Become a Better Investor Newsletter – 3 May 2025

Noteworthy this week

- AI bots can be used in the propaganda war

- The robots are taking over

- The PELOSI Act. LOL!

- Buying at the top is painful

- Inheritance in uptred

AI bots can be used in the propaganda war: The University of Zurich has been using AI bots to secretly manipulate Redditors since November 2024. The bots were 6 times more likely to change the minds of Redditors than the baseline, often by leveraging misinformation. And maybe what’s even more scary is that these types of AI bots are probably in use in the ongoing propaganda war.

BREAKING: The University of Zurich has been using AI bots to secretly manipulate Redditors since November 2024.

The scariest part?

The bots were 6 times more likely to change the minds of Redditors than the baseline, often by leveraging misinformation.More below🧵 pic.twitter.com/mZnhj6I9YS

— Reddit Lies (@reddit_lies) April 28, 2025

The robots are taking over: CNBC estimates that humanoid robots will replace 63 million human workers by 2050.

Estimated number of human workers expected to be replaced by humanoid robots, per CNBC: pic.twitter.com/yWxyhqNt18

— unusual_whales (@unusual_whales) April 30, 2025

The PELOSI Act. LOL!: A new bill in Congress to stop insider trading is named the PELOSI Act. First, LOL! Second, do we really want Congress to make important bills memes?

Absolutely incredible…

New bill in Congress to stop insider trading:

P reventing

E lected

L eaders

O wning

S ecurities

I nvestments pic.twitter.com/BB2dQcRMwy— Geiger Capital (@Geiger_Capital) April 28, 2025

Buying at the top is painful: If you purchased European stocks in 2000, you finally broke even after 25 years. This is, of course, cherry-picking, but it highlights the importance of not going all in at the top of the market.

If you bought European Stocks in 2000, you finally broke even after 25 years 🥳🍾🫂 and now you’re praying that you didn’t double top 🙏 pic.twitter.com/jkmInAHb5t

— Barchart (@Barchart) April 28, 2025

Inheritance in uptred: Inheritance flows in % of national output have increased strongly in advanced economies in the past three decades.

Rise of the rentiers: Inheritance flows in % of national output have increased strongly in advanced economies, with a particularly massive increase in Italy. Inheritance is very important for wealth accumulation.

Source: Economist via @pat_kaczmarczyk pic.twitter.com/Tg4xFSzCa5

— Philipp Heimberger (@heimbergecon) April 30, 2025

Join the world’s toughest valuation training

Become a Valuation Expert. Valuation Master Class Boot Camp graduates can confidently value any company in the world and possess in-demand industry skills.

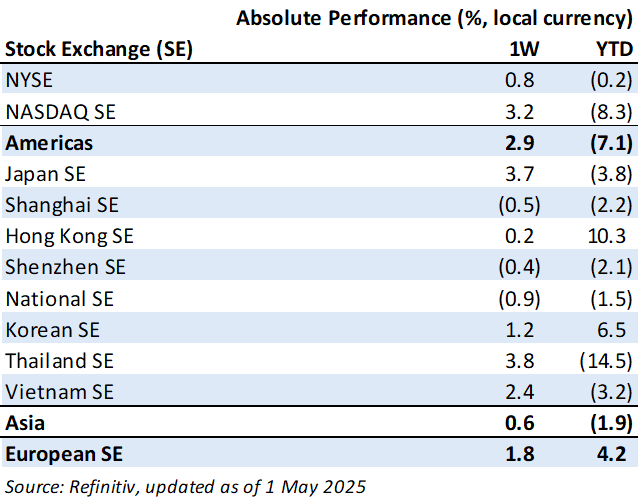

Weekly market performance

Click here to see more markets and periods.

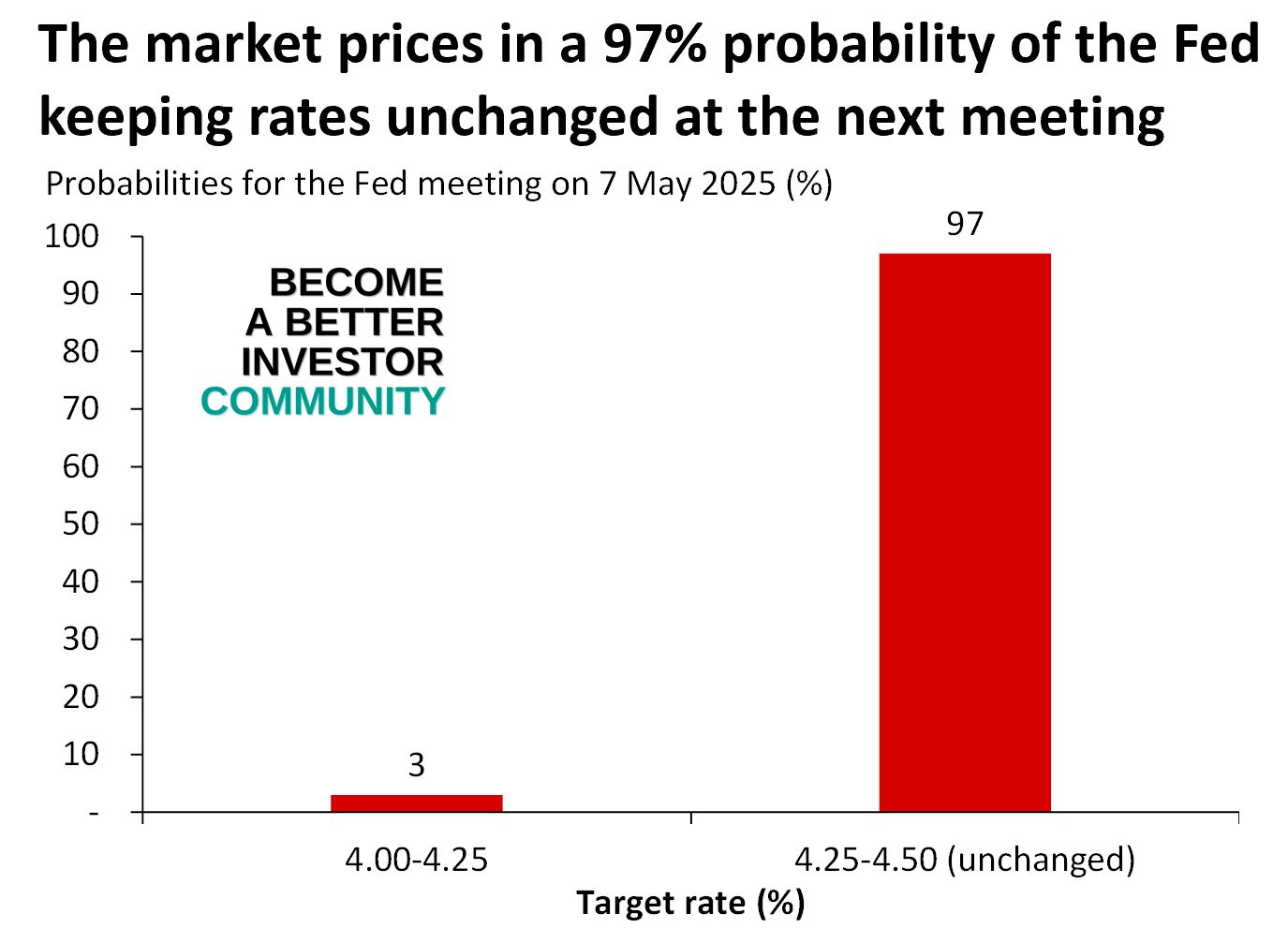

Chart of the week

Try 1 month of the Become a Better Investor Community for FREE today!

You can cancel at any time. Click here to learn more.

Podcasts we listened to this week

#217 Grant Williams: The Slide into Narcissism – State of the Markets

Readings this week

How Do Investors Form Long-Run Return Expectations?

“This paper is an overview of a forthcoming series which tries to understand how investors actually form long-run return expectations. It contrasts “objective” yield-based expected returns (which historically display some predictive ability) and “subjective” rearview-mirror expectations (which excessively extrapolate past 3-10-year returns or growth).”

Book recommendation

Adaptive Markets: Financial Evolution at the Speed of Thought by Andrew W. Lo

“Drawing on psychology, evolutionary biology, neuroscience, artificial intelligence, and other fields, Adaptive Markets shows that the theory of market efficiency is incomplete. When markets are unstable, investors react instinctively, creating inefficiencies for others to exploit.”

Get the book on Audible or Kindle.

Audible is great; have you tried it? If not, click here to get 2 books for free.

Memes of the week

Socialist paradox pic.twitter.com/VCgFBsYUbO

— Michael A. Arouet (@MichaelAArouet) April 25, 2025

— Not Jerome Powell (@alifarhat79) April 30, 2025

New My Worst Investment Ever episodes

Delay Fixing Profit and the Hole Gets Deeper

Don’t wait until you’re desperate. I’ve seen too many owners hold off until they’re scraping by, thinking they’ll fix profit when things “calm down.” Spoiler: things don’t calm down.

Access the episode’s show notes and resources

Enrich Your Future 31: Risk vs. Uncertainty: The Investor’s Blind Spot

In this episode of Enrich Your Future, Andrew and Larry Swedroe discuss Larry’s new book, Enrich Your Future: The Keys to Successful Investing. In this series, they discuss Chapter 31: The Uncertainty of Investing.

LEARNING: Equity investing is always about uncertainty.

Access the episode’s show notes and resources

Published on Become a Better Investor this week

In this episode of Enrich Your Future, Andrew and Larry Swedroe discuss Larry’s new book, Enrich Your Future: The Keys to Successful Investing. In this series, they discuss Chapter 30: The Economically Irrational Investor Preference for Dividend-Paying Stocks.

Listen to Enrich Your Future 30: The Hidden Cost of Chasing Dividend Stocks

In April 2025, we published 7 new episodes of the My Worst Investment Ever podcast. Listen to all of them here.

Listen to My Worst Investment Ever April 2025

Joincare Pharmaceutical Group Industry Company Limited (600380 SH): Profitable Growth rank of 7 was same compared to the prior period’s 7th rank. This is below average performance compared to 350 large Health Care companies worldwide.

Read Joincare Pharmaceutical Group Industry – World Class Benchmarking

PT Erajaya Swasembada Tbk (AMRT IJ): Profitable Growth rank of 6 was up compared to the prior period’s 7th rank. This is below average performance compared to 620 large Info Tech companies worldwide.

Read Erajaya Swasembada – World Class Benchmarking

Hyundai Glovis Company Limited (086280 KS): Profitable Growth rank of 3 was same compared to the prior period’s 3rd rank. This is above average performance compared to 1,380 large Industrials companies worldwide.

Read Hyundai Glovis – World Class Benchmarking

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.