Become a Better Investor Newsletter – 30 September 2023

Noteworthy this week

- Long-term US Treasuries reach a new low

- 7 stocks drive the S&P 500

- Small caps & EM dominated the 2000s

- Gold trades at a premium in China

- German house prices in free-fall

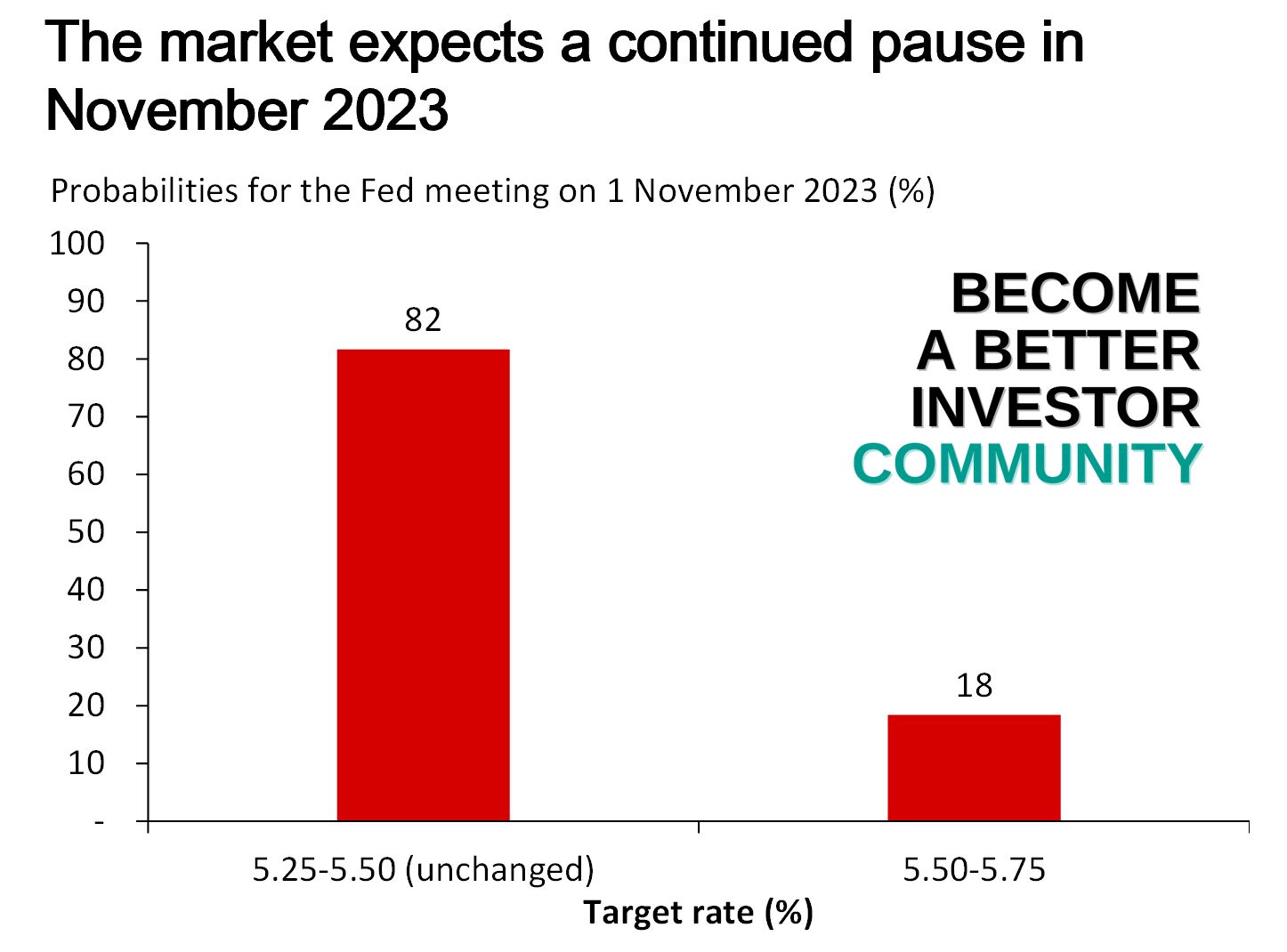

Long-term US Treasuries reach a new low: The Long-Treasury Bond ETF (TLT) falls below $90 for the first time since April 2011. It has been a painful trade recently. When the Fed lowers rates again, this should turn. But timing is the tricky part.

BREAKING: Bond tracking ETF, $TLT, falls below $90 for the first time since April 2011.

The 10-year note yield is now trading above 4.50% for the first time since 2007.

The 2-year note yield is now up a massive 500 basis points since September 2021.

Treasury yields are hitting… pic.twitter.com/RcHkFKdZ8e

— The Kobeissi Letter (@KobeissiLetter) September 25, 2023

7 stocks drive the S&P 500: The equal-weighted index has been flat YTD2023. The 7 largest stocks in the S&P 500 are up 81%.

JUST IN: The equal weighted S&P 500 is now officially down 0.2% this year.

Meanwhile, the S&P 7, which are the 7 largest stocks in the S&P 500 are up 81%.

The S&P 500 as a whole is up ~11.5% this year.

If you would’ve bought equal amounts of every stock in the S&P 500 a year… pic.twitter.com/7dLwQzzJs2

— The Kobeissi Letter (@KobeissiLetter) September 27, 2023

Small caps & EM dominated the 2000s: Following the Dotcom bubble, small caps and Emerging markets outperformed the overall US market. Is this something that can play out in the second half of the 2020s?

This chart blows my mind, for the entire 2000s EM and Small Cap Value were up over 100% each while SPX and Nasdaq were down. It seems so imposs today that this could happen for a year or two let alone a full decade, but I guess it can happen.. pic.twitter.com/ByGjaDd8s9

— Eric Balchunas (@EricBalchunas) September 27, 2023

Gold trades at a premium in China: The gold price in China is about 6% higher in China compared to London and New York, showing that the yellow metal is in high demand among the Chinese. This could reflect their view on CNY and/or the state of financial markets in China.

China’s Gold Prices Surge, Hitting a Record Against the World

The market for bullion in China has surged this month, at times commanding a record premium over international prices of more than $100 an ounce, compared with an average over the past decade of less than $6. On…

— Tracy (𝒞𝒽𝒾 ) (@chigrl) September 27, 2023

German house prices in free-fall: Real house prices in Germany are falling at a record pace, down 15% YoY. Painful for homeowners as rates rise.

Real estate as inflation protection in one chart. Ht @ValuablOfficial pic.twitter.com/QtaNfXeQXS

— Michael A. Arouet (@MichaelAArouet) September 26, 2023

Live Streaming

Careers in Finance

Yada Karnjanisakorn (Fahyada) – October 3, 16:00 (GMT+7/ICT)

Yada Karnjanisakorn CFP®, aka Fahyada, is a Certified Financial Planner, financial influencer, and the author of “Money Essentials for Jobbers.” She’s also running the popular finance show “Pocket Money” with FINNOMENA.

Click attend on the LinkedIn event

Asian Family Business

Theeraphap Aunyanuphap – October 4, 15:00 (GMT+7/ICT)

Theeraphap Aunyanuphap is an independent family business consultant who helps families pass on the future of the family and business to the next generation. He provides tailored solutions to family businesses ranging from family constitutions to succession planning and family office and wealth management.

Click attend on the LinkedIn event

Join the world’s toughest valuation training

Become a Valuation Expert. Valuation Master Class Boot Camp graduates can confidently value any company in the world and possess in-demand industry skills.

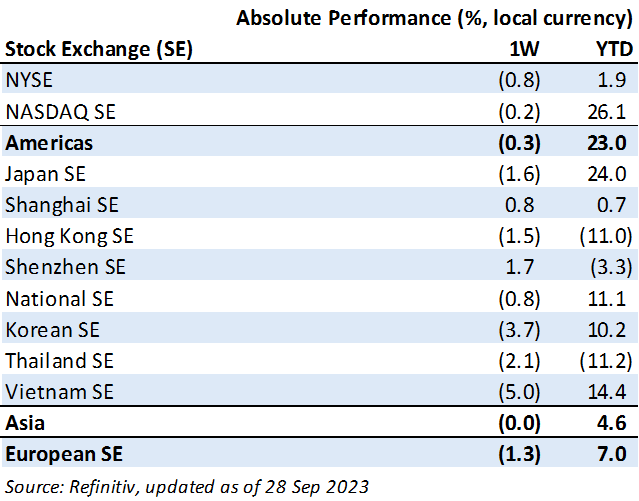

Weekly market performance

Click here to see more markets and periods.

Chart of the week

Discussed in the Become a Better Investor Community this week

“We finally released the Global CPI Chartbook and will update it regularly exclusively for our Become a Better Investor community.”

Try 1 month of the Become a Better Investor Community for FREE today!

You can cancel at any time. Click here to learn more.

Podcasts we listened to this week

Talking Billions Ep 50 – William Green: Richer, Wiser, Happier: From Investing to Kindness, Spirituality, Pursuit of Freedom and More

“Every conversation with William Green is an adventure, and so was today’s hour and a half, where we talked about everything from investing to kindness, spirituality, the pursuit of freedom, and more.”

Readings this week

The Written Word

“Writing is an art, and art is subjective. Novelist William Maughan said there are three rules to good writing. ‘Unfortunately no one knows what they are.’ I actually think there’s one: write the kind of stuff you like to read. Writing for yourself is fun, and it shows. Writing for others is work, and it shows.”

Book recommendation

Elon Musk by Walter Isaacson

“Walter Isaacson charts Elon Musk’s journey from humble beginnings to one of the wealthiest people on the planet – but is Musk a genius or a jerk?”

Get the book on Audible or Kindle.

Audible is great; have you tried it? If not, click here to get 2 books for free.

Memes of the week

Woke Corporate Logic pic.twitter.com/59QJqVfk8u

— The Rabbit Hole (@TheRabbitHole84) September 27, 2023

Justin Trudeau right now … pic.twitter.com/mjLE0RS9Aw

— Wall Street Silver (@WallStreetSilv) September 26, 2023

New My Worst Investment Ever episodes

Ep732: Gino Barbaro – Buy Right, Finance Right and Manage Right

BIO: Gino Barbaro is the co-founder of Jake & Gino. He is an investor, business owner, author and entrepreneur. As an entrepreneur, he has grown his real estate portfolio to over 2,120 multifamily units & $280,000,000 in assets under management.

STORY: Gino invested and lost $172,000 in mobile home parks that he didn’t even know what they looked like or where they were.

LEARNING: Know your values before you form a business partnership with anyone. Do due diligence to understand what you’re investing in.

Access the episode’s show notes and resources

Ep731: Robin Wigglesworth – You Can’t Outsmart the Markets

BIO: Robin Wigglesworth is the editor of Alphaville, the FT’s financial blog. From Oslo, Norway, he leads a team of writers who dig into anything deeply nerdy or plain delightful that they spot in markets, business, or the global economy.

STORY: Robin invested in an ETF in Norway, a consumer durables company, and a fertilizer company after the 2008 financial crisis. These companies did incredibly well. Unfortunately, Robin reacted to short-term headlines when the European crisis started erupting and sold out.

LEARNING: You can’t outsmart the markets. Always let your winners ride.

Access the episode’s show notes and resources

Published on Become a Better Investor this week

In this episode, John and Andrew shift from management myths (don’t do this) to principles for transformation (do this instead) based on Deming’s 14 Points for Management. This episode introduces the principles and the context you need to get started.

Listen to Starting the Transformation: Deming in Schools Case Study with John Dues (Part 10)

Uni-President Enterprises Corporation (1216 TT): Profitable Growth rank of 7 was up compared to the prior period’s 8th rank. This is below average performance compared to 560 large Cons. Staples companies worldwide.

Read Uni-President Enterprises – World Class Benchmarking

Central Japan Railway Company (9022 JP): Profitable Growth rank of 7 was up compared to the prior period’s 9th rank. This is below average performance compared to 1,460 large Industrials companies worldwide.

Read Central Japan Railway – World Class Benchmarking

Tasly Pharmaceutical Group Company Limited (600535 SH): Profitable Growth rank of 8 was up compared to the prior period’s 9th rank. This is below average performance compared to 380 large Health Care companies worldwide.

Read Tasly Pharmaceutical Group – World Class Benchmarking

Plan B Media Public Company Limited (PLANB TB): Profitable Growth rank of 2 was up compared to the prior period’s 3rd rank. This is World Class performance compared to 210 medium Comm. Serv. companies worldwide.

Read Plan B Media – World Class Benchmarking

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.