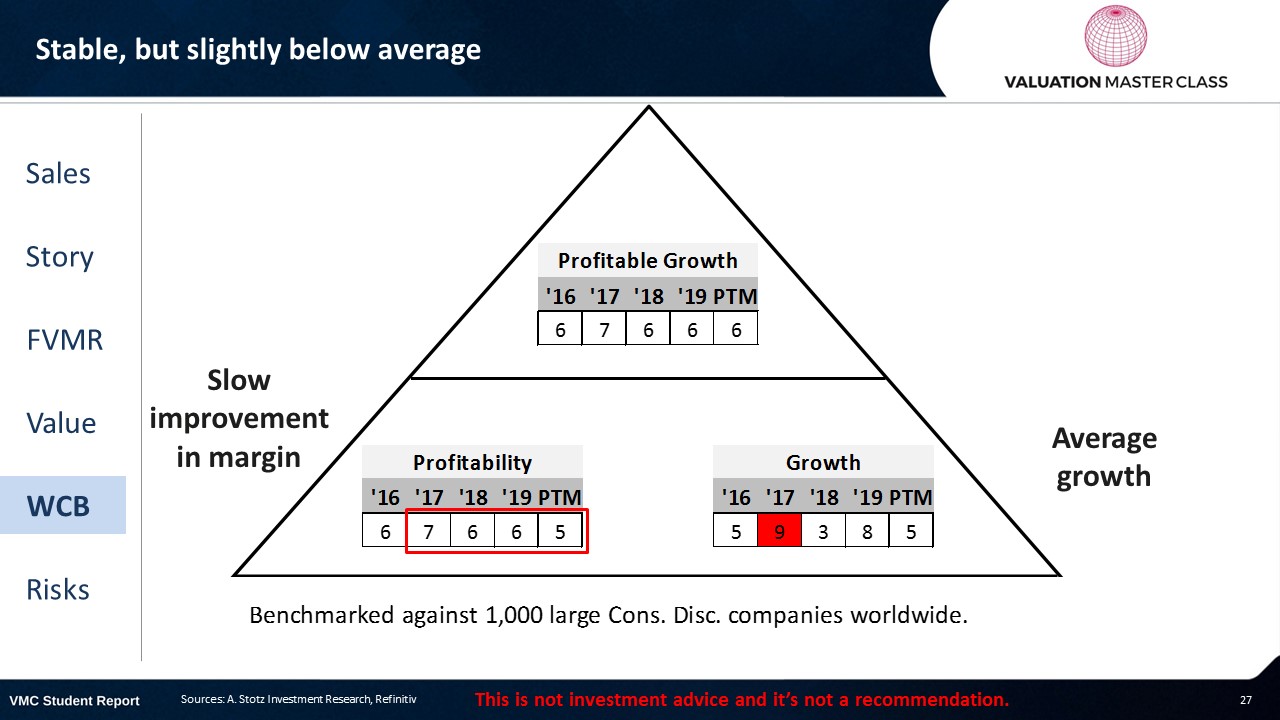

World Class Benchmarking Scorecard – Toyota

- Identifies a company’s competitive position relative to global peers

- Combined, composite rank of profitability and growth, called “Profitable Growth”

- Scale from 1 (Best) to 10 (Worst)

Key risk is adverse regulatory changes

- Ongoing supply chain disruptions create shortages (e.g., semiconductor chips) and increase production costs

- Failure to keep up with technological changes could result in loss of market share

- Adverse regulatory changes that push for electric vehicles only policy

Conclusions

- Production is on track and could lead to record profits

- Solid dividend and share buyback offer attractive return even without upside

- In the long run, Toyota must sooner or later shift to EV

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.