Understanding the Inverted Yield Curve as a Recession Indicator

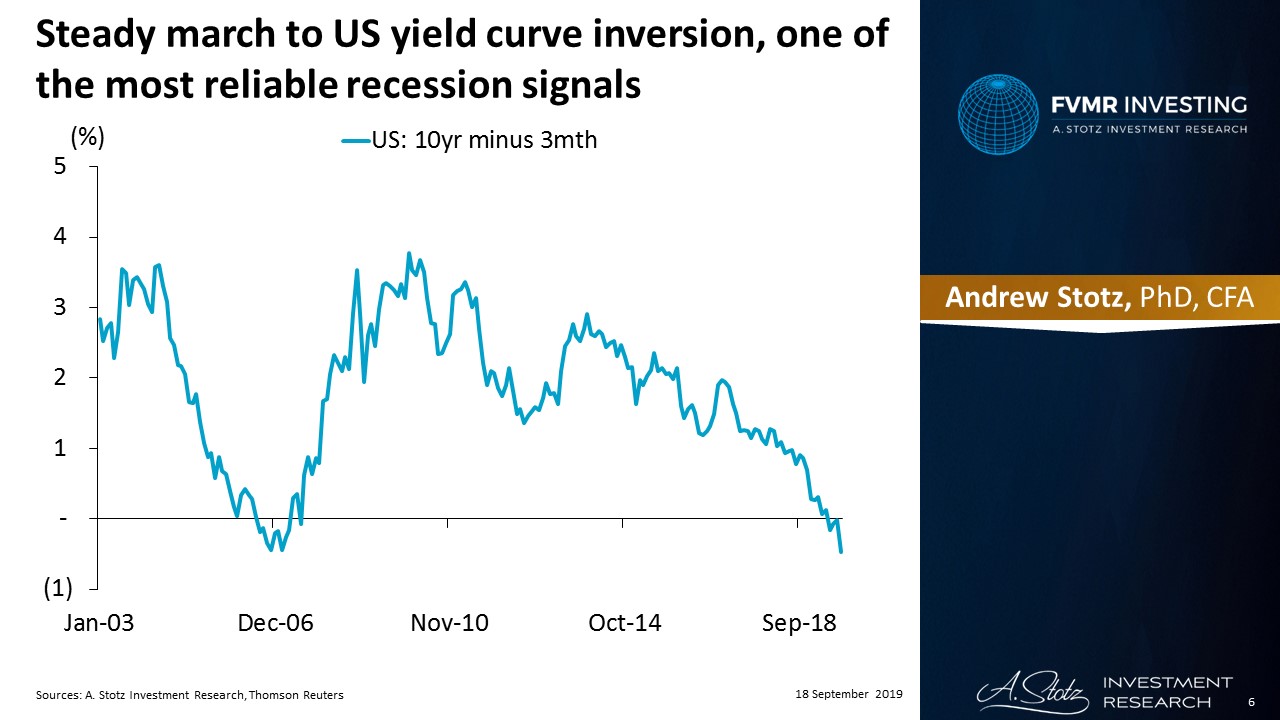

The level of inversion of the yield curve is one of the most powerful predictors of future economic growth, inflation, and recessions. Defined as the difference (or spread) between the long-term (LT) and short-term (ST) (10-year US Treasury bond rate and the 3-month US Treasury bond rate) bond rates.

Usually, LT rates are higher than ST rates which leads to the upward or positively sloping yield curve. Occasionally, LT rates are lower than ST rates which leads to the downward or negatively sloping yield curve. Positively sloped yield curve usually means inflationary growth. Negatively sloping almost always means recession.

The yield curve is a very reliable predictor of US recessions

Used in the Financial Stress Index published by the St. Louis Fed. Used in the US Index of Leading Economic Indicators published by The Conference Board. The New York Fed publishes a monthly recession probability prediction derived from the yield curve. Arturo Estrella and Tobias Adrian found that when the spread becomes less than 93 basis points, unemployment rises.

All recessions in the US since 1970 were preceded by an inverted yield curve. Average time from inversion until the recession started was about 12 months. The yield curve became inverted in the first half of 2019, for the first time since 2007. However, it broke through the 93-bps level in mid-2018. Let’s see in the following chart.

Steady march to US yield curve inversion, one of the most reliable recession signals

Normally banks fund themselves through low-cost ST deposits and give higher-yielding LT loans. Banks earn a profit on new loans and have a desire to expand lending, leading to inflationary growth. When the yield curve is inverted, banks pay more for ST deposits than they earn on LT loans. This turns lending profits to losses leading to a credit crunch.

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.