Can Change in Asset Turnover Predict Future Return?

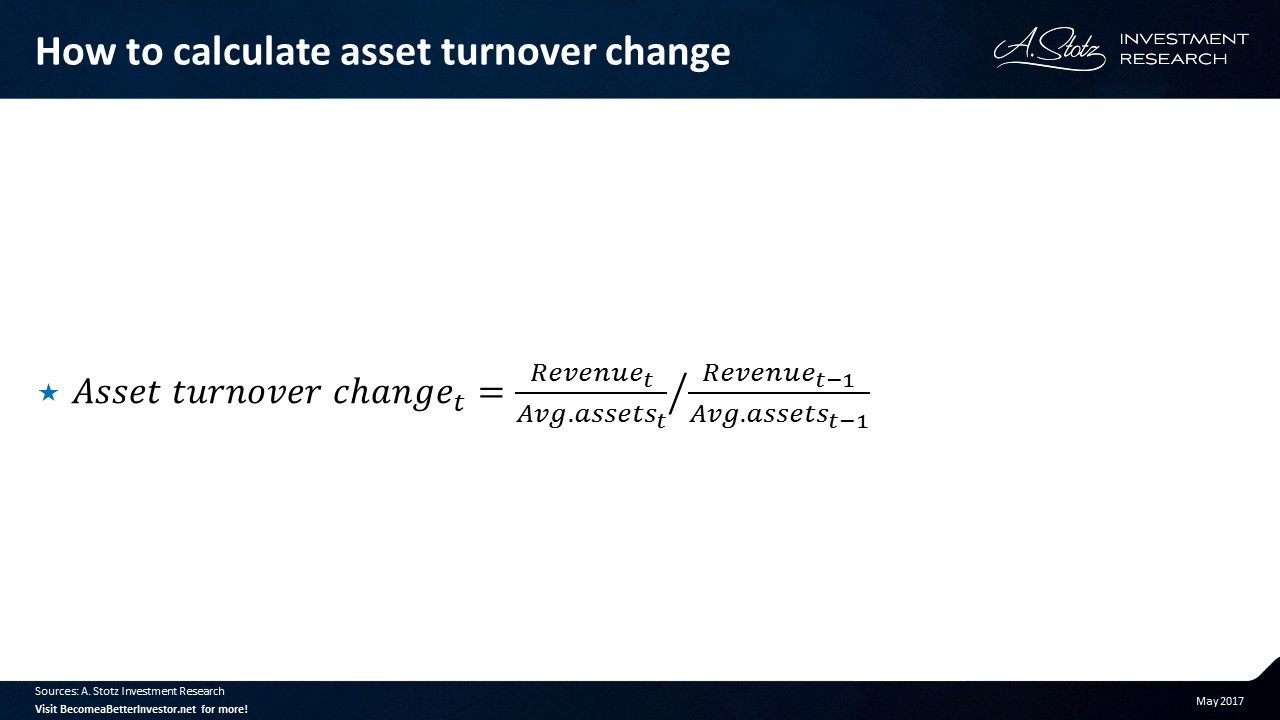

In this Academic-Style Research we tested a fundamental factor, change in asset turnover, on a global universe of stocks. Asset turnover is a measure of efficiency, the ratio analyzes how efficient a company is in the use of its assets. Asset turnover answers the question: How much revenue does a company generate for each unit of assets?

Hypothesis

Investing in companies with high change/improvement in asset turnover generates share price outperformance.

Universe

A global universe of stocks from June 2006 to April 2017. Only included companies with a minimum market cap of US$500m (no micro caps) and more than US$3m in 3MADTO (no illiquid stocks). On average, the universe consisted of 3,200 stocks per quarter.

Methodology: Testing the relationship between asset turnover change and return

We winsorized at +/- 3 standard deviations to exclude outliers. Divided the universe into deciles and added two additional groups: Top 15 and Bottom 15. We calculated the equal-weighted return for each group. The groups were reselected and rebalanced each quarter. All returns are presented in US dollar terms.

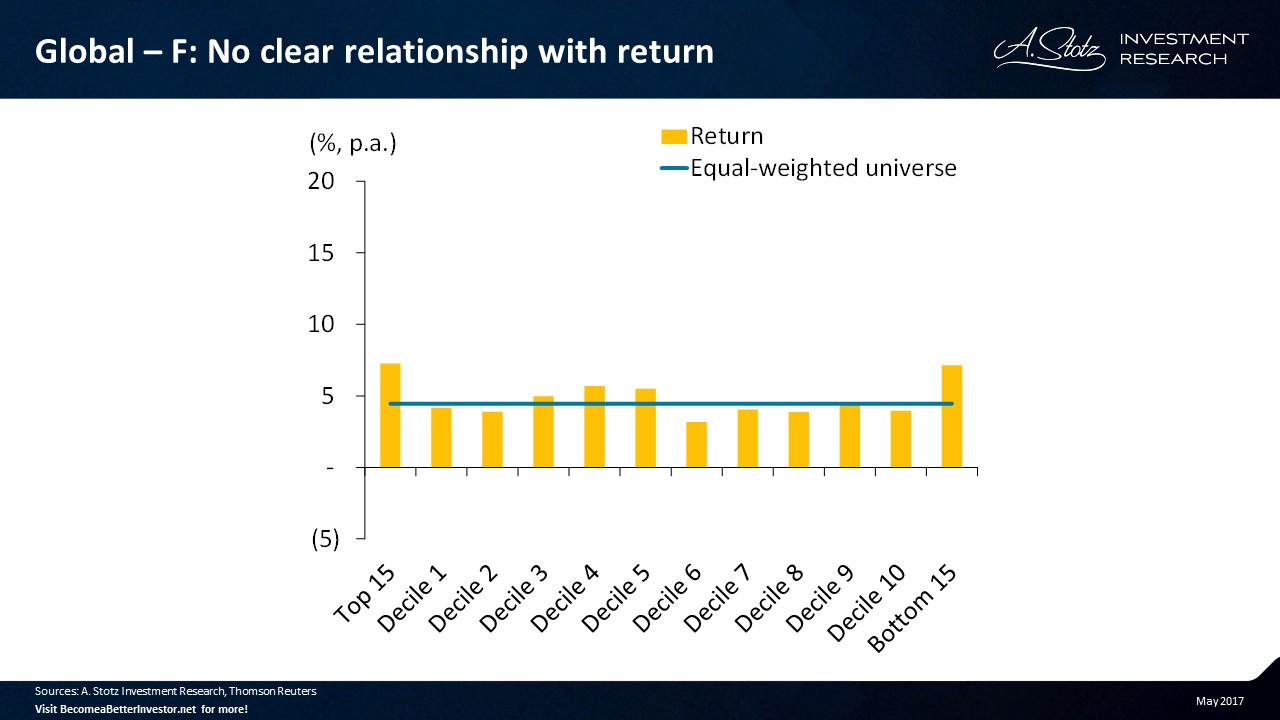

Asset turnover change didn’t show any clear relationship with return

Asset turnover change didn’t show any clear relationship with return for a global universe.

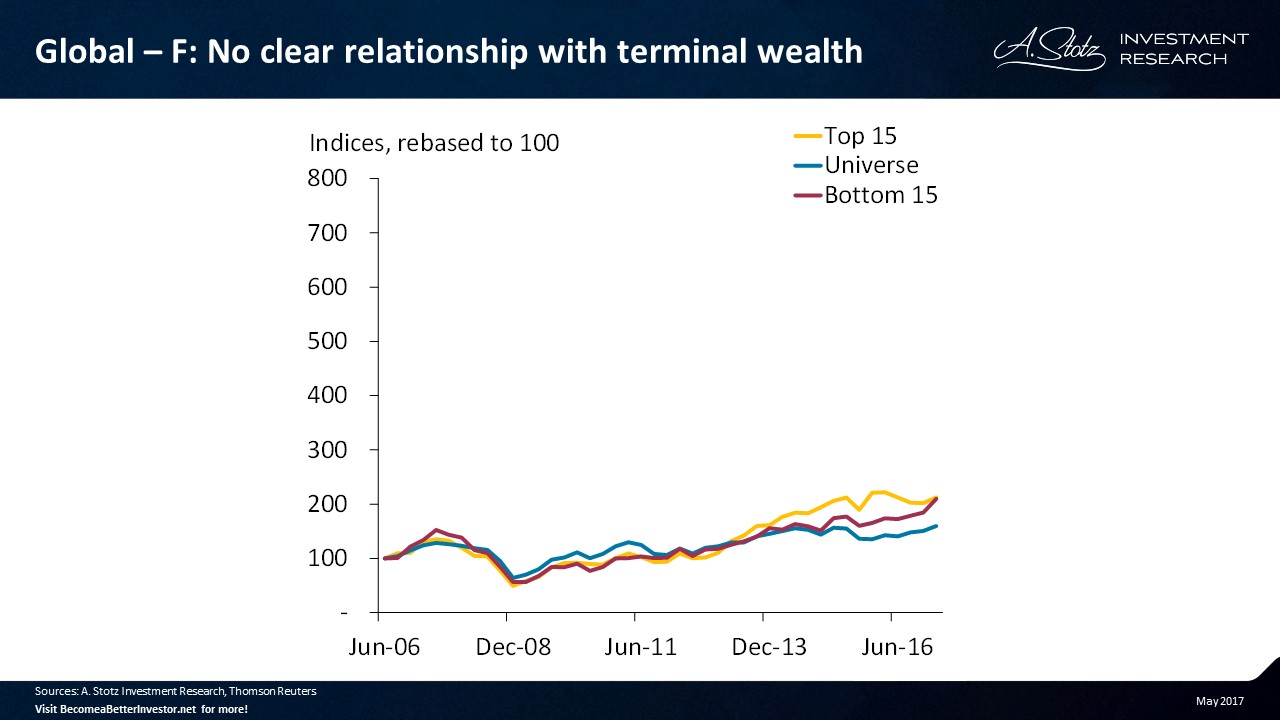

No clear relationship with terminal wealth either

Looking at the Top 15 and Bottom 15, they both had periods of outperforming and underperforming the universe. Over the whole time period, both groups have outperformed the universe.

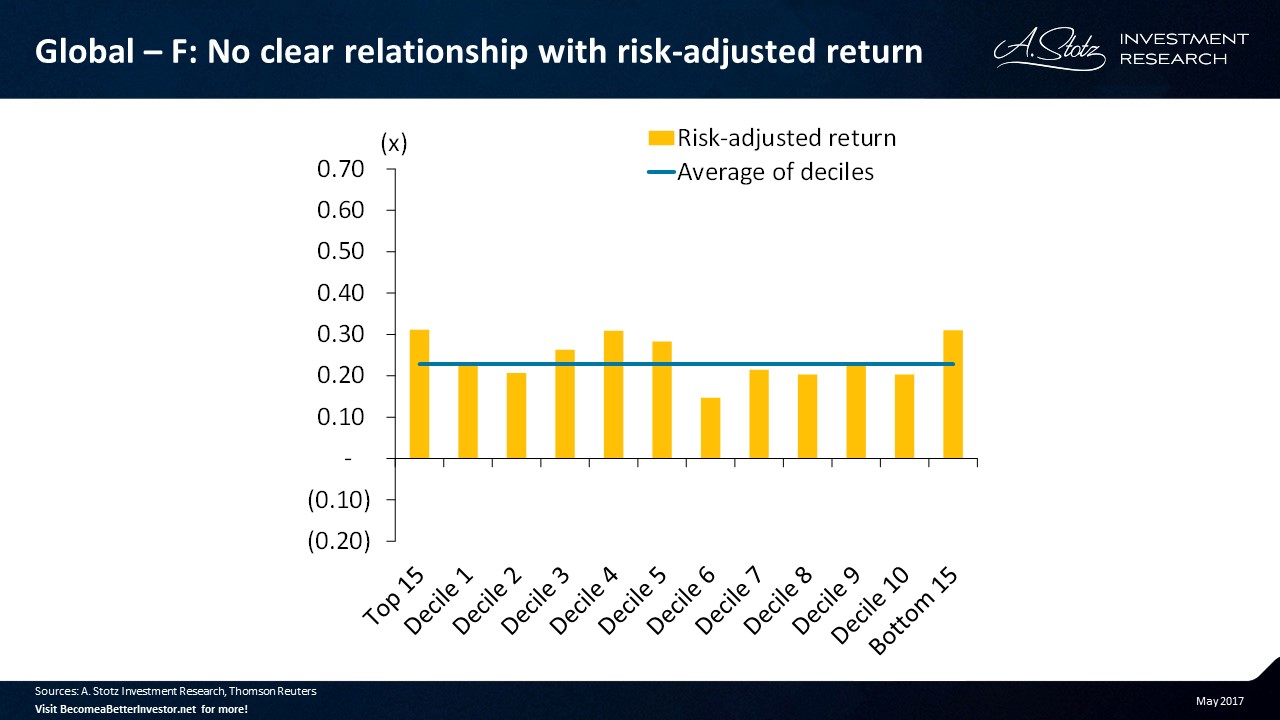

No clear relationship with risk-adjusted return

Return adjusted for volatility shows asset turnover change didn’t have any clear relationship with risk-adjusted return for a global universe.

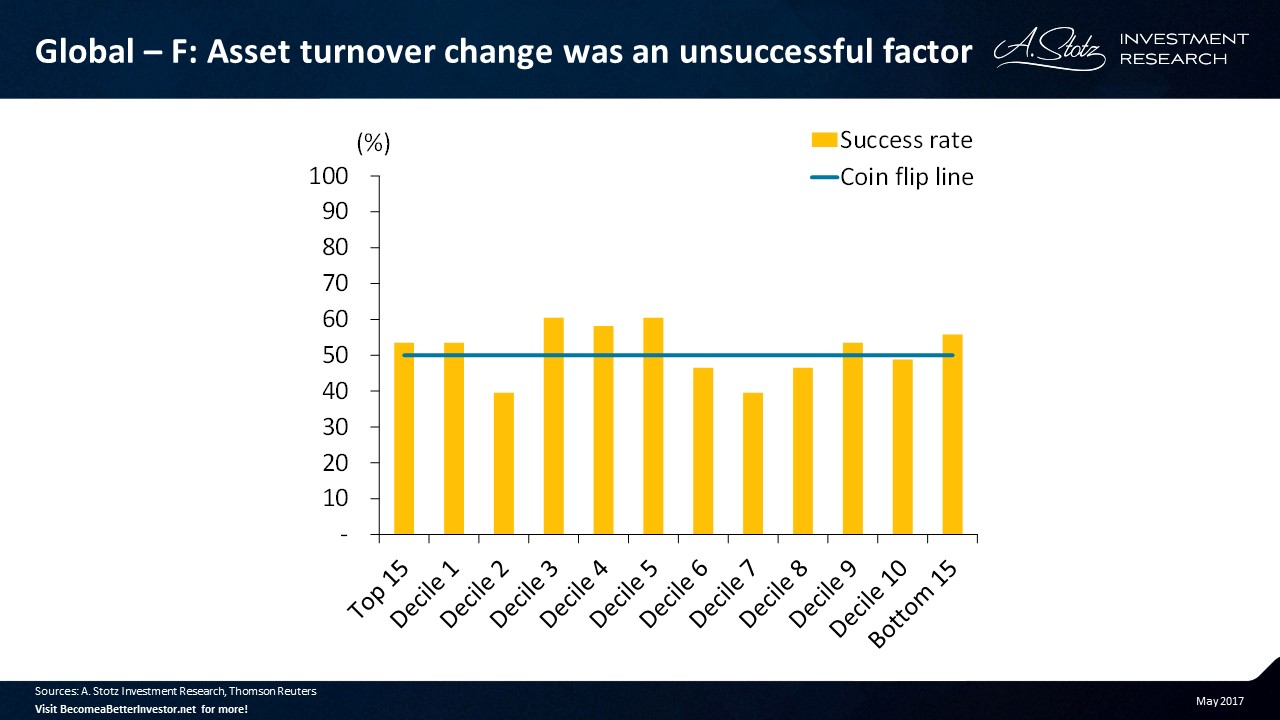

Asset turnover change was an unsuccessful factor

A successful quarter is when that group of stocks returned more than the equal-weighted universe. The success rate is given by the number of successful quarters divided by the total number of quarters. Top 15 and Decile 1 had a success rate above 50%, but so did the Bottom 15 and Decile 9.

What you have learned

Asset turnover change didn’t show any clear relationship with return for a global universe. Overall it showed to be an unsuccessful factor.

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.