Become a Better Investor Newsletter – 26 October 2024

Noteworthy this week

- Buffett indicator at an all-time high

- S&P 500’s profit margin at an all-time high

- S&P 500’s market cap concentration at an all-time high

- Gold at an all-time high

- Silver at a 12-year high

Buffett indicator at an all-time high: The Buffett indicator, stock market cap divided by GDP, hits 200% for the first time in history, surpassing the Dot-com Bubble and the Global Financial Crisis.

JUST IN 🚨: Warren Buffett Indicator hits 200% for the first time in history, surpassing the Dot Com Bubble and the Global Financial Crisis pic.twitter.com/w0NV4RaMw7

— Barchart (@Barchart) October 22, 2024

S&P 500’s profit margin at an all-time high: S&P 500’s forward 12m profit margin has risen to a new all-time high.

S&P 500’s forward 12m profit margin has risen to a new all-time high pic.twitter.com/72Fxi22070

— Kevin Gordon (@KevRGordon) October 21, 2024

S&P 500’s market cap concentration at an all-time high: The 3 largest companies in the S&P 500 (Apple, Nvidia, & Microsoft) make up over 20% of the index, a record high.

The 3 largest companies in the S&P 500 (Apple, Nvidia, & Microsoft) make up over 20% of the index, a record high.

Video: https://t.co/uXDwE4VDQ5 pic.twitter.com/HjwUh0yYV5

— Charlie Bilello (@charliebilello) October 21, 2024

Gold at an all-time high: Gold hit another all-time high and is on pace for its best year since 1979 with a gain of 30%+ 2024YTD.

Gold hit an all-time high today for the 4th day in a row. Now on pace for its best year since 1979 with a gain of 33% YTD.https://t.co/l5IYmkeySJ pic.twitter.com/VypINZLJjo

— Charlie Bilello (@charliebilello) October 23, 2024

Silver at a 12-year high: While gold price has surged, silver has done even better, surpassing US$34/oz t, a 12-year high.

The gold meltup continues, touching a new all time high of $2740 earlier, but it’s silver that is stealing the show now, spiking to a 12 year high of $34 earlier today pic.twitter.com/tCUuWYwUpP

— zerohedge (@zerohedge) October 21, 2024

Join the world’s toughest valuation training

Become a Valuation Expert. Valuation Master Class Boot Camp graduates can confidently value any company in the world and possess in-demand industry skills.

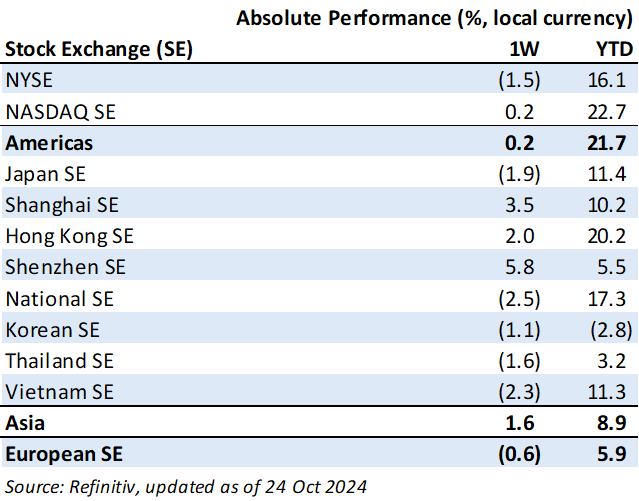

Weekly market performance

Click here to see more markets and periods.

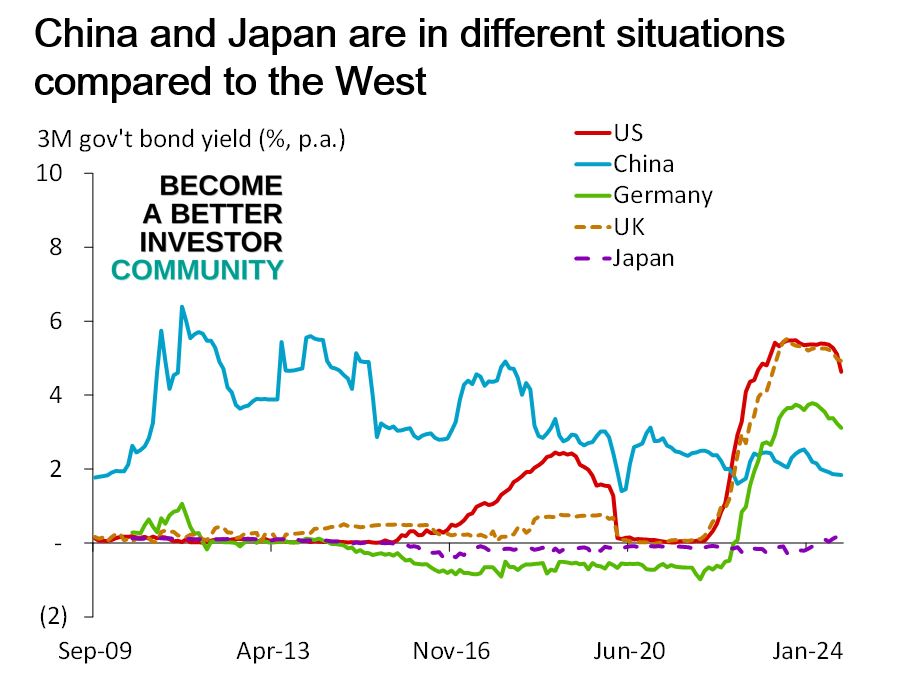

Chart of the week

Discussed in the Become a Better Investor Community this week

“You can now access your weekly updated, Market Cheat Sheet and Equity FVMR Snapshots.”

Try 1 month of the Become a Better Investor Community for FREE today!

You can cancel at any time. Click here to learn more.

Podcasts we listened to this week

RWH050: THE INTELLIGENT INVESTOR W/ JASON ZWEIG

“In today’s episode, William Green chats with Jason Zweig about his updated & revised edition of Benjamin Graham’s The Intelligent Investor, which Warren Buffett describes as “by far the best book on investing ever written.” Jason, who also writes the Wall Street Journal’s Intelligent Investor column, explains why Graham’s classic book still holds vitally important lessons for today’s investors. He also shares what he’s learned from interviewing Buffett & Charlie Munger.”

Readings this week

Ruminating on Asset Allocation

“In his latest memo, Howard Marks outlines the need to base asset allocation decisions around an established risk target. He describes the fundamental differences between ownership and debt, as well as the importance of finding the combination of the two that gets an investor’s portfolio to the desired position on the risk/return continuum. Finally, he expands on the increased utility of debt investments in today’s portfolios.”

Book recommendation

Seeing Like a State: How Certain Schemes to Improve the Human Condition Have Failed by James C. Scott

“Hailed as “a magisterial critique of top-down social planning” by the New York Times, this essential work analyzes disasters from Russia to Tanzania to uncover why states so often fail—sometimes catastrophically—in grand efforts to engineer their society or their environment, and uncovers the conditions common to all such planning disasters.”

Get the book on Audible or Kindle.

Audible is great; have you tried it? If not, click here to get 2 books for free.

Memes of the week

BREAKING: Jerome Powell is awarded the 2024 Nobel Prize in Chemistry for turning the US dollar into shit pic.twitter.com/dbVoM0bDKE

— Not Jerome Powell (@alifarhat79) October 23, 2024

“If you could describe 2024 in one photo what could it be?”

Me: pic.twitter.com/HhLfEmyhmU

— Not Jerome Powell (@alifarhat79) October 22, 2024

New My Worst Investment Ever episodes

Enrich Your Future 17: Take a Portfolio Approach to Your Investments

In this episode of Enrich Your Future, Andrew and Larry Swedroe discuss Larry’s new book, Enrich Your Future: The Keys to Successful Investing. In this series, they discuss Chapter 17: There is Only One Way to See Things Rightly.

LEARNING: Consider the overall impact of investments rather than focusing on individual metrics.

Access the episode’s show notes and resources

Published on Become a Better Investor this week

In this episode of Enrich Your Future, Andrew and Larry Swedroe discuss Larry’s new book, Enrich Your Future: The Keys to Successful Investing. In this series, they discuss Chapter 16: All Crystal Balls are Cloudy.

Listen to Enrich Your Future 16: The Estimated Return Is Not Inevitable

Is the whole simply a sum of its parts? In this episode, Jacob Stoller and Andrew Stotz discuss what happens when you divide a company into pieces and manage them separately – and what to do instead.

Listen to The Myth of Segmented Success: Boosting Lean with Deming (Part 2)

Carabao Group Public Company Limited (CBG TB): Profitable Growth rank of 2 was up compared to the prior period’s 3rd rank. This is World Class performance compared to 400 medium Cons. Staples companies worldwide.

Read Carabao Group – World Class Benchmarking

KT Corporation (030200 KS): Profitable Growth rank of 7 was same compared to the prior period’s 7th rank. This is below average performance compared to 250 large Comm. Serv. companies worldwide.

Read KT Corp – World Class Benchmarking

GD Power Development Company Limited (600795 SH): Profitable Growth rank of 8 was same compared to the prior period’s 8th rank. This is below average performance compared to 290 large Utilities companies worldwide.

Read GD Power Development – World Class Benchmarking

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.